In 2020, the way forward for businesses is by creating seamless omnichannel experiences for customers, especially for industries like Fintech where creating a mobile-first approach is critical. According to a survey of banks across Europe, North America, and Asia-Pacific, 80% of all customer touchpoints occur on digital*.

TitleMax is one legacy financial brand that has successfully adopted an omnichannel strategy. TitleMax, which is the flagship brand of the TMX Family of Companies, was founded in 1998 in the US and has expanded into 16 states. TitleMax offers title-secured loans/pawns, personal loans, and lines of credit to help as many people as possible get the cash they need.

Eager to learn about their omnichannel evolution, we spoke with Adrianna Warnell, Direct Marketing Manager. Her role involves communicating with users through various channels to bring them to TitleMax.

The Need for a Single Source of Truth

When making the omnichannel transition, TitleMax had multiple touchpoints for each of their communications channels such as emails, SMS, push notifications, and more. Because of this, there were multiple data points to analyze and large amounts of data to transfer. Not to mention data silos made it difficult to understand how customers interacted with the brand. They couldn’t map the end-to-end user journey or make data-driven decisions, which proved the need for an integrated platform to eradicate data silos and automate their communication.

Actionable analytics helps Warnell’s team understand user behavior, including how users navigate the app and behave over time. Equipped with a centralized, real-time view of users across data sources, they can gauge the impact of their messaging and campaigns and they better their marketing efforts to achieve core business goals.

Read More: What is Omnichannel Marketing? Examples & Strategy

Educating, Engaging, and Converting Users

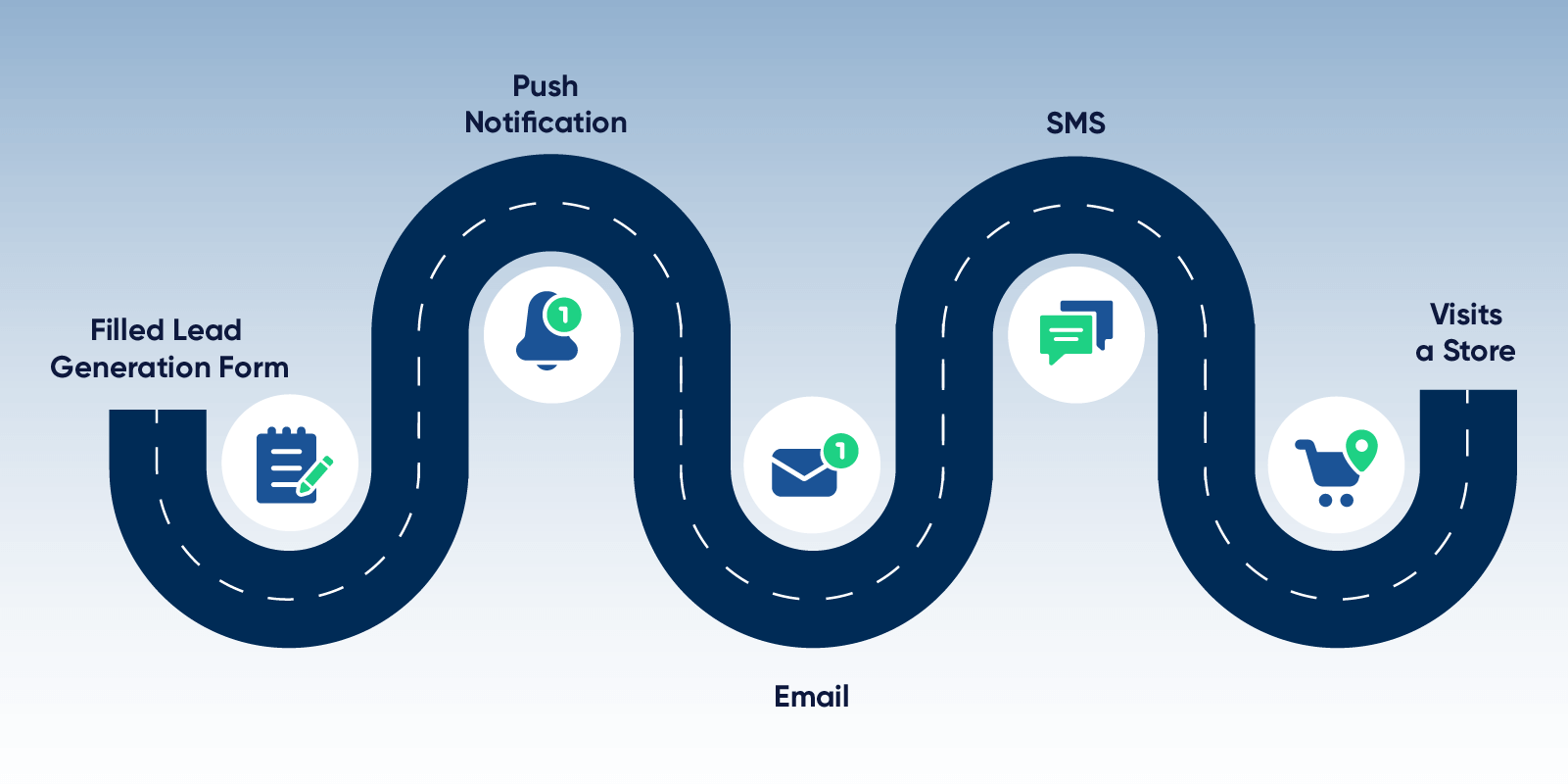

The TitleMax team tracks KPIs like open rates, engagement rates, and conversion rates, and have created over 10 journeys to cover their entire customer lifecycle. For example, they have a 30-day lead-nurturing journey designed to engage users who have submitted a lead form on their website but haven’t yet visited a store.

They’ve also set up a cart abandonment journey that engages users who’ve started a loan application but fail to complete it. By reminding users that their application will expire in a couple of days, TitleMax gets them to complete their application. This journey also offers TitleMax an opportunity to cross-sell products.

Reaching Users at the Best Time

TitleMax communicates with customers on a variety of channels, including email, text, direct mail, push notifications, app pop-ups, web pop-ups, and the app inbox. TitleMax uses the best time for batch campaign feature to engage with customers at their preferred time and create a better customer experience.

They track any issues with email bounces by staggering campaigns. If necessary, they can pause between campaigns to troubleshoot underlying issues. With these tactics, Warnell’s team achieves an open rate of up to 70%. And by automating routine tasks, she can focus more on marketing strategy.

Adapting to the Evolving Times

During the beginning of COVID-19, Warnell received requests to send various types of communications, ranging from store closures to broadcasting letters, from their President. The team has seen a dramatic increase in its mobile adoption rate since the start of COVID-19.

Engaging with users through various channels will remain a top priority for TitleMax while moving forward with a mobile-first business model. We are proud to partner with TitleMax in their journey to make credit accessible to everyone.

Learn more about how the world’s top Fintech brands are finding success with CleverTap, or read more case studies here.

Mrinal Parekh

Leads Product Marketing & Analyst Relations.Expert in cross-channel marketing strategies & platforms.

Free Customer Engagement Guides

Join our newsletter for actionable tips and proven strategies to grow your business and engage your customers.