Learn how you can Unlock Limitless Customer Lifetime Value with CleverTap’s All-in-One Customer Engagement Platform.

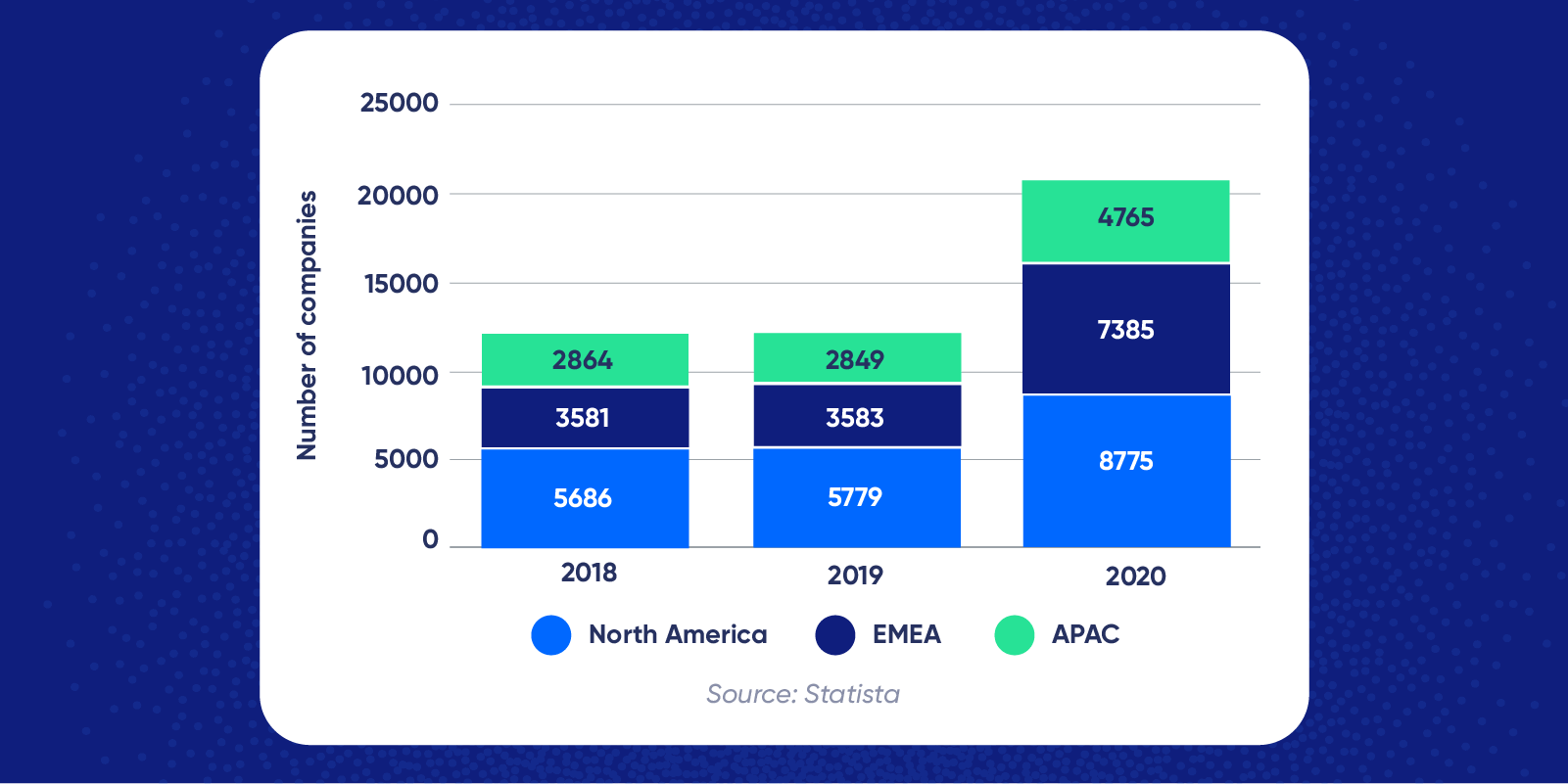

The past decade has seen tremendous growth for Fintech companies as they disrupt traditional banking and payments around the world.

In the midst of this growth, traditional banking companies took stock of the situation and started responding. Improvements in processes gave way to mobile-first thinking, as banking giants started to consider how to modernize the customer experience.

Regulation tried to keep pace with innovation and the unbundling of services. While Fintech companies created differentiators by moving fast and being nimble, launching services across geographies, the industry now has emerging forces and trends at play.

At first, banks began by collaborating with small Fintech startups to test the waters, understand the shifts in customer expectations, and leverage the Fintech company’s expertise in the digital realm.

Over the years, this collaboration has led many banks to pick up sizable stakes in Fintech companies. While this was first done to piggyback on newer models, this has now become a necessity — especially for older companies dealing with legacy processes, corporate structure, and business models that make it difficult to innovate in-house. More and more banks are choosing to buy innovation by partnering with, or acquiring, Fintech startups.

Traditionally, banks have been the gatekeepers of most financial services. With payments being unbundled at first by the likes of Paypal, Paytm, and Alipay, in the next round, technology played a key role in unbundling lending and wealth management. Even insurance providers were seeing competition from Fintech firms offering bite-sized insurance plans with scaled distribution.

Next, huge strides in technology and mobility allowed for robo-advisors, mobile POS, and newer underwriting models that leverage real-time data. Incumbents also gained a considerable understanding of these technologies, making competition fierce. Non-Banking Financial Institutions (NBFCs) are now playing in the terrain of traditional banks, while Fintechs are trying to encroach on NBFCs’ turf.

A renewed focus on technologies like cybersecurity and data privacy is increasing, with incumbents and Fintech startups alike making considerable investments to prevent and thwart financial fraud.

Worldwide, regulators are playing catch up to provide the standards needed to balance innovation with consumer interests.

Across Europe and Asia, regulators have been proactive in helping businesses deliver greater customer value in the digital realm by defining data privacy rules. As a result, companies are also focusing on compliance with legislation around GDPR, PSD2/3, etc.

These forces have fueled a massive shift in how people buy, spend, save, borrow, and invest. Given the massive innovation in this sector, Big Four accounting firm KPMG International divides the Fintech arena into five broad categories:*

As regulatory barriers shrank and traditional banks were disrupted, incumbents started to rethink their business models and leverage digital innovations. As a result, the next phase of growth will be more difficult for Fintechs.

While strategies will evolve differently for companies in each of these 5 categories, Fintech startups will need to focus on 3 key areas to drive growth in this environment: customer experience, personalization, and data.

Many consumers talk about the confusing and intimidating customer experience of acquiring a loan or insurance claim settlement. And while Fintech businesses have rapidly evolved the processes involved, there is still a lot of ground to be covered in delivering a stellar user experience beyond a minimalistic UI.

Fintechs have led the way in convenience and accessibility, and today, opening an account at any of the Neo banks is a breeze. There’s greater transparency in showcasing charges and fees upfront. Trading platforms like Robinhood have simplified financial jargon. Payment apps like Paytm have added functionality like insurance, gold investments, mutual funds, and much more.

But simply adding on more functionality is not enough. Customer experience will need to be enhanced by leveraging technology and focusing on the user.

Finance has a perception of being complex. Conversational UI mimics chatting with a real human and can deliver information to the user in the way they need it. Advancements in Natural Language Processing (NLP) mean conversational UI can be used to not only decipher the exact words a user said, but also parse out their intent.

Fintechs can embrace a valuable opportunity to create a differentiator by delivering a more personalized user experience. For example, many banks and Fintechs use Interactive Voice Response (IVR) technology, even though a study by New York University shows that 83% of users do not benefit from IVR systems.* Instead, conversational UI can be used to improve things like basic customer support, assisting users in completing forms, and matching customers with the ideal credit card or insurance plan.

Marketing automation has made user journey mapping easy. While Fintech apps provide timely information on bill payments, account balances, and service renewals, in the future Fintechs will need to predict customer needs. Companies will need to leverage real-time data and omnichannel marketing to provide customized solutions to each user and enhance their brand relationship. Each customer has their own path to purchase, and Fintechs are well poised to provide a consistent experience across channels and between departments.

Personalization has been at the core of banking for a long time. However, today personalization means interacting with a user on their preferred channel, at the right time, and with a solution tailored to their exact needs.

“What’s the cross-sell or upsell that can be offered to a particular user?” This is the question that usually starts the personalization discussion. However, personalization’s true potential doesn’t lie in marketing and sales – it lies in transforming customer interactions to build meaningful relationships. Personalization in banking is not primarily about selling. It’s about providing stellar service, relevant information, insights, and advice.

Fintechs have an upper hand here as banks have fragmented databases (yes, even today) which makes it difficult for them to deliver relevant information to an individual. 94% of banks are unable to deliver on the personalization promise.* This leaves the door open for Fintechs to double down on personalization, leading to reduced churn and long-term customer loyalty.

Users today are open to accepting Fintechs as their financial wellness coach, as seen with wealth advisor companies like Indwealth delivering personalized recommendations to users to avoid choice overload. Some customers may feel overwhelmed with a wide range of options, and effective personalization provides them only with the options they actually are looking for.

To achieve the right level of personalization, Fintechs will need precise customer insights. In addition to data points like account balance and outstanding loans, Fintechs must understand a user’s interactions with their brand and get insights into the user’s health, social interactions, and life events (with permission). This level of insight can only be built by developing a deep trust with consumers. User data will need to be treated with the utmost respect. Which brings us to the third area of growth.

Customers want complete transparency about how their data will be used. They also want to have robust security around their data. If there are privacy concerns, trust is eroded and the customer experience takes a significant hit.

Banks and Fintechs have access to incredibly intricate user data. Robust security and privacy protocols are critical, as one misstep can erode the brand. Fintechs will need to invest in technology that enables data to be kept safe and in control of the user.

In addition, Fintechs must leverage data well to improve customer interactions, gain a better overview of the entire customer journey, and provide better services. For example, analysts believe that lending will become more robust as a sector, owing to newer data sets and underwriting principles.

Companies have built businesses by marrying user data with publically available data. For example, by using improved datasets and algorithms to efficiently deliver solutions, robo-advisors (online services that use algorithms to automatically perform investment tasks typically done by a human financial advisor) can help users save and invest better. These services have democratized access to financial advice, which has traditionally been available only to the wealthy.

Companies like Plaid have created a data exchange and an API layer that ties financial products together. It’s now possible to build a range of financial products because fintechs can pull in robust data through these aggregator services. With open data protocols in place, fintechs can build more tailored financial products on top of open data.

India’s financial regulator has allowed account aggregators (a unique type of NBFC) to act as data intermediaries between users/entities who are the primary owners of data, and the banks and financial institutions that maintain and manage it. Account Aggregators are trusted intermediaries that are empowered to broker consumers’ financial data between data providers and data users.

Account Aggregation is expected to go fully operational in the latter half of 2020 with several account aggregators, large banks, and NBFCs launching consent-based data sharing.

All of these developments open up a range of possibilities for Fintechs to leverage data in new ways.

Fintechs have grown rapidly in the past few years. Access to data presents new opportunities for growth, however, data breaches are also the fastest way to lose consumer trust. But with the pace of innovation picking up at banks, they will need to focus on customer experience and personalization to truly drive user loyalty.

About the Author

A former CMO at Mobikwik, Milkbasket, and Wecash, Daman Soni has grown multiple products to 50+ million users. He was also the India Head for LINE. He consults startups on marketing, growth, India entry, and go-to-market strategies. Check out his blog for in-depth articles on growth, marketing, and startups at www.damansoni.com.