Learn how you can Unlock Limitless Customer Lifetime Value with CleverTap’s All-in-One Customer Engagement Platform.

Part 2 of our series on Mobile Marketing Strategies for Fintech Brands. Read Part 1.

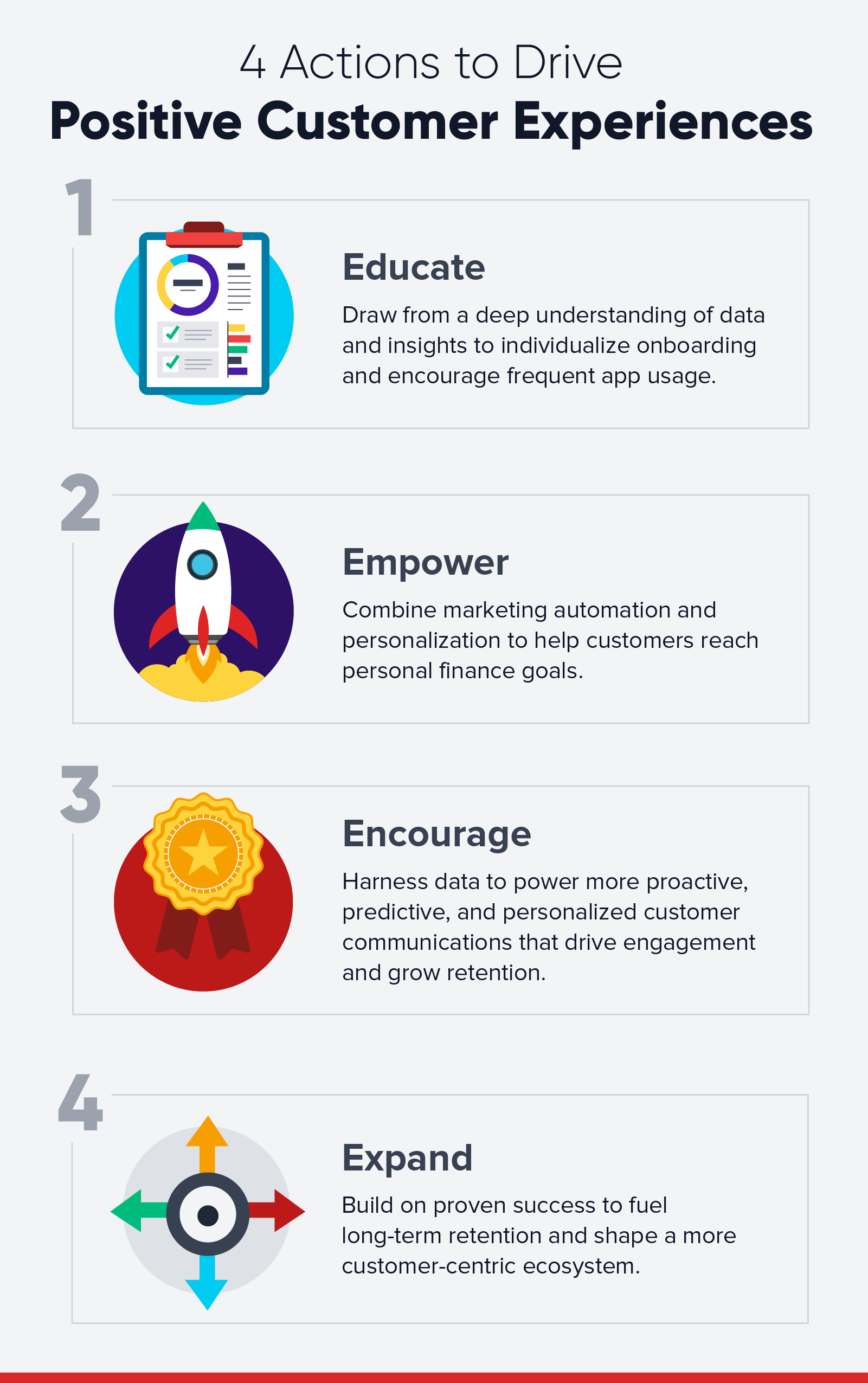

We’ve been talking about the four steps marketers can take to drive positive customer experiences that their users will want to keep returning to. Part 1 of this series talked about educating customers. This second installment talks about empowering them to reach their personal financial goals using a combination of marketing automation and personalization.

Fintech apps are getting personal, helping consumers manage their lives, not just their money. As McKinsey reminds us, the “move to digital,” accelerated by global events, is more than permanent. It has positioned mobile and apps at the core of our collective existence, making them the go-to for daily life and personal finance.

The outcome is a paradigm shift in marketing from selling to serving. In practice, it’s also a development that turns up the pressure on marketers to get closer to customers in the early and critical stages of the journey to offer guidance, support and a sense of instant gratification.

To adapt to your customer’s needs, you should start by retiring the typical lockstep pathways and deliver individualized advice and assistance at each onboarding stage. This is where marketers must draw from data to predict customer requirements and empower each customer to reach their personal finance goals on their terms.

It sounds like a tall order. But in the 2021 Rethink Fintech Playbook — the resource I wrote in collaboration with mobile analyst Peggy Anne Salz — I spotlight fintech pioneers who are harnessing data to deliver marketing and messaging that unlocks the individual potential of their customers and additional revenues for their companies.

A prime example is Albo, one of Mexico’s hottest and fastest-growing tech apps, serving a market where 45% of the 130 million population are underbanked. It offers customers a wide range of financial services, including an app, a bank account, and a debit card. The combination allows users to open a bank account in less than 5 days and access personalized financial tools quickly to help them monitor their spending and learn better savings habits.

Today, they have a customer base of over 1.2 million. That’s a 2x increase from customer numbers in the early months of COVID-19. But massive growth isn’t always a bonus. In their case, it’s a dynamic that increases the importance of identifying and activating high-quality customers from the get-go. It’s a call that Aline K. Carranza, Albo CRM & Engagement Manager, says she makes with the help of tracking metrics such as clickthrough rates, open rates, and conversions.

For Albo, high-quality users are users who have made a transaction in the first month. “The goal, working with CleverTap, is to configure formats and messages at the right moment to ensure we have better-quality customers who will go through all our journeys,” Carranza says.

It starts with a segmentation approach that groups customers based on their actions and behaviors. Albo then creates individualized engagement strategies to address each segment’s needs, covering all the touchpoints from the initial download to the first transaction.

Before deploying their onboarding journey, customers used to take an average of four months before their first transaction, Carranza says. “Today, it takes them less than a week, so we could say that it is almost immediately after finishing their onboarding process.”

Having a clear understanding of user behavior within the app is vital for accurate segmentation, format, and personalized messages, Carranza says. “We provide our users with as much information as possible throughout the onboarding journey to increase our conversion and engagement rates,” Carranza says. “Our goal is to create a highly engaged user base, so we create Journeys to help us reach that goal in an automated and effective way.” Albo defines a power user as someone who uses every feature of the app and makes more than 10 transactions per month.

“It’s critical for us to channel customers to the correct cluster so that, depending on their profile, they have the best experience,” she says. The team reserves email for more informative campaigns to onboard new users. In-app messaging is a better fit for efforts that require a personal touch. Customers who show through their actions that they are well on their way to becoming power users expect more personalized messaging. Power users also respond positively to recommendations that are aligned with where they are in the customer lifecycle.

In the insurance sector, the capability to deliver highly relevant experiences and products is no longer a nice-to-have. A survey of insurance companies by global consulting firm Accenture reports more than three-quarters (80%) of insurance customers are “are looking for personalized offers, messages, pricing and recommendations from their auto, home or life insurance providers.”

Unfortunately, Accenture also found that a significant number of companies are falling short of the promise of personalization. Over 20% of insurance customers complained that their providers do not tailor customer experiences.

So the race is on in 2022 to satisfy consumers’ craving for relevant and personalized offers, recommendations, and messaging at every step of their journey. But not all companies will be in catch-up mode.

Jerry, a fast-growing fintech startup with offices and employees across three countries, has built an AI-powered personal concierge that positions it as the first fully automated insurance agent for car and home insurance.

An avalanche of interest, buoyed by top-notch app store reviews, has allowed the company to expand into home and rental insurance. “Automation and AI are essential,” according to John Spottiswood, Jerry Chief Operating Officer. “But it’s critical to balance this efficiency with personalization.”

Personalized messaging, aligned with where customers are in their individual journeys, has allowed the company to increase conversion rates by 20%. More importantly, the ability to personalize messaging and deliver genuinely valuable advice and assistance has helped convert customers, give the app positive reviews and ratings, and reach new audiences.

The ability to A/B test messaging quickly and iterate on the fly clinches the deal. “It’s so valuable for us to be able to see which message is resonating most impactfully with our customers.” The work to personalize messaging across multiple journeys can be daunting, but Spottiswood has a clever approach.

“We’ve micro-segmented to the point where there are almost 30 separate journeys depending on which group a customer falls into,” Spottiswood explains. Some customers are returning to check if they can save money, and some are buying insurance for the first time. “Each customer has a different history and a different expectation of the product, and so we need to be able to communicate that in a very individual way based on their situation.”

A winning product succeeds in grabbing customer attention and interest. The challenge, Spottiswood says, is keeping the conversation going between app sessions and over longer periods between renewals.

Working with CleverTap allows Jerry to customize and contextualize messaging to drive engagement and bridge the gap between app sessions and interactions. This is critical in a business where customer journeys can span 12 months or more.

To this end, Jerry has developed separate content streams of information and assistance around broad topics related to each customer’s journey. This ranges from information to help customers decide whether it’s cost-effective to invest in collision insurance for an older vehicle to explaining the differences between insurance deductibles and what makes sense on a budget.

Jerry has also launched a membership product at a lower price point to appeal to the customer segments across its customer base that show interest. Here visibility into customer behavior enabled by CleverTap alerts Jerry to the app interactions and patterns that indicate customers are moving from acknowledgment to action. The primary focus,” Spottiswood says, “is to keep customers engaged so we can arrive at the point that we can shift them from being a free customer to a potential paying one.

Moving forward, Jerry plans to leverage capabilities to personalize and deliver recommendations. “It’s all about creating journeys to keep our customers engaged to the point that we can offer them savings we know they will appreciate and then get them over the line to convert,” Spottiswood says. Get it right, and track cohorts over time, and the way is clear to drive higher conversion rates earlier in the journey and significantly grow retention rates throughout the customer lifecycle.

Personalized communications create the customer expectation that products will also match their life stages and changes. Another factor driving this dynamic is the proven ability of Netflix and other streaming companies to cater entertainment to consumer preferences from the moment they log into the system. Instant gratification is a hard-to-beat benchmark. The pressure is on banks and challenger banks to align product, marketing, and communications to treat customers as individuals.

This is the second in our series, preparing fintech and finserv marketers to be fighting fit in 2022. Read Part 1 here.

You can download the 2021 Rethink Fintech Playbook here, which includes expert contributions from:

Rethink Fintech Playbook: 2021