Learn how you can Unlock Limitless Customer Lifetime Value with CleverTap’s All-in-One Customer Engagement Platform.

In part three of our Reimagine Growth masterclass series, John Spottiswood, COO at Jerry and our very own CleverTap expert McKenzie Davis, talked about mobile app marketing strategies that strike a balance between acquisition and monetization.

Below we present some highlights from their conversation on monetization, as well as some hard won lessons from mobile brands that Spottiswood led in companies like Match.com, Lending Club, Earnin, and now Jerry.

So the generalized learning across most industries is that you must educate your user before asking for payment. The more you can convince them that this is the right app or service for them, prior to asking them to put in their credit card information, the less drop off you’re going to get at the point of monetization.

Which means you’ve got to help users understand the value of what you’re offering.

Match.com: The Allure of the Free Trial Period

“At Match.com, we used a free trial period,” Spottiswood said. “And that can be — if it works for your business — a really valuable way to educate them.”

He tested 3-day, 7-day, 14-day, and 30-day free trial periods. And in the majority of cases, the 7-day trial period was the winner. But there are exceptions to that.

“If you can’t use a free trial,” said Spottiswood, “Or it turns out that for some reason it’s just not a multi-use product and a free trial gives away too much value, then another interesting strategy is using the time between the screens to educate.”

And that’s what he did next.

Lending Club: The Efficacy of the Interstitial

At Lending Club, where Spottiswood ran the small business lending division, a user would sign up to essentially get a small business loan. Which meant the user had to go through a loan application process. A free trial didn’t make sense in that scenario since these users would not be asking for a loan over and over. So Spottiswood’s team made the application as streamlined as possible and then brought up the offer page as quickly as they could.

There was a problem however. Spottiswood said: “Almost everybody was getting through to the offer page, but then they wouldn’t move beyond that to complete the offer!”

To experiment with solutions they:

In the end however, he figured out a crucial lesson: “People who have completed an application with you, or have completed a number of steps, are probably not going to leave before you generate whatever it is that they completed the application for,” Spottiswood shared.

So they created a one-minute as well as a three-minute interstitial that ran after the application was completed, but before the offers were returned. At the top, it would show a status bar creeping along, meanwhile underneath they showed a number of key selling features as well as customer testimonials and information to set them up for what to expect on the offers page.

Spottiswood shared: “As I’d hoped, the interstitial ultimately handily beat the control and the three-minute interstitial actually far exceeded the one-minute interstitial. In total, it ended up generating more than a 10% increase in funded loans.”

Jerry: The Power of Mobile Messaging

At Jerry, the online insurance provider, Spottiswood doesn’t use the same exact technique. Instead his team uses SMS messaging and push notifications via CleverTap to communicate with users. These messages:

Spottiswood said: “Because insurance is a fairly complex decision and a considered choice, this mobile messaging journey helps to build the user’s confidence and keep them engaged with us prior to us asking them to put in their payment information.”

In general, the later the better.

At Match.com, they asked for payment information early on, but would only bill the credit card after the free trial period had ended. Users still had the option to opt out at that point, giving them a way to experience the value of the service before paying for it.

At Earnin, payment information was collected at the early stages as well because it was needed for depositing the user’s monies. But payment for the service would come after those deposits were in the bank, and in the form of voluntary tips from the user.

At Jerry they only collect payment at the very end of full price discovery. They did, in fact, tested asking for payment at the initial quote stage. But what they found is that pushing it further down, when the user has the most confidence in the service, is the best single approach

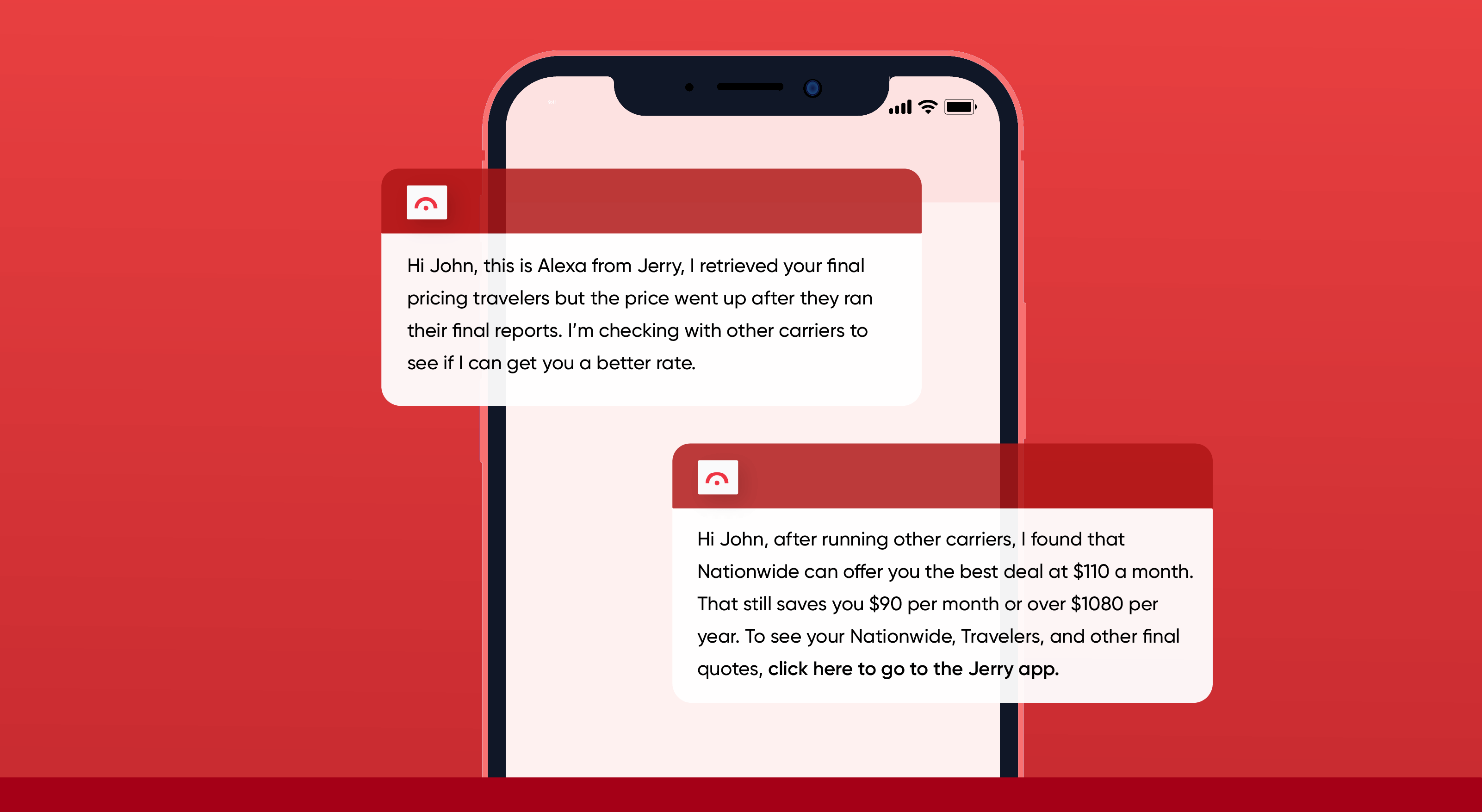

Here’s an example of how messaging can be used to build confidence in customers.

Users on Jerry might get an initial quote from Travelers that is $100 a month and is the lowest price for them. And over the next few minutes, they will get a series of texts or push notifications, such as:

Personalized messages like these can help build trust while educating the user. And because of the relationship that is built, this enables them to ask for payment later without sacrificing conversion.

Another quick and effective technique is using webhooks to automate processes. If you’re unfamiliar with webhooks, we’ve got an entire blog post about them.

The short version is: webhooks are automated processes that deliver a response to a specific programmed event in one app. Instead of a user requesting data and waiting for its delivery, apps request it on your behalf and send you the answer when you need it — before you even have to ask for it.

Spottiswood shares an example of an SMS message that triggers an automated process in the Jerry servers: “Normally we try to get a user to click through to our app to view final prices and request them. But if, after a couple of messages, users have not clicked through and visited the app, it will send them a text message that says, ‘Reply YES and we’ll get the final price for you.’”

“What we found is that over 20% of the users who don’t visit the app will nonetheless reply ‘YES’ to the final price.”

The system then takes that YES, and triggers a webhook that runs the final price automation for them just as if the user had clicked on the final price within the app itself.

In short, don’t give up on a user who hasn’t engaged with your app. Use webhooks like this to automate processes via SMS. It might just become the secret weapon that helps increase conversion rates for you.

Keeping users engaged really matters. It builds a stronger relationship with the customer, and when done right, increases the chances of them purchasing more.

Spottiswood shares three specific reasons to keep engaging your users:

App monetization is a tricky move that can possibly alienate users accustomed to a free app. But when you are able to communicate the value your app brings, or better yet, allow users to test what they’ll get, then it becomes an effective way to bring in revenue. The key lies in educating users on the benefits that the app gives them and then effectively engaging them to keep them coming back.

The User Retention Pocket Guide