Seeing an increase in your app downloads but no corresponding rise in transactions or transaction value can be both frustrating and perplexing. While high download numbers may look like a win, they’re only part of the equation. Without strong engagement, those installs are just vanity metrics, offering little to no impact on your bottom line.

In the high-stakes world of fintech, where trust, speed, and reliability are paramount, user engagement is mission-critical. This is where push notifications emerge as a powerful tool, not just for marketing, but also for building customer confidence, streamlining onboarding, and driving meaningful actions throughout the financial journey.

In this blog, we’ll discuss the value of push notifications in fintech, including benefits, best practices, and real-world examples, so you can boost engagement and drive revenue growth.

Why Push Notifications in Fintech Are a Game-Changer for User Engagement

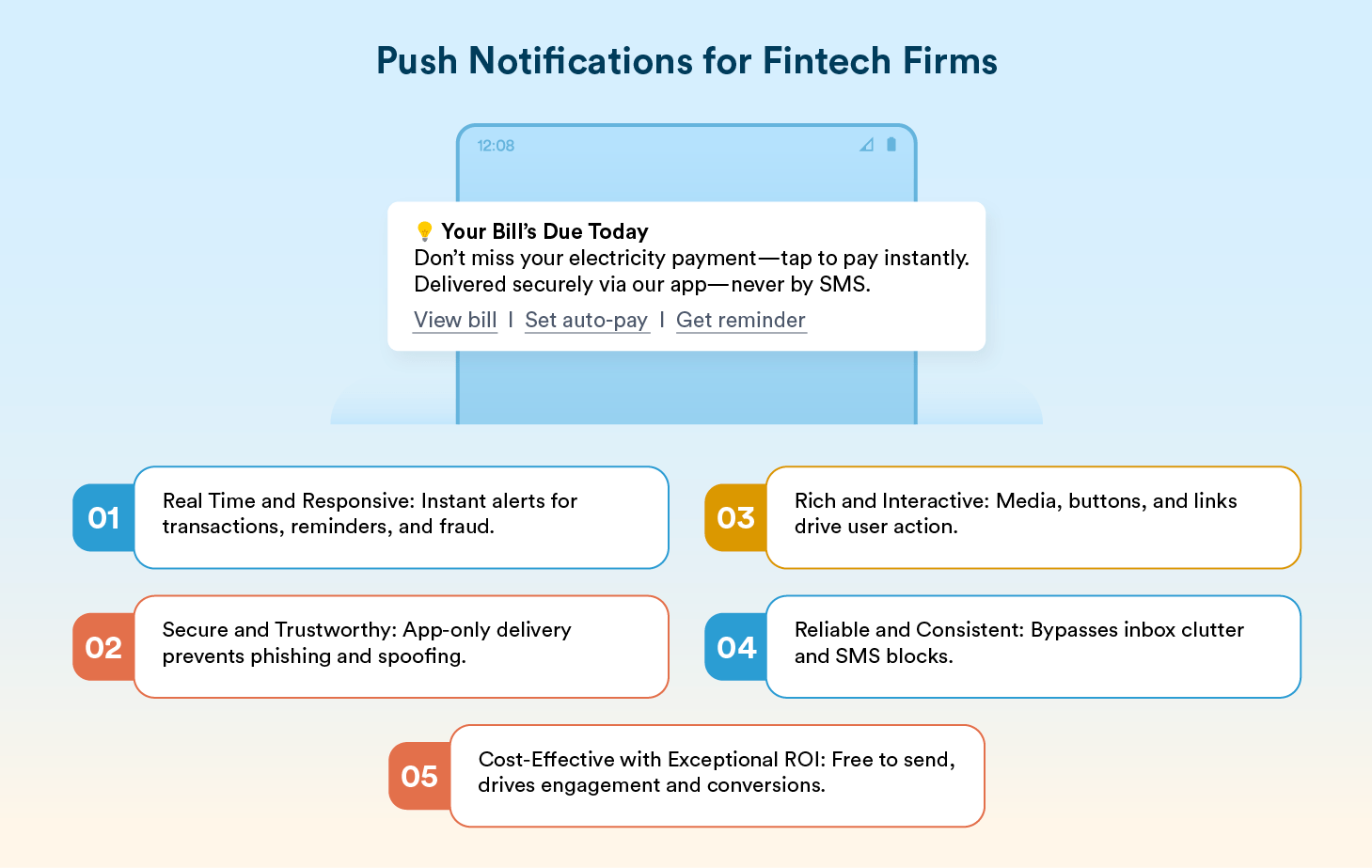

Push notifications are fast, secure, and highly visible, making them perfect for real-time fintech actions like payment alerts, fraud warnings, and investment nudges. Only the app can send them, ensuring user trust, while rich media and personalization make them interactive and actionable.

They’re free to send, yet deliver incredible ROI.

- Push notifications have a view rate of up to 90% on mobile devices.

- Fintech apps using personalized push strategies can see up to 31% conversion rates when push is combined with other channels like email and in-app messaging.

- CTRs in fintech average 9%, with significantly higher performance on Android (up to 50% higher than iOS).

In short, push is reliable, cost-effective, and built for customer engagement at scale.

The edge of using push notifications in fintech:

- Real Time and Responsive: Whether it’s a transaction alert, payment reminder, or fraud detection, real-time push notifications ensure users get notified instantly, empowering them to act in real time. This immediacy is essential in a domain where seconds can make a financial difference.

- Secure and Trustworthy: Only your app can send push notifications to its users, eliminating risks of phishing, spoofing, or unauthorized communication. This direct, app-authenticated channel reinforces safety and builds long-term user trust.

- Rich, Interactive, and Personalized: Today’s push notifications can carry images, GIFs, carousels, action buttons, and deep links—transforming plain alerts into interactive journeys. With tailored content, you can nudge users toward desired actions like completing KYC, making a payment, or investing with just a tap.

- Reliable and Consistent: Unlike emails that may get lost in crowded inboxes or SMSes that can be blocked, push notifications are delivered directly to the user’s device, ensuring high visibility and reliability.

- Cost-Effective with Exceptional ROI: Push notifications are free to send, unlike SMS or paid ads. Yet they drive incredible returns by reactivating users, improving conversions, and increasing session frequency.

Push notifications in fintech deliver the immediacy, relevance, and reassurance that users demand.

Top Benefits of Using Push Notifications in Fintech Firms

Push notifications give fintech firms a direct channel to drive timely, personalized engagement with users, without relying on them to open the app. When implemented well, push notifications can help fintech brands drive:

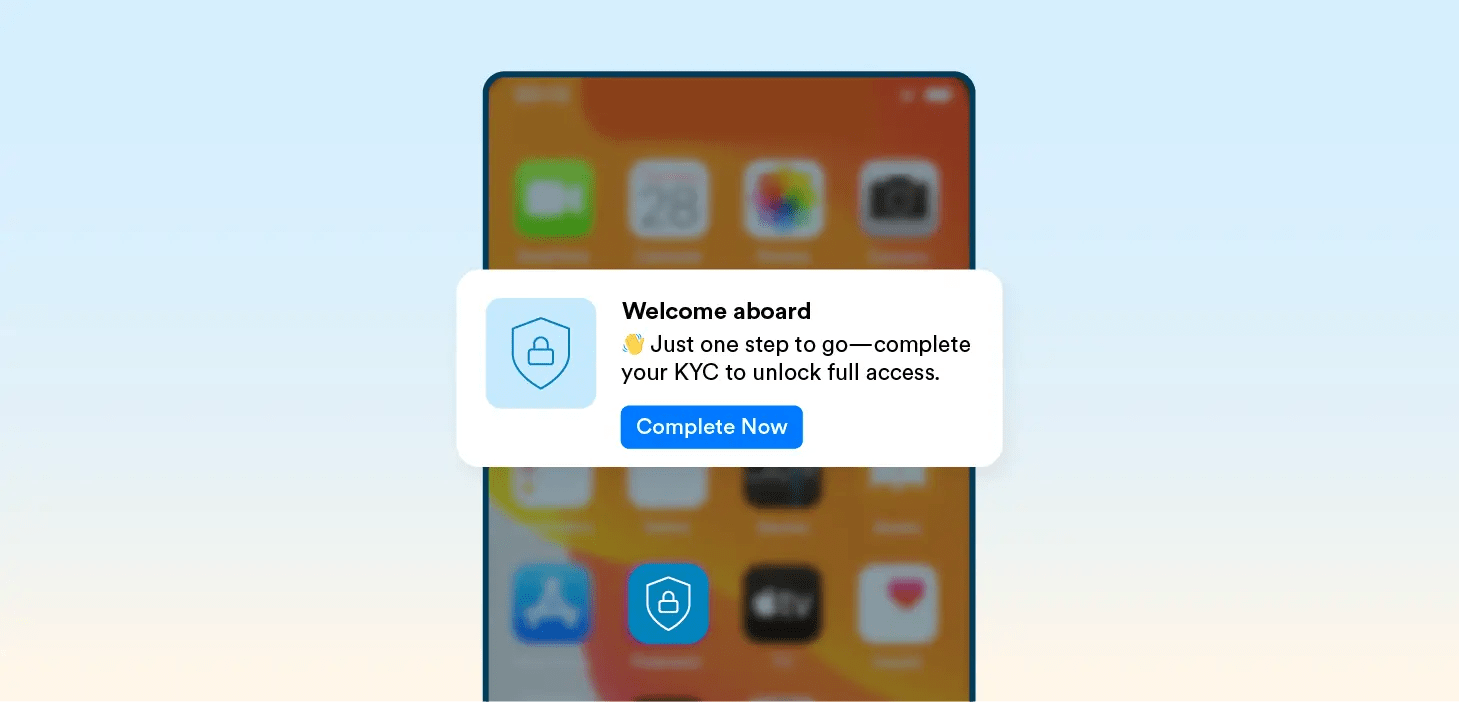

1. Onboarding: Guiding Users After App Download

76% of new users convert within seven days when engaged via push notifications. This early conversion is driven by the immediacy and accessibility of push, which becomes the first—and often only—active channel right after app install.

Since users may not have opted into email or SMS yet, push notifications play a critical role in nudging them to complete account setup, verify KYC, and take that all-important first step inside the app. Timely onboarding nudges delivered through push help minimize friction and reduce user drop-offs at this vital stage.

2. Early Engagement: Encouraging First Transactions

15% of users make repeat transactions in the first week when push notifications are used to guide their early app experience. According to CleverTap’s 2024 Cross-Channel Engagement Report, push notifications contribute directly to a 26% uplift in first-transaction rates when integrated into a broader multi-channel strategy that includes email and in-app messaging.

These nudges help reinforce behavior by prompting key financial actions such as topping up an investment account, making a UPI transfer, or activating a SIP. In fintech, timing is everything, and well-placed push notifications ensure users continue engaging during this crucial early window.

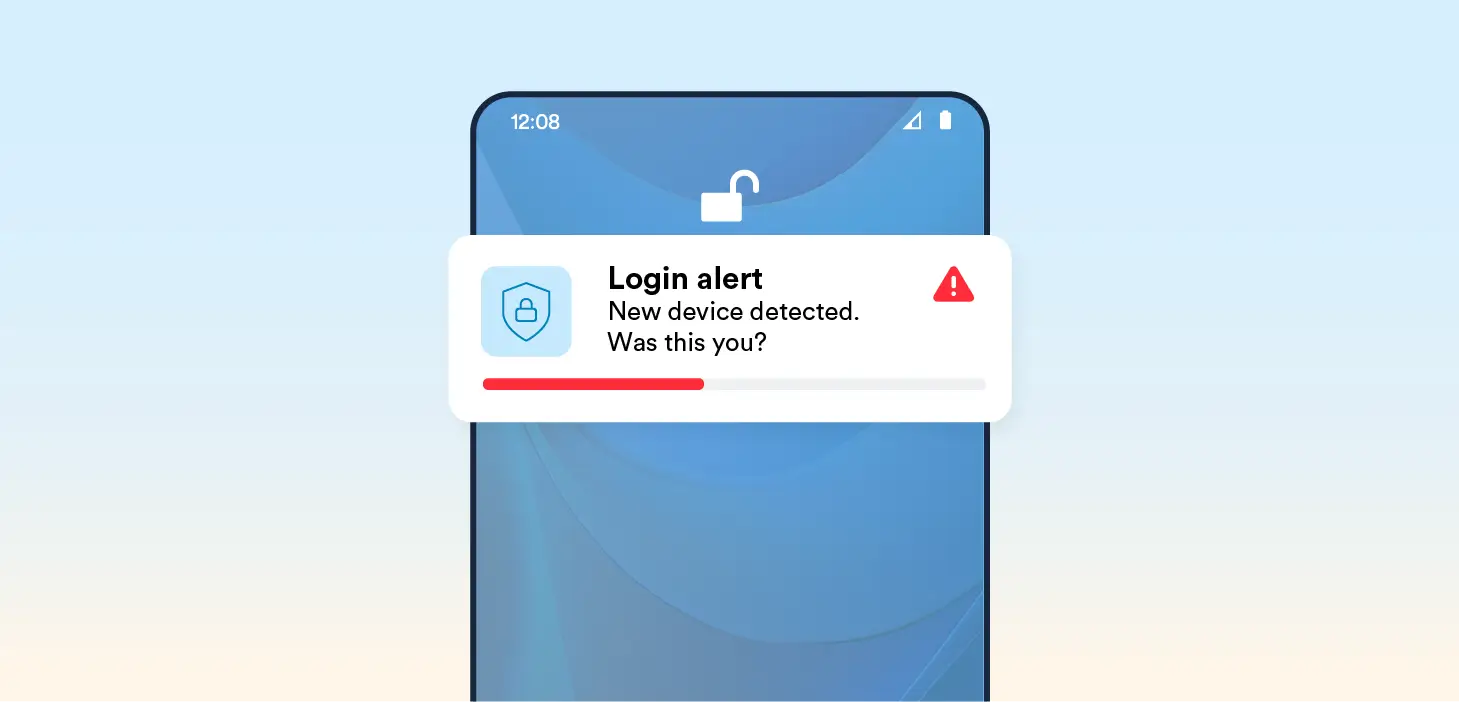

3. Trust: Real-Time Alerts and Account Safety

Push notifications achieve up to a 90% view rate, making them the most visible and trusted way to alert users about sensitive activity. In fintech, where trust is non-negotiable, these real-time alerts for payments, failed transactions, login attempts, or changes in personal information provide users with instant visibility and control over their accounts, building confidence and reducing uncertainty.

Plus, because only your app can send them, push notifications offer a secure, app-authenticated channel—shielding users from phishing, spoofing, or third-party threats.

4. Stickiness: More App Opens and Engagement

Fintech apps see the average stickiness rate rise to 27.96% when push is included in a multichannel strategy. This uplift comes from push’s ability to highlight engaging and contextual updates, content, and interactive tools for budgeting and investment planning, encouraging users to explore more and return frequently.

6. Re-Engagement: Winning Back Inactive Users

From a re-engagement perspective, push notifications play a pivotal role in driving timely user actions—especially when paired with channels like email, app inbox, and in-app messaging.

This multi-channel approach can lead to a 23.25% uplift in overall user engagement. Push notifications, in particular, stand out for their ability to deliver real-time financial updates and actionable alerts that keep users connected and informed.

Additionally, trigger-based push campaigns are highly effective at reactivating dormant users by surfacing personalized prompts—such as reminders for pending transactions, expiring rewards, or new offers—bringing them back into the app experience at the right moment.

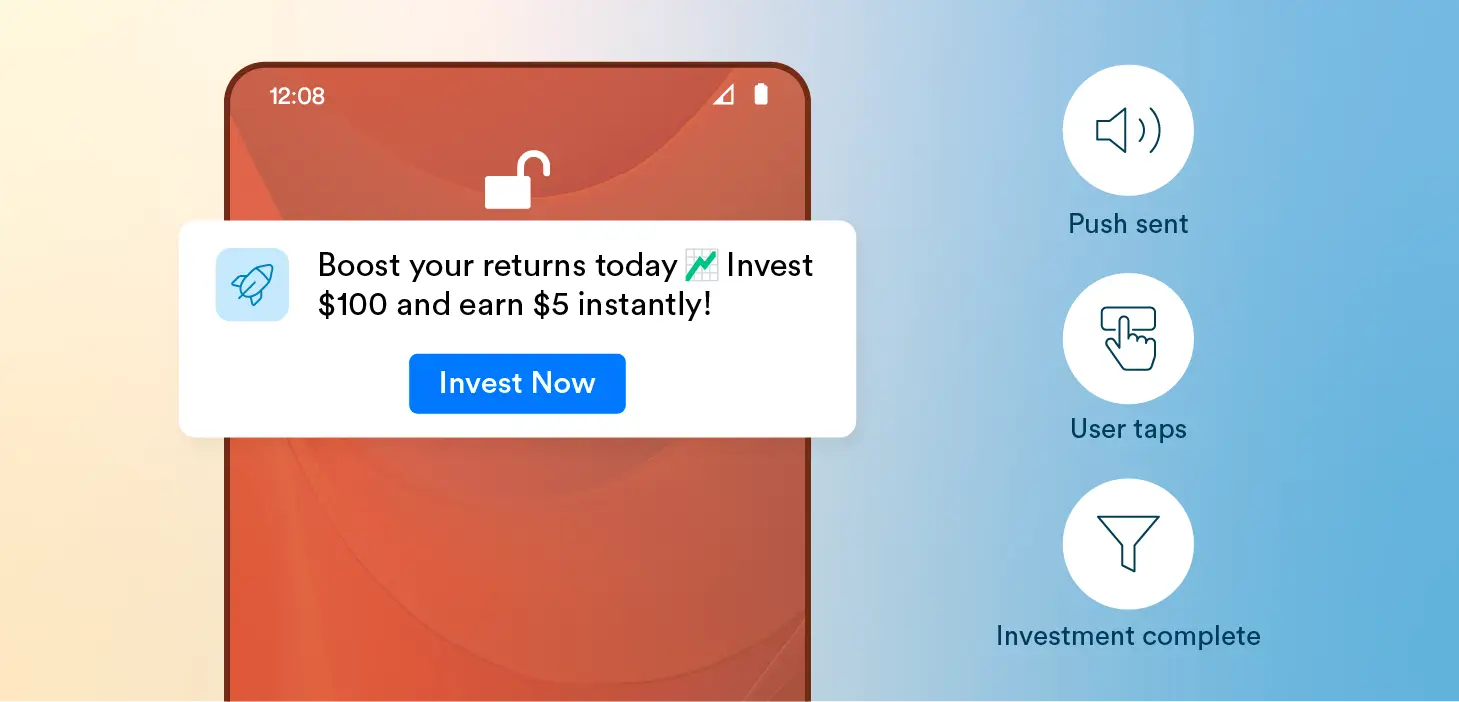

7. Conversion: Driving Revenue-Impacting Actions

Fintech brands report up to a 31% conversion rate when using push notifications as part of a multichannel stack that includes email, in-app messages, and app inbox . These prompts drive high-value actions like investment top-ups, bill payments, or premium upgrades, especially when personalized and delivered at the right time.

Push Notifications in Fintech: Real-World Use Cases from Top Brands

Let’s take a look at how leading fintech brands are use push notifications to drive measurable business outcomes—boosting conversions, improving user engagement, and cutting communication costs through real-time, personalized messaging.

Axis Bank: 27% Boost in Credit Card Conversions with AI-Powered Push

Axis Bank implemented real-time, contextual push notifications across credit card upgrade and personal loan retargeting journeys. Push was integrated into a multi-channel orchestration (WhatsApp, Email, In-App) with automation and AI (Scribe and IntelliNode) to personalize timing and messaging.

Key Results:

- 27% increase in conversions for dropped-off credit card upgrade users

- 13% higher click-to-conversion rate for personal loans via mobile push

- Reduced cost per subscription (CPS) through more efficient communication

Read the full case study here.

PVcomBank: 134% Increase in Digital Product Adoption Using Push

PVcomBank transitioned from SMS to cost-effective push and app inbox notifications. They used behavioral analytics to trigger personalized nudges at key drop-off points like eKYC or savings account journeys, significantly improving onboarding and engagement.

Key Results:

- 134% growth in digital adoption

- 24.78 billion VND saved by replacing SMS with app-based messaging

- 95% reduction in average call center consultation time

Read the full case study here.

Niyo: Elevating Customer Experience With Personalized Push Campaigns

Niyo used personalized push notifications to communicate contextually across the lifecycle—from onboarding to transaction reminders and service updates. These were triggered using real-time behavioral cues and customer profile data.

Key Results:

- Higher activation and retention through tailored nudges

- Improved user understanding and usage of Niyo’s fintech features

- Lifecycle campaigns increased repeat engagement

Read the full case study here.

Best Practices for Using Push Notifications in Fintech

When fintech firms fail to use push notifications strategically, they risk users disabling notifications—or worse, uninstalling the app entirely. To keep this critical engagement channel open and effective, it’s essential to ensure your messages remain timely, relevant, and non-intrusive.

Keep It Short, Clear, and Relevant

The primary goal of push notifications in fintech is to grab the user’s attention and drive quick action. Messages should be brief, direct, and immediately understandable, even at a glance.

Push notification character limits vary by device:

- iOS allows up to 178 characters.

- Android supports 65 characters for the title and 240 for the message body.

While this gives you space for around four lines of text, most users won’t read beyond the first line or two. So, write with clarity and purpose.

For marketers looking to add emotional nuance to brief push copy, tools like CleverTap’s Scribe, an AI content assistant can help create emotionally tailored push notifications to boost engagement and click-through rates. It generates personalized messages using tones like joy, trust, anticipation, surprise, and FOMO to capture user attention more effectively.

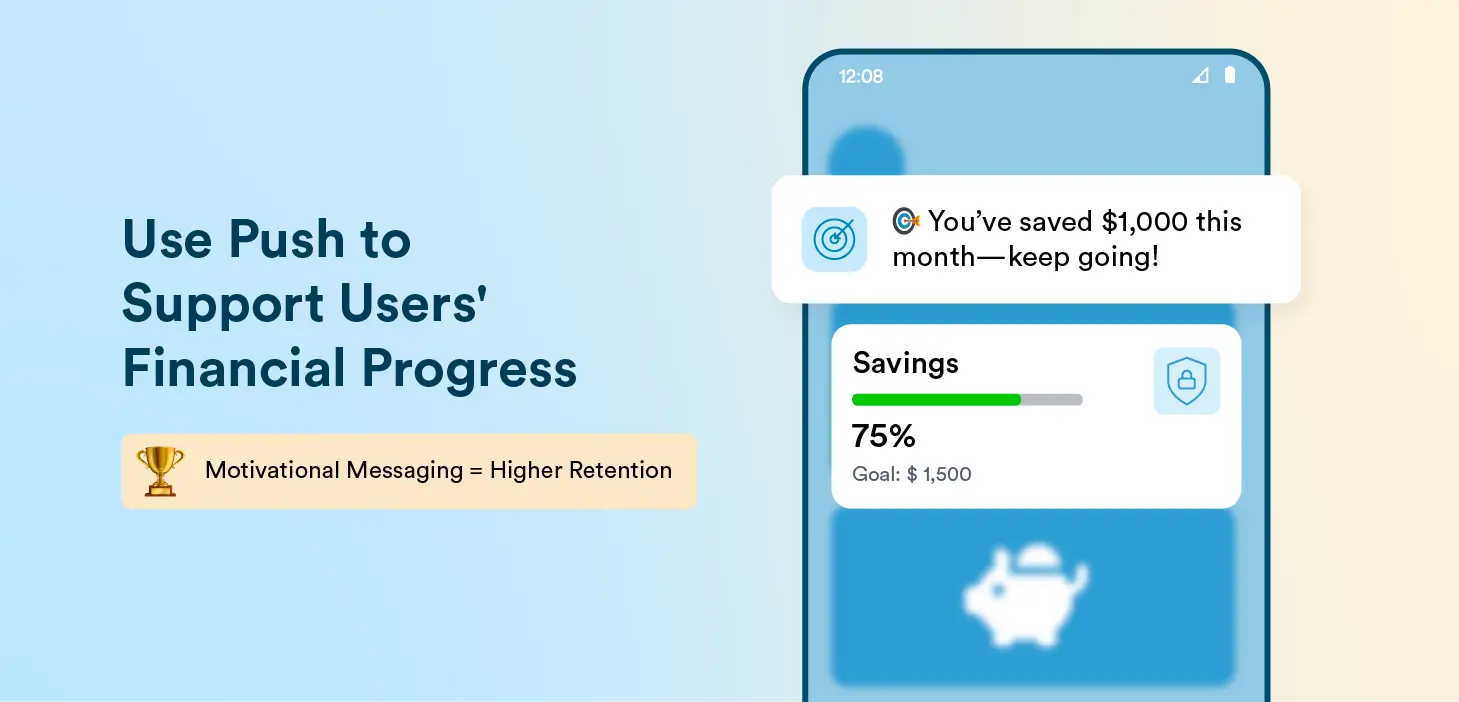

Reinforce Users’ Financial Goals

As a financial partner, your app should help users achieve their goals—not just transact. Push notifications can offer encouragement and updates tied to financial well-being, such as:

- Celebrating a successful savings deposit

- Notifying users about eligibility for higher-tier accounts

- Alerting them to interest rate or fee changes

- Introducing helpful tools like savings calculators or in-app budgeting features

These messages signal that your app is invested in their financial success.

Prompt Inactive Users to Take Action

Trigger-based campaigns are highly effective for re-engaging users who’ve gone silent. Remind them what they’re missing—whether it’s accumulated rewards, missed investment opportunities, or loyalty points. Highlighting potential benefits can prompt users to re-engage.

CleverTap enables fintech brands to send personalized push notifications based on real-time user actions like failed transactions, missed EMIs, or wallet inactivity. With External Triggers, campaigns respond instantly to backend or app events, delivering timely, relevant messages.

Key use cases include:

- Wallet top-up reminders

- Loan and EMI alerts

- KYC and onboarding nudges

- Cross-sell/upsell offers

- Investment and savings notifications

Make Contextual Interventions

Personalization increases relevance and reduces the chances of being mistaken for spam. Tailor notifications based on user interests, behavior, goals, and location. Use the user’s name, reference recent activity, and send lifecycle-relevant nudges:

- Wish them a happy birthday

- Congratulate them on opening an account

- Offer help if they abandon the onboarding process

True personalization requires historical depth. CleverTap’s unified user profile, powered by TesseractDB™, stores unlimited user data with a 10-year lookback, enabling real-time, 1:1 personalization. Fintech marketers can enrich push notifications using real-time data from CRMs, payment systems, or web activity—ensuring messages are hyper-personalized, timely, and context-rich.

You can also enhance personalization using rich push elements like emojis, images, and action buttons to make interactions more engaging and dynamic.

Learn how rich push notifications can enrich your fintech marketing strategy.

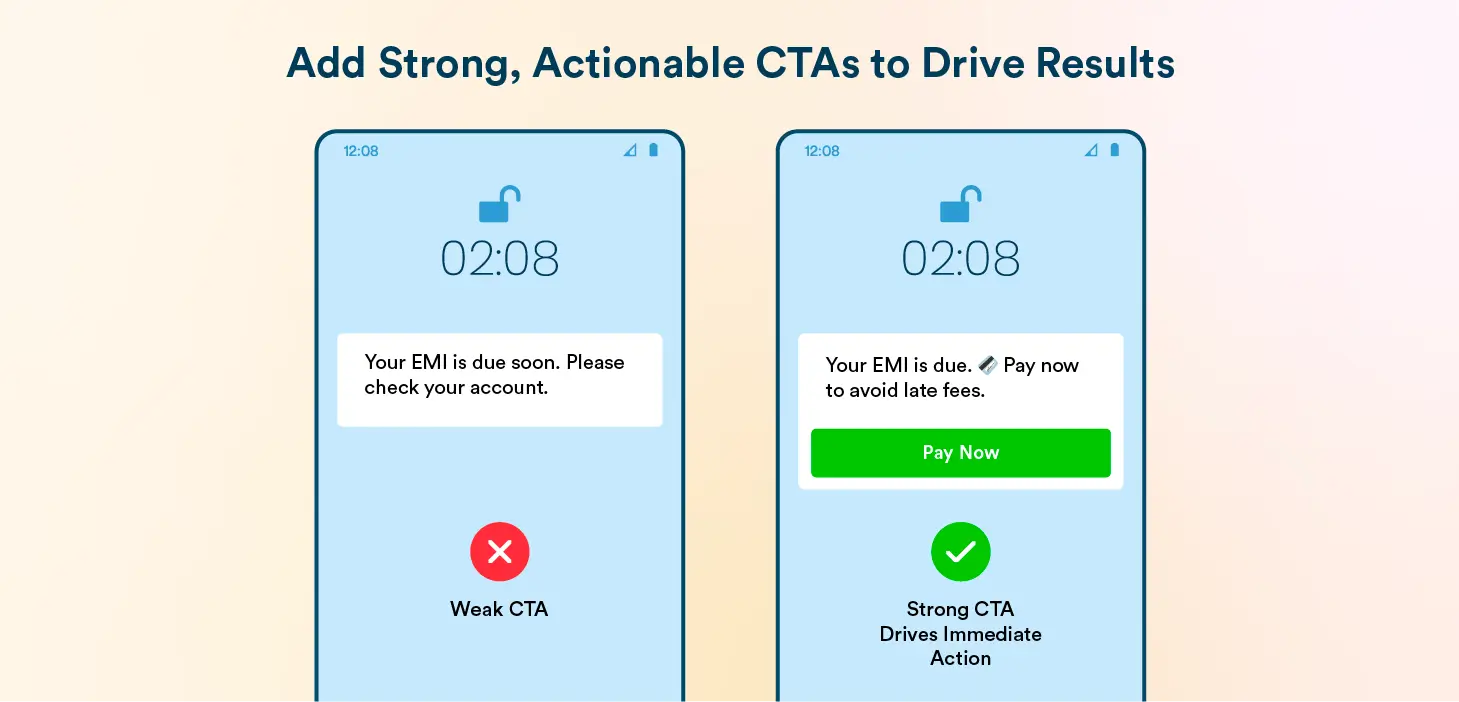

Include a Clear Call to Action (CTA)

Every push notification should clearly suggest the next step. A strong CTA eliminates confusion and drives immediate engagement. Examples include:

- Update now

- Pay now

- Rate us

- View earnings

- Track transaction

- Complete onboarding

Leverage Rich Media & Interactive Elements

Modern fintech apps are increasingly using rich media to increase engagement. Use visual and interactive elements like:

- Images and GIFs to highlight promotions or app features

- Action buttons to simplify navigation and task completion

- Carousels to showcase updates (e.g., new offers or portfolio performance)

- Emojis to make urgent alerts feel more friendly and conversational

Rich push notifications can significantly increase tap-through and conversion rates when thoughtfully executed.

Learn how to use emojis in push notifications effectively to engage your customers.

Test, Measure, and Iterate

The first version of your message is rarely the best. Use A/B testing to experiment with:

- Message tone

- Timing

- CTA placement

- Content variations

Track KPIs like open rates, click-through rates, and follow-through actions to identify what resonates most with your users.

Challenges of Using Push Notifications in Fintech

Despite their strengths, push notifications must be handled with care, especially in fintech, where trust, timing, and privacy are paramount.

Notification Fatigue

Too many notifications—especially irrelevant ones—can overwhelm users. This leads to opt-outs, silencing of notifications, or full app uninstalls. Prioritize quality over quantity and time messages based on user behavior and preferences.

Lack of Personalization

Generic messages like “Check your balance” offer little value. Without personalization based on user profiles, goals, and actions, your notifications are likely to be ignored—or worse, perceived as spam.

Data Sensitivity and Privacy

Unlike retail or entertainment apps, fintech apps deal with highly sensitive information. Avoid revealing personal or transactional details directly in the notification. Always adhere to data protection standards like GDPR, CCPA, and relevant financial regulations.

Lifecycle Blind Spots

Push strategies must evolve as users do. A first-time user and a loyal investor shouldn’t receive the same notifications. Yet many fintech apps fail to conduct customer segmentation deeply enough, missing key engagement opportunities across the lifecycle.

One way to bridge these lifecycle gaps is through real-time, no-code segmentation. CleverTap’s Journey Builder and TesseractDB™ let fintech brands segment users in real time—no coding needed. Marketers can trigger contextual push notifications based on user actions like app opens, missed payments, or onboarding drops, enabling dynamic, automated campaigns that guide users through key steps like KYC, wallet top-ups, or reactivation.

Overcoming Delivery Barriers on Android Devices

Many Android OEMs (like Xiaomi, Huawei, Oppo) aggressively manage battery and background activity, often blocking or delaying push notifications. This leads to silent message failures, poor engagement, and missed opportunities—especially in markets where such devices dominate.

CleverTap’s proprietary RenderMax™ technology overcomes these visibility issues—boosting render rates by up to 90% and directly improving engagement, conversions, and app stickiness.

Poor Timing

A great message sent at the wrong time is wasted. Push notifications should be optimized for time zones, daily routines, and behavioral patterns. Avoid sending messages during odd hours or when users are unlikely to engage.

Learn about the best time to send push notifications to engage your customers and drive conversions.

Driving Fintech Growth with Smarter Push Campaigns

Push notifications in fintech are tools to build trust, drive action, and add value. When timely, relevant, and personalized, they turn passive users into active ones. With CleverTap’s smart segmentation, automation, and testing, fintechs can create campaigns that engage, convert, and retain.

Download our Fintech App Engagement Benchmark Report and discover strategies and benchmarks to inform your campaigns.

Mrinal Parekh

Leads Product Marketing & Analyst Relations.Expert in cross-channel marketing strategies & platforms.

Free Customer Engagement Guides

Join our newsletter for actionable tips and proven strategies to grow your business and engage your customers.