Loyalty programs are no longer a nice-to-have for banks, as they’re a competitive necessity.

From reward points to personalized offers, banks are using loyalty programs to drive engagement, increase retention, and differentiate themselves in a crowded market.

And it’s working.

Take Axis Bank, for example. By using a customer engagement platform to personalize rewards and communications, they saw a 29% increase in conversions. This isn’t an isolated win. Bain & Company reports that most retail banks now view customer loyalty as a key driver of profitability and growth.

Why? Because loyal customers don’t just stick around, they refer others, cost less to serve, and are more receptive to new products.

The question is no longer whether banks should invest in loyalty programs. It’s about designing them in a way that works.

What are Bank Loyalty Programs?

Bank loyalty programs are reward-based initiatives that increase customer retention and promote long-term usage of a bank’s products or services.

Bank loyalty programs are similar to frequent flyer programs. You get points or coins for continued usage of a bank’s facility, such as a credit card. The points can be in the form of cashback or premium access to certain places.

For banks, loyalty programs are a smart way to keep customers coming back. Getting new customers is costly, but keeping existing ones is much cheaper and more profitable. Loyalty programs help banks stay top of mind, especially as digital channels get more crowded.

Done right, they turn everyday banking into a stronger relationship. Instead of just handling transactions, customers feel more connected to the bank, and are more likely to stay, use more products, and refer others.

Key Benefits of Banking Loyalty Programs

Bank loyalty programs aren’t just about freebies. They’re strategic tools to increase customer lifetime value (CLV) and reduce churn.

The banking institution enjoys the following benefits:

- Customer retention increases with personalized rewards.

- Consumers engage more frequently, giving banks richer behavioral data to create more personalized offers and journeys.

- Exclusive tiers create a strong brand affinity. For example, “Platinum Reserve in Amex cards” creates an emotional connection and status signaling.

- Cross-selling and upselling become easier when customers feel rewarded.

Similarly, customers get tangible rewards for regular banking activity, with fee waivers on ATM withdrawals or financial benefits. Consumers enrolled in a bank’s loyalty program also get priority services and faster resolutions to their queries.

Loyalty programs are equally rewarding for customers as they get access to an exclusive experience.

Read in detail: Key benefits of customer loyalty programs every marketer must know.

Types of Loyalty Programs In Banking and Financial Services

There are different types of loyalty programs for banks on the market. Some reward customers with points, while some give access to exclusive benefits. Here’s an overview of the common categories:

- Point-based bank loyalty programs reward customers with points for their transactions or for using banking services.

- Partnered programs offer rewards for spending at select retailers or service providers. Banks team up with brands to create these offers.

- Tiered loyalty programs reward customers when they reach a new level of benefits based on their activity or account balances.

- Cashback programs give customers a percentage of their spending back as cash. They are simple and attractive, especially for those who want quick rewards.

- Hybrid programs combine different types of rewards. Users can earn points for certain activities and get cashback for everyday spending. This flexible setup helps banks serve varied preferences and boost loyalty.

Take a closer look at our loyalty program management guide designed to help brands build sustainable loyalty.

12 Real-World Bank Loyalty Program Examples

Let’s take a look at real examples of how banking institutions are driving customer loyalty.

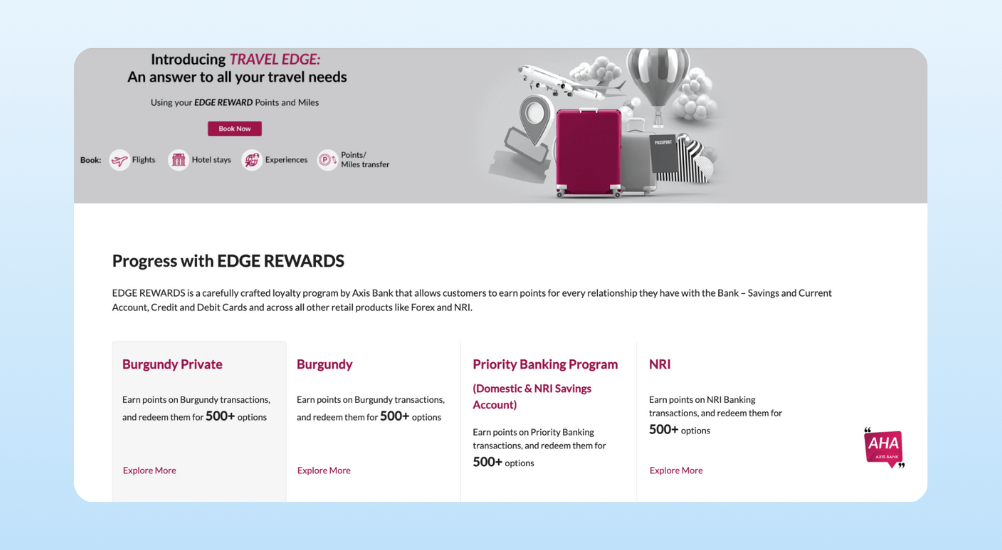

1. Axis Bank Edge Rewards

Axis Bank gives rewards for different types of transactions, including points on Burgundy Private, Burgundy, Priority Banking Program, NRI, credit card, and debit transactions.

These Edge Rewards have a validity of 3 years. After three years, the reward points lapse.

On Axis Bank’s Rewards credit card, you get 5000 rewards points on a cumulative spend of Rs. 1000 or above in 30 days of card issuance. Beyond that, there are milestone benefits of 1500 points on net spends of Rs. 30,000 in a payment cycle.

These milestone rewards encourage customers to spend more than Rs. 30,000 per month, which means consistent business for banks.

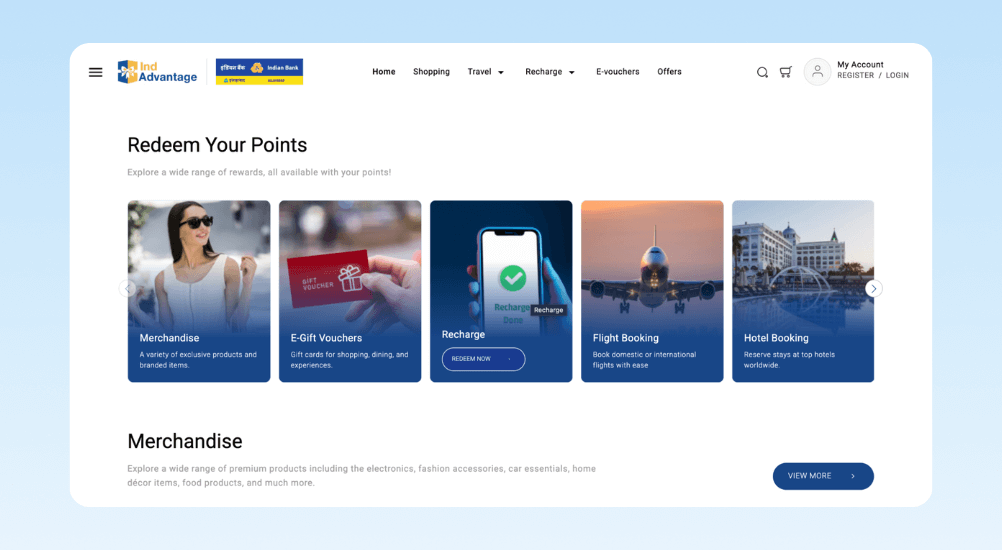

2. Ind Advantage: Indian Bank’s Loyalty Program

Ind Advantage is the loyalty program of Indian Bank. It rewards customers with points for using a debit card, mobile banking, and internet banking. The value of each point is Rs. 0.25.

Users can redeem these points on different purchases. With this program, Indian banks motivate their customers to make more purchases to get rewards. Essentially, it ensures usage and transactions, encouraging existing customers to keep doing business with the bank.

The bank has kept a minimum benchmark of 500 points to qualify for redemption. This further reinforces the bank’s effort to keep up the transaction volume, motivating more customers to reach 500 points soon.

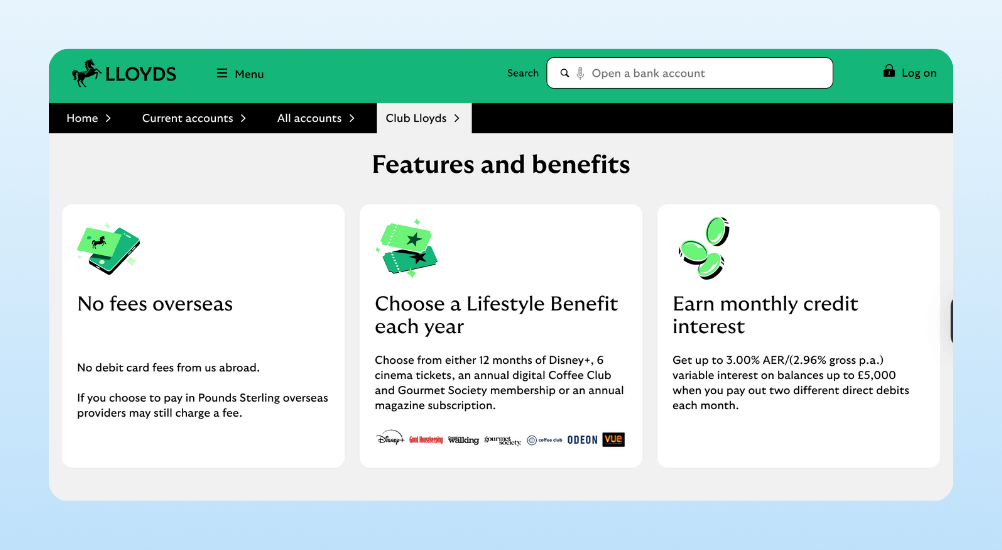

3. Lloyds Bank’s Club Lloyds Program

Lloyds Bank operates a tiered subscription model, offering lifestyle benefits as part of its loyalty program. These benefits include movie tickets, dining offers, and streaming subscriptions. It offers great perks along with no debit card fees abroad and a monthly credit interest.

There is a monthly fee of £5 for this program. As you go on to higher tiers, benefits increase. For example, the Silver Tier offers European family travel insurance and mobile phone insurance. The monthly fees also increase with the tier levels.

This program encourages customers to spend more to get a bigger share of the monthly credit interest. As you pay more (£2,000), the monthly fees are also refunded.

4. Niyo Card Rewards Program

Niyo, a fintech startup offering zero forex markup international debit and credit cards, runs a reward program and gives 5000 Niyo coins (per quarter) to customers on one free international ATM withdrawal per quarter.

It allows customers to redeem these Niyo coins for flight bookings, visa services, hotel stays, and international eSIMs.

Essentially, Niyo isn’t a bank. However, it offers products from SBM and DCB Bank. Both types of users get rewarded differently. This is how Niyo encourages customers to use its services in international travel.

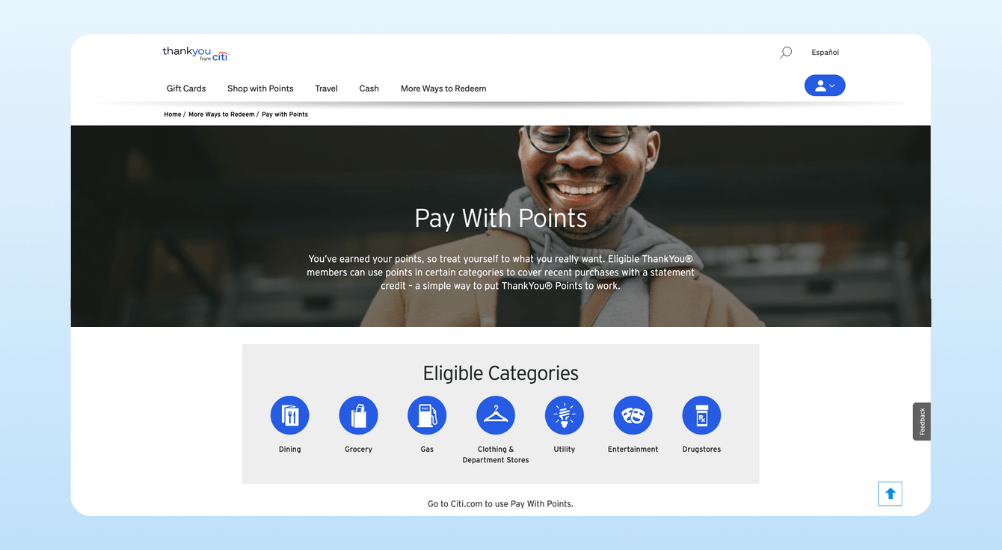

5. Citibank’s Citi ThankYou® Rewards

Citi ThankYou® Rewards is a point-based system. The bank’s customers earn points by using credit cards or banking with Citi while using a checking account. Customers can redeem these points on different categories of products mentioned below:

The freedom and flexibility offered to customers while spending make the loyalty program incredibly unique.

6. Amex Membership Rewards

American Express runs a Membership Rewards program that makes everyday spending feel a little more rewarding. Every time you use your Amex card, you earn points. These points can then be redeemed for a wide range of options, for example, from flights and hotel stays to shopping, dining, and even credit on your statement.

You get curated rewards such as premium merchandise, experiences, or vouchers from top brands like Amazon, Flipkart, and Taj Hotels. The banking institution positions this as a lifestyle upgrade instead of a loyalty program.

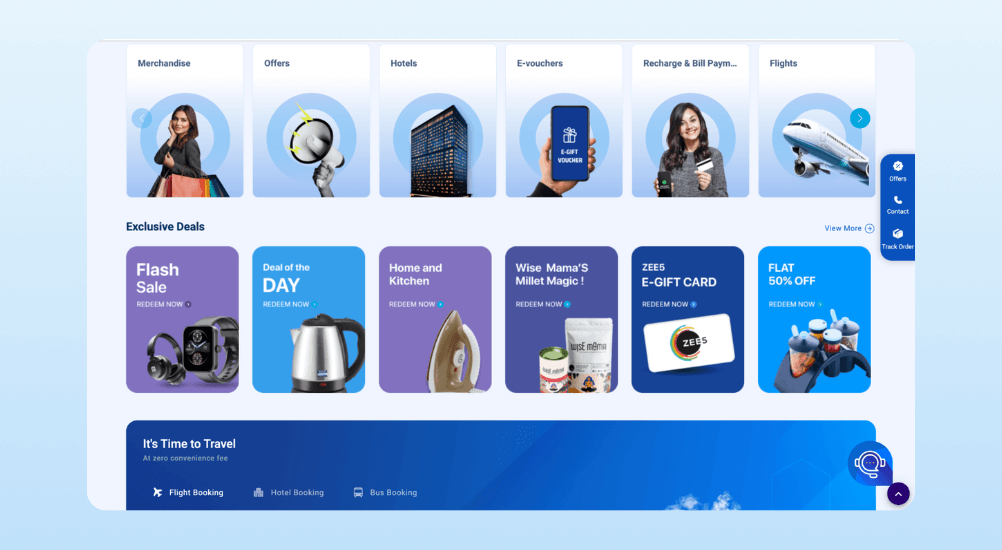

7. SBI Rewardz

The State Bank of India, one of the biggest public-sector banks in the country, runs an enterprise-wide loyalty program, SBI Rewardz. It gives reward points to SBI customers for everyday transactions across different banking channels.

Once you reach the reward goal with set points, you can redeem them to purchase certain products or book travel. There are options targeted at Indian customers, for example, subscription to the Sony Liv or Zee 5 apps.

Here’s an overview of different items and services you can take by redeeming reward points:

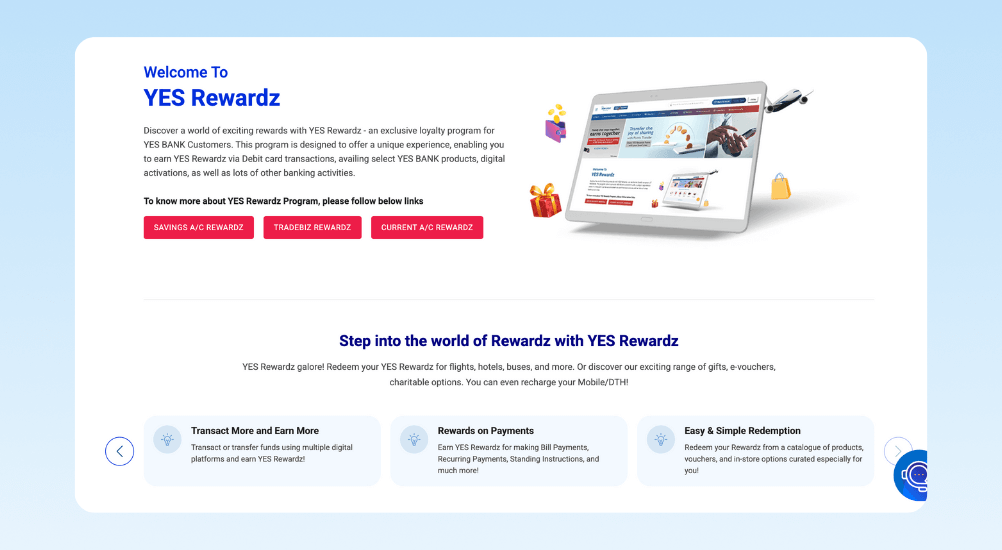

8. YES Rewardz

Yes Bank rewards customers from onboarding. When customers open and activate their accounts, they get a reward. As you switch to higher-tier program variants, you get additional rewards while aggregating reward points from every transaction.

You can use these accumulated reward points for making bookings and shopping for products of your choice. The bank has many tie-ups with vendors like Moginis, Pothy’s, and Pai, from where you can get the products you desire.

The tiered loyalty program instantly rewards consumers as they come in, motivating them to activate the account soon. The tiers keep them encouraged to transact and reach higher tiers to get additional benefits as they transition.

9. Bank of America’s Preferred Rewards

Bank of America’s Preferred Rewards offers better perks as your account balance grows. The structure is simple but clearly geared toward customers with substantial deposits:

Depending on your tier, you can unlock benefits like higher savings interest rates, bonus credit card points, and ATM fee waivers. For instance, Gold members earn 5% more interest on savings, 25% more credit card points, and pay no fees at out-of-network ATMs.

These rewards are based on the monthly-average balance (MAB). This tiered structure encourages customers to keep more deposits with the banks.

10. Capital One Rewards

Capital One offers three categories of rewards: general, travel, and cashback. General rewards, at the base level, offer reward points on everyday spending categories like dining, groceries, and entertainment.

Travel rewards are for customers using Capital One Venture or VentureOne travel cards. Customers can use them toward flights, hotels, or other travel-related expenses. Lastly, the Cashback rewards are for Quicksilver credit card holders. In this tier, customers get cashback on every purchase.

Altogether, the Capital One Rewards program caters to both everyday spenders and high-usage cardholders, keeping all types of users loyal to the bank.

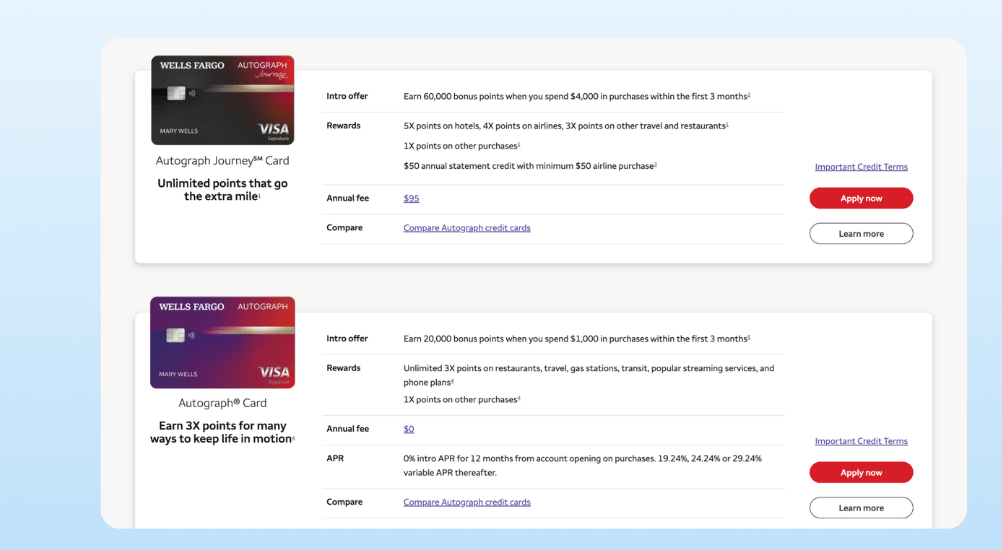

11. Wells Fargo Rewards

Wells Fargo’s Rewards program is open to all customers who hold a qualifying rewards-based credit card from the bank. Members redeem their rewards in several ways, be it cash back into their account, gift cards, purchases, or travel-related expenses like flights and hotel bookings.

Wells Fargo also allows users to donate their points to charities such as the American Red Cross or transfer them to another Wells Fargo customer, adding an extra layer of flexibility and goodwill.

What sets the program apart is its ease of use. Customers can effortlessly track and manage their rewards directly through the Wells Fargo website, making it convenient to stay on top of balances, redemptions, and upcoming offers without any added complexity.

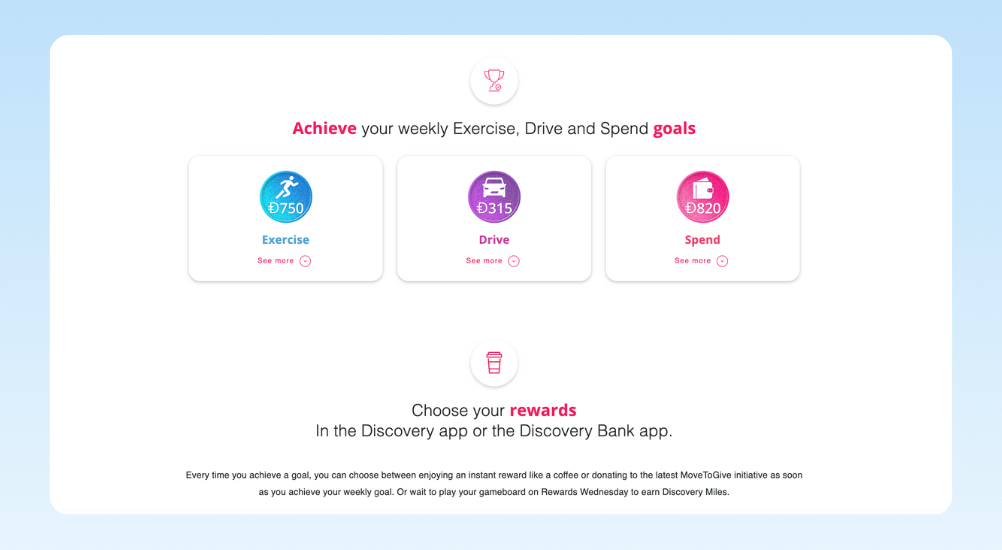

12. Discovery Bank’s Vitality Rewards

Discovery Bank offers a unique loyalty program with its Vitality Rewards program. Unlike traditional point-based systems, this program rewards customers for both financial responsibility and healthy lifestyle choices.

The program uses Discovery Miles as its rewards currency. Customers earn these miles by using their credit card for purchases that align with wellness and sustainability, such as gym memberships, health food stores, and eco-friendly transport options. The more they engage in positive habits, the more they earn.

This stands out because not only does it encourage interactions with banking products, but it also promotes healthy living with it.

Make Your Loyalty Program Fun and Relevant With CleverTap

The all-in-one customer engagement platform, CleverTap, transforms loyalty from a static program into a strategic growth engine. Financial services and banks get more engaged customers with higher retention and measurable ROI. This is driven by the platform’s automation, intelligence, and seamless omnichannel execution.

CleverTap Promos lets you create dynamic reward rules based on real-time customer actions. You can tailor offers based on behavior, app usage, spending patterns, and financial goals. It allows you to simplify end-to-end lifecycle management from wallet creation, reward code generation, distribution, validation, and analytics, making it easier to manage everything on CleverTap.

The platform empowers you with an in-app rewards catalog and redemptions while making the loyalty experience consistent across web or mobile. As a cherry on top, you get advanced segmentation and gamification functionality to make customers’ experiences more fun and relevant.

Lastly, to make sure you’re not flying blind, the platform gives comprehensive visibility over what’s working and what’s not with built-in analytics. It helps tie rewards and engagement back to specific campaigns, channels, and customer segments.

Turn every customer interaction into lasting loyalty with CleverTap.

Driving Loyalty With CleverTap

CleverTap helped PVcomBank, one of Vietnam’s leading banks, take customer loyalty to new heights with a 134% increase in digital adoption, with 24.78Bn VND cost savings. The bank closely tracked user action on their app with CleverTap to understand customer behavior better. They nudged the users using behavioral triggers at the perfect time to reduce drop-offs, increasing the bank’s digital service growth.

While driving loyalty, the bank was also able to reduce average call-center consultation time by 95%.

Get more details on driving customer loyalty with CleverTap Promos.

Shivkumar M

Head Product Launches, Adoption, & Evangelism.Expert in cross channel marketing strategies & platforms.

Free Customer Engagement Guides

Join our newsletter for actionable tips and proven strategies to grow your business and engage your customers.