When we think of trading and brokers, our minds tend to conjure up images of a chaotic trading floor filled with men in pinstriped suits gesticulating wildly as they lock in their trades for the day. Up until a few years ago, when wealth was a prerequisite for accessing the stock market, that’s how it was.

However, with the advances of the internet over the past few years, it’s now possible for small traders anywhere to trade in the stock market for a small fee. With mobile apps, all it takes is access to the right app, and an account with trading houses that will probably offer add-on services such as alerts, investment tips, inquiries with industry watchers, and more.

And the growth in the numbers is staggering. In just over 100 years, the number of brokers on Asia’s largest stock exchange, BSE, has grown 1,000x. In fact, the entire exchange business was valued at a mammoth $98 Billion USD industry in FY 2017-18.

As a part of our initiative to identify the leaders driving innovation and growth in mobile marketing, we talked with Shantanu Barman and Ashwini Deshpande, Marketing Product Managers at Angel Broking, one of the largest retail brokerage houses in India that provides trading and advisory services through a web and mobile platform as well as through their network of more than 11,000 sub-brokers.

Tell us a little bit about Angel Broking and the business you’re in.

Shantanu: Angel Broking is one of the largest independent full-service retail broking houses in terms of the number of clients on the National Stock Exchange (NSE), India. We have two consumer-facing business units:

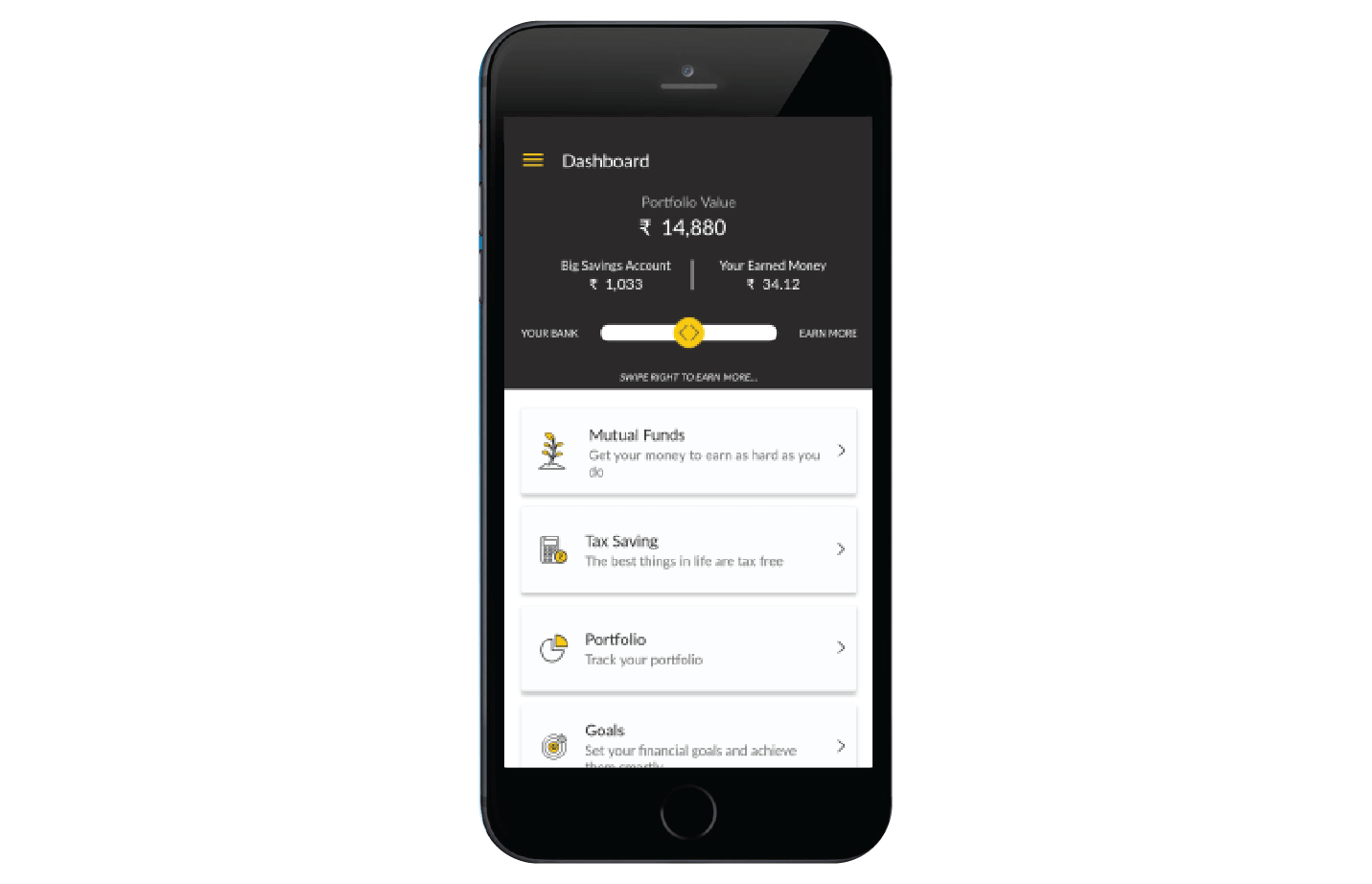

- Angel Broking, which provides users with a web and app-based platform for trading and investment requirements.

- Angel Bee, which offers a simple, quick way for users to track and manage all their finances at any time. It aims to provide a one-stop solution for all mutual fund investments.

A key differentiator for us at Angel Broking is our proprietary technology called ARQ, an automated, AI-powered investment engine that provides predictive investment recommendations supported by machine learning, cutting-edge cognitive technology, and deep industry insight. It leverages the Modern Portfolio Theory01 to recommend investments specific to each client.

What are some of your key responsibilities as part of the innovation team?

Shantanu: For both Angel Broking as well as Angel Bee, our aim is to improve the user experience across our different properties, web and mobile app. Some of the things we monitor on a daily basis include:

- The user journey within the app

- Identifying the friction points, or where drop-offs occur

- User engagement

- Reactivation of users

For all these activities, we use CleverTap as our data source.

Ashwini: The two main measures of success we monitor are:

- Activation of users, where a user opens an account with Angel Broking or Angel Bee, and

- Monetization of these users – getting them to trade on the platform

What are some of the things you take into consideration when it comes to reactivation of customers?

Shantanu: For reactivation, we look at users who are dormant and most likely to churn. We identify these segments and based on the insights, our user retention team runs win-back and retention campaigns for these users.

Ashwini: For the Angel Broking app, we look at user profiles and the user journey through CleverTap’s Flows and Funnels and create segments of users who require additional campaigns to be brought back to the app. These features are extremely helpful for us as they allow us to drill down to event properties and get granular data about users.

Automated Segmentation based on Recency, Frequency, and Monetary value (RFM Analysis) of customers also helps us understand users based on their lifecycle stage: Champions, At Risk users, Hibernating users, Potential Loyalists, and so on. We look at monthly trends, so if you have a set of champion users who have suddenly moved to hibernating, we identify the causes and work on targeted campaigns to win them back. We also share this data with our contact centers so that they can reach out to these customers and re-engage them, or identify opportunities to upsell.

What were some of the mobile marketing challenges that you were facing before you zeroed in on CleverTap?

Shantanu: Before we implemented CleverTap, we were using a few other point solutions, and did POCs and trial runs with other platforms. The challenge was to unify this data and gain actionable insights.

Ashwini: Also, the level of analysis we did earlier wasn’t very detailed and we wanted to look at it in a more granular way to get a better understanding of our funnel.

Shantanu: There were three main reasons that swung our decision in favor of CleverTap:

- Simplicity: CleverTap offered us the ease of finding events, and user activity which could further be used to create appropriate segments on the basis of these events.

- Combination of analytics with engagement features: The fact that we could look at app user analytics, segment them based on behavior, and create campaigns and journeys played a key role in our decision-making process.

- Unifying data silos: We were able to get a single view of the customer by combining data being captured by CleverTap with our external systems and vice versa. The fact that it was easy to integrate all our data sources was something that we found very useful.

These checked off all the boxes for us in terms of features and functionality that we were looking for, and helped us overcome the challenge of data silos that were created by multiple point solutions. We now depend on CleverTap for all our insights – from the app, website, and our attribution systems.

What are some of the CleverTap features that help you with your daily routine?

- Funnels allows us to accurately chart out how our users navigate the Angel Broking platforms, and where they drop off before reaching a conversion step. As mentioned earlier, the priority is to get users to trade more. And with funnel reporting we can identify the friction points and send these users relevant messages to get them to convert.

- Flows we use on a daily basis to view how users are moving across their entire journey on the web and app. Using this feature, we can craft campaigns to either re-engage users who have dropped or optimize the user experience to minimize the friction points.

- Journeys is an engagement feature, that allows us to send automated engagement campaigns to over a million users every day.

- Trend Analysis we use extensively to plot the occurrences of any event over time. For events that need to be monitored frequently, we’re able to bookmark them and get up-to-date reports as and when required. We also marry the trend analysis data with our back end systems to create event-specific user segments.

What is the business impact of using CleverTap?

Shantanu: We recently started using targeted audience for campaigns, and other features more extensively. With the use of CleverTap across the board, including some of the business teams which focus on the revenue, we’re more confident in our data and are seeing some good results.

We’ve started seeing engagement on our onboarding campaigns, with as high as 8% CTRs for push notifications that nudge newly onboarded users to start transacting. These push notifications are sent when we see user inactivity after registration.

What’s next for Angel Broking?

Shantanu: We are looking to explore how some of the advanced AI/ML-based features such as Psychographic Segmentation can be used to understand the predominant interests of a user. For example, whether a user who has a diverse portfolio is predominantly interested in trading equity, derivatives, or commodities, and so on. This will help us engage users better with the most relevant information and tips.

Ashwini: In the coming year, we’re excited to drive the adoption of CleverTap across the organization, and testing of the newer features on your roadmap. We’d love to explore more features around mobile A/B testing not just from a campaign perspective but also the new functionality that we introduce within our apps.

Shivkumar M

Head Product Launches, Adoption, & Evangelism.Expert in cross channel marketing strategies & platforms.

Free Customer Engagement Guides

Join our newsletter for actionable tips and proven strategies to grow your business and engage your customers.