“What are the key metrics we need to monitor for our transactional app?”

We could easily list down 7 mobile marketing metrics that you need to track. Or even point you to our definitive guide, which breaks down 6 entire categories of marketing metrics. Except these are useful in a very generic way. And since we’re talking about transactional apps here, we will need to focus on the metrics that directly impact engagement and CLTV within the realm of financial transactions.

In this article, we explore the essential metrics that transactional apps should monitor and leverage to increase user engagement, customer retention, and maximize CLTV.

The Unique Case for Transactional Apps

Transactional apps do two main things: they enable users to perform financial transactions (such as transferring money to your checking account) or exchange money for goods and services (such as purchasing groceries). These are the shopping apps and the banking apps, the peer-to-peer payment apps and the fintech apps, the cryptocurrency apps and the stock trading apps. Transactional apps are used to buy or sell products, transfer money, pay bills, and manage finances securely.

Because these apps require users to input sensitive financial info such as bank account or credit card numbers, security and privacy are of utmost importance to building a user experience that can be trusted. Much more here than in other categories of apps. If the user doesn’t feel like they can trust you with their money, then the only metric you’re going to see a lot of is churn.

User Acquisition Metrics

User acquisition is the act of bringing new customers to your brand and into your transactional app. Without acquisition, you have no customers. These are the metrics you need to measure:

- New Downloads: Track the number of new app downloads on a daily, weekly, or monthly basis to see how your UA strategies are working.

- Cost per Install (CPI): Measure the cost of acquiring new users by tracking the expenses related to app installations. Lowering CPI can increase your app’s profitability and enable more resources to be allocated to user engagement strategies.

- CAC-to-Conversion Rate: Sure, customer acquisition cost (CAC) is important. But we suggest you break it down further to the type of conversion event your app needs, whether that’s CAC-to-Install, CAC-to-Register, or CAC-to-Conversion. For transactional apps, CAC-to-Conversion is the most critical as it gives insights into the effectiveness of both your user acquisition campaigns and your conversion strategies.

Engagement Metrics

For transactional apps, engagement metrics provide brands with information on how engaged users are with the app or service. You need to track:

- Daily Active Users (DAU) and Monthly Active Users (MAU): Tracking the number of unique users who actively use the app within a 24-hour period or a 30-day period is fundamental. But be aware that it may not be critical for some transactional apps. For example, a user is not on his banking app every day to check payment activity. More than DAU or MAU, we suggest focusing on monthly retention rate, key conversion rates, and customer lifetime value (CLTV).

- Session Length and Frequency: Measure the average duration of each user session and the number of sessions per user. Understanding these metrics helps identify the level of app engagement and oftentimes highlights opportunities for improvement.

- In-App Purchases (IAP): Monitor the revenue generated through in-app purchases. By analyzing IAP data, marketers can optimize monetization strategies and identify the most profitable user segments.

User Retention Metrics

User acquisition is a leaky bucket. Which is why improving retention rates by even just 5% can boost profitability by 25% to 95%*. To keep users loyal, you need to be monitoring:

- Customer Lifetime Value (CLTV): Track the monetary value a customer has netted you to date. And to ensure your app stays profitable, CLTV needs to eventually exceed Cost Per Acquisition. To calculate CLTV, use our Customer Lifetime Value Calculator.

- Net Promoter Score (NPS): Measuring user satisfaction and how they feel about your brand is a good way to see how loyal they’ll be. Be aware though that there are studies that criticize NPS as a metric having a lot of weaknesses.

- Average Revenue Per User (ARPU): Determine the average revenue generated per user. This metric assists in evaluating the profitability of different user segments and tailoring marketing strategies accordingly.

- Churn Rate: Calculate the percentage of users who stop engaging with the app over a specific period. By understanding churn patterns, marketers can implement retention strategies to reduce churn and increase CLTV.

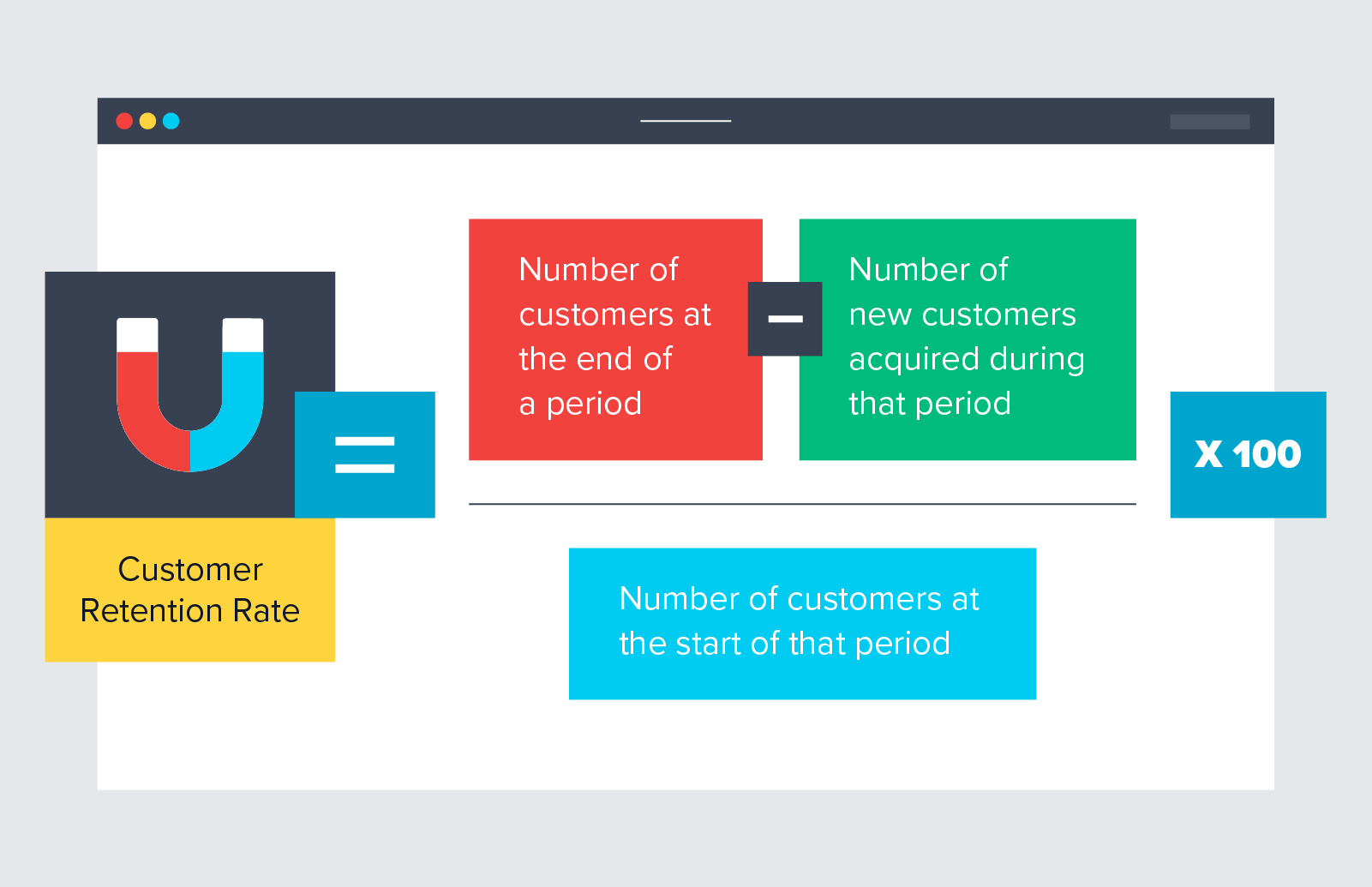

- Retention Rate: Monitor the percentage of users who continue to engage with the app over time. Higher retention rates indicate a strong user base and can lead to increased CLTV.

Transactional Apps Need Better CLTV

Tracking and analyzing key customer engagement metrics is essential for transactional apps to increase user engagement and maximize CLTV. By carefully monitoring user acquisition, engagement, and user retention metrics, you can identify opportunities for optimization and deliver exceptional experiences to your users.

Remember, that consistent measurement of these metrics will enable better decision-making. And if your analysis leads to improved user engagement, it will inevitably increase CLTV as well — a win-win for both the user and your brand.

The Mobile Marketing Metrics that Matter to CMOs

Shivkumar M

Head Product Launches, Adoption, & Evangelism.Expert in cross channel marketing strategies & platforms.

Free Customer Engagement Guides

Join our newsletter for actionable tips and proven strategies to grow your business and engage your customers.