The Fintech space has come a long way—and it’s showing no signs of slowing down. With digital-first habits now deeply ingrained in everyday life, users expect speed, simplicity, and above all, security from the financial tools they rely on.

The global Fintech industry is valued at $226.71 billion as of 2024 and is projected to soar to $1071.27 billion by 2034, growing steadily at a 16.8% CAGR*. The number of Fintech startups has more than doubled in just a few years, climbing from around 12,000 in 2019 to over 26,000 globally*.

But if there’s one element that hinders fintech apps from massive user acquisition and customer retention, it’s the question of trust. A 2023 study shows that 47% of US consumers still worry about data security when using Fintech apps, making it the top barrier to adoption*.

Fintech’s Trust Problem

Financial technology, or fintech companies, can refer to a broad spectrum of services and apps dealing with money.

On one end of the spectrum, you have companies like Boost innovating cashless payments in Malaysia, or Ayopop helping users manage finances in Indonesia. On another end, you have everything from retail banking apps like PayPal and Cash App to crowdfunding and micro-payment platforms.

However, precisely because it deals with money and intimate personal information, every Fintech brand faces the challenge of getting customers to trust its app.

Below, we tackle the top 5 ways Fintech apps can gain users’ trust and succeed.

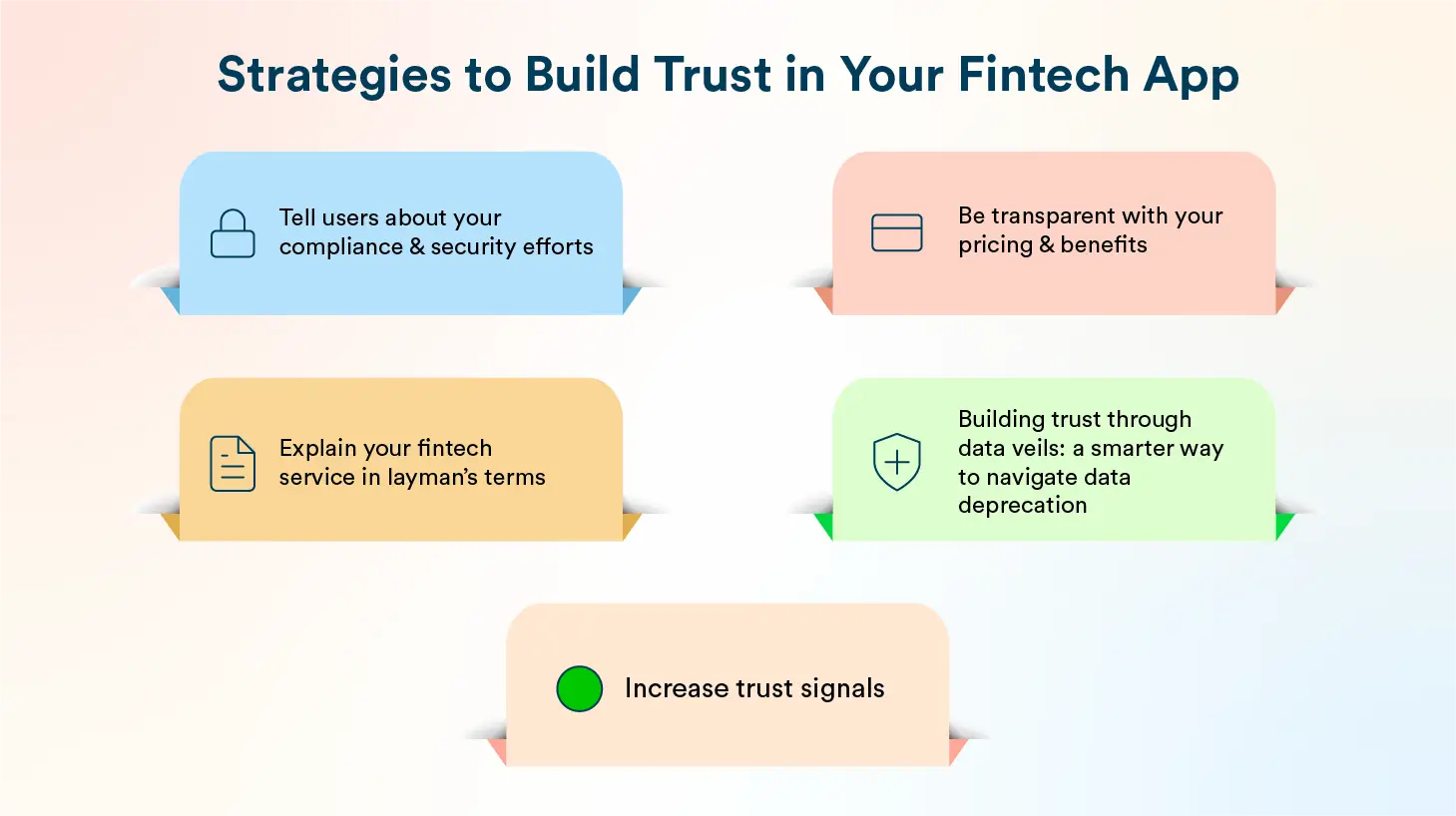

5 Strategies to Build Trust in Your Fintech App

With nearly half of fintech users citing security concerns, these five strategies offer proven ways to overcome trust barriers and boost adoption.

1. Tell Users About Your Compliance & Security Efforts

Every Fintech company must navigate a broad and complex landscape of regulatory and compliance standards—from GDPR to FTC, CFPB, FCA, CAN-SPAM, and others, each outlining specific data privacy, consumer protection, and operational guidelines. In the US, for example, apps must comply with both federal and state-level financial regulations.

Even more, you’ve got to ensure your mobile app security practices are bulletproof so customer data is safe and cannot be compromised by malicious actors. You need everything from physical and network security to encryption, strict access control, and plans for business continuity in case of disasters.

Explaining in plain words, what compliance efforts you’ve gone through, what regulatory policies your app now follows, and what security protocols are in place to safeguard both their data and their money can go a long way toward building trust in your Fintech app.

Bonus additions:

- Zero-trust architecture eliminates assumptions about trust within your network.

- AI-powered fraud detection allows for real-time anomaly tracking and prevention.

- Behavioral biometrics offer seamless and secure login experiences based on how users interact with their devices.

2. Be Transparent With Your Pricing & Benefits

Users don’t want surprises, especially when it comes to money. If you’re crystal clear about how much your service will cost, you’re already on the right track. No hidden fees, no unclear fine print. Lay out the total cost of ownership and emphasize the unique benefits your app offers.

More importantly, explain and quantify the value your app provides—whether it saves users six hours a month managing their finances, helps them avoid late fees, or simply gives them better control over their money.

AI & automation tip:

If your product uses algorithmic decisions (credit approvals, investment suggestions), clarify how these systems work and what data they use. Transparency in AI builds user confidence.

Optimize every user journey with Clever.AI

3. Explain Your Fintech Service in Layman’s Terms

And since we’re talking about using plain words… Fintech services aren’t always easy to explain to less sophisticated users. As mobile marketers, you’ve got to be able to unpack what your app does in the plainest language possible so a wide range of people understand the value of your technology, particularly those who may not have a background in finance.

Explaining difficult concepts clearly can go a long way toward building goodwill with your prospective users. But don’t just oversimplify matters either. Complex ideas and processes can still be tackled in an educational manner without “dumbing things down.” Your users deserve clarity, not oversimplification.

Pro tip:

Incorporate user education directly into your product via in-app nudges, smart alerts, and financial tips. It builds confidence while guiding healthy financial behavior.

4. Building Trust Through Data Veils: A Smarter Way to Navigate Data Deprecation

As data deprecation reshapes customer engagement, driven by stricter privacy regulations and platform constraints, fintechs must adopt more transparent and secure data practices. One emerging approach is Data Veils, a CleverTap innovation that enables selective, purpose-driven access to customer data.

Data veils act as protective layers between data sources and processing systems. Their “thickness” and “porosity” adapt to the brand’s specific use cases, ensuring only the necessary portions of a customer’s identity graph are accessible for engagement, while sensitive data remains shielded.

Take, for example, a Fortune 500 company running health incentive campaigns through its app. User activity data flows to a risk assessment system, which then triggers CleverTap-driven engagement. CleverTap never sees the raw health data—only anonymized channel interactions—ensuring user privacy and data security throughout.

By adopting data veils, fintechs can maintain personalization while honoring privacy, laying the foundation for stronger customer trust in a privacy-first world.

5. Increase Trust Signals

One of the easiest ways to get users to place their trust (and money) in your app is to use trust signals. Show off your third-party reviews, security seals, accreditation, and more on both your website and your app store pages.

Also, pay close attention to the small details of how you present your brand. Is the grammar on your website or app store page impeccable? Are your screenshots and website professionally designed? Nothing screams “fly-by-night” or “untrustworthy” more than typos in your text and images or websites that look unprofessional.

Finally, nothing builds trust quite like customer testimonials. Show off those reviews and customer quotes on your website, and highlight outstanding reviews on your app store pages.

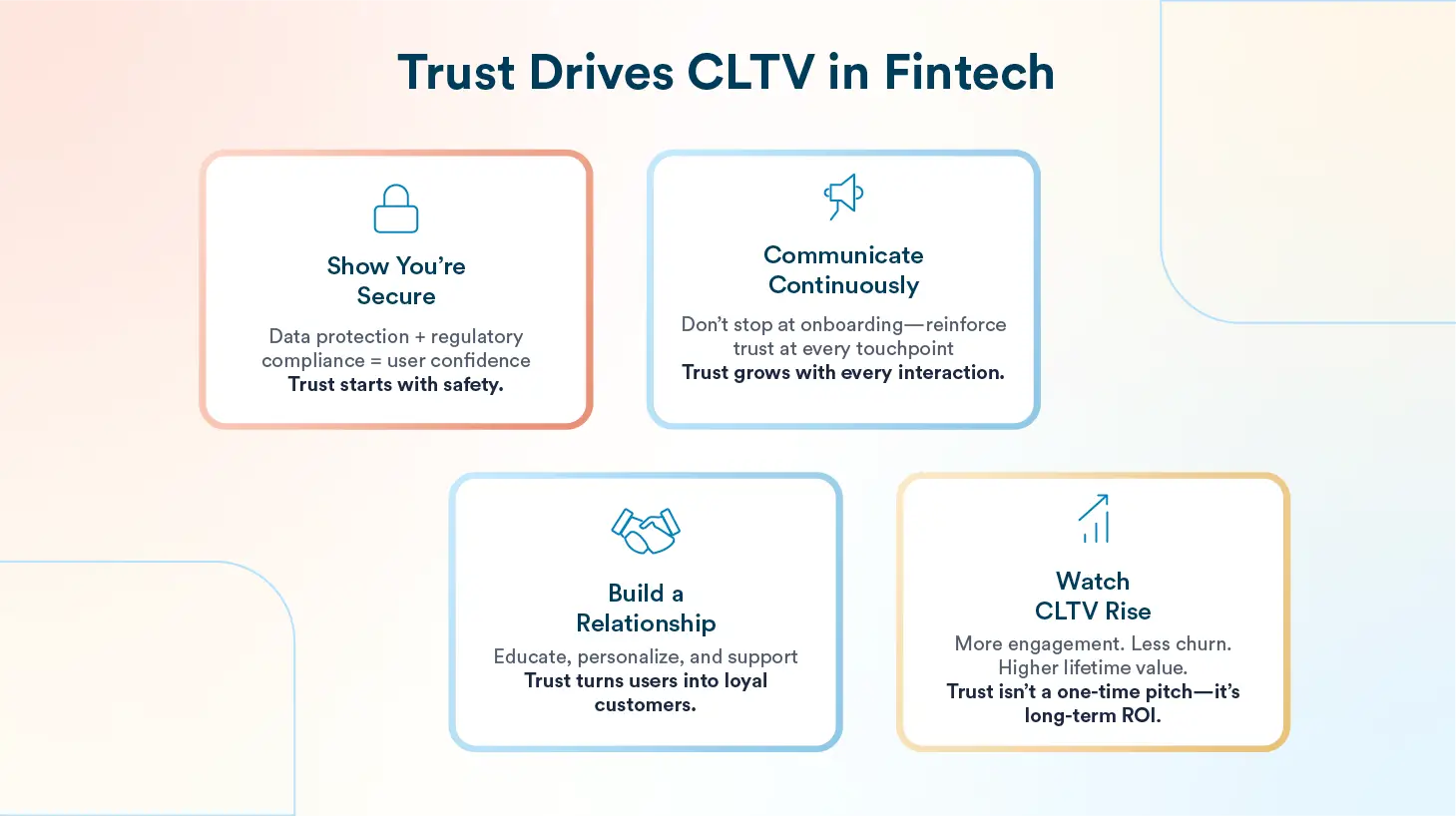

Building Trust in Fintech Leads to Higher CLTV

If you want people to adopt your app and use it regularly, you have to be able to instill confidence in both investors and customers that your financial technology app is secure and complies with all regulations. You have to be able to guarantee that customer data is bulletproof from external attacks or internal abuse.

But also, you have to be able to communicate all these things in a systematic way throughout a customer’s entire life cycle. You shouldn’t be sharing these things just during the app onboarding. Instead, engage users in a continuous cycle of communication that not just educates them but also builds a relationship that will translate to higher customer lifetime value down the road.

How CleverTap Can Help Your Fintech App

CleverTap is purpose-built to help fintech brands earn and maintain user trust across complex, high-stakes journeys, while ensuring compliance, transparency, and security at every touchpoint.

Whether you’re streamlining KYC, nudging users toward transactions, or reactivating dormant accounts, CleverTap helps you influence behavior with precision and privacy in mind. At the core is TesseractDB™, a powerful behavioral data engine that captures up to 10,000 data points per user each month and retains up to 10 years of history, enabling deep personalization even across long user gaps.

To further enhance trust, data veils offer a flexible layer of security between data origination and processing systems. These purpose-built filters ensure only relevant customer data is accessed based on the use case, safeguarding sensitive information like financial or health data and maintaining user anonymity.

Fintechs also benefit from AI-powered segmentation, predictive analytics, and lifecycle automation to engage users at the right moment, before churn, at peak intent, or during critical onboarding steps.

With over 15 secure, omnichannel engagement options, including push notifications, in-app messaging, WhatsApp, SMS, email, and Signed Call™ (our branded VoIP feature that builds credibility in real-time voice calls), CleverTap ensures your messages are always contextual, compliant, and trusted.

From digital wallets and lending apps to BNPL and insurance platforms, CleverTap empowers you to design user journeys that are not only effective but also ethical, privacy-first, and trust-centric.

Power your fintech app with privacy-first engagement from CleverTap

Mrinal Parekh

Leads Product Marketing & Analyst Relations.Expert in cross-channel marketing strategies & platforms.

Free Customer Engagement Guides

Join our newsletter for actionable tips and proven strategies to grow your business and engage your customers.