Roughly one-fourth of the global population do not have a bank account or access to a financial institution,* including 45 million Brazilians.* To open a bank account, Brazilians must have proof of address and income as well as pay account fees. While online transactions are growing in popularity every day, it is this unbanked segment that runs the risk of being financially excluded.

But with the launch of challenger banks and digital wallets, that’s changing.

As an agile Fintech startup, Airfox aims to make financial services available to all in developing economies. Airfox was recently acquired by Brazilian retail giant Via Varejo, which owns more than 800 stores across Brazil. Airfox’s digital banking service banQi is now the digital wallet for Via Varejo.

Transforming the Casas Bahia Customer Experience

banQi differentiates itself from other digital banks with its association with Casas Bahia, a furniture and electronics retail chain owned by Via Varejo. In the ‘90s, Casas Bahia started a credit program where customers could purchase big-ticket items like furniture and appliances and repay in installments using payment slips (CDC ‘carnês’ bills) at a Casas Bahia store.

But repayment was an offline process, as customers had to keep track of these slips, return to the store every month with cash in hand, and wait in long lines to make repayments. With banQi, this process is now completely digital.

With the introduction of digital payment slips, the Airfox team needed an integrated analytics and engagement platform to help them understand user behavior, segment users, engage with them in real time, and improve the customer experience. With CleverTap, they now use data to strike a meaningful connection with customers without the hassle of managing and integrating multiple platforms.

To learn more about banQi and their journey with CleverTap, we spoke to Livia Tateyama, who currently manages user engagement and retention at Airfox.

Improving CX with In-app Messaging

Customer satisfaction is very important for banQi. They have a prepaid card that is delivered to users via mail, but third party logistics meant cards took 14+ days to reach customers. Because of this, the amount of calls their support team had to handle was high.

To rectify this, the team implemented two campaigns using CleverTap. As soon as users placed the order for their card, they received a push notification congratulating them. While the card made its way to customers, banQi would send messages educating users on how to unlock the card and where to contact them for further information. Additionally, they created an email series where the tracking number was sent to the customers. These measures helped them improve customer experience and satisfaction.

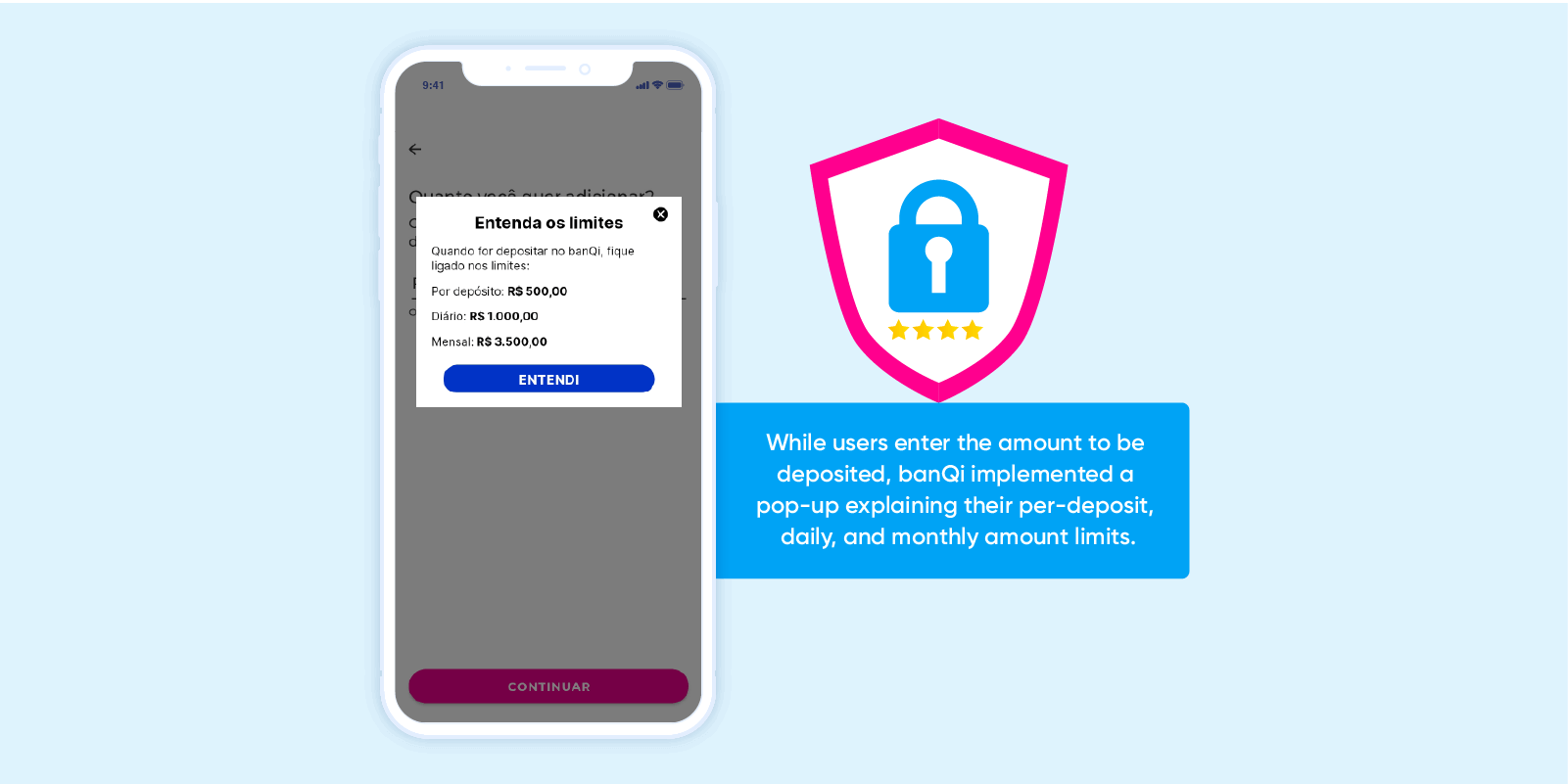

Earlier they worked with a small group of developers, and even simple changes in the app took time to implement. In many instances, they used in-app notifications to clarify possible user queries and improve the user experience while also ensuring that users don’t drop off before completing a transaction.

Another area where banQi incorporates in-app notifications is for fraud protection. By showing an in-app notification every time a user submits a deposit, they can educate users on daily, weekly, and monthly deposit limits.

Understanding the Real Impact

Every quarter the team prioritizes one objective — with 3 key results around that objective. For Q4 2020, their objective is to double their MAUs. The 3 key results around this objective are to increase user registrations, increase the number of new users who make their first deposit within 30 days of install, and increase the monthly retention rates.

The most important metrics are the number of installs and registrations, and the number of registrations per acquisition channel, activation rate, customer satisfaction, and monthly retention rate.

banQi tests all their marketing campaigns for their cashback, rewards, and loyalty programs. For example, before implementing cashback as a permanent campaign, they ran some pilots by giving cashback to users on a weekly basis to encourage them to spend and transact more using the app.

Custom list segments help them understand the distinct behavioral patterns and actions among their two key segments: card users and CDC ‘carnês’ bill payers. Funnels help in identifying how users navigate the app and where they drop off before converting. By splitting the funnels across profile properties, they can compare user paths across different types of segments.

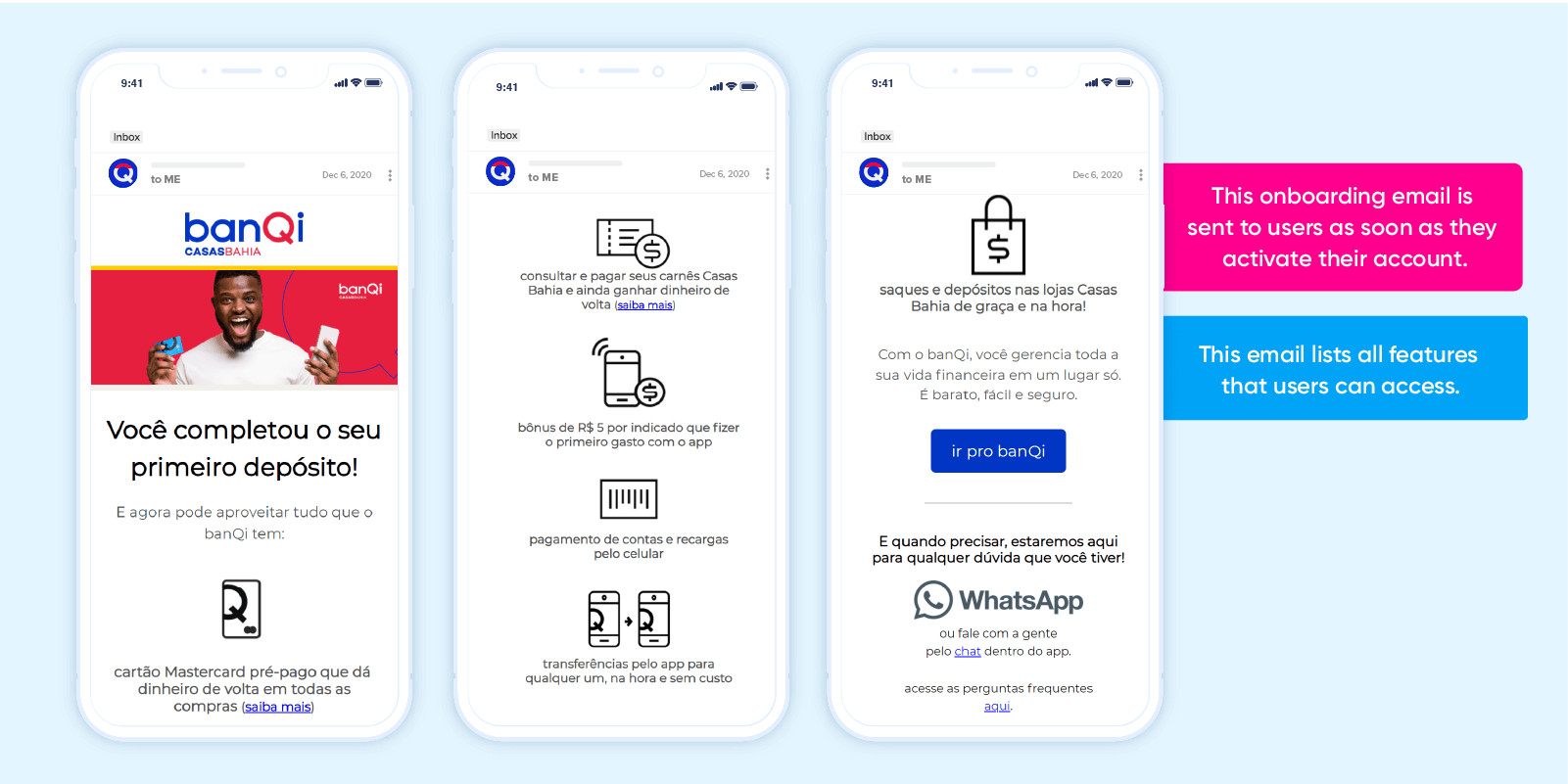

At banQi, Journeys are used daily. They built their onboarding journey to educate new users and help them navigate the app. Journeys enable them to orchestrate a sequence of campaigns aligned to specific business goals, eg: getting new users to complete registration.

They build custom dashboards for various campaigns and journeys to have a snapshot of all the important metrics in a single dashboard. By sharing this dashboard across the entire organization, everyone can keep track of campaign performance and results.

With Real Impact, they can understand how and to what extent banQi card users and CDC ‘carnês’ bill payers are responding to campaigns. By comparing the control group with the target group for both segments, she gets a long-term view of the impact of various campaigns on business metrics like installs, registrations, first deposit, and first spend. This helps in optimizing marketing spend and maximizing ROI.

Using funnels, campaigns, and journeys, banQi saw a 22% increase in new activations and a 30% month-over-month increase in MAUs.

The Roadmap for banQi

With COVID-19, banQi’s target audience has evolved. The team intends to strengthen its partnership with Via Varejo and implement credit options, QR codes, and other payment systems, as well as work on improving the CDC process to give more Brazilians access to capital. We believe they have a massive opportunity to change the way their country accesses financial services and are grateful to be a part of their mission.

The Intelligent Mobile Marketing Platform

Mrinal Parekh

Leads Product Marketing & Analyst Relations.Expert in cross-channel marketing strategies & platforms.

Free Customer Engagement Guides

Join our newsletter for actionable tips and proven strategies to grow your business and engage your customers.