“We should be paying for customers?”

“Don’t customers pay us?”

Paying for customers might seem paradoxical. But unfortunately, you won’t see customers lining up to try your new product or service. You’re actually more likely to hear crickets until your advertising and marketing efforts catch up.

Customer acquisition cost can seem complicated, but it’s an important metric to track nonetheless. Today, companies have the tools to track new customer referrals directly, allowing for a more accurate customer acquisition cost calculation.

But what exactly is customer acquisition cost? Let’s start with the basics, as to not embarrass yourself in front of potential investors or business partners. Continue reading to learn what customer acquisition cost is, how to calculate it and why it’s important to do so. Or, you can jump to our infographic below.

What is Customer Acquisition Cost?

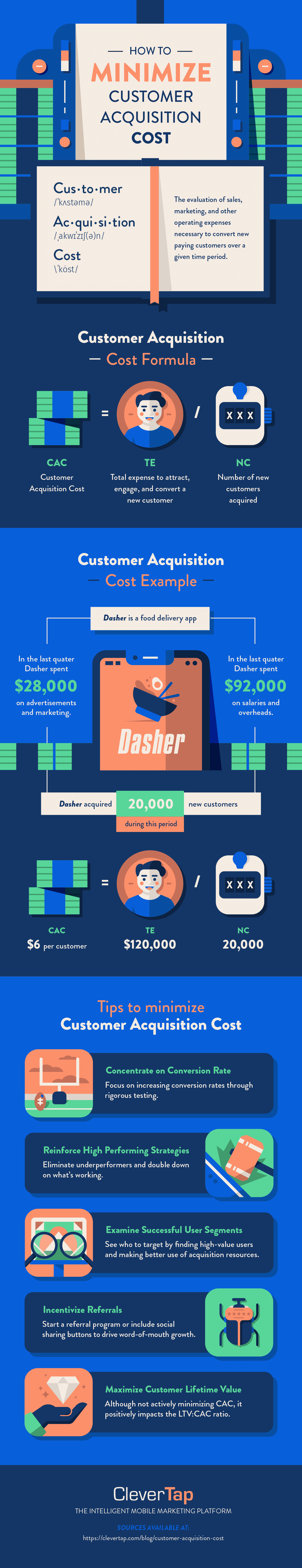

Customer acquisition cost, or CAC for the acronym du jour, is an evaluation of the average amount of sales, marketing, and other operating expenses required to obtain new paying customers over a given time period.

There are different philosophies about how to best calculate customer acquisition cost. In fact, your business model might require a unique method.

Some people, for instance, insist that sales and marketing expenses are the only areas of the balance sheet that should be evaluated. But in some cases, there are general operating expenses that ultimately contribute to a paying customer — more on that later.

As a mobile marketer, what figures do you need to put together in order to calculate your customer acquisition cost? Let’s cover the general formula.

Calculating Customer Acquisition Cost Formula

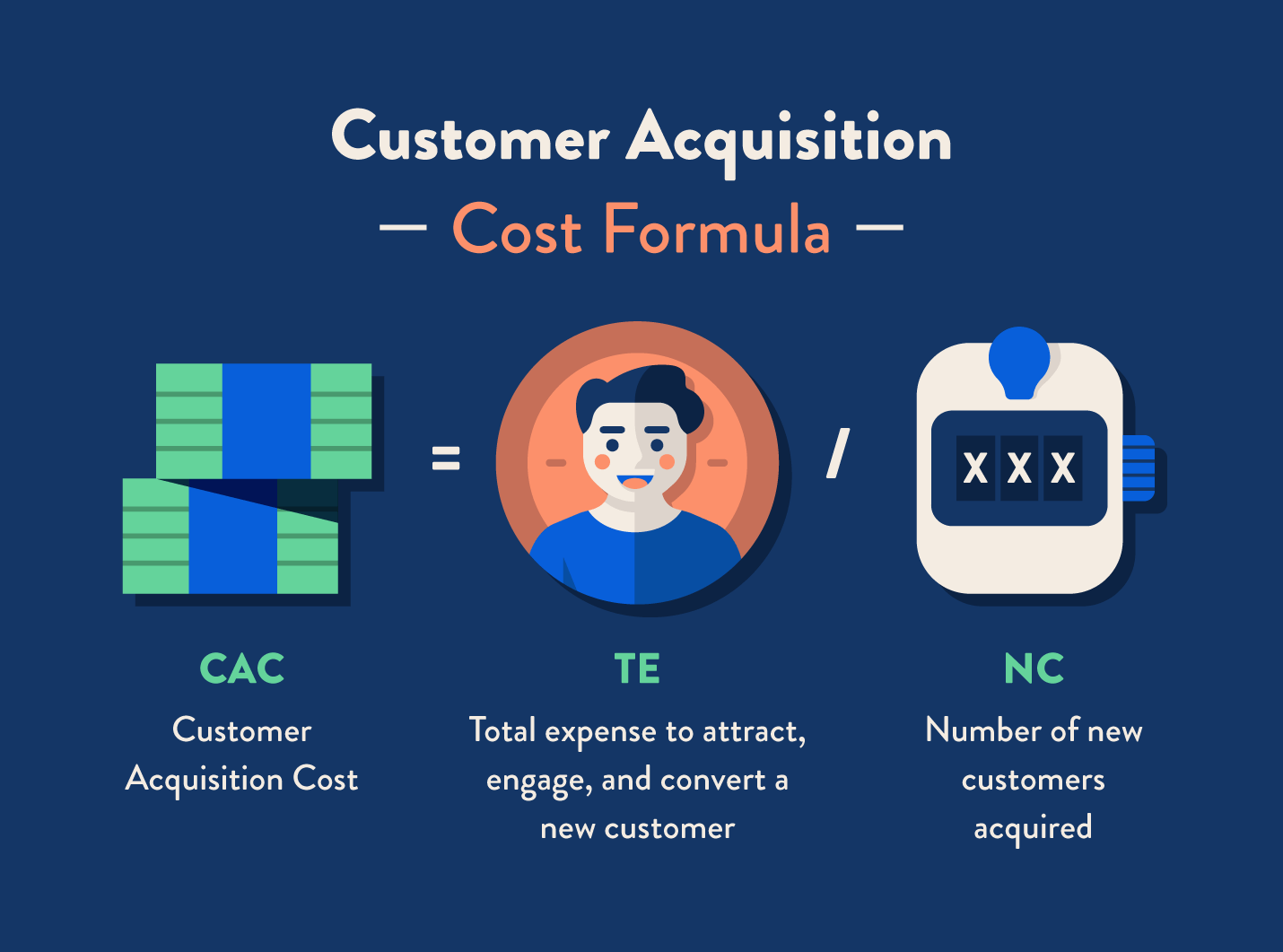

Calculating customer acquisition cost requires two inputs, both of which require some business model-specific interpretations. The formula for calculating customer acquisition cost is:

CAC = TE / NC

CAC: Customer acquisition cost

TE: Total expense to attract, engage, and convert a new customer.

NC: Number of new customers acquired.

The denominator represents the number of new customers acquired over the period in question. This may seem straightforward, but when you consider businesses that actively participate in retargeting, engagement, and retention efforts, inadvertently including returning customers in the CAC figure can be an easy mistake.

The numerator is the total expense spent on gaining a new customer, or a returning customer if retargeting expenses are substantial enough.

When analyzing the total expense (TE) required to convert a new customer, it can be easy to overlook auxiliary costs such as overhead, salaries, and other fixed expenses, skewing your final customer acquisition cost.

Let’s discuss business-specific scenarios that can influence the calculation of customer acquisition cost.

Customer Acquisition Cost Factors by Business Model

Some businesses will need to adopt a unique approach to calculating customer acquisition cost based on their business model.

For example, mobile apps that use the Freemium model typically have a large segment of free service users and a much smaller segment of paying customers. When calculating CAC, these businesses will need to assess the cost of serving those free users in relation to the percentage of paid users.

Advertising-based app businesses will also need to differentiate between their users and customers to calculate customer acquisition cost. Mobile games, news, and social media apps are examples of products that are free for general users, but their customers are advertisers that monetize user data.

Customer Acquisition Cost Calculation Mistakes

By now you are probably well aware, but to reiterate: there is no universal method for calculating customer acquisition cost.

With no standard way to calculate CAC across all industries, there is a lot of room for error. Most people simply underestimate the expenses necessary to acquire a new customer. It can also be tempting to overlook certain expenses to report a lower cost to acquire a customer.

Say you have the hottest freemium app in the App Stores. Great! The goal of hosting free users is to convert them into paying customers, right? So the freemium product is a tool for customer acquisition. Do you see where this is going? The costs to service these free members must be included in your customer acquisition cost calculations to be a true indicator.

If you choose to calculate retention costs separately, then you must differentiate between new customers and returning customers. If returning customers are counted as new customers, this can distort your true customer acquisition cost.

LTV vs CAC Ratio

Comparing customer acquisition cost to customer lifetime value is important for understanding the viability of the business’s acquisition model. Simply put, if customer acquisition cost exceeds expected customer lifetime value, the acquisition model is not sustainable.

When calculating the LTV:CAC ratio, you will need to simplify the ratio since the lifetime value and customer acquisition cost will likely be large and uneven numbers that do not make simplified ratios.

It’s worth noting that the costs associated with retaining customers will need to be evaluated later and compared against this LTV:CAC ratio. An otherwise favorable LTV:CAC ratio could be shattered upon the realization that the cost to acquire and retain customers exceeds your customer lifetime value. Oops.

You can calculate your retention rate and the dollar retention rate to project the sustainability of your customer retention strategy. Try our customer retention rate calculator.

For an easy way to calculate LTV or CLTV, use our Customer Lifetime Value Calculator.

Customer Acquisition Cost Case Study

Let’s use a hypothetical business news app called BreakerNews as an example. The BreakerNews team has a unique business model because the majority of their news is provided free for users, with the exception of their proprietary finance research which is a paid subscription. The freemium content model is subsidized by advertising revenue.

For the sake of this example, we will use round numbers. BreakerNews has 200,000 free monthly readers and 80,000 paid subscribers and growing. The paid subscription brings in recurring monthly revenue of $10 per subscriber.

BreakerNews: Calculating CAC

It costs $1.1 million per year to provide freemium content with annual ad revenues of $3.2 million. In the last quarter, sales and marketing expenses, excluding salaries, totaled $40,000. The sales and marketing team is comprised of 3 full-time employees with salaries totaling $200,000.

With advertising revenues more than offsetting the costs to service the freemium users, calculating customer acquisition cost can be reduced to sales and marketing expenses.

In the latest fiscal quarter, BreakerNews acquired 20,000 new paid subscriptions. With sales and marketing expenses of $240,000, the customer acquisition cost is calculated as:

$240,000/20,000 customers = $12 CAC

BreakerNews: Calculating Customer Lifetime Value

The BreakerNews team finds the average premium subscriber continues to pay $10/month over the course of 2 years. The research is rather expensive to put out on a monthly basis, which is why the profit margins are only 10%.

The customer lifetime value for BreakerNews would be calculated as follows:

CLV = $10 x 12 x 2 x 10% = $24

BreakerNews: LTV:CAC

BreakerNews now wants to calculate their LTV:CAC ratio. They discovered they have a customer acquisition cost of $12 and a customer lifetime value of $24. The LTV:CAC ratio would be expressed $24:$12.

In order to simplify this ratio, the BreakerNews team would need to divide the antecedent and consequent by a common factor, in this case, 12:

12/12 = 1

24/12 = 2

In this example, the LTV:CAC ratio for BreakerNews is 2:1. While a common benchmark for LTV:CAC is 3:1, a higher ratio means the customer lifetime value exceeds the customer acquisition cost. A LTV:CAC ratio of 5:1 means BreakerNews could be investing more heavily in customer acquisition cost and still maintain a healthy business model.

Customer Acquisition Conclusion

As you can see, customer acquisition cost is not a metric you can afford to ignore. Failing to track customer acquisition cost and measure against customer lifetime value is akin to flying a plane blind. Without the instrumentation to guide your decisions, you are bound to crash and burn.

Customer acquisition cost is one of the more important metrics for a growing business to track. To learn more about the metrics that matter, check out our free handbook for growth marketing.

See how today’s top brands use CleverTap to drive long-term growth and retention

Subharun Mukherjee

Heads Cross-Functional Marketing.Expert in SaaS Product Marketing, CX & GTM strategies.

Free Customer Engagement Guides

Join our newsletter for actionable tips and proven strategies to grow your business and engage your customers.