Few marketing channels offer precision, privacy, and performance like email does, especially when it comes to financial services. With digital competition intensifying and regulations tightening, financial institutions need a way to reach customers directly, securely, and at scale. That’s where email marketing for financial services comes into play.

The average ROI for marketing emails in the US and UK is between 3600% and 3800%—outperforming nearly every other channel—even in highly regulated sectors like banking and fintech. But for financial institutions, the value of email marketing goes far beyond ROI. It builds trust, nurtures long-term relationships, and delivers timely, compliant messages that customers actually want to receive.

In this guide, we’ll break down why email marketing for financial services is so effective, the unique challenges banks and fintechs face, and how to build campaigns that drive real results. You’ll see real-world financial email examples, best practices for compliance and personalization, and proven strategies to maximize ROI.

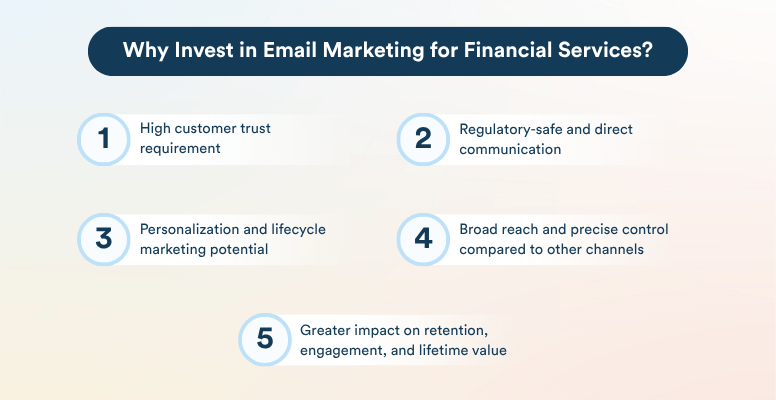

Why Invest in Email Marketing for Financial Services?

Email marketing offers trust, compliance, and measurable impact for financial services. Here are a few reasons why it stands out as a critical channel for banks, fintechs, and other financial institutions:

1. High Customer Trust Requirement in Financial Communication

Financial services operate in a space where trust is of the essence. Customers expect sensitive information, like account updates and investment advice, to be delivered securely and reliably. With email marketing for financial services, organizations can provide a direct, private channel that aligns with these expectations, helping institutions maintain credibility and foster long-term relationships.

2. Regulatory-Safe and Direct Communication Channel

Unlike social media or SMS, email allows full control over message content, delivery, and compliance. Financial institutions can easily include the required legal disclaimers, privacy notices, and opt-out options. This ensures every message meets strict regulatory standards like GDPR and CAN-SPAM, making email marketing for financial services effective and safe in a heavily regulated environment.

3. Personalization and Lifecycle Marketing Potential

Email marketing for financial services stands out for its ability to tailor messages to each customer’s unique situation. By using advanced email segmentation and email automation, institutions can send emails that reflect a person’s financial goals, account type, or stage of life.

Regardless of whether it’s a personalized product recommendation or a reminder about an upcoming milestone, this thoughtful approach increases engagement and helps guide customers through every step of their financial journey, from onboarding to long-term loyalty.

4. Comparisons Against Other Channels (Social, SMS, Push)

Although channels like social media and SMS have their advantages, email stands out for its broad reach and precise control. Over 50% of consumers prefer getting financial updates via email, highlighting its strong performance in visibility and engagement.

Unlike social platforms, which can limit message length or change how content is shown through shifting algorithms, email gives financial institutions the freedom to share detailed, timely information directly with their audience.

5. Impact On Retention, Engagement, And Lifetime Value

Email marketing is a proven driver of customer loyalty and deeper engagement. When financial institutions use well-targeted email campaigns, they often see customers sticking around longer, interacting more, and ultimately becoming more valuable over time.

The average email open rate in fintech is 34%, while the sector sees impressive conversion rates averaging 21% both far above many other industries.

Email consistently outperforms social media in conversion rates, and with an average return of $36 for every $1 invested, it remains one of the most innovative and cost-effective ways for financial services to nurture lasting relationships.

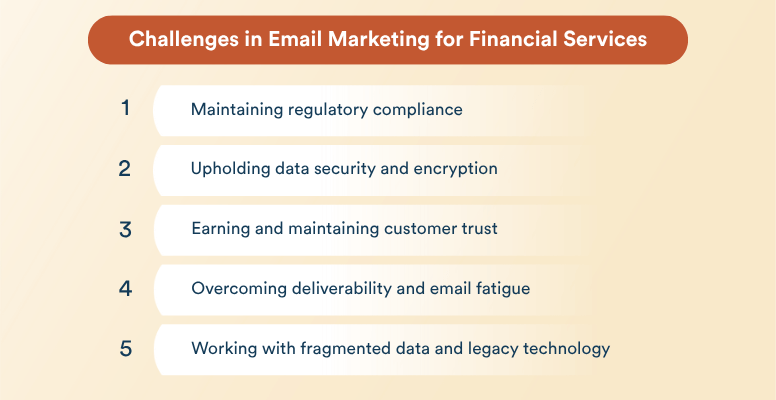

Key Challenges in Email Marketing for Financial Services

While email marketing delivers outstanding ROI for financial institutions, it comes with a set of unique, industry-specific hurdles that require constant vigilance and adaptation.

1. Maintaining Regulatory Compliance

Financial institutions face some of the most stringent regulatory requirements in marketing communications. Beyond general laws like GDPR and CAN-SPAM, banks and fintechs must comply with sector-specific mandates such as the Gramm-Leach-Bliley Act (GLBA) in the US, which governs the sharing and safeguarding of customer financial data, and the Reserve Bank of India’s guidelines on digital communications for regulated entities.

These rules dictate not only how customer data is collected and stored, but also how consent is obtained, disclosures are presented, and audit trails are maintained for every email sent.

Financial services email marketing must follow guidelines for consent, transparency, and proper disclosures. Keeping up with these changing requirements avoids fines and maintains the trust of your customers.

2. Upholding Data Security and Encryption

Financial services handle high volumes of sensitive personal and transactional data, making them prime targets for cyber threats. The risk is not just reputational—regulatory penalties for breaches can be severe.

A single misrouted statement or unencrypted alert can expose personally identifiable information (PII) or account details, violating laws and eroding customer trust. Encryption, secure authentication, and strict access controls are not optional add-ons but baseline requirements for email marketing for financial services.

3. Earning and Maintaining Customer Trust

Trust is foundational in financial services, yet it’s fragile. Customers are hyper-vigilant about phishing, spoofed domains, and suspicious links. Even minor missteps, like inconsistent branding, unclear sender information, or poorly formatted transactional alerts, can trigger distrust and prompt recipients to ignore or even report legitimate emails as spam.

With 79% of consumers viewing their financial institution as merely transactional, every email is an opportunity to build or lose credibility.

4. Overcoming Deliverability and Email Fatigue

Financial institutions often send high volumes of alerts, statements, and promotional offers, which can easily overwhelm recipients and trigger spam filters. The crowded inboxes of financial advisors and consumers alike make it difficult for important messages to stand out.

Email fatigue is a real risk: with thousands of asset managers competing for attention, relevance and timing are critical to avoid low open rates and high unsubscribe rates.

Learn what email deliverability is and the factors it relies on.

5. Working with Fragmented Data and Legacy Technology

Many banks and financial firms still rely on legacy CRM systems and siloed data sources, making it difficult to unify customer information and deliver personalized experiences. For example, data about account activity may reside in a core banking platform, while marketing preferences live in a separate email tool, and transaction histories are stored elsewhere.

This fragmentation hinders segmentation, slows campaign execution, and limits the ability to leverage newer technologies like real-time behavioral triggers or AI-driven personalization.

Building a Successful Email Marketing Strategy for Financial Services

A high-impact financial services email marketing strategy blends data-driven insights, robust segmentation, automation, and a relentless focus on customer trust. Here’s how leading institutions are building smarter campaigns and how CleverTap empowers them at every step.

Define Customer Segments

Segmentation is the foundation of impactful email marketing for financial services. Grouping customers by demographics, account types, behaviors, wealth tiers, and life stages allows you to send targeted messages that resonate. For example, sending tailored investment advice to high-net-worth clients or personalized loan offers to younger customers increases relevance and engagement.

CleverTap’s advanced segmentation capabilities enable marketers to create dynamic, real-time segments based on user behavior and preferences.

Let’s take Beblue, a leading fintech app, for example. They leveraged CleverTap to engage over two million users with personalized campaigns. By automatically segmenting users based on in-app activity and profile data, Beblue significantly boosted daily engagement and campaign effectiveness, demonstrating the power of precise segmentation in financial services email marketing.

Set Clear Goals Per Campaign Type

Every campaign should have a focused objective, whether you are building awareness, onboarding new customers, upselling products, retaining clients, or reactivating inactive users. Clear goals help measure success and optimize performance.

CleverTap’s campaign orchestration tools allow marketers to design and automate multi-step customer journeys aligned with these goals. Niyo, for instance, used CleverTap to automate its onboarding process, sending personalized reminders and notifications at critical moments. This strategy resulted in a 40% optimized conversion rate for mobile-verified users and doubled its click-through rates compared to previous campaigns.

These results underscore how goal-driven, personalized email campaigns can significantly improve customer activation and engagement in financial services.

Use Data Responsibly and Strategically

First-party data and behavioral triggers are essential for sending relevant, timely emails. Tracking actions like transactions, app usage, or inactivity enables financial institutions to engage customers with contextual messages that drive action.

CleverTap empowers financial institutions to use first-party data and behavioral triggers for highly relevant and timely email campaigns. With CleverTap, marketers can segment audiences in real time based on actions like transactions, app usage, or inactivity, then automatically trigger personalized emails, such as payment reminders or inactivity nudges, at the optimal moment.

The platform ensures all communications are both effective and privacy-compliant by supporting robust consent management, secure data handling, and dynamic content personalization. Advanced analytics and A/B testing further allow teams to refine messaging and maximize engagement, all while maintaining strict adherence to financial industry regulations.

Maintain Compliance and Accessibility

Compliance with regulations is critical in financial services email marketing. Every email must include legal footers, opt-out options, and respect privacy laws. Accessibility is equally important in email marketing for financial services, emails should be easy to read and interact with for all users, including those with disabilities.

CleverTap’s platform supports compliance by simplifying the inclusion of legal disclaimers and managing consent preferences. It also offers tools to create accessible, responsive emails that meet diverse user needs.

Design for Clarity and Trust

Clear and trustworthy design strengthens customer confidence. Financial emails should feature a clean visual hierarchy, simple layouts, and security badges or trust signals to reassure recipients.

CleverTap provides customizable templates and a drag-and-drop editor that make it easy to maintain professional branding and transparent messaging. Dynamic content blocks and interactive elements can further enhance engagement.

Beyond email marketing for financial services, learn how to build trust in your fintech app.

Incorporate Personalization and Automation

Personalization is key to keeping financial communications relevant. Using dynamic content tailored to each customer’s portfolio, account status, or life stage ensures messages resonate. Lifecycle-based messaging, such as onboarding email sequences, product recommendations, or milestone celebrations, helps maintain ongoing engagement.

Automation enables trigger-based journeys that deliver the right message at the right time. This includes welcome sequences, inactivity reminders, abandonment campaigns, and birthday greetings.

CleverTap’s automation and AI engine power these journeys at scale.

For example, Niyo used CleverTap’s Scribe AI to craft emotionally intelligent onboarding messages, doubling click-through rates compared to previous campaigns. Beblue’s targeted automation saved their marketing team 20 hours weekly while improving engagement. MobiKwik’s automated win-back emails, triggered by uninstall events, recovered nearly 25% of lost users, highlighting the real-world impact of CleverTap’s personalization and automation in financial services email marketing.

Personalize, segment, and automate email marketing for financial services with CleverTap.

9 Email Types Used in Email Marketing for Financial Services with Real-World Examples

A successful financial services email marketing strategy relies on a mix of email types, each serving a distinct purpose in the customer journey. Below are the most impactful categories with financial email examples for inspiration.

Welcome Emails

Welcome emails are the first touchpoint after a customer signs up or opens an account. They set expectations, introduce essential services, and build trust. A digital bank, for example, sends a branded welcome email confirming account creation, outlining security tips, and providing a direct link to set up online access. This immediate, friendly communication reassures new users and encourages them to explore the institution’s offerings, laying the groundwork for a strong relationship from day one.

For example, YNAB (You Need a Budget) sends a friendly, branded welcome email that confirms account creation, provides security tips, and offers a direct link to set up online access. This immediate outreach reassures new users and encourages them to explore services from day one.

Onboarding Email Sequence

Onboarding emails guide new customers through account setup, verification, and initial transactions. These sequences reduce friction and drive early engagement.

For example, Stripe’s onboarding email works because it uses clear, action-oriented language and a clean layout that guides users seamlessly through their next steps. It offers helpful links and resources, reducing friction and helping new users get value quickly.

Transactional and Alert Emails

Transactional and alert emails provide real-time updates about account activity, such as deposits, withdrawals, bill payments, or security events. These messages are critical for transparency and customer confidence.

For example, Monzo sends clear, well-designed alerts that notify customers instantly about transactions, including detailed amounts and locations. These prompt, informative notifications help users monitor their finances closely and build trust through transparency.

Product Education Emails

Product education emails deliver valuable content on financial literacy, product features, and best practices. They empower customers to make informed decisions and increase product adoption. A mutual fund provider, for example, sends a monthly newsletter with investment tips and market insights. By simplifying complex topics and offering actionable advice, email marketing for financial services positions the institution as a trusted advisor and encourages deeper engagement with financial products.

For example, this product education email from Stripe is effective because it clearly connects new features to real-world business benefits. The content is concise yet informative, helping users understand how these updates can simplify operations and expand their global reach.

Upsell and Cross-Sell Emails

Upsell and cross-sell emails recommend additional products or services based on customer data and behavior. They increase wallet share and deepen relationships by offering relevant solutions at the right time.

CleverTap’s segmentation and automation capabilities enable fintech brands to deliver these offers when customers are most likely to respond. For example, after noticing increased travel budgets, a bank might suggest a premium travel credit card, driving higher conversion rates.

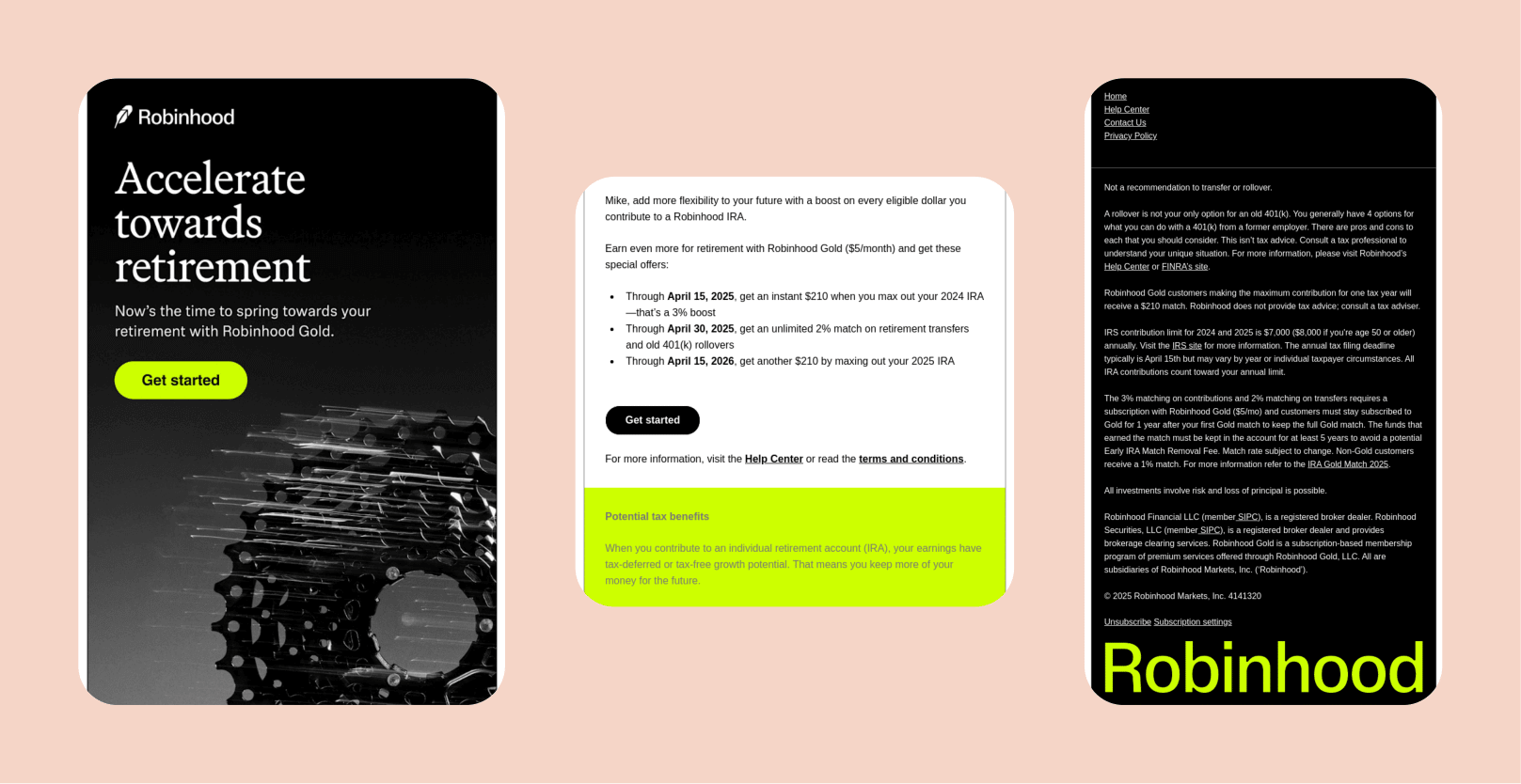

Robinhood, for example, sends targeted emails suggesting premium features or new investment opportunities based on a user’s trading activity, increasing engagement and wallet share.

Monthly Statements and Activity Summaries

Monthly statements and activity summaries provide a consolidated view of account activity, balances, and recent transactions. These emails promote transparency and help customers track their finances. A digital bank, for instance, emails monthly statements with a clear breakdown of deposits, withdrawals, and fees, along with links to budgeting tools and customer support. Regular summaries reinforce engagement and trust.

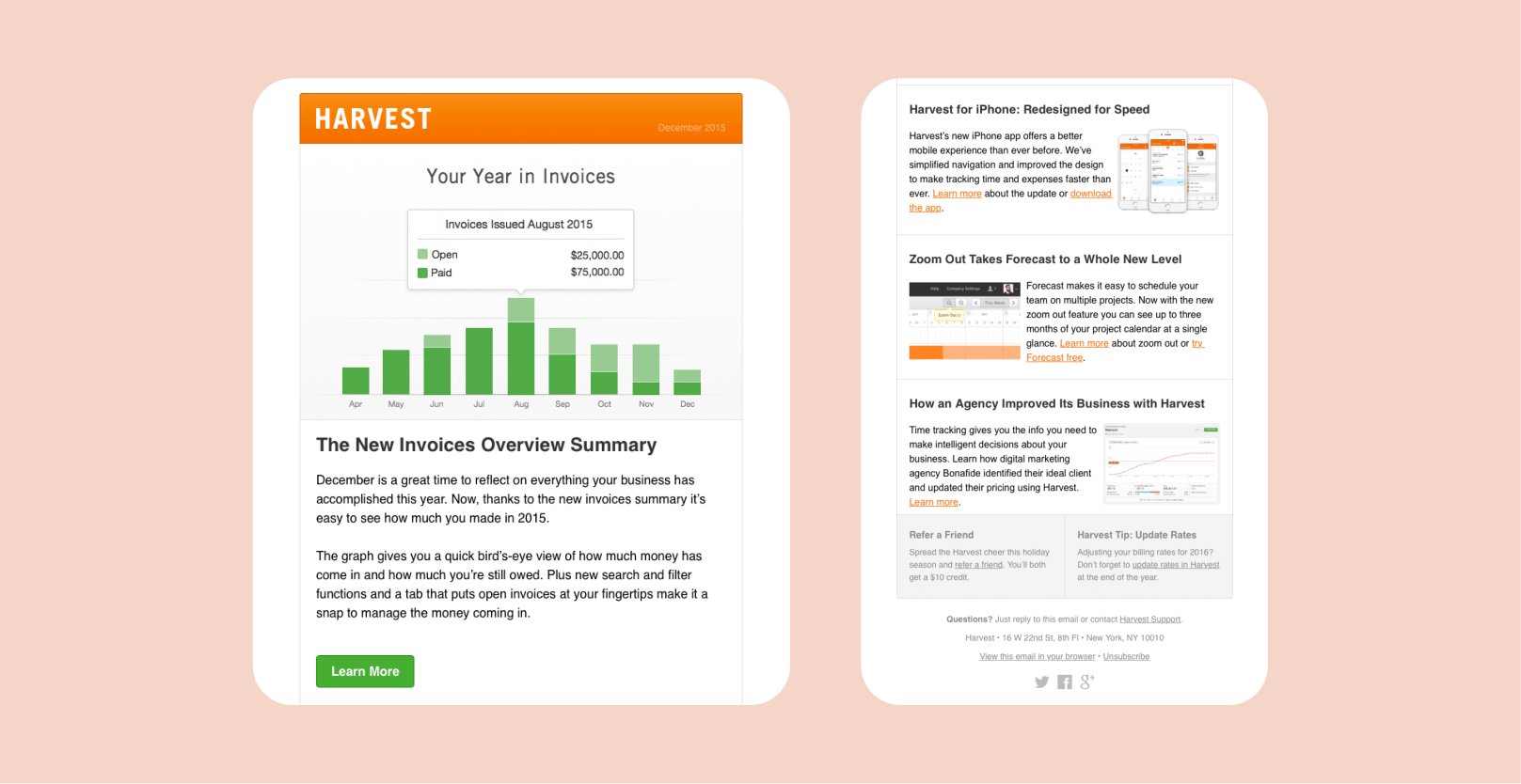

Harvest’s monthly statement emails combine easy-to-read summaries with actionable insights and links to budgeting tools, reinforcing transparency and customer engagement.

Renewal and Reminder Emails

Renewal and reminder emails notify customers about upcoming renewals, payments, or expiring services. They help reduce missed payments and prevent service lapses. An insurance provider, for example, sends a reminder email a week before a policy renewal date, including payment options and a direct link to renew online. Proactive reminders improve retention and make it easy for customers to take timely action.

This renewal email from Venmo is highly effective because it’s personalized and friendly, and positions the message as a helpful refresher to re-engage them. It highlights updated features and reminders tailored to the user’s context, reducing friction and encouraging them to dive back into the app.

Customer Feedback and NPS Emails

Customer feedback and Net Promoter Score (NPS) emails collect insights on satisfaction and service quality. They show a commitment to customer experience and provide actionable data for improvement.

Fintech apps using CleverTap can trigger feedback surveys after key milestones, such as completing a transaction. Automated, well-timed requests mean higher response rates and more valuable insights, helping brands refine their offerings and strengthen relationships.

For example, this feedback email from Robinhood works because it feels personal and friendly, making the recipient feel appreciated. It builds goodwill without asking for anything, creating a positive brand impression through thoughtful, low-pressure engagement.

Reactivation or Win-Back Emails

Reactivation or win-back emails target inactive users or those who have uninstalled the app, aiming to re-engage them. MobiKwik, a digital wallet platform, used CleverTap to identify users who had uninstalled the app and trigger personalized win-back campaigns.

These emails offered incentives and highlighted new features, successfully recovering nearly 25% of lost users through data-driven re-engagement strategies. Activation strategies like this can significantly boost retention and customer lifetime value.

Mastering Email Marketing for Financial Services

Financial services email marketing plays a crucial role in building trust, enhancing customer engagement, and driving long-term loyalty. By using a variety of targeted email types and adopting best practices around segmentation, personalization, and compliance, financial institutions can deliver timely and relevant communications that truly resonate with their audience.

This strategic approach not only improves customer experience but also boosts retention and lifetime value in a highly competitive market.

CleverTap offers advanced segmentation, automation, and AI-powered personalization designed specifically for financial services. With CleverTap, you can create data-driven, compliant campaigns that engage customers at every stage of their journey, helping you build stronger relationships and achieve measurable growth. Book a demo today!

Shivkumar M

Head Product Launches, Adoption, & Evangelism.Expert in cross channel marketing strategies & platforms.

Free Customer Engagement Guides

Join our newsletter for actionable tips and proven strategies to grow your business and engage your customers.