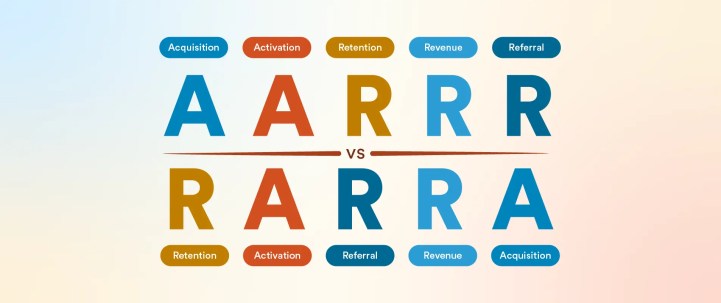

For over a decade, growth marketers have sworn by the AARRR framework, Dave McClure’s famous “Pirate Metrics”. Since 2007, AARRR has been a go-to framework, helping startups focus on key user growth levers.

However, modern marketing deals with saturated acquisition channels, high CAC, and comparatively high churn. RARRA offers a retention-centric remix of the pirate metrics, helping growth leaders strategize in a competitive space.

In this article, we’ll compare AARRR and RARRA in detail while touching base on how to implement them in your company. This guide will help you with the technological construct necessary to enforce these frameworks in reality.

What is AARRR and Why Was it So Popular?

AARRR stands for acquisition, activation, retention, referral, and revenue. It’s a five-stage framework that maps the customer journey from first contact to monetization.

Let’s take a look at each stage in detail.

- Acquisition: This is the stage where users discover and arrive at your product through SEO, content marketing, PR, performance ads, etc. To estimate acquisition, you look at key metrics such as website/app visitors, sign-up rate, cost per acquisition (CPA), and conversion by channel.

- Activation: At this stage users have their first “aha!” moment or successful experience. This is measured by the following metrics: activation rate ( % of sign-ups that complete a key action), time to activation (or time to value), onboarding completion, and early churn rate. You can influence these metrics with streamlined onboarding flows, in-app tutorials, product tours, and first-use incentives.

- Retention: This stage tracks whether users keep coming back over time. You measure this with retention rate (e.g., % of users active after N days), churn rate (the inverse), daily/monthly active users, session frequency, and cohort retention curves. Push/email engagement or re-engagement campaigns play a major role in this, with constant support from the customer success team.

- Referral: Users refer others via word-of-mouth. NPS score, referral invitations, social shares, and the viral coefficient (K-factor) give a measurement in this stage. You strategize it through referral programs and community-building efforts.

- Revenue: Users generate monetization events. Metrics like conversion rate to paid, average revenue per user, lifetime value, or monthly recurring revenue showcase this stage well.

AARRR offers a clear, linear model where each stage is intuitive and tied to specific teams. Marketers could focus on one stage at a time. When digital channels were unsaturated and acquisition costs were relatively cheaper, the AARRR model gave a handy funnel to acquire and convert users. Some marketers adopted the AARRR as a standard to track user growth. However:

AARRR May No Longer Be Effective: Here’s Why

Despite its past success, marketers question AARRR’s effectiveness in a market saturated with different apps and SaaS products. It puts acquisition first, which automatically becomes a priority. However, the days of grabbing users are behind us. Compared to the past decade, the iOS App Store now hosts over 1.96 million apps, with another 3.3 million on the Google Play Store. Due to competition in the majority of categories, the CAC is continuously soaring.

Users have many choices, making your brand the preferred choice a rather expensive affair. An analysis reveals that CAC has increased so much that e-commerce brands lose $29 on average for every new customer acquired, vs. just $9 in 2013. It’s highly likely to see similar trends across categories

Bearing this high CAC gets tricky when retention doesn’t hold up. According to industry data, the average mobile app loses 77% of its daily active users within 3 days of install, 90% within 30 days, and over 95% within 90 days. This makes retention virtually ineffective. It makes you really rethink how you’re strategizing the user journey for your brand. If retention isn’t a priority, many trials or signups might just be some vanity metrics you celebrate.

Your product needs to immediately deliver value. If you invest in growth before building a retention strategy, you’re simply renting users, not acquiring them. This makes it tricky to lead with an acquisition-led growth model, creating space and opportunity for a model that’s highly focused on retention, the RARRA.

Introducing RARRA: A Retention-First Growth Model

RARRA stands for Retention, Activation, Referral, Revenue, Acquisition. It is effectively the AARRR metrics reordered with retention at the top. Growth experts Thomas Petit and Gabor Papp popularized this model around 2017 as an evolution of pirate metrics for the modern app ecosystem. In RARRA, user retention is the north star metric that fuels all other stages of growth.

This model treats retention as a precondition for stable and sustainable growth. Retention isn’t just a KPI here; it’s the driver of compounding growth. The RARRA model highlights activation in service of retention.

The rest of the metrics are meant, measured, and influenced in the same way as we covered in the AARRR section. Gabor Papp noted that many startups focus on the funnel sequence linearly, and “that will destroy your startup” if retention isn’t fixed.

AARRR vs. RARRA: Which Framework for What Situation?

Both AARRR and RARRA cover the same fundamental growth metrics, but the difference lies in focus and sequence. Depending on your product’s stage, business model, and industry dynamics, one framework may be more appropriate than the other:

| Stage/Model of a Business | AARRR vs. RARRA: The Choice |

| Established or Saturated Markets | When you’re in a saturated market, RARRA is more effective. An existing user base is an asset that helps you drive more value than winning a new customer. |

| Product-Led Growth Models | These companies rely on RARRA for growth. Free users are converted to paid users, and over time, they champion the product to different organizations and networks. |

| Consumer Apps and E-Commerce | These can go either way depending on maturity. A new social app might need an initial burst of user acquisition focus to generate network effects, but if those users don’t retain, the network never solidifies. It’s more of AARRR + RARRA. On the other hand, a mobile game or e-commerce app with a sizeable user base should probably switch to retention-first to maximize lifetime value. E-commerce in particular has seen the pendulum swing toward retention in recent years, with rising ad costs and low consumer loyalty. |

| Early-Stage or New Product Launch | AARRR: To reach the product market fit (PMF) and get early traction. If you’re in a low-competion market with an innovative product AARRR helps you quickly capture the market share. and, RARRA: When you have built some acquisition, but the retention numbers aren’t holding up in parallel, you need to focus on scaling retention first and test it; otherwise, there may be a bigger pivot in line to reach PMF. |

If your GTM is sales-led, you would have an AARRR focusing on retention. In this context, retention is the expansion of revenue. Conversely, a marketing-led GTM is predominantly RARRA, since you need usage and referrals to grow.

How to Implement AARRR and RARRA

Regardless of the approach you choose, the customer lifecycle stages and their strategies remain the same for both AARRR and RARRA. However, the priority of these stages varies, and so does your focus on them. Below is a practical guide to implementing AARRR and RARRA, including key metrics and strategies for each stage.

Acquisition

When bringing new users to your product, you need to monitor several metrics. These include the number of signups, CAC by channel, landing page conversion rate, CTR on ads, and App Store (or Play Store) conversions.

Identify the channel with the strongest ROI. If you’re early, it’s likely social media, PR, or influencer mentions. You can also get traction from scrappy sources like product hunts or cold outreaches.

Tools like Google Analytics would be helpful. If you need a more in-depth metrics analysis with clear attribution to specific campaigns, CleverTap analytics would be a preferred choice. The overall goal here is to drive awareness for cheap. If your AARRR metrics are lagging, invest more time in experiments to find what works best in your case.

Activation

Define your product’s “aha” moment and identify the path that leads users toward it. Activation brings users to this aha moment, where they realize the product’s value. To do that effectively, optimize app onboarding with tutorials, in-app notifications, guides, and omnichannel campaigns if a user’s app activity is low.

It’s best to A/B test different onboarding flows to find the one with the highest impact. CleverTap’s IntelliNode helps optimize user flow in real time, encouraging more users to reach the AHA moment faster, leading to conversion. This allows you to strategize for real usage and delivering value rather than purely vanity metrics.

Retention

It’s all about ensuring users consistently get value. Classic retention metrics include N-day retention rates (e.g., % of users active 7 days, 30 days, 60 days after signup), churn rate per period, cohort analysis, frequency of use indicated by daily active users/monthly active users, or session duration.

Push notifications and effective user segmentation can influence these metrics. Targeted messaging to these segments allows you to win back users who have slipped away due to inactivity. The CleverTap platform will enable you to influence users’ stickiness in your brand’s favor. It lets you engage users on multiple channels, primarily through chat, SMS, in-app push, or email, encouraging user activity.

The platform comes with TesseractDB™, the world’s first purpose-built database for customer engagement and retention, which has 10 years of user behavior data and 10,000 data points per user per month. This allows precise real-time targeting of high-value or at-risk users.

Referral

It’s a viral growth element, where existing users bring in others. Not every product has a referral dynamic, but many do, especially consumer apps and some B2B with user-driven expansion. In many companies, this is measured by NPS.

You’re likely aware of how the referral mechanism works. Everyone implements it, but only a few see the results they expect to drive. Value exchange is often tricky in the case of referrals. A “2 months free subscription” or “$50 discount” isn’t big enough to put reputation at stake.

You’re more likely to get referrals when the value exchange feels meaningful to the user. For example, if a tool gives access to their high-tier paid plan, which costs $200/month, at the rate of the low-tier plan (around $20/month) for every referral, that’s a value hard to miss. Similarly, giving early-stage founders free access to a paid plan can encourage signups and build loyalty. These approaches help you acquire new users while also building stronger retention for existing users. Users who see long-term value are more likely to stick with your product and convert to paying customers as their needs grow.

Most importantly, you need to ask for referrals at the perfect time. Triggering them after a high-satisfaction moment is effective. CleverTap’s event-triggered campaign automates these with real-time segmentation.

Revenue

This is where you make money. Average revenue per user (ARPU), monthly recurring revenue (MRR), churn monthly recurring revenue (MRR), and expansion MRR are some metrics that inform revenue activity. You can optimize these metrics in different ways. For example, a B2C e-commerce brand can introduce subscriptions at a discounted rate to encourage users to come back to their store for purchase. This increases the average revenue per user for the brand.

Importantly, an AARRR-driven team might risk chasing short-term revenue at the expense of long-term retention. For instance, aggressive pop-ups that upgrade annoy users. One must balance this carefully, even in AARRR, the best revenue strategy is a great user experience that users want to pay for.

For a RARRA model, the priority of these stages changes; the tactics, methods, metrics, and strategies remain the same.

Building a Case for RARRA: Based on Real Examples

Check out how Hitlist and Blinkit leveraged a retention-focused model for their growth:

Hitlist: Form Acquisition Hype to Retention Turnaround

Hitlist is a travel deals app, launched with fanfare in 2013. Initially, it acquired tens of thousands of users almost immediately. Some investors urged the team to double down on that momentum with more marketing spend. However, within three months, the sobering reality set in. Fewer than 5% of users remained active after the initial excitement. This is where Hitlist’s team aligned with the RARRA framework. They didn’t throw money at ads but focused on retention and making the product better.

They overhauled the UX and feature set to serve better “ready buyers” rather than casual browsers. Hitlist 2.0’s relaunch failed almost every acquisition vanity metric, but under the surface, it excelled where it mattered. 42% of new users were still active a week after download, a massive improvement from before. More importantly, users were truly engaging and generating revenue. Over 10% of monthly active users were booking deals (up from <1%), with many making multiple purchases per month. Within a year, Hitlist quietly grew to a quarter of a million users across 163 countries, booking over $6 million in travel.

Blinkit: Driving Retention and Activation

Blinkit, formerly Grofers, is an Indian quick-commerce app that delivers groceries and essentials. In a highly competitive market, with giants like Amazon and local rivals, Blinkit recognized that superior customer experience and retention would differentiate it. They leveraged CleverTap’s customer engagement platform to implement a RARRA-style strategy. According to Blinkit’s growth team, getting real-time user insights was a key challenge. They needed to react quickly to user behavior to keep users coming back.

Using CleverTap’s real-time analytics and segmentation, Blinkit could micro-segment users based on purchase frequency and recency. They mapped out lifecycle stages and focused on activating new users.

With the RARRA strategy in play, Blinkit increased its overall user retention rate by 6% quickly. More dramatically, the focused onboarding journey led to a 53% increase in Week-1 new user logins. This indicates far better activation, which, as we know, feeds into retention. The cart abandonment campaigns increased conversion rates by 2.6%, drastically increasing revenue.

| Takeaways from both stories: Key to Success: Success came from addressing retention and user value first. Learning: AARRR strategy with retention is hollow. Hitlist learned hard, but Blinkint proactively focused on retention from the beginning. Numbers: Both saw increased retention, which we can translate into revenue expansion and a higher ARPU. |

How to Create a RARRA-focused Growth Strategy

Adopting a retention-first (RARRA) mindset isn’t just a metric shuffle; it often requires organizational and process changes.

- Set Retention as a North-Star Goal: Make it explicit in your planning that retention is the top priority. For example, your quarterly goals might say “Improve 30-day retention from 25% to 35%” or “Reduce monthly churn to <2%”. This ensures every team (product, marketing, customer success) knows what “success” looks like.

- Cross-functional Retention Task Force: Break the silos between marketing, product, and support. Retention is a shared responsibility. Consider forming a “Retention Squad” with product managers, marketers, data analysts, and even customer support, who meet to analyze user feedback and drop-off data.

- Lifecycle Stage Mapping: Map out your customer lifecycle stages clearly. For each stage, define entry/exit criteria (e.g., a user is “At-Risk” if 14 days have passed since their last login, and they usually log in weekly). Then, on your roadmap, plan initiatives for each stage. For example, drip campaigns for new users, personalized offers, or steal deals for users at risk. CleverTap’s Lifecycle Optimizer feature helps in this planning. It shows how users progress through stages and where to intervene.

- Prioritize Product Improvements that Drive Retention: Often, the biggest wins for retention come from the product itself. Analyze which features correlate with long-term retention. Then, prioritize those in your product development. A retention mindset sometimes means deprioritizing shiny new acquisition-driven features in favor of polishing the core experience.

- Personalization and Segmentation: Not all users are the same. A retention-first strategy often involves personalizing the experience for each user segment to maximize engagement. Many companies use RFM analysis, short for recency, frequency, monetary value, to strategize their retention approach.

- Measure, Iterate, and Communicate: Make retention progress visible. Have a public dashboard or regular report on retention metrics for the team. Celebrate improvements like you would celebrate new user milestones. If retention drops or churn spikes in a period, make it an “all-hands-on-deck” investigation. The roadmap should be a living document: revisit it each month or quarter and adjust it based on what the data shows.

CleverTap: Automating The Heavylifting In AARRR and RARRA Frameworks

CleverTap offers the right data, customer segmentation, and engagement tools that align strongly with both AARRR and RARRA stages. At the heart of CleverTap is TesseractDB™, the platform’s proprietary, purpose-built database for customer data. It enables you to analyze user behavior across all funnel stages instantly.

For AARRR, you track each metric, from acquisition source to activation events to revenue, while quickly identifying drop-offs. For RARRA, it’s even more crucial. You calculate retention cohorts on the fly, segment users by engagement level, and trigger personalized campaigns based on live behavior.

You get lifestyle optimizer functionality to create retention and lifetime value. This aligns perfectly with the RARRA philosophy, moving users from onboarding to habit, and then to advocacy. It helps you visualize and map out campaigns for each stage while experimenting with different approaches.

CleverTap brings you a standout feature, RenderMax™. It tackles a common retention challenge on Android devices. Push notifications often don’t “render” if the device is in battery-saving mode. RenderMax uses device-level optimizations and retry mechanisms to ensure messages are displayed on-screen, around 90% of the time. This has a direct impact on retention campaigns.

With its strong tools and functionality, CleverTap supports both AARRR and RARR models, helping brands make the most of every acquisition.

Support your growth model with the technology it deserves.

Agnishwar Banerjee

Leads content and digital marketing.Expert in SaaS sales, marketing and GTM strategies.

Free Customer Engagement Guides

Join our newsletter for actionable tips and proven strategies to grow your business and engage your customers.