Metrics like revenue are often used to measure growth, but retention is just as important, if not more so. After all, without active, recurring users, what’s the point of having an app? Building it is one thing; making sure people keep using it is another. That’s where “stickiness” comes in. This term refers to how often users return to your app and is measured by comparing daily active users (DAU) to monthly active users (MAU).

According to our Fintech App Engagement Benchmark Report, fintech apps have an average stickiness quotient of 22%. This number is higher than the average across other app categories and highlights Fintech’s ability to keep users engaged over time.

According to CleverTap’s Market Research in Financial Services, loyal customers drive 2.5x higher transaction value than others. Referred prospects are 3.5x more likely to onboard. However, 50% of banking executives fail to fully leverage their high-NPS customers to drive value.

What Is Stickiness and How Do You Measure It?

To calculate stickiness, first determine the average number of users who are active daily and monthly. Then, divide the daily number by the monthly number and multiply by 100 to convert it into a percentage:

Stickiness Rate = (DAU ÷ MAU) × 100

A high stickiness rate suggests your app is successful at getting users to come back regularly. A low stickiness rate may indicate users aren’t finding enough value to return often. The good news? You can improve this metric with targeted strategies.

Fintech Best Practices to Improve DAU and MAU

A company’s stickiness rate reflects how well it delivers value each time a user interacts with the app. Every app is different, so the key to better customer engagement is understanding what they are looking for—and delivering it.

Here are five proven tactics you can use right away to improve user activity:

1. Simplify Onboarding

Make it as easy as possible for users to get started. A long or confusing sign-up process creates friction, which can cause users to abandon your app before they even begin.

Read more: Mastering Fintech App Onboarding: Expert Tips & Best Practices

2. Encourage Habitual Nudges

Turn financial tasks into habits. Encourage routine behaviors like checking balances, paying bills, or setting savings goals with micro-nudges. Even simple reminders like “Pay your credit card bill today and earn rewards” can create to 40% spike in daily activity.

3. Cross-Sell Through Context, Not Spam

A one-size-fits-all approach won’t work. The best fintech brands use life-stage data to predict and recommend the next best product. For instance, a user who took a car loan six years ago might now be ready for a home loan, exactly the kind of moment where personalization drives higher MAU and deeper engagement.

4. Leverage User Analytics

Use analytics tools to learn how users are interacting with your app. Which features are popular? Where are users dropping off? Let the data guide your decisions.

5. Personalize in Real-Time at Scale

Relevance = retention. Use behavioral and contextual data to trigger hyper-personalized alerts, like notifying a user when their balance dips below ₹1,000 or suggesting a SIP plan after salary credit. This real-time personalization makes the app feel intelligent and helpful, not intrusive.

Tailor your app experience based on user data. Customized messaging, offers, and content make users feel seen and increase their likelihood of returning.

Read more: Hyper-Personalization: What Every Brand Needs to Know

6. Gamify Engagement

Introduce rewards or challenges that encourage users to interact more often. Gamification taps into users’ desire for progress and recognition, keeping them motivated to return. Use tiered rewards and gamified referral programs to turn passive users into brand advocates. A simple push like “Refer 3 friends and win vouchers” backed by intelligent segmentation (via RFM analysis or NPS) ensures you’re targeting the right customers for the biggest return.

7. Re-Engage Dormant Users

Reach out to users who haven’t opened your app in a while. Push notifications, emails, or social media reminders can bring them back, especially when the message is timely and personalized.

Listen: Podcast: How to Re-Engage Mobile App Users

Fintech Expert Tip: Find the Right KPIs for Your Engagement Model

Not every app will (or should) have the same engagement patterns. For example, a trading app may see more daily use than a loan management app. What matters is tracking the metrics that make sense for your specific use case.

If DAU and MAU aren’t relevant for your model, consider tracking user activity over longer timeframes like quarterly or yearly retention. Define what “active” means for your app—whether it’s logging in, making a transaction, or using a feature—and use that definition consistently in your reporting.

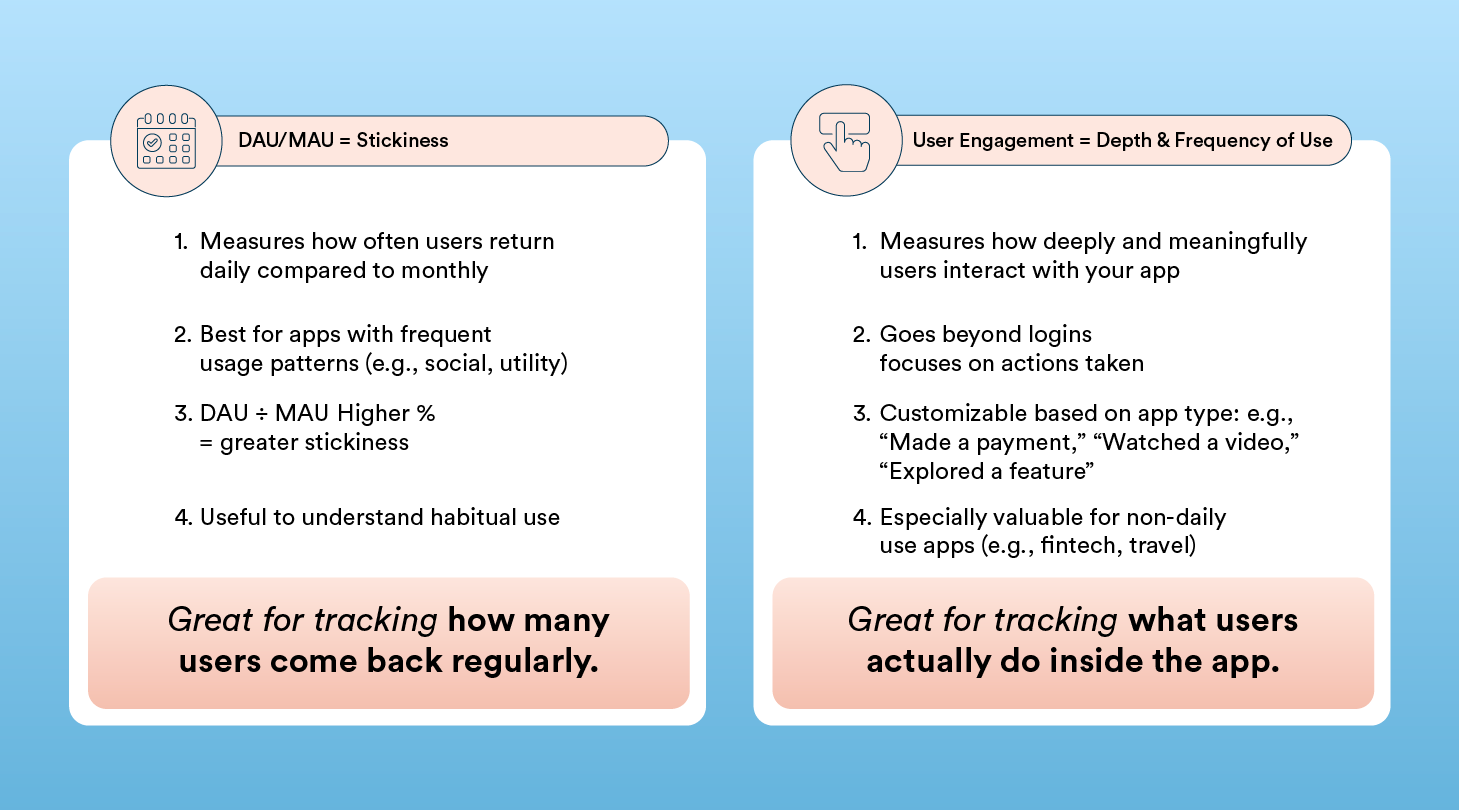

DAU/MAU vs. User Engagement: Understanding the Difference

Stickiness and engagement are closely related, but not the same. Stickiness is a formula that compares daily to monthly usage. Engagement is broader—it looks at how often and how deeply users interact with your app over time.

Engagement is especially useful for apps that aren’t meant to be used every day. In these cases, it’s important to define what “active” means. Is it just logging in? Or completing an action like making a payment or exploring a feature?

Once you define what counts as meaningful activity, you can track engagement accordingly.

Common Pitfalls to Avoid When Measuring Engagement

Even if your app isn’t used daily, you can still use DAU and MAU in a way that fits your business. But it’s easy to make mistakes when measuring engagement. Here are a few to avoid:

- Don’t mistake launch spikes for long-term success. Just because a campaign brings in new users doesn’t mean they’ll stick around.

- Don’t copy another company’s KPIs. Your app is unique. Your metrics should be, too.

- Don’t focus on total active users alone. A large user base means little if those users don’t return. Repeat users are what really matter.

- Understand your usage frequency. Apps like Airbnb don’t expect daily use, but they still define and track engagement on their terms.

How CleverTap Can Help Your Fintech Business

CleverTap is built to help fintech businesses tackle a key challenge: driving sustained engagement across complex, regulated, and high-stakes user journeys. As a mobile-first engagement and retention platform, it enables financial apps to shape user behavior at crucial points, like onboarding, activation, or reactivation, while remaining compliant with regulatory standards.

For fintech apps offering payments, lending, or investment services, CleverTap supports:

- Improve onboarding and streamline KYC flows

- Nudge users toward first transactions

- Drive wallet top-ups

- Send loan repayment reminders

- Reactivate dormant users

- Recommend personalized financial products

These capabilities help fintech businesses maintain engagement over longer decision-making cycles and during critical financial interactions.

Unified Customer Data Platform

- 360° Customer Profiles combines online and offline data (with 10+ years of lookback data) for a complete view of each customer.

- TesseractDB™ is a purpose-built customer engagement database for real-time insights and personalization at scale.

Predictive AI & Smart Engagement

- Clever.AI guides next-best actions, curates AI-driven journeys, and personalizes recommendations using behavioral and intent data.

- Scribe is an emotionally intelligent messaging engine to craft high-impact, conversion-driven messages.

- Predictive Segmentation detects early customer intent and life-stage changes to trigger proactive outreach.

Real-Time, Dynamic Personalization

- Transactional triggering enables real-time fraud alerts, OTPs, balance updates, etc. for timely, trust-building engagement.

- Dynamic segmentation based on evolving customer behavior, preferences, and context.

- Personalized journeys, offers, and multichannel campaigns tailored by lifecycle stage and intent.

CleverTap’s proprietary database, TesseractDB™, is built to handle high-scale behavioral data specific to fintech needs:

- Stores up to 10,000 data points per user/month

- Retains up to 10 years of user history

- Supports real-time segmentation and journey personalization

Example: A customer who abandoned a credit card application 8 months ago can now be re-engaged with a personalized incentive. Platforms with shorter data retention windows can’t offer this level of historical context.

Product & Experience Optimization

- Product Experiences enables A/B testing of UI/UX elements to customize the in-app experience and improve ROI.

- No-code experimentation enables marketers and product managers to make real-time changes without relying on technical dependencies.

Omnichannel Engagement

- 15+ Channels include: Push notifications, In-app, Email, WhatsApp, SMS, and more – all orchestrated from one platform.

- With Omnichannel Engagement, choose the best time to send. Optimize message delivery for maximum engagement.

Secure and Compliant Customer Interactions

- Signed Call™ allows branded, secure real-time calls within the app for processes like onboarding and KYC.

- End-to-end encryption for PII data security and compliance, especially critical for regulated entities.

- Message archiving helps maintain compliance and audit readiness by archiving all customer communications.

Loyalty, Retention, and Cross-Sell

- Behavior-driven offers help incentivize specific actions based on transaction or inactivity patterns.

- Referral Campaigns can be triggered by loyalty or NPS scoring to maximize acquisition via high-value customers.

Lifecycle Marketing & Predictive Segmentation

CleverTap helps fintech brands automate personalized engagement with:

- Lifecycle Optimizer helps move users from one stage to another (e.g., “KYC Complete” → “Wallet Funded”) with minimal manual input

- RFM Segmentation automatically classifies users into groups like “At-Risk” or “Champions”

These tools are ideal for fintech apps where timing, trust, and nudges play a central role in user retention.

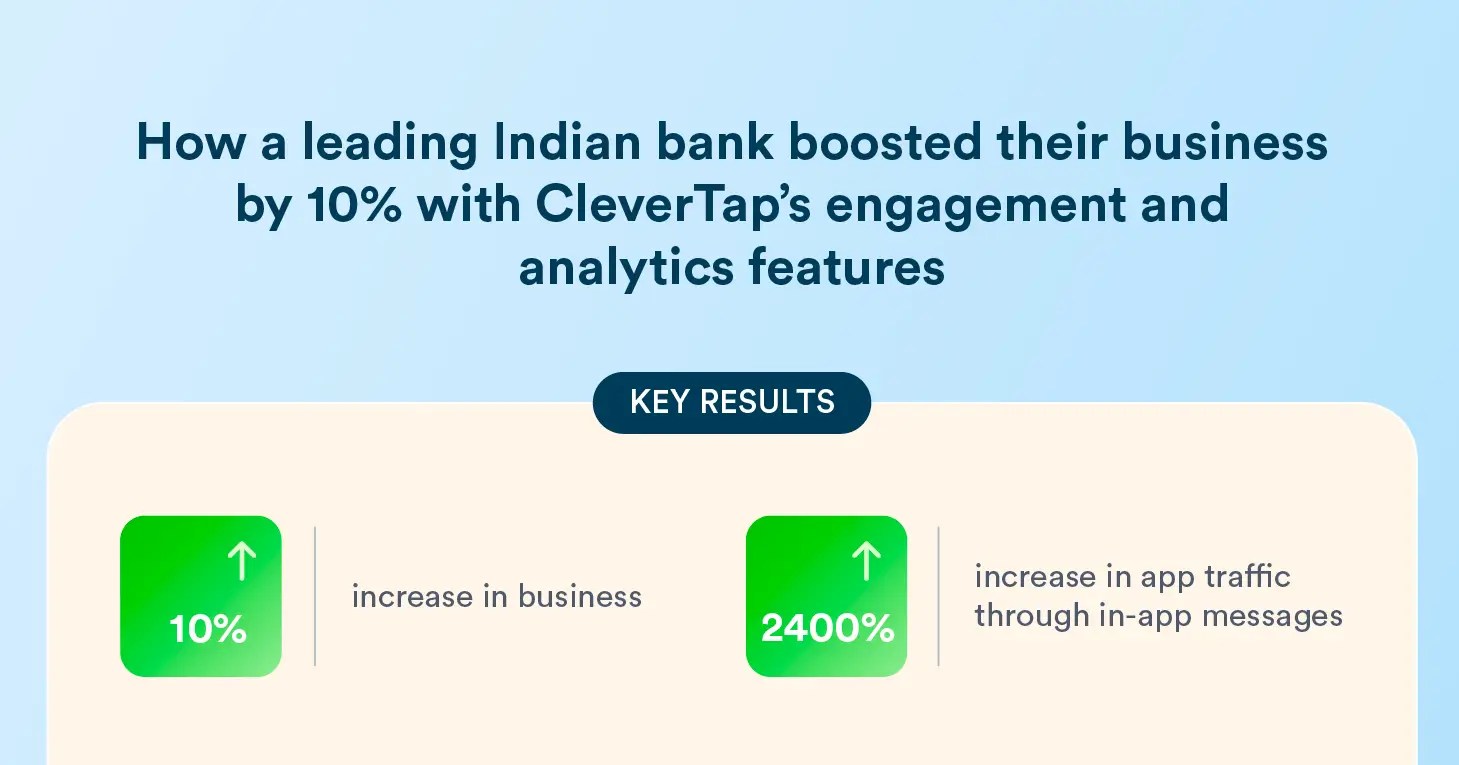

How a Leading Indian Bank Used CleverTap to Improve Engagement and Conversions

CleverTap enabled one of India’s top private-sector banks to elevate user engagement on its mobile app. Originally launched in 2008 to enhance digital banking, this app was revamped in 2020 to unify banking and payment services for customers of any bank. The objective: increase engagement through actions like fixed deposits, cross-sells, and journey completions.

The Challenge: Despite offering over 250 services, in-app campaigns drove only 1% of app and website traffic. The bank needed to increase product page visits, improve conversion rates for key actions, and drive more cross-sell revenue.

The Solution: The bank adopted CleverTap’s engagement and analytics toolkit, including:

- 49+ Journey campaigns to drive usage and re-engage lapsed users

- A tailored Next Best Offer (NBO) model via in-app interstitials

- Drop-off notification campaigns to recover incomplete user journeys

- Behavioral analytics (funnels, trends, pivots) for insights and optimization

The Results:

- In-app campaigns now contribute 25% of app and website traffic, up from 1%

- 4x increase in fixed deposit conversions through staggered drop-off campaigns

- 10–12% overall business growth attributed to CleverTap

“CleverTap is critical to running our day-to-day business. With analytical features like funnels, flows, trends, and pivots, we understand our customers’ behavior and how well the journeys we’ve created perform.” — Ankur Srivastava, Mobile Marketing Manager

Want the full story? Read the case study here.

The journey from app download to active, engaged user isn’t linear. It’s shaped by thoughtful onboarding, contextual nudges, and meaningful experiences at every turn. When fintech brands shift their focus from mere conversion to customer lifetime value, they unlock not just usage but loyalty, advocacy, and growth.

Summary: Why Fintechs Choose CleverTap

| Feature | Benefits for Fintech |

| TesseractDB™ | Personalize using deep behavioral data, even from 10 years ago |

| Lifecycle Optimizer | Automatically guide users from sign-up to transaction to retention |

| Predictive AI | Proactively engage users at risk of churn |

| Signed Call™ | Trusted VoIP communication for sensitive use cases |

| RenderMax™ | Boost message delivery rates during critical alerts |

| Omnichannel Orchestration | Coordinate communication across Push, WhatsApp, SMS, and more |

| Impact Analytics | Track ROI, retention lift, and funnel drop-offs with clarity |

Want to visualize a custom journey for your app? Let us know, and we can map a workflow tailored to your fintech product—whether it’s lending, wallets, BNPL, or insurance. Click here to contact us.

Where Does Your Fintech App Stand?

Knowing how your app compares to others in the fintech space is the first step in improving retention. Want to see how your metrics stack up against industry averages? Check out our Fintech App Engagement Benchmark Report.

Drive sustained DAU and MAU growth with smarter engagement. Explore CleverTap

Marcell Rosa

Heads Latin America region.Expert in enterprise sales & driving global expansion & revenue growth.

Free Customer Engagement Guides

Join our newsletter for actionable tips and proven strategies to grow your business and engage your customers.

![Fintech Best Practices to Increase Daily and Monthly Active Users [DAU/MAU]](https://clevertap.com/wp-content/uploads/2023/02/Fintech-Best-Practices-to-Improve-Daily-and-Monthly-Active-Users.webp?w=1024&w=721)