With the current challenges that Fintech apps face and the current global health crisis, you might expect the Finance technology sector to be losing users like water from a leaky bucket. But the retention rates for new users are healthy, and retention rates for existing users actually improved from before the COVID lockdowns. Nothing as dismal as other industries that are more dependent on in-person services or face-to-face interactions (e.g.: event ticketing).

Still, what Fintech trends are affecting the industry? And how can these trends help inform your mobile marketing strategy?

We’ve put together a list of the current trends in the Fintech industry based on conversations we’ve been having with customers as well as larger trends we’re seeing across a broad spectrum of mobile verticals. And with each trend, we give you a takeaway and further resources.

Fintech is Changing Payments & Banking Habits

If there’s one area in Fintech that has seen accelerated adoption, it is digital banking. The pandemic forced millions of consumers to suddenly take to contactless payments and banking services. Now these services have seen a doubling in the number of users who only bank digitally.

According to a J.D.Power study, before the pandemic, 52% of bank customers were branch dependent, meaning they would visit a physical branch an average of 1.5 times a month. The increased adoption of digital banking has turned the number on its head. Now, 30% of bank customers only use digital services and forego physical banks altogether.*

There is a caveat to this growth, though: that same study shows that although customers are flocking to digital-only banking, these same customers are showing the lowest levels of satisfaction according to customer surveys sent out to 91,950 retail banking customers in 182 of the largest banks in the United States.

Meanwhile, digital payment apps across the globe have helped users rely less on cash wallets in favor of mobile wallets. And everything from online bill payments to live shopping experiences can now be done even if you’ve left your physical wallet at home.

Takeaways:

Digital banking services must successfully replace the kind of face-to-face service one used to get at physical banks with personalized services across digital channels.

For this to work, they have to give customers experiences that are relevant to their behavior in the app, their habits, and their needs. In this case, personalization can mean sending marketing messages that match a user’s past behavior (e.g., an SMS reminder that a user can deposit physical checks with the app), or sending information at the most relevant time (e.g., an alert that deposited funds are now available).

Overall, for digital banks to gain back the customer satisfaction numbers they once boasted of, the basic and most used app functionalities have to be easier to access and navigate. Service offerings must be widened to cover all bases. Most of all, banks have to be able to simplify the ways a customer can transact.

Resources:

- Watch: How Expert Marketers Are Adapting to a Global Pandemic [Webinar]

- Read: How Ayopop Reduced 90-day Churn by 15% [Case Study]

Retention Rates Are Inching Back to Pre-COVID Numbers

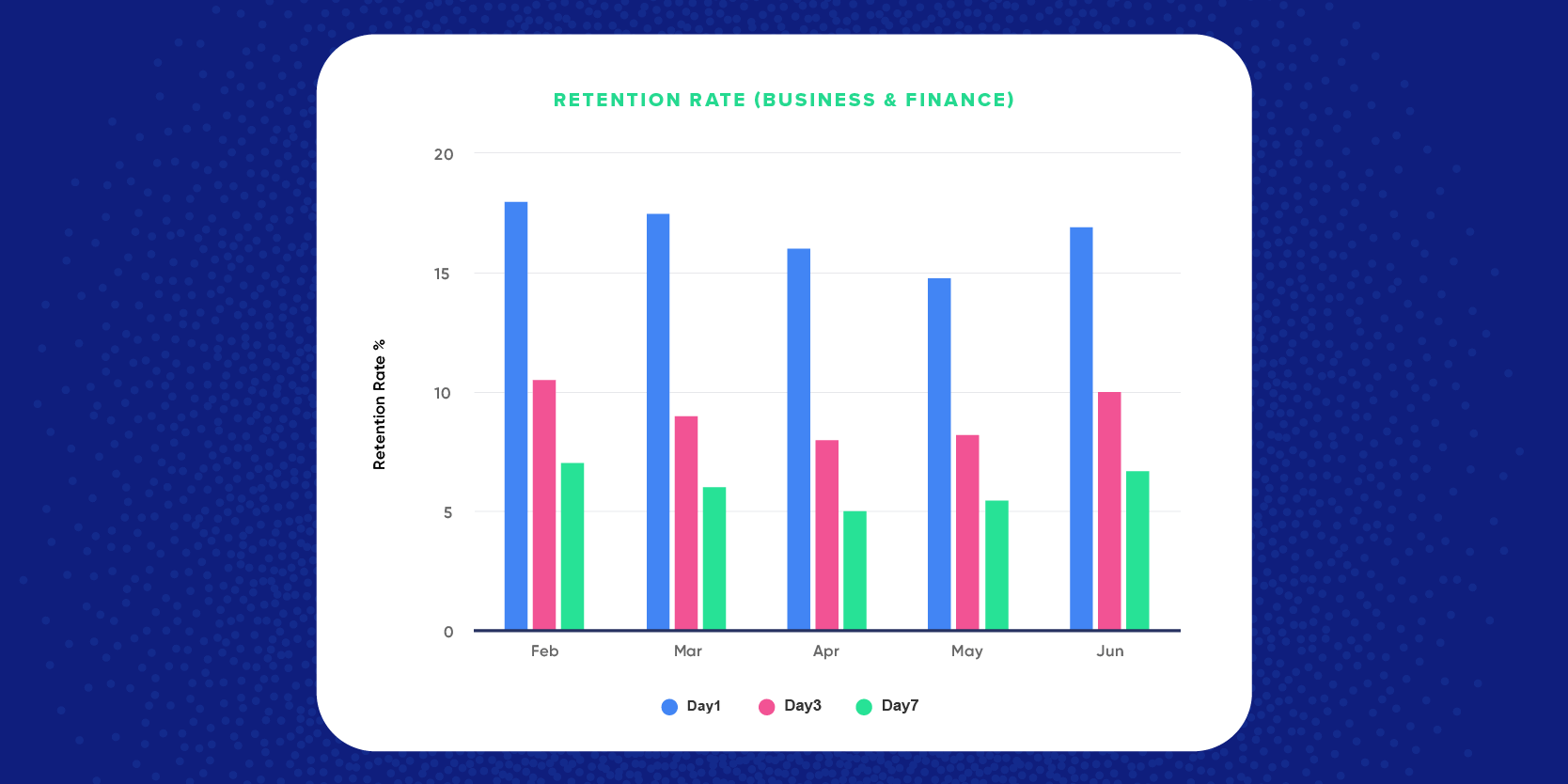

In June 2020, retention rates in the Business and Finance sector continued to be lower than during February’s pre-COVID period. Although if you do take a look at the Day 7 retention rate, the numbers are close to returning to their February state. So, there is some stability inching into the stats, which means Fintech app customers are continuing to use the apps at least a week after installation.

Takeaway:

For Fintech mobile apps, users are calming down and staying on longer when they see the value of contactless payments or money transfer services.

But like anything, the service you provide must be stellar for them to keep using it. You can’t delight a customer if your app’s user experience is lackluster. Or if you’re not providing enough trust signals to boost their confidence in your service.

Resources:

- Read: The User Retention Pocket Guide [ebook]

- Watch: COVID-19 and the Changing Rules of Engagement [Webinar]

Fintech Brands Moving Beyond Partnerships

Two quick examples of how Fintech is moving past merely partnering with traditional banks and sponsor banks to deliver services:

Varo Money, a Fintech challenger bank, applied to the Office of the Comptroller of the Currency (OCC) for a national bank charter back in 2017 and the FDIC approved their application for deposit insurance this February 2020. This charter means they can go beyond core checking and savings accounts and expand to offer credit cards, loans, and even more savings products.*

Meanwhile, Jiko, another Fintech app, has actually bought a national bank. The acquisition will allow them to combine their broker-dealer account with a banking account and debit card. Their idea: turn Treasury bills into everyday spending money for users, all via a subscription fee like Netflix or Amazon.*

While two examples may not constitute a trend, it does indicate that Fintech brands are maturing. They’re rapidly moving to expand their products and services and reach more people.

Innovation is the name of the game especially in the competitive landscape of financial services. And for some companies, this means finding ways to control all the various parts in their workflow, from moving money to accessing payment rails — the systems that allow for quick transmission of payment transactions.

Takeaway:

How can you make your own app’s core services more efficient? Are there intermediaries that are blocking you or impeding end-to-end delivery of your services to users? Think of the 10,000-foot view and what your service could accomplish with a bigger vision.

Resources:

- Download: Industry Benchmarks for Mobile Payment Apps [Report]

- Read: Fintech App Teardowns: How the Best in the Business Attract, Engage, and Retain Customers [Blog]

Cybersecurity: Everyone’s Top Priority

With the onset of the global pandemic came a rise in the number of scams and cyber crimes that flooded the internet — from spam callers offering pandemic “stimulus checks,” to hackers taking control of app backdoors.

According to a 2019 report, 98% of the most prominent and well-funded Fintech startups are vulnerable to phishing, web, and mobile app security attacks.*

For Fintech apps, the focus on security is no surprise. The security and integrity of customer data is the foundation upon which this industry is built. Here, trust and security are tantamount to growth. With no security in place, there is no hope of acquiring or even retaining users. Without the trust of its users, a Fintech brand has no business to speak of.

Takeaway:

Security will continue to be a huge area of focus for every app, regardless of vertical. Fintech apps in particular must safeguard intimate user data, or else those users will turn to the competition. So test for security vulnerabilities in your own app and ensure that things are bulletproof.

Resources:

- Read: How to Build Trust in Your Fintech App [Blog]

- Read: Mobile App Security Threats and Secure Best Practices [Blog]

Individualization Assisted by AI

Sure, personalization is nothing new. Customer delight has always been founded on giving the customer what they want and how they want it.

But what has been changing is the ability to use artificial intelligence and machine learning to help make individualization scalable and accessible to Fintech companies regardless of size.

When executed well, the combination of user behavior in your analytics and AI can determine the best mix of marketing messages to send to a customer. It can determine the best products for a user, or the best times and channels to reach them. Tools like the AI-assisted RFM analysis can automatically group users into segments so you can send messaging based on the characteristics of each segment. You can then use triggered or scheduled campaigns to send relevant messages at the right time.

Takeaway:

Look over your analytics package. Does it have AI capabilities, and if so, can the AI predict and recommend the best marketing content to serve your customers? Can it harness the user data to help you optimize your messaging, or gain a deeper understanding of your audience?

Resources:

- Read: How AI is Being Used in Mobile Apps [Blog]

- Read: How AI is Changing the Customer Retention Game [Blog]

Fintech Trends: Final Thoughts

Overall, innovation is happening at a rapid rate in Fintech. And COVID-19 has helped fuel the adoption of Fintech services particularly in developing countries struggling with traditional banking infrastructure.

But there’s a lot of work to be done.

In the end, the most powerful way to show that your customers come first is to give them experiences that are delightful. Experiences that they can get to from the channels they already use.

And to make those experiences delightful, they should be relevant to each customer. Experiences that respond in real time to users’ behavior. Experiences that continue to build on the foundation of trust that every Fintech app needs.

The Experience Optimization Pocket Guide

Shivkumar M

Head Product Launches, Adoption, & Evangelism.Expert in cross channel marketing strategies & platforms.

Free Customer Engagement Guides

Join our newsletter for actionable tips and proven strategies to grow your business and engage your customers.