Customer lifetime value (CLV) is a metric that estimates how much revenue an average customer is worth to your company over the entire relationship, not just from a single sale. In this comprehensive guide, we’ll explain what customer lifetime value is, show you how to calculate the lifetime value of a customer (including formulas, examples, and a ready-to-use calculator), and share 14 proven ways to improve CLV.

What is Customer Lifetime Value (CLV)?

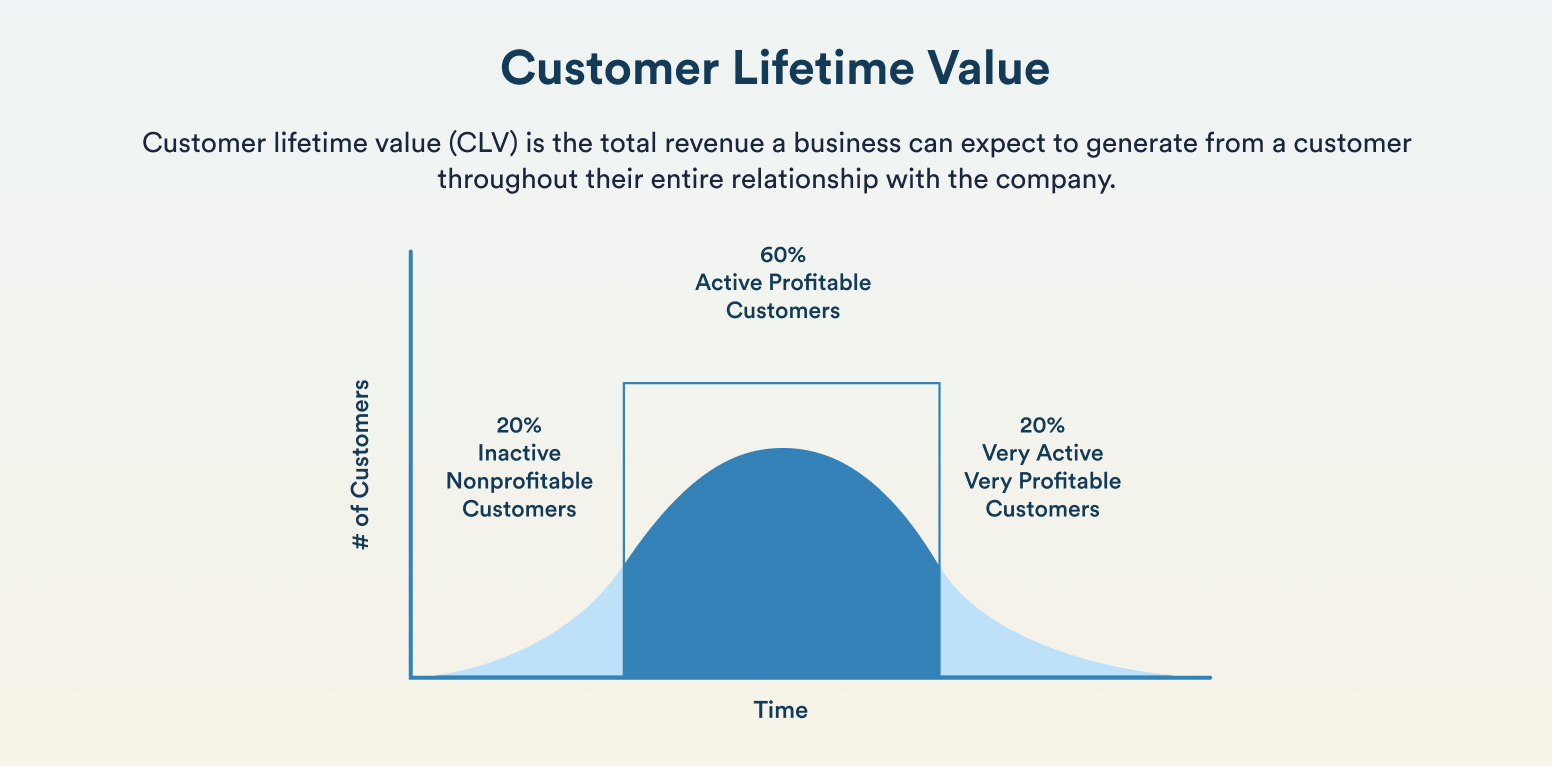

Customer lifetime value (CLV) is the total revenue a business can expect to generate from a customer throughout their entire relationship with the company. Also known as lifetime value (LTV), it measures the sum of all purchases and revenue a customer generates from their first purchase until they stop doing business with you.

This metric considers all potential transactions with that customer over time, rather than just focusing on one purchase or a single period.

In practical terms, CLV puts a dollar value on customer loyalty. If the average customer stays with your company for 3 years and spends $500 per year, their lifetime value is about $1,500. Companies track LTV to understand how valuable their customer base is in the long run.

How to Calculate Customer Lifetime Value (CLV)

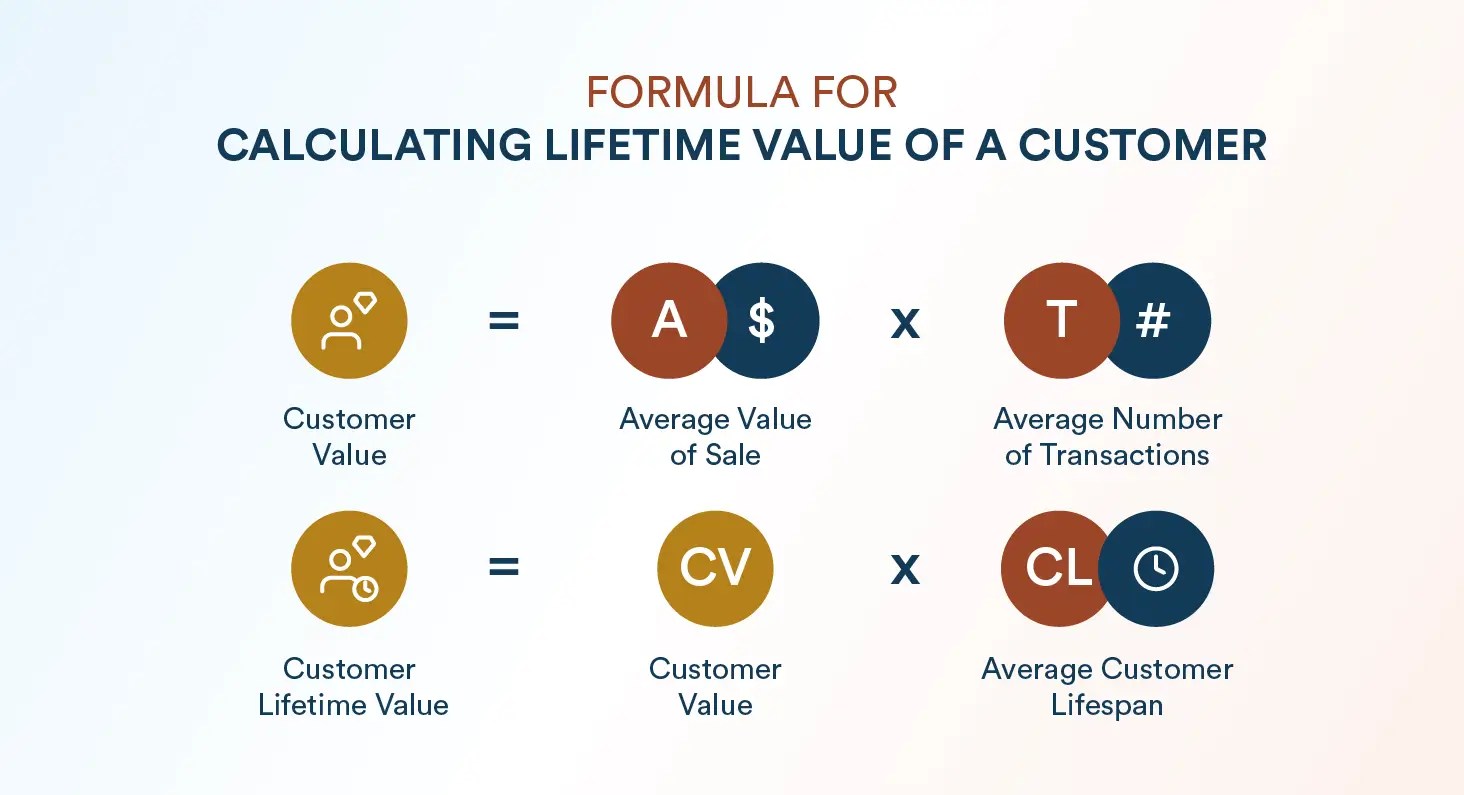

Customer lifetime value can be calculated in different ways. The basic CLV formula is:

Customer Lifetime Value = Average Purchase Value × Average Purchase Frequency × Average Customer Lifespan

This simple equation estimates the total revenue you earn from an average customer. Here’s what each component means:

- Average Purchase Value: How much does a customer spend on average per purchase? (e.g., if your typical transaction is $50, that’s the average purchase value.)

- Average Purchase Frequency: How often the average customer buys from you in a given time period. (e.g., 2 purchases per month, or 5 purchases per year, etc.)

- Average Customer Lifespan: How long a customer continues to buy from you, on average, before churning. This could be measured in years or months. (e.g., 3 years, or 18 months, etc.)

For instance, if customers spend $50 per purchase, purchase 3 times a year, and remain customers for 5 years on average, then:

CLV = $50 × 3 × 5 = $750 in revenue.

This basic calculation can be refined in a few ways:

Include Gross Margin

Often, businesses care about profit, not just revenue. In that case, you might multiply the CLV by your gross profit margin to get a profit-based CLV.

For example, if your margin is 60%, that $750 CLV would be $450 in lifetime gross profit.

Account for Churn Rate

In subscription businesses or cases where you have a churn percentage, another formula is used. A common one for SaaS or subscription CLV is:

CLV = (Average Revenue per Customer per Period × Gross Margin) / Customer Churn Rate

For example, if a SaaS customer pays $100 per month and has a monthly churn rate of 5% (meaning on average they stay ~20 months), and your gross margin is 80%, then:

CLV = ($100 × 0.8) / 0.05 = $1600

This formula essentially calculates the expected revenue until churn. It’s a quick way to get CLV for steady subscription models.

Learn how to calculate churn rate.

Step-by-Step: Simple Customer Lifetime Value (CLV) Calculation

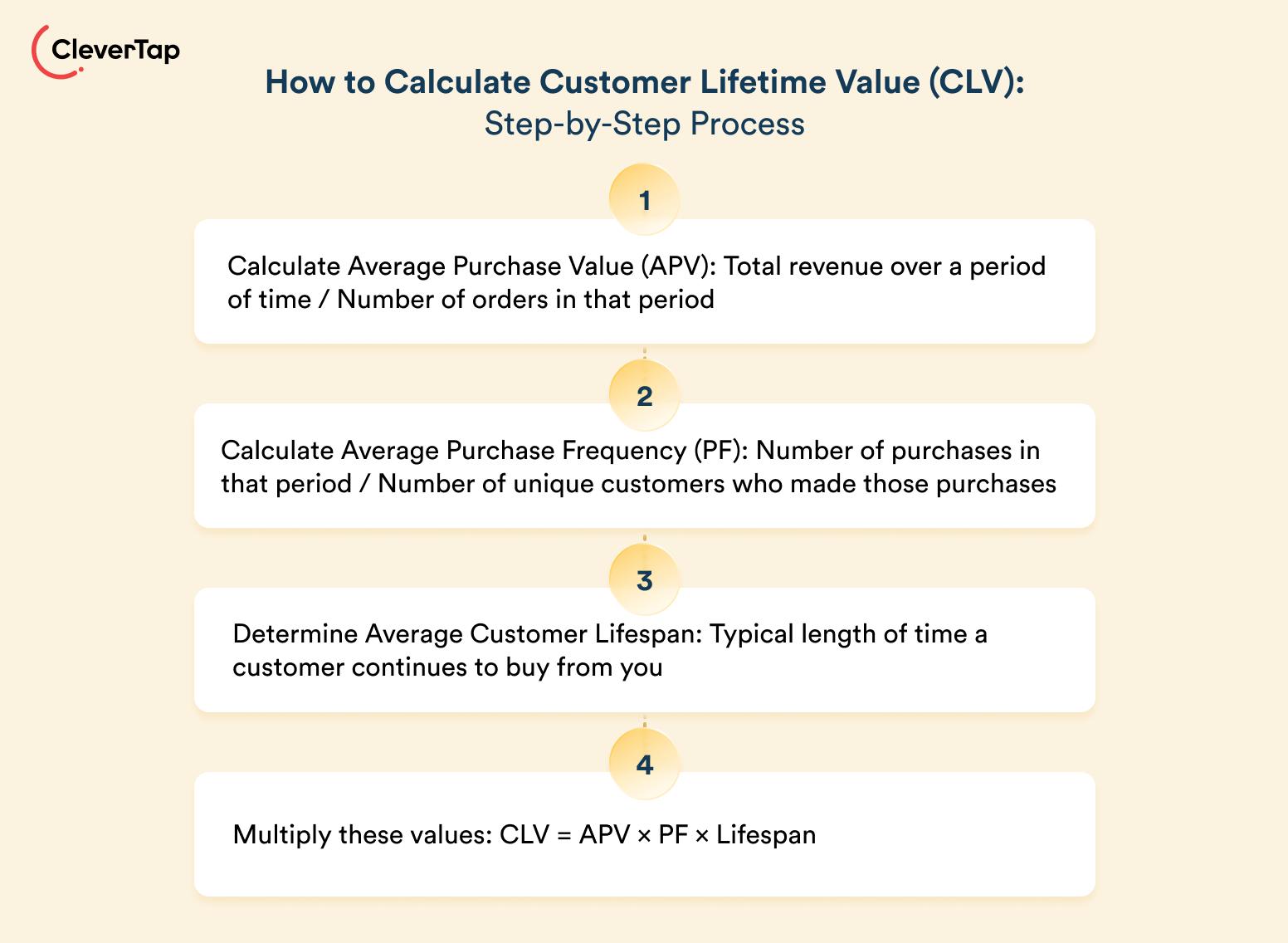

Let’s break down a straightforward way to calculate CLV in four steps:

1. Calculate Average Purchase Value (APV): Total revenue ÷ number of purchases. E.g., $100,000 revenue ÷ 2,000 orders = $50 APV.

2. Calculate Average Purchase Frequency (PF): Total purchases ÷ number of unique customers. E.g., 2,000 orders ÷ 400 customers = 5 purchases/customer.

3. Determine Average Customer Lifespan: Use average time a customer stays active, or 1 ÷ churn rate.

E.g., 25% annual churn → 1 ÷ 0.25 = 4 years.

4. Multiply these values: CLV = APV × PF × Lifespan. So, $50 × 5 × 4 = $1,000 revenue/customer. With 50% profit margin, it comes up to $500 lifetime profit.

These are average values, individual customers will vary. Some will spend far more (your VIPs and power users) and some far less. But this gives a baseline to work with for planning purposes.

Tip: If your business has distinct customer segments, consider calculating a simple CLV for each segment separately. For example, compare new customers to returning customers or one product line to another to see differences. Also, remember to use consistent time units: if purchase frequency is per year, lifespan should be in years (and use annual spend); if using monthly churn, use monthly revenue and lifespan in months.

Customer Lifetime Value Calculator

Here’s an easy-to-use CLV calculator to quickly estimate the lifetime value of your customers and make smarter marketing decisions.

Customer Lifetime Value (CLV) Calculation Examples

Let’s walk through a few industry examples to make CLV more concrete. Each scenario will show how the formula can be applied and what the results might look like:

1. Cafe

An average customer spends $5 per visit, visits 2 times a week (100 visits/year), and stays loyal for 3 years. Then, CLV = $5 × 100 × 3 = $1,500 in revenue. With a 70% margin, profit-based CLV is $1,050. This shows how small, frequent purchases quickly add up. Even slight increases in frequency or customer lifespan can significantly boost CLV.

2. SaaS Business

A subscription costs $50/month, and customers stay for 24 months. Then, CLV = $50 × 24 = $1,200 in revenue. With an 80% margin, profit-based CLV is $960.

Alternatively, using churn (4.2% monthly), CLV ≈ $50 × 0.8 ÷ 0.042 = ~$952. This gives a clear benchmark for what each customer is worth and helps optimize CAC (e.g., spending $300 to acquire a customer is sustainable).

3. E-commerce Retailer

Average order value is $80, with 3 purchases/year over 3 years. Then, CLV = $80 × 3 × 3 = $720 in revenue. At a 50% margin, profit-based CLV is $360.

Why Calculating Customer Lifetime Value (CLV) is Important

Tracking and improving customer lifetime value is crucial because it directly ties to your company’s growth, profitability, and marketing efficiency. Here are a few key reasons why CLV matters:

Improves Customer Retention

Keeping existing customers happy is far cheaper than constantly acquiring new ones. In fact, acquiring a new customer can cost 5 to 25 times more than retaining an existing one. Additionally, loyal customers tend to buy more over time. Increasing customer retention rates by just 5% can boost profits by 25% to 95%.

Higher LTV means customers stay longer and spend more, driving significantly higher profit margins.

Better ROI on Marketing Spend

Knowing your LTV to customer acquisition cost (CAC) ratio helps optimize your marketing investments.

For example, if the lifetime value of a customer is $500, you’ll want to spend significantly less than that to acquire them. Many experts consider an LTV:CAC ratio of about 3:1 to be healthy, meaning you earn $3 in lifetime revenue for every $1 spent to acquire a customer.

Tracking CLV ensures you’re acquiring valuable customers and not overspending on acquisition relative to their long-term value.

Informs Customer Acquisition vs. Retention Strategies

CLV gives a long-term perspective on customer relationships. A high average CLV might indicate that investing in customer retention is paying off. Conversely, if CLV is low, it may signal a need to improve the product or customer experience.

Focusing on LTV encourages strategies that increase customer satisfaction and loyalty (which are often more cost-effective than solely chasing new customers).

Guides Product and Service Improvements

Analyzing CLV by segment can reveal which customer groups are most valuable to your business. Customer segmentation insight helps you tailor your product development, customer service, and marketing to replicate success with high-CLV customers across your base.

It also highlights unprofitable segments where you might be wasting resources.

Signals Long-Term Business Health

Investors and stakeholders often use customer lifetime value (CLV) in conjunction with metrics like CAC to gauge a business model’s viability. Companies with high CLV tend to have more resilient revenue streams and can better weather competitive pressures since they rely on lasting customer relationships instead of one-off transactions.

Next, let’s look at the different ways to view and model LTV.

Types of Customer Lifetime Value (CLV) Models

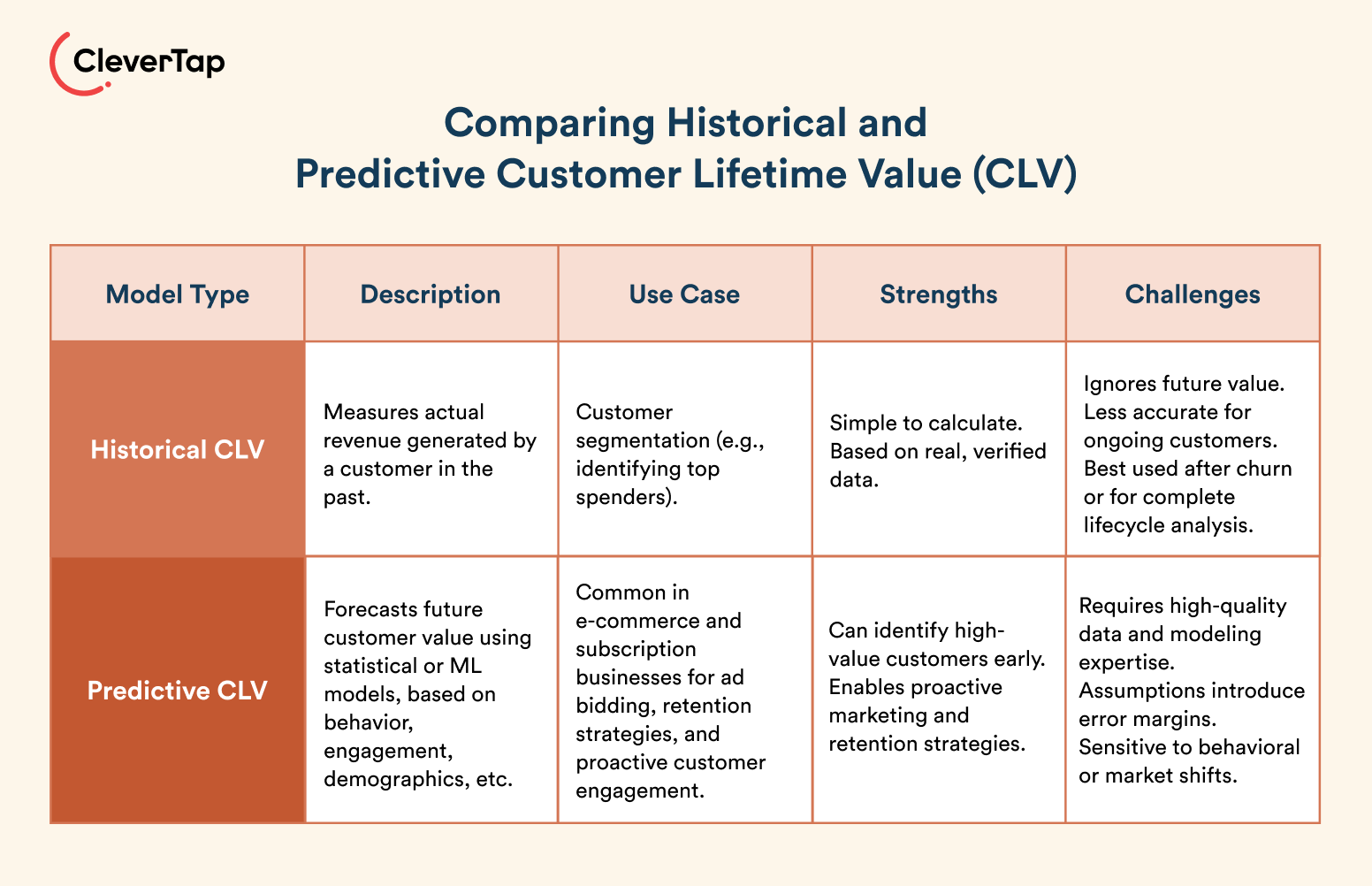

CLV is a single number, but depending on your approach and data, there are a few ways to model and analyze it. The two primary models are historic CLV and predictive CLV, along with a third model. Understanding these models helps you decide how to calculate and use CLV effectively.

Historical CLV (Backward-Looking)

Historical CLV looks at the actual revenue a customer has already generated in the past. This model is measuring past customer value.

Historical CLV helps understand the realized value of your current and past customers. It can inform you which customers (or cohorts of customers) have been most valuable so far. However, historical CLV doesn’t tell you anything about future value; it’s purely retrospective.

To calculate historical CLV, sum up all the purchases or revenue from a given customer (or the average per customer) throughout their relationship with your business. For example, if a customer spent $200 in year 1 and $300 in year 2 before churning, their historical lifetime value is $500.

Use case: It’s often used in customer segmentation analyses, for example, to identify the top 25% of customers by spend.

Challenges: The downside is that it ignores future potential.

- A customer who has only been with you for 6 months might have a low historical CLV so far, but could end up being high-value in the future.

- Historical CLV also doesn’t account for customers who haven’t ended their relationship. It’s most accurate after a customer has churned or when looking at the average across fully elapsed lifecycles.

Predictive CLV (Forward-Looking)

Predictive CLV uses statistical models and assumptions to forecast a customer’s total future value. It estimates how much a customer will spend going forward (and for how long they will remain a customer).

Advanced predictive CLV approaches might use machine learning algorithms that factor in historical purchasing behavior, customer demographics, engagement metrics, and even external trends to project each customer’s remaining lifetime value. It can account for things like expected customer lifespan, churn probability, and even changes in spending patterns over time.

Companies use it to identify high-value customers early and invest in keeping them, or to flag customers with dropping predicted value and intervene (for example, with re-engagement campaigns).

Use case: It’s common in subscription businesses and e-commerce to predict CLV so that marketing spend can be adjusted in near-real-time (e.g., bidding higher on ads for customers predicted to be high LTV).

Challenges: Predictive models require quality data and expertise.

- They can be complex and are only as good as the assumptions and data fed into them.

- There’s always a margin of error: customer behavior or market conditions can change unexpectedly.

Segment-Based CLV (by Customer Group)

In addition to individual customer value, many companies analyze LTV by segment. This means calculating the average lifetime value for different groups of customers, for example, by acquisition channel, demographic, or behavior cohort. It’s best used to customize approaches (e.g., special loyalty perks for top tiers) without ignoring the broader customer experience.

Segment-based CLV isn’t a separate formula, but rather a way to see how CLV varies across your customer base.

Use case: This approach helps identify your most valuable customer segments and those needing attention.

For instance, you might find that customers acquired via referrals have a higher LTV on average than those from paid ads, or that VIP subscribers have 3x the lifetime value of basic tier subscribers. Such insights let you allocate marketing budget to the best channels or tailor strategies to boost CLV in lower-performing segments.

Challenges: You need enough data to segment meaningfully and be careful not to oversimplify.

- Averages can still hide individual variation.

- Focusing too much on high-CLV segments while neglecting others could hurt your brand’s overall balance.

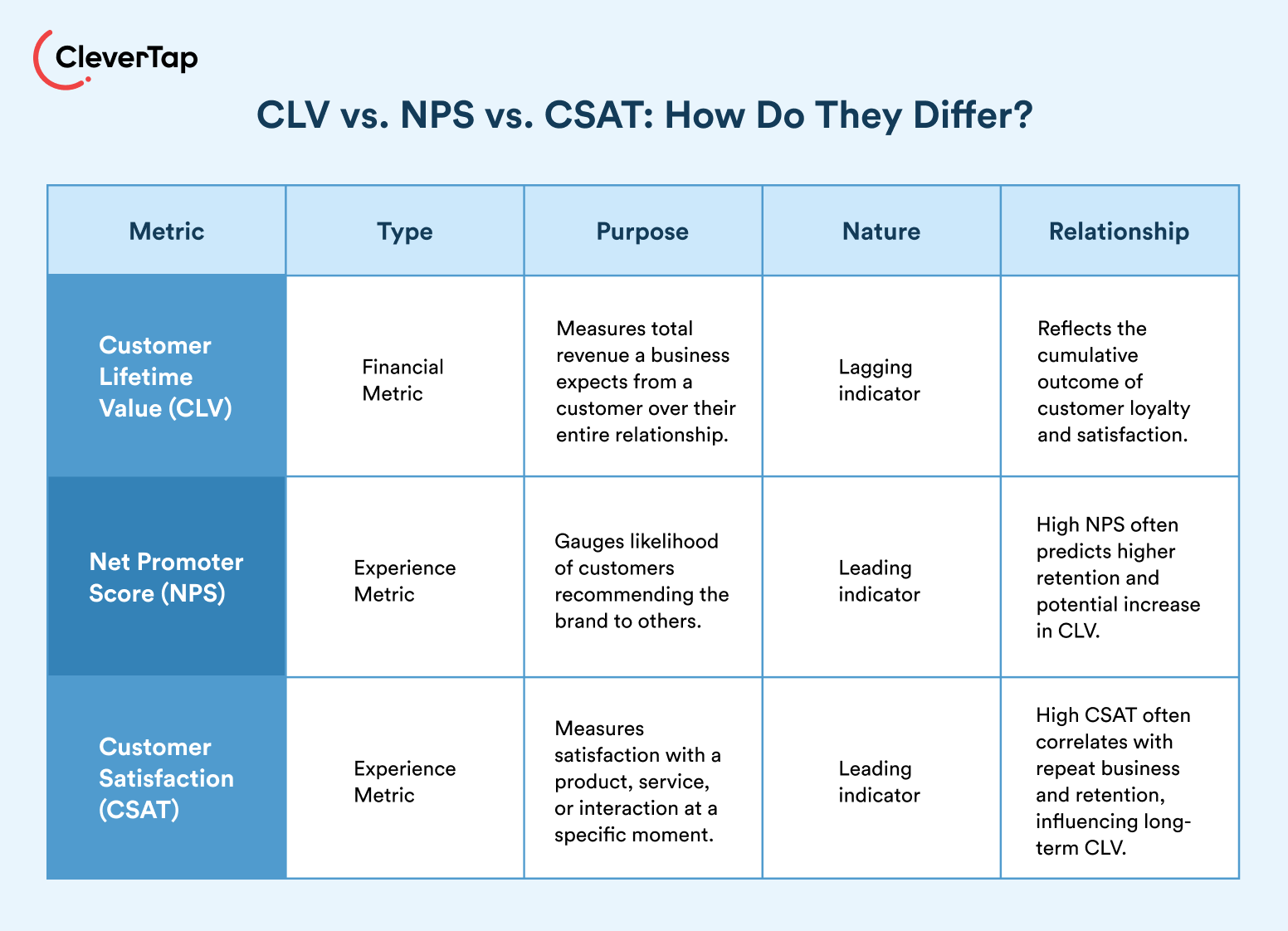

CLV vs. NPS/CSAT: Different Metrics, Common Goal

It’s worth distinguishing customer lifetime value from metrics like net promoter score (NPS) and customer satisfaction (CSAT).

CLV is a financial metric. NPS and CSAT are experience metrics: they measure customer sentiment and loyalty intention.

These metrics are related but not interchangeable. A high NPS or CSAT doesn’t directly increase CLV, but it usually correlates with behaviors that do. Satisfied customers tend to stay longer and spend more, thus increasing their lifetime value.

NPS and CSAT are leading loyalty indicators, while CLV is a lagging outcome of loyalty and repeat business.

Companies should track both types of metrics for a comprehensive view. Together, they help identify which improvements in customer experience (raising NPS/CSAT) translate into higher lifetime value.

Here’s everything you need to know about leading vs. lagging indicators.

Factors That Affect Customer Lifetime Value (CLV)

What drives customer lifetime value? There are several key factors, and importantly, most of them are levers that you can influence through business strategies:

Customer Retention Rate

The higher your retention rate, the greater the lifetime value will be. If you can turn one-time buyers into repeat customers and keep them coming back year after year, CLV rises dramatically.

Learn how you can conduct retention analysis to control churn.

Purchase Frequency

If you can encourage customers to buy more frequently (say, turning a quarterly purchaser into a monthly purchaser), you naturally boost their total value. Tactics to increase purchase frequency include:

- Subscription models

- Refill reminders

- Promotional campaigns

- Expanding your product line so customers have more reasons to buy

Average Order Value

Higher average purchase value means higher CLV. Upselling and cross-selling are strategies that affect this. If each time a customer buys, they spend a bit more (by adding extra items or choosing a premium option), their lifetime value increases even if the number of purchases or lifespan doesn’t change.

So, factors that affect basket size or spend, such as pricing strategy, product mix, or bundling, also affect LTV.

Onboarding and Customer Experience

A smooth, positive onboarding process ensures the customer sees value quickly and continues using your product or service. Customers may churn early if the onboarding is poor or the product doesn’t meet expectations. In fact, ineffective onboarding is cited as a leading cause of customer churn – one study found it accounts for about 23% of customer churn.

Beyond onboarding, every touchpoint (website usability, delivery speed, support interactions, etc.) affects whether customers remain loyal. A great experience increases satisfaction and the likelihood of repeat business, extending the customer’s lifetime and value.

Customer Support and Satisfaction

Customers who receive prompt, helpful service when they have an issue are more likely to stay loyal. High customer satisfaction (often measured by CSAT or NPS as discussed) typically correlates with higher retention, more referrals, and more spending. Happy customers stay longer and contribute more value.

Upselling and Cross-Selling Success

If your business offers multiple products or tiers, the ability to upsell (move customers to a higher-priced tier or plan) or cross-sell (sell additional products/services to existing customers) can increase the revenue per customer. This directly boosts CLV by increasing the average purchase value or frequency.

However, these upsells must genuinely benefit the customer. If they feel oversold or that you’re just extracting money, it can backfire and hurt satisfaction.

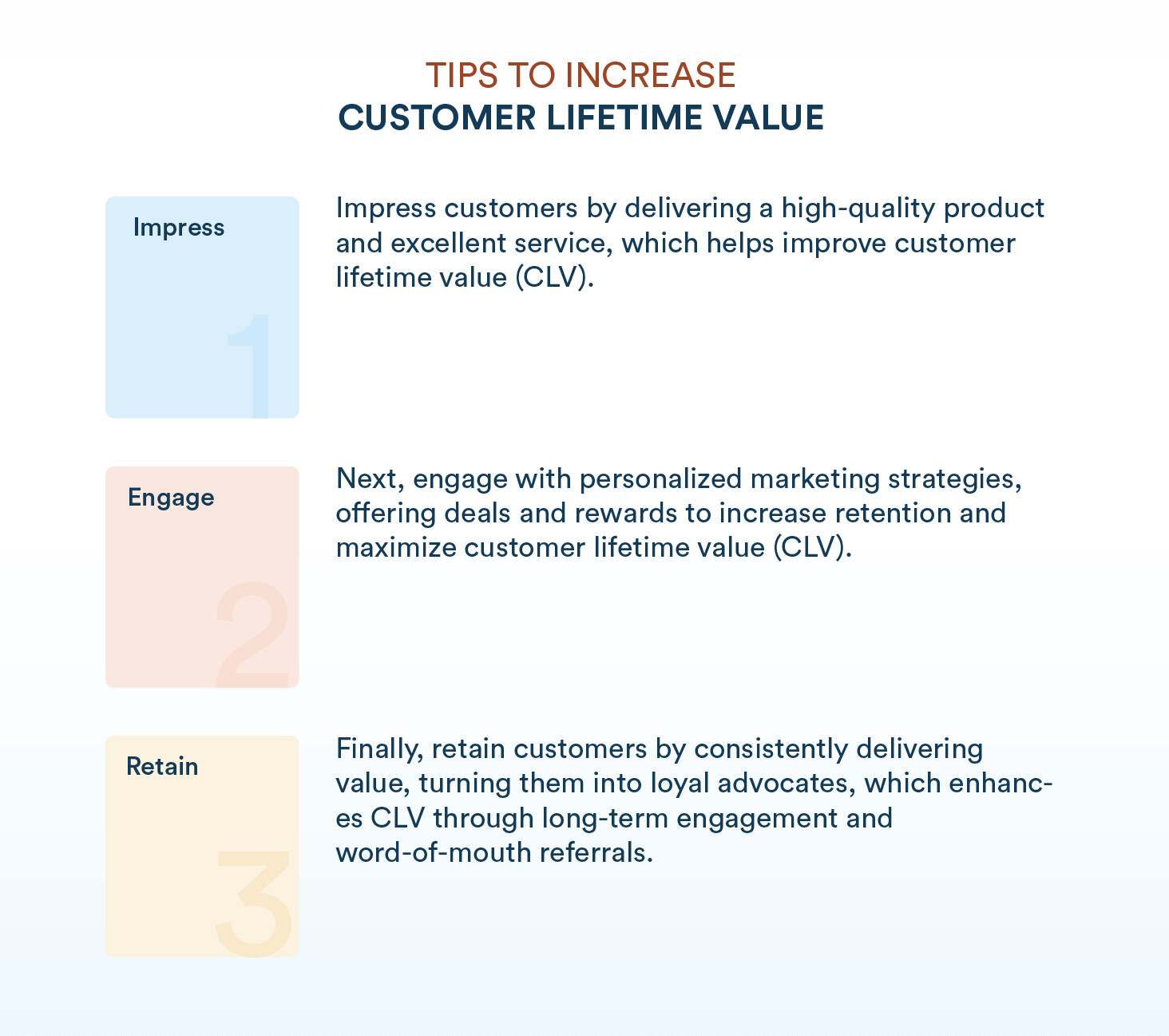

14 Proven Ways to Improve Customer Lifetime Value (CLV) & Real World Examples to Demonstrate Success

Improving customer lifetime value comes down to two goals: keep customers longer and get them to spend more (or more often).

Below are 14 proven strategies, each addressing one or more of the CLV factors we discussed, that can help boost your customer lifetime value. (Many of these strategies overlap or work best in combination!)

1. Launch a Loyalty Program

A well-designed loyalty or rewards program gives customers an incentive to keep coming back. Whether through point systems, cashback, or exclusive perks, loyalty initiatives boost repeat purchases and foster emotional connection, which in turn drives higher CLV.

Get inspired by these customer loyalty program examples from top brands.

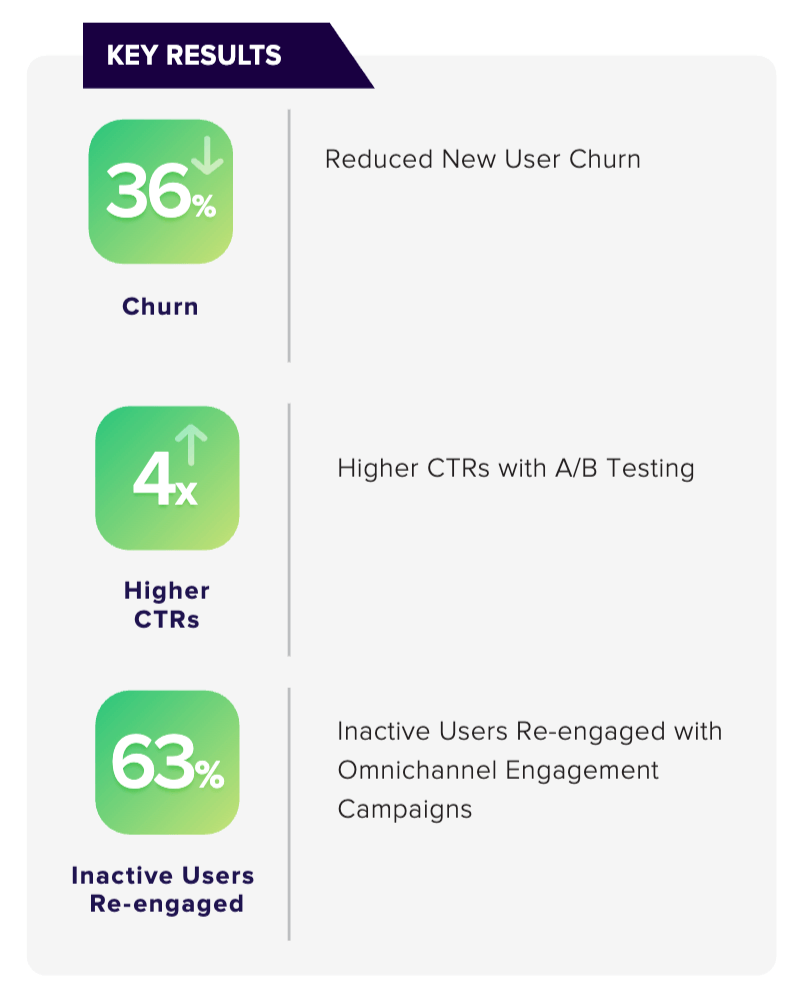

2. Improve Onboarding

Your onboarding process sets the tone for the entire customer relationship. Helping users experience early value through guided setup, tutorials, or check-ins can reduce churn and increase the likelihood of long-term engagement.

For example, MOVii, a Colombian fintech company, reduced onboarding churn by 36% using CleverTap. By analyzing in-app behavior, launching targeted omnichannel campaigns, and using real-time segmentation, they re-engaged inactive users—63% of whom returned to complete onboarding.

Tackling their churn problem head-on, they are now better equipped to improve their overall CLV.

3. Offer Exceptional Customer Service

Responsive, helpful, and empathetic customer support builds trust. Customers who feel taken care of are more likely to stay loyal, recommend your brand, and spend more over time—all of which directly impact lifetime value.

4. Personalize Every Touchpoint

Using data to personalize messages, product recommendations, or offers creates more relevant experiences. Personalization increases conversion rates, repeat purchases, and satisfaction, all of which compound to lift CLV.

For example, Boost, a Malaysian e-wallet, was facing challenges in tracking user behavior and personalizing communication across its 7 million-strong user base. Boost implemented CleverTap’s advanced analytics and segmentation tools to create micro-segments and personalized campaigns tailored to specific user groups.

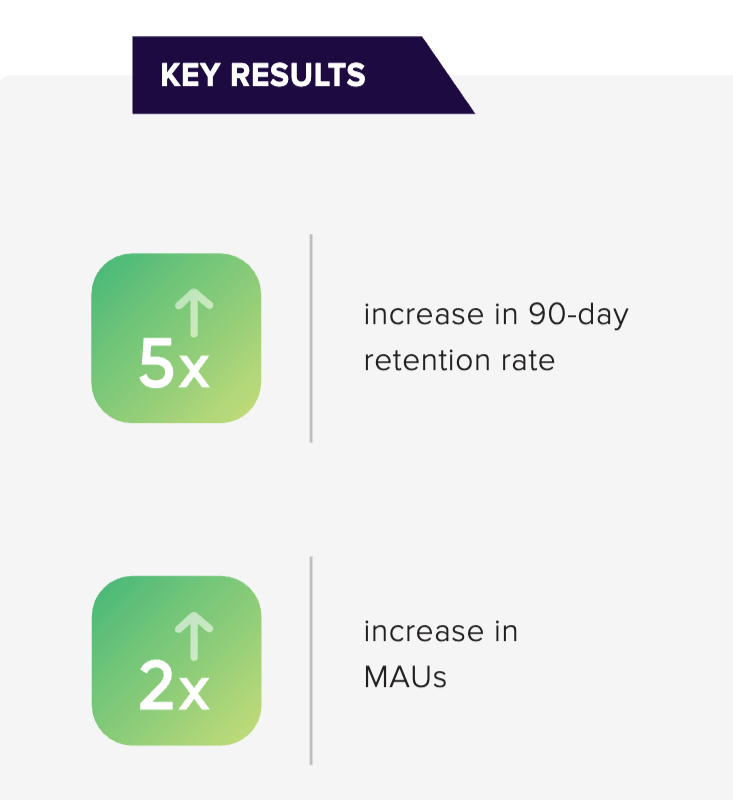

The company delivered contextually relevant, personalized content to users based on their activity levels. This led to a 5x increase in 90-day retention rates and doubled monthly active users. The success underscores the effectiveness of data-driven personalization in enhancing customer lifetime value.

5. Run Retargeting and Re-Engagement Campaigns

Not all customers stay active on their own. Retargeting ads and win-back campaigns (via email, SMS, or push notifications) help bring inactive users back, increasing both retention and purchase frequency.

6. Simplify the User Experience

Friction kills loyalty. Streamline your website or app by making navigation intuitive, checkout seamless, and support easy to access. A smoother experience means happier users who are more likely to return.

7. Create Referral Incentives

Referral programs turn your happiest customers into brand advocates. When you reward referrals, you not only gain new customers but also reinforce loyalty in the ones doing the referring—both groups tend to have higher CLV.

8. Educate Customers

Empower customers with product knowledge through tutorials, webinars, or blogs. Educated users get more value, are less likely to churn, and often purchase add-ons or upgrades, driving their lifetime value up.

9. Engage Across Channels

A consistent experience across web, app, email, social media, and in-store builds trust and accessibility. Meeting customers where they are increases satisfaction and encourages continued engagement with your brand.

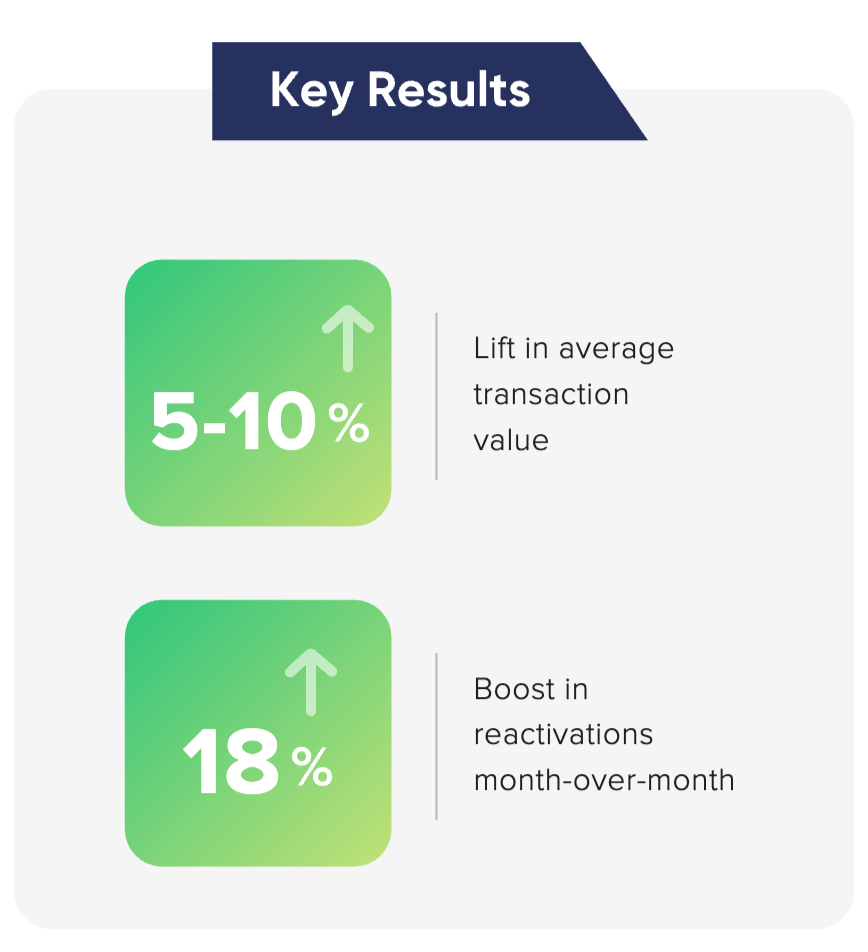

For example, PayMaya, a leading digital payments platform in the Philippines, partnered with CleverTap to enhance user engagement and boost customer lifetime value.

By leveraging CleverTap’s analytics and engagement tools, PayMaya implemented automated, personalized campaigns across various channels, including push notifications, in-app messages, and emails.

This strategy led to a 10x increase in monthly app launches and an 18% month-over-month boost in user reactivation.

10. Upsell and Cross-Sell Thoughtfully

Use behavior and purchase data to suggest relevant upgrades or complementary products. Done well, this boosts order value without being intrusive, increasing the revenue each customer generates over time.

From the above example, utilizing the AARRR framework, PayMaya segmented users based on behavior and lifecycle stage. This allowed for targeted upselling and cross-selling, resulting in a 5–10% increase in average transaction value.

Additionally, campaigns were designed to encourage users to add funds to their accounts, facilitating more transactions. Persistent in-app messages ensured users could access promotions at their convenience, further enhancing engagement.

This data-driven approach enabled PayMaya to deliver timely, relevant communications, significantly improving user experience and driving growth.

11. Recognize VIP Customers

High-value customers should feel appreciated. Offer them early access, exclusive perks, or VIP tiers to increase retention and encourage further spending. Recognition deepens loyalty and makes top customers even more valuable.

12. Act on Feedback

Collect and respond to customer feedback to improve products, fix issues, and show customers that their voice matters. Closing the loop builds trust, which leads to stronger relationships and higher CLV.

For example, Parco, a mobility app, faced a challenge in understanding user sentiment and identifying friction points that were leading to churn. Parco integrated CleverTap’s in-app NPS surveys into its engagement strategy.

The real-time feedback allowed them to capture user sentiment directly within the app. Using CleverTap’s segmentation tool, Parco grouped users based on their NPS scores and delivered personalized messaging accordingly.

The impact was significant: Parco achieved a 17% increase in its NPS within months. This improved customer satisfaction translated into better retention and reduced churn. By turning feedback into action, Parco was able to see long-term customer lifetime value.

Read the full case study here.

13. Build a Brand Community

Creating spaces where customers can interact with each other—like forums, social groups, or in-app communities—encourages brand affinity and loyalty. Community involvement often translates to more repeat purchases and advocacy.

14. Continuously Improve Your Offer

Use customer data to evolve your product, service, and experience. When customers see that you’re innovating based on their needs, they’re more likely to stick around and spend more, increasing their overall lifetime value.

Just like the brands mentioned above, try CleverTap to boost your customer lifetime value.

Customer Lifetime Value (CLV) Challenges & Limitations

Customer lifetime value is a powerful metric, but it comes with caveats. Here are key limitations to keep in mind:

- Data Gaps: Accurate CLV relies on complete customer data. If purchase history is fragmented across systems (e.g., online vs. in-store), CLV estimates can be misleading. Better data integration, like using a unified CRM, helps improve accuracy.

- Defining “Lifetime”: It’s not always clear when a customer relationship ends, especially in non-subscription models. CLV often depends on assumptions about customer lifespan, which can vary widely and affect results. Predictive models help, but come with uncertainty.

- Averages Hide Variability: CLV is often shown as an average, but not all customers contribute equally. A small group may drive most revenue, while others have low potential. Segmenting CLV helps identify top performers and avoid overlooking growth opportunities in mid-tier segments.

- Assumptions & Complexity: All CLV models use assumptions on churn, margins, or purchase frequency. Real-world behavior changes, and complex models can become black boxes. Keep CLV estimates flexible, updated, and scenario-tested.

- Long-Term vs. Short-Term Tradeoffs: A focus on CLV may lead to chasing high-value customers while neglecting near-term cash flow. Startups, especially, must balance long-term value with short-term sustainability. Use CLV alongside other metrics like CAC, NPS, and margin for a fuller view.

CLV is a strategic tool, not a perfect number. Understand its assumptions, segment your data, and apply it in context. Used wisely, it can guide better decisions across acquisition, retention, and growth.

FAQs About Customer Lifetime Value (CLV)

Q1: What is a good CLV?

A 3:1 CLV to CAC ratio is considered ideal — you should earn $3 for every $1 spent acquiring a customer. Lower than 3:1 may mean you’re overspending; higher could suggest room to invest more in growth.

Q2: How often should CLV be updated?

Review your CLV at least annually, or quarterly if your customer behavior or business model changes. Regular updates help you make more accurate marketing and retention decisions.

Q3: Is CLV the same as LTV?

Yes, CLV (Customer Lifetime Value) and LTV (Lifetime Value) mean the same thing — the total revenue a customer brings over their relationship with your business.

Q4: Does CLV apply to all industries?

Yes, CLV is relevant across industries. While the numbers vary by sector, any business with repeat or long-term customers can use CLV to drive smarter growth strategies.

Putting CLV Analysis into Action

Customer lifetime value (CLV) is essential for shifting focus from short-term sales to long-term, profitable relationships. The key is to keep customers happy and engaged. Small improvements in retention, purchase frequency, or average spend can significantly boost CLV. Regularly track your CLV and use it to guide smarter marketing, product, and customer success decisions.

Ready to get started? Use a CLV calculator to benchmark where you stand, then implement a few tactics to increase value over time. With the right approach and tools, your customers will stay longer, spend more, and become powerful drivers of sustainable growth.

Subharun Mukherjee

Heads Cross-Functional Marketing.Expert in SaaS Product Marketing, CX & GTM strategies.

Free Customer Engagement Guides

Join our newsletter for actionable tips and proven strategies to grow your business and engage your customers.