With an increase in fintech apps globally, there’s heightened competition in this fast-growing industry. Understanding the effectiveness of your fintech marketing campaigns in comparison to industry peers is key to guiding your strategy and amplifying your impact.

By measuring and analyzing click-through rates (CTRs), you can determine whether your marketing efforts are driving the response you want. Are your emails or in-app notifications prompting users to open your app and sign up?

Let’s delve into the effectiveness of email and in-app CTRs and how you can optimize your in-app and email marketing strategy to drive maximum results.

Are Emails and In-App Notifications Still Relevant?

Emails and in-app notifications continue to be highly relevant for fintech marketing.

The click-through rate for in-app messages and emails measures the percentage of users who interact with and click on your messages. With an average CTR of 24%, in-app notifications offer a significant opportunity to nudge user actions in a certain direction. One way to do this is by sending contextual, hyper-personalized messages. Sending your users the right message at the right time is a proven way to maximize CTRs for in-app notifications.

With an average open rate of 34%, emails are a great way to communicate more complex messages. Since emails accommodate more words than in-app notifications, they’re ideal for educating fintech app users about property mortgages, investment opportunities, and insurance. These complex topics all require deeper explanations and exploration than an in-app notification can accommodate. Email communications also allow fintech app users to take action at a later time.

Improving the Effectiveness of Email

Although the statistics show email can be a strong fintech marketing tool, there are email marketing best practices that will further determine your success.

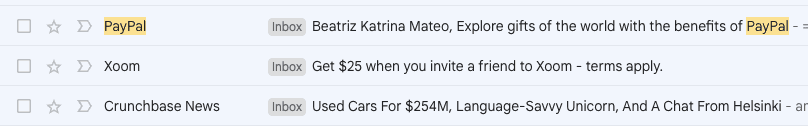

1. Use an attention-grabbing subject line

Subject lines that promise to deliver value are less likely to be ignored.

One of the most important determinants of whether recipients open fintech marketing emails is how effective the email subject line is. The subject line should not only be enticing and pique the reader’s interest, but it should also accurately reflect the content of the email.

Misleading, spammy, and click-bait headlines can hurt your company’s marketing efforts. You might think these types of subject lines will get users to open your email. However, once they see the content isn’t what you promised in the heading, they will likely unsubscribe or relegate you to the spam folder.

The email preview text gives you another opportunity to encourage readers to open the email. This line of text typically appears as a sneak peek into the content. Don’t repeat the subject line. Also, avoid words such as “unsubscribe” or “trouble viewing this email?” Instead, add a call to action (CTA) or a statement that builds viewer curiosity.

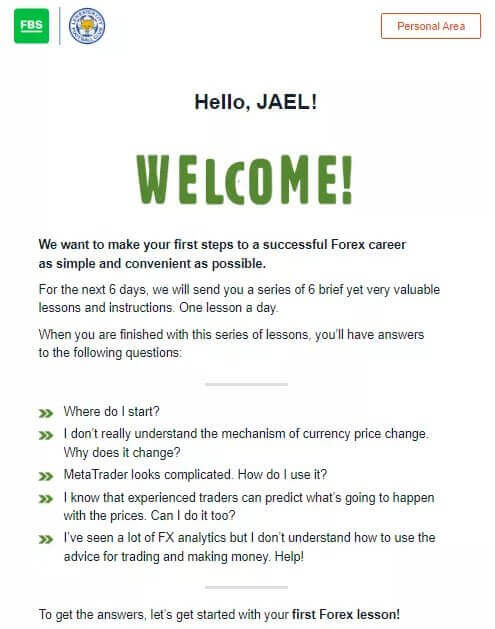

2. Create personalized content for each user

Trading app FBS provides free lessons to users who want to learn more about trading. Users who avail of this service receive a personalized welcome email informing them of where they currently are in the course.

One of the most effective ways to make your fintech marketing emails more impactful is to personalize your messaging. Address customers by their name and send information that’s relevant to their individual interests. The more relevant information is to the user, the more they will engage.

If the recipient is new to your fintech app, include emails that guide them along the user journey. If the user has been using the app for some time, offer information that’s relevant to the services they use or promote new offerings they may benefit from.

3. Keep emails short and simple

People are busy and don’t have time to read lengthy blocks of text. There should be one main message that immediately catches their eye so they know where to focus. So keep emails simple, clear, and concise. Use them to point customers to your app or website to dig into lengthier blogs, user guides, and video content.

Besides avoiding information overload and viewer abandonment, email messages should also be short to accommodate mobile viewing. Since more people are accessing emails on their mobile devices, it’s essential to optimize your messages for mobile. A few sentences on a small device look like a novel. Keep the design responsive for various screen sizes, and keep the content short and to the point.

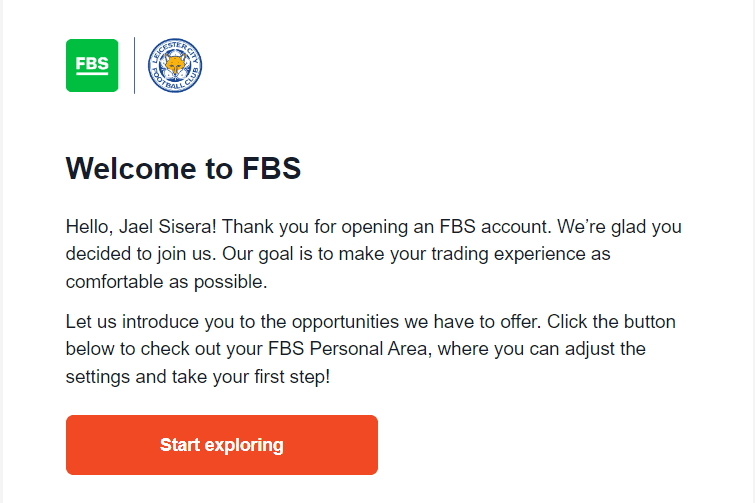

This email from FBS is short and simple. Aside from setting the tone of the whole user experience, it also contains a clear CTA that lets the user know which step to take to move forward.

4. Don’t forget to add a CTA

In the same way that an overly busy layout confuses where the eyes need to focus, too many CTAs make the desired path of action unclear. Instead, include just one call to action so the reader’s next steps are obvious. After all, a fintech marketing email’s job is to make the user’s life easier. Provide one clear call to action that leads to a matching, user-friendly landing page.

5. Use intent-based segmentation

Intent-based segmentation — a Machine Learning-assisted function that predicts the likelihood of a customer converting — is essential to making your emails relevant and highly targeted to a user’s intents at an individual level.

Incorporating intent-based segmentation into your fintech marketing strategy allows you to send users messages that align to where they’re at on the customer journey. This sends users information and offers that are most likely to appeal to each of them, which in turn improves email open rates and CTRs.

Creating Effective In-App Notifications

When comparing push notifications, in-app notifications, and marketing emails, in-app notifications have the highest CTR. This makes them an essential component of any fintech marketing strategy.

A user who is already engaging in your app when a notification pops up is likely to respond to the message at that very moment. From guiding seamless onboarding to announcing new features, strategic messages engage users at just the right time. This can drastically improve the user experience. However, for in-app notifications to maximize CTRs, messages need to be highly contextual and personalized.

Benefits of Optimized In-App Notifications

Enhanced User Experience

When messages feel organic and serve as a guide to users, especially during onboarding, they remove friction points. Navigating and learning about app features become a seamless and pleasurable experience rather than a frustrating one. Notifications are your real-time ally in boosting customer satisfaction.

Test and Optimize Flows

Using a tool that offers analytic results about in-app notification performance provides insight into messaging effectiveness. This allows you to make data-driven decisions to optimize future notification strategies across every stage of your product lifetime.

Drives Freemium Conversions

Non-invasive in-app notifications foster engagement. A timely offer to upgrade, for example, is more enticing if the user has previously tried a free trial version or viewed your pricing page, or has been using your app regularly for the past months. Notifications that are specifically user experience-focused also drive loyalty.

Improved User Retention and Lifetime Value

With consistent notifications that add value to your users’ experience, you lead them away from churning. This improves retention rates and drives opportunities for increased app use.

Best Practices to Optimize In-App Notification Success

Given its high conversion rates, you don’t want to waste the in-app notification touchpoint. Use these tips to create messages that will resonate with users and drive them to action:

1. Create contextual, hyper-personalized notifications

While in-app notifications are key to your fintech marketing success, they can also be detrimental when poorly executed. If users receive untimely or out-of-context messages, they will likely become irritated. The notifications should overcome obstacles, not cause frustration.

For example, sending onboarding tips to someone who has been using your app for some time is irrelevant and distracting. Similarly, sending feature updates incompatible with the user’s location or country is annoying. Users quickly lose interest when they consistently receive messages that don’t apply to them and won’t hesitate to switch to an app that offers personalized benefits.

Getting it right means messaging prompts should generate value. For instance, the moment a user struggles with a specific action is exactly when a notification should appear to assist them.

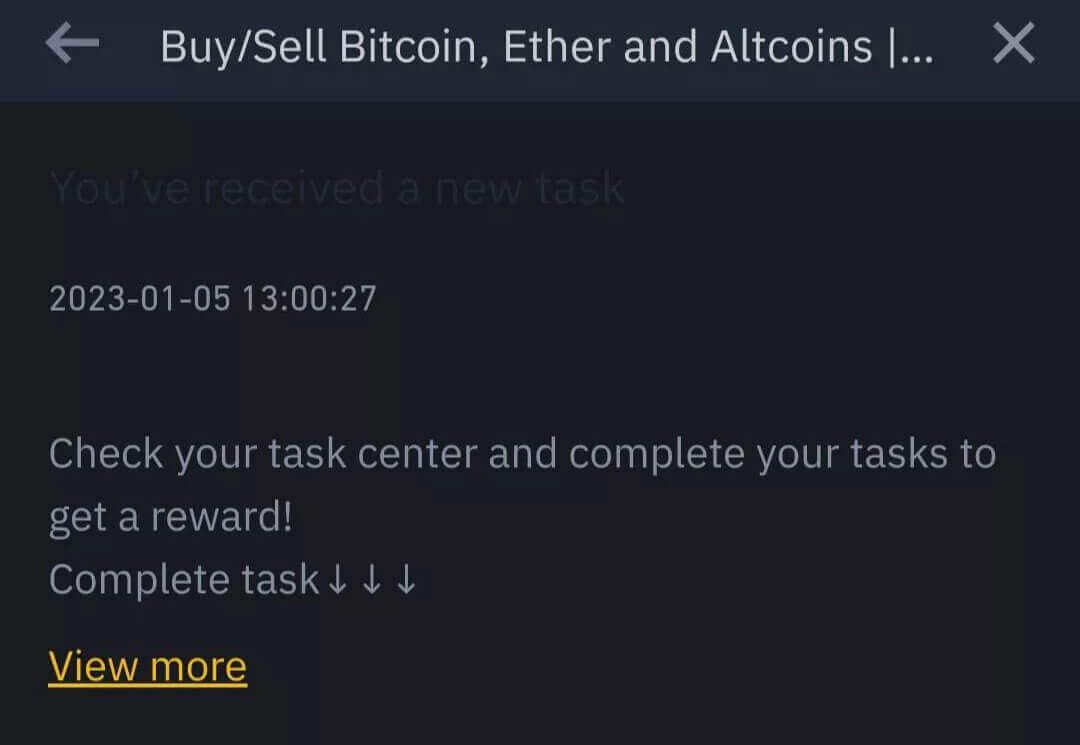

2. Align in-app messaging strategies with push notifications

Crypto app Binance regularly reminds its users to complete certain app-related tasks, using rewards to encourage them to further engage.

In-app notifications allow you to communicate key information with users while they are busy in the app. These notifications should always enhance the user experience at the moment of engagement. Push notifications, on the other hand, happen outside the app. The in-app message bridges the gap between external communication and internal channels.

For example, a push notification may alert you of a received payment. By following the notification link to the app, you can check payment details. A push notification can also alert you to new features, offers, or policy changes. Viewing the feature details or special offers will require you to access the app.

Push notifications often serve to draw users back into the app to increase engagement. The two types of notifications, therefore, need to align, even though they serve different fintech marketing purposes.

3. Provide value

We’ve touched on providing value in terms of onboarding and solving user obstacles. However, there’s a great deal of everyday value you can offer users to boost CTRs as well as your reputation as an industry leader.

Notifications don’t just assist users in navigating and getting the best use out of the app features. They also aim to prolong app engagement by offering users reasons to stay on the app. The nature of the app will determine the various value propositions offered by in-app notifications, which can include:

- Educating users about features they’re missing out on

- Invitations to watch video clips that explain premium features

- Invitations to join webinars

- Tool tips and integrations

- Available resources such as personal and business finance guides

- Insights into market trends

- Gathering feedback and prompting reviews

- Industry updates

- User awards (for example, completing a certain number of transactions)

- Links to investment guides and advice

- FAQs

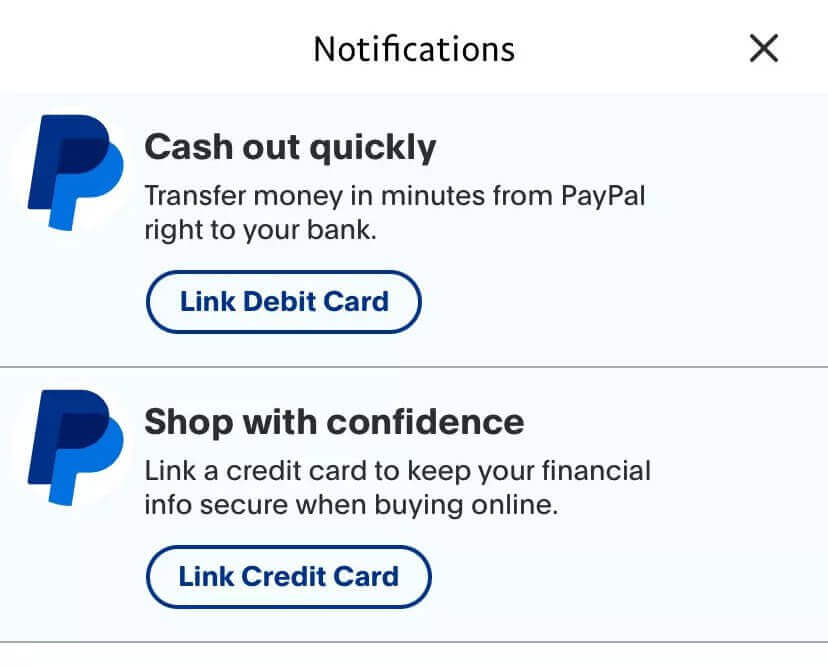

Popular fintech app PayPal regularly sends tips and updates to its users through in-app notifications.

Knowing which notifications to show to which users requires a thorough knowledge of who your users are, how they behave, and what their interests are. For example, someone who uses your app to make easy online shopping payments will be motivated by notifications about loyalty rewards for regularly using the app in this way. On the other hand, this user might have no interest whatsoever in notifications about stock market investment resources.

To get the right message to the right customer, you must segment your users.

4. Segment users according to their behavior

Segmenting app users enables you to deliver more personalized messages that are relevant to individual user interests. Audience segmentation can occur on many levels, including:

- Technographic (user device)

- Psychographic (interests and values)

- Behavioral (in-app user trends)

- Demographic

- Location

You can also group together users who are in the same stage of their consumer journey. For example, you can send all newly registered users a notification about unlocking certain app features. Similarly, you can send all users in a certain location a notification about a new account or payment options in their local currency.

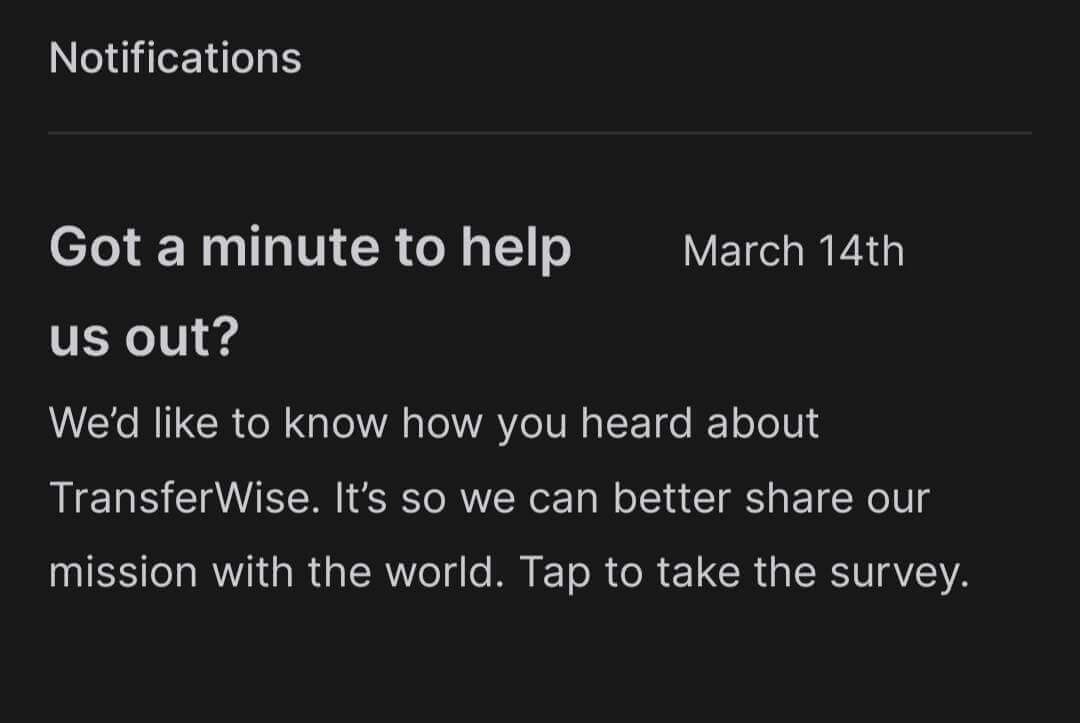

Wise, a money transfer app, uses in-app notifications to get users to participate in surveys—effective tools that can help companies segment their users.

While this is a diverse and overwhelming amount of data to handle, the right mobile marketing tool will simplify and automate data capture and analysis. By mobilizing the right data, you turn every interaction into a strategic exchange. This drives engagement, CTRs, app installs, and ultimately revenue.

Another key reason to adopt audience segmentation as part of your fintech marketing strategy is that it enables you to exclude certain audiences from notification campaigns. Consumers who continually receive irrelevant notifications will remove the app and likely not perceive your service as something that has value for them.

Fintech Marketing Made Easy With CleverTap

There’s no denying user engagement plays a key role in the success of your app. In-app notifications and emails have proven to be powerful tools to deliver value at every stage of the user journey. By boosting click-through rates, you drive engagement and ultimately encourage users to become loyal brand followers.

Getting the right messages to the right audience, at the right time, and through the right channel sounds like a mammoth task. In addition, as your business grows, the data complexity does too. But it doesn’t have to be complicated. With a comprehensive mobile marketing tool, you can guarantee emails and in-app notifications won’t be perceived as interruptions to your users but rather as valuable guidance. With automated behavioral analysis and real-time behavioral segmentation, you save countless hours of work and gain more time to optimize campaigns with content your users will value and click on.

CleverTap offers regular expert tips to help you optimize all customer touchpoints, both inside and outside your app. Subscribe to our blog and start discovering leading strategies to take your mobile app to new heights.

Shivkumar M

Head Product Launches, Adoption, & Evangelism.Expert in cross channel marketing strategies & platforms.

Free Customer Engagement Guides

Join our newsletter for actionable tips and proven strategies to grow your business and engage your customers.