Part 1 of our series on Mobile Marketing Strategies for Fintech Brands

Never have more people in more countries relied on finance apps to manage their lives and plan their futures. The increase in consumer dependency on fintech and insurtech apps for assistance and advice at every step of the journey opens opportunities for a new breed of finance companies that pivot to be a lifeline for their customers. And the stakes are higher than ever because digital-only has become the new norm for financial services.

To grasp this opportunity, marketers must cultivate the tools and talent to deliver right-time, real-time experiences and individualized messaging that is valuable and relevant. Communications at every stage must provide genuinely helpful (and human) advice.

More importantly, marketers should map what they say and how they say it to essential stages in the customer lifecycle. In the 2021 Rethink Fintech Playbook — the resource I wrote in collaboration with mobile analyst Peggy Anne Salz — I have identified four key stages and the actions marketers can take to drive positive outcomes for customers and their companies:

- Educate: Draw from a deep understanding of data and insights to individualize onboarding and encourage frequent app engagement and use.

- Empower: Combine marketing automation and personalization to help customers reach personal finance goals.

- Encourage: Harness data to power more proactive, predictive, and personalized customer communications that drive engagement and grow retention.

- Expand: Build on proven success to fuel long-term retention and shape a more customer-centric ecosystem.

It’s a new lens through which you can view the customer journey and align your communications strategy and tactics with customer needs and expectations.

Customer Education in the Marketing Mix

At this early stage in the journey, customers are new to the app and want assistance and advice at the moment of friction. It’s here that effective marketers excel through their ability to anticipate issues and pre-empt problems. They also succeed based on their data-formed ability to proactively suggest and recommend solutions and features to customers who are largely unaware of them and yet highly likely to benefit from them.

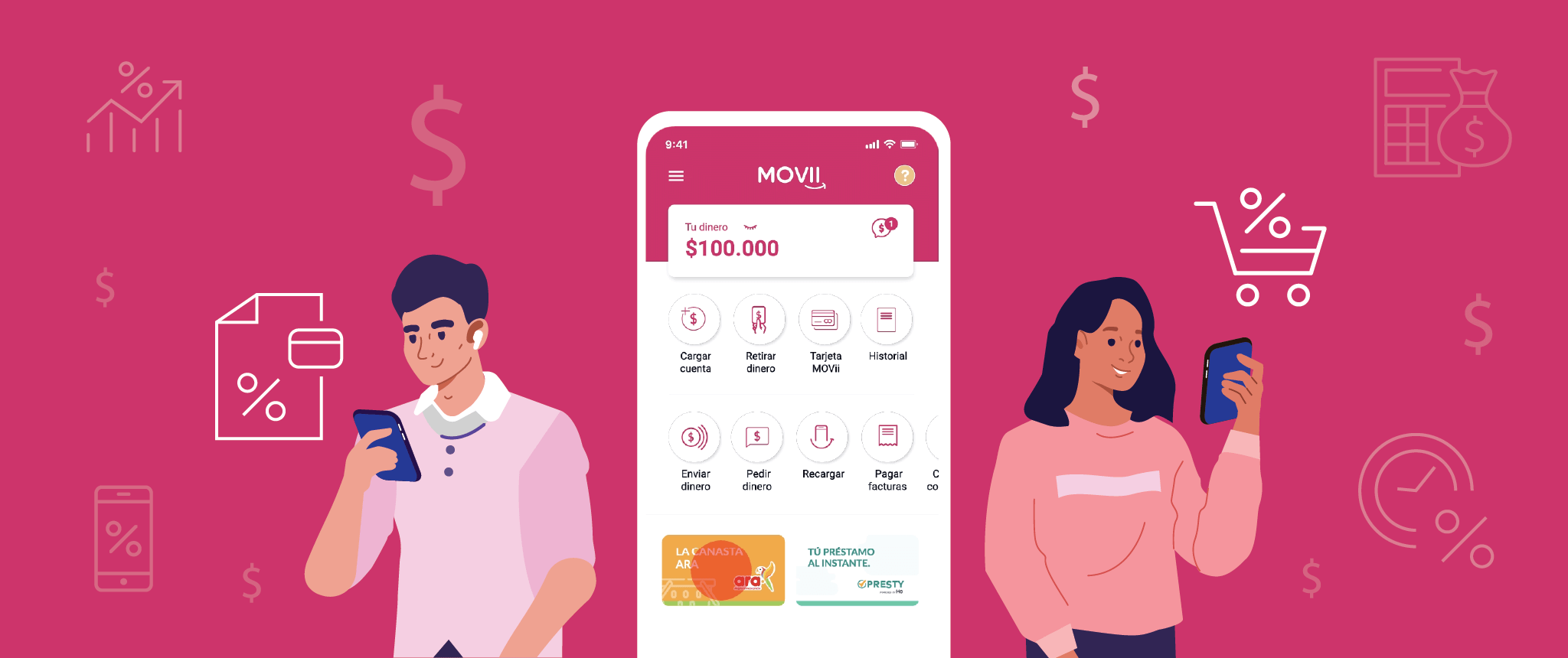

It’s all about approaches that reimagine onboarding to offer proactive education, communication, and care. A prime example is MOVii, a leading mobile wallet and challenger bank in Colombia, on a mission to encourage greater financial inclusion by providing products that allow customers to handle and move their money as simply as they use cash today.

The pathway is financial services that are accessible to, and understood by, everyone. This requires a new approach to education enabled by messaging that becomes the trusted tutor, according to Natalia Garcia Ocampo, MOVii CMO. In her view, the emphasis on education has profound implications for marketing organizations.

Personalized Education Reduces Churn

“Education has become a leading vertical inside the marketing team,” Garcia says. In practice, the team divides efforts between acquiring, engaging, and educating users according to their profile. “Improving and individualizing education is one of our main objectives right now.”

Using CleverTap has helped MOVii understand each customer’s journey and the segment that person falls into, Garcia says. Learning how users get into the app and what they are using it for in the first place allows MOVii to surface offers and information that add the most value at the critical moment. This also paves the way for occasional users to become high-value users loyal for the longer term, she says.

“Not everyone receives the same kind of information and messaging because not everyone needs the same kind of training,” Garcia explains. A big part of education is ensuring users get unstuck and get assistance when they encounter problems or simply have questions.

A prime example is the registration process, where the law requires customers to provide a selfie, proof of identity, and proof of address. It’s here that MOVii distills the data to see where users are getting stuck and sends a personalized push to help them continue in the funnel. This individualized approach to education, enabled by CleverTap, has allowed MOVii to reduce monthly churn by 82% — from 17% to 3% — and drive record numbers of mobile transactions.

“First, messaging needs to educate users to become familiar with features that help them achieve financial wellness.” Moving forward, she says, messaging needs to increase brand awareness and drive more transactions.

Learning From Users to Increase Relevance

This requires learning of a different kind. It’s a scenario where MOVii is the student, learning from user behavior when the time has come to switch tactics. “We need to recognize the triggers that tell us our customers don’t need help using the app. And we need to know when users are ready to learn all the possibilities that are relevant and their situation so they can begin to live their financial life in the MOVii app.”

Garcia’s Top Advice

- Understand the complete customer lifecycle and the stages where users should be — depending on where they come from and what they intend to do.

- Start by crafting an end-to-end customer journey map that shows all the potential optimization opportunities and steps where customers could need a helping hand.

- Adapt educational and empathetic messaging to an analysis of customer behavior at every stage of the customer lifecycle.

Editor’s Note:

This is the first in our series, preparing fintech and finserv marketers to be fighting fit in 2022. The next in the series will look at how companies use models and methods to empower customers and deepen engagement.

You can download the 2021 Rethink Fintech Playbook here, which includes expert contributions from:

- Adam Hadi, VP of Marketing, Current

- Aline K.Carranza, CRM & Engagement Manager, Albo

- Ankit Banga, Head of Marketing, Dhani Housing Finance

- Carlo Isles, Head of Performance Marketing, PayMaya Philippines

- Deniz Güven, CEO & Co-Founder, Platform XIT and formerly CEO, Mox Bank

- Dhanraj Shetty, Chief Manager, Digital Analytics, Edelweiss Group

- Anand Sharma, Head of Digital Products & Design, Edelweiss Group

- Jay Moon, General Manager, Credit, Credit Sesame

- Jithesh P.V., Vice President & Head, Digital Centre of Excellence, Federal Bank

- John Spottiswood, Chief Operating Officer, Jerry

- Kelly Street, Director, Fraud and Identity, LexisNexis Risk Solutions and formerly Director, Consumer Marketing, Fiserv

- Mike Ng, Chief Revenue Officer, Digital Turbine

- Natalia Garcia Ocampo, CMO, MOVii

- Noopur Chaturvedi, CEO, NPCI Bharat BillPay Ltd. and formerly Country Head – SMB, PayU India

- Ved Prakash Yadav, Head of Growth and Marketing, Khatabook

Rethink Fintech Playbook: 2021

Sunil Thomas

Co-Founder, Chairman & CEO.Expert in technology & building companies.

Free Customer Engagement Guides

Join our newsletter for actionable tips and proven strategies to grow your business and engage your customers.