In a landscape where trust is paramount and competition is fierce, customer engagement has emerged as a critical growth lever for insurance providers. With heightened customer expectations for personalized and meaningful engagement, insurers are reimagining how they connect with customers across the policyholder lifecycle.

This blog examines the evolving expectations of insurance customers, the critical need for personalization, proven strategies for enhancing web engagement, and how CleverTap’s powerful capabilities can help insurers establish deeper customer connections.

The Web is King: Customer Engagement Realities in Insurance

Today, people increasingly prefer online channels to buy policies due to convenience, ease of comparison, and quicker processing. The online insurance market is projected to grow from $98.76 billion in 2024 to $276.84 billion in 2029.

That said, our conversations with customer organizations and industry experts have highlighted a key customer engagement trend in the insurance industry. Unlike industries such as retail or fintech, where mobile apps dominate customer interactions, insurance customers rely heavily on web interfaces for research, policy management, renewals, claims, and customer support.

Here are a few reasons why insurance remains a web-first ecosystem for many customers:

- Policy Complexity: Insurance products often require deeper understanding, comparisons, and paperwork, making desktops a more comfortable medium.

- Demographic Behavior: A significant portion of policyholders are from Gen X and Boomers, who prefer managing financial products on larger screens.

- Regulatory Compliance: Critical customer actions like KYC, claims filing, and renewals often involve secure, form-heavy interactions better suited to web platforms.

- Trust and Verification: The desktop environment is often perceived as more secure, especially when handling sensitive data or financial decisions.

This places immense importance on delivering a seamless, personalized, and responsive web experience that builds trust, enhances satisfaction, and drives long-term loyalty. With customers expecting tailored journeys that anticipate their needs, respond in real time, and adapt to their behavior and intent, investing in optimized web experiences is no longer a choice for insurance providers; it’s the only option.

Why Web Personalization is No Longer Optional

Personalization is more than a buzzword – it’s a business imperative. Especially in insurance, where trust, relevance, and timing are everything, personalized web engagement can significantly impact conversion rates, retention, and customer satisfaction. Studies have shown that insurance providers offering tailored products and personalized customer experiences can boost customer retention by 81% and customer engagement by 89%.

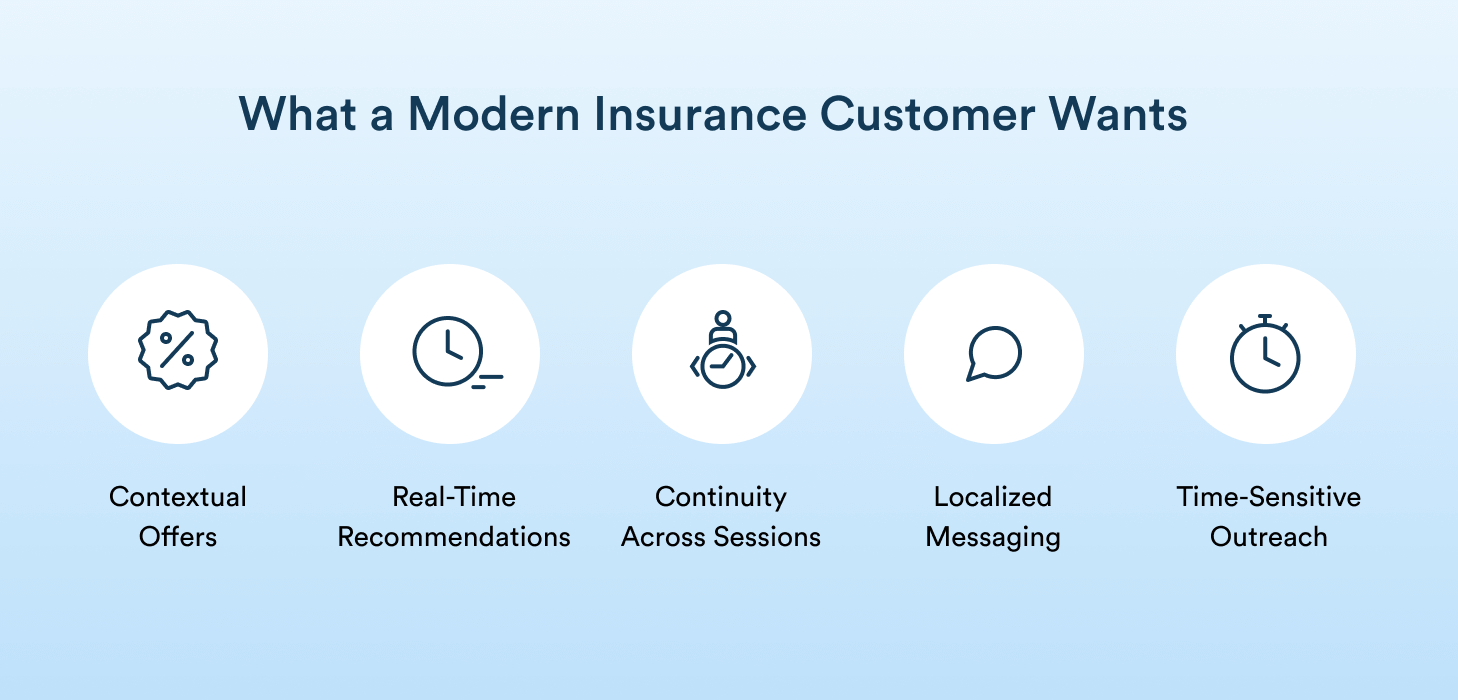

Here’s what today’s insurance customers expect:

- Contextual Offers: Whether it’s bundling home and auto insurance or suggesting critical illness riders, customers want offers that reflect their life stage and needs.

- Real-Time Recommendations: Based on browsing patterns, intent signals, or prior interactions, customers expect insurers to guide them proactively.

- Continuity Across Sessions: If a customer starts a quote or claim on one visit, they expect to pick up where they left off seamlessly.

- Localized Messaging: Policyholders expect engagement that reflects their location, region-specific risks, or regulatory environment, such as high flood-risk zones, new compliance requirements, and more.

- Time-Sensitive Outreach: Policyholders expect proactive engagement timed around key lifecycle events like renewals or premium due dates.

To achieve this, insurers must combine user data, behavioral signals, and automation into a cohesive web experience that feels tailored and intuitive. When done effectively, it can help them improve quote-to-policy conversion rates, policy renewal rates, and Net Promoter Scores (NPS), and reduce customer churn.

Strategies to Elevate Web Engagement Through Personalization

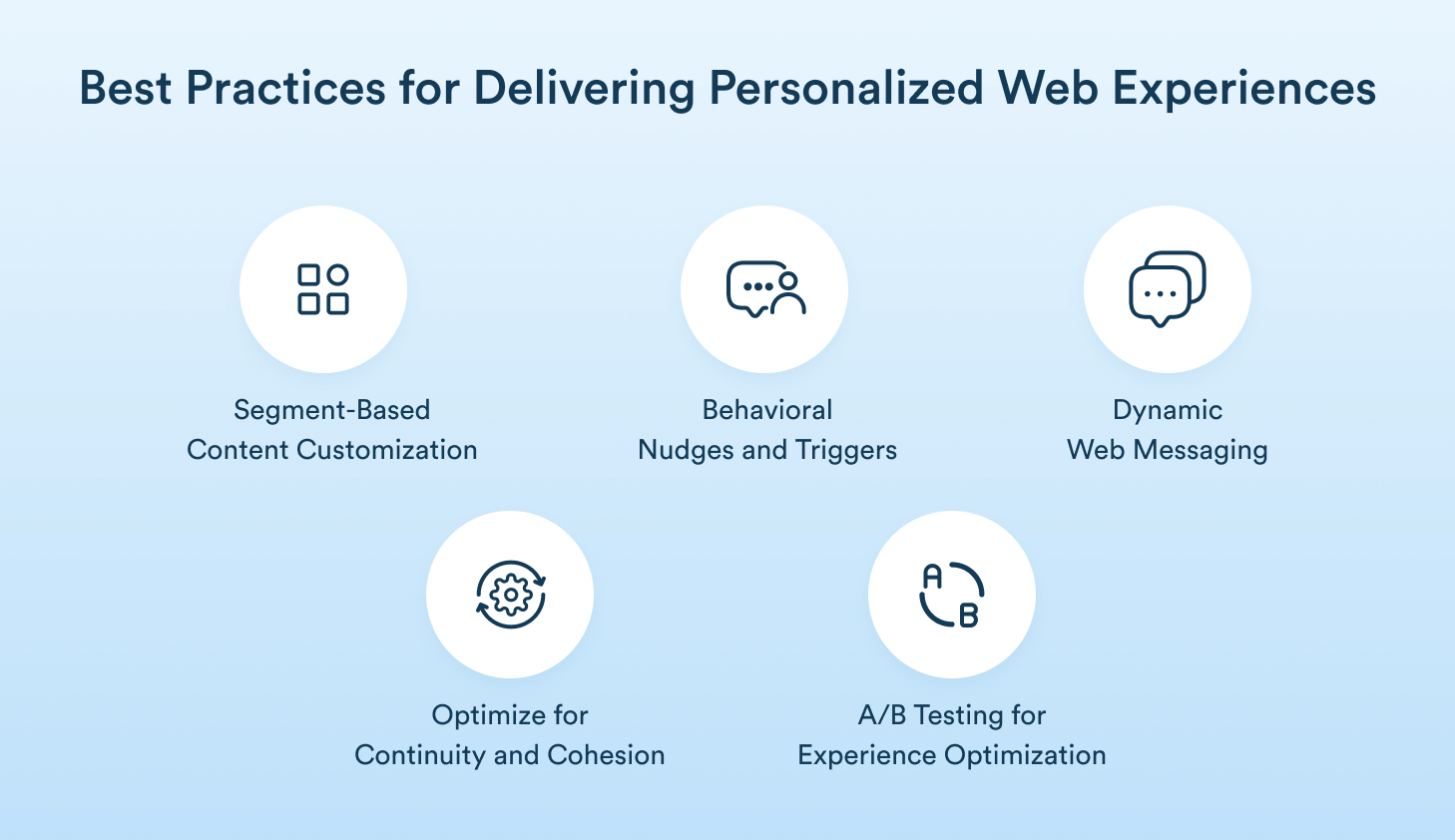

To deliver meaningful and personalized web experiences, insurance providers should adopt a strategic, data-driven approach. Here are the five best practices:

1. Segment-Based Content Customization

Leverage behavioral and demographic segmentation to deliver content tailored to specific customer cohorts. For instance, first-time visitors exploring life insurance can see educational content and quote calculators, while returning users can receive policy upgrade recommendations.

2. Behavioral Nudges and Triggers

Use event-based triggers to guide users based on their on-site actions. For example, if a user drops off after filling 70% of a quote form, trigger a message offering help, a call-back, or a discount reminder.

3. Dynamic Web Messaging

Incorporate dynamic banners, exit-intent popups, and personalized overlays that respond to real-time user behavior. These can be used to:

- Highlight policy renewal deadlines

- Promote relevant cross-sell offers

- Collect customer feedback

4. Optimize for Continuity and Cohesion

Ensure that returning users see continuity in their journey. If a customer logs in after a week, pre-fill their partially completed forms or remind them of the last product viewed.

5. A/B Testing for Experience Optimization

Continuously test and refine web elements such as CTAs, layout, content blocks, and more based on engagement metrics to improve overall experience quality and performance.

How CleverTap Helps Insurance Providers Personalize Web Experiences

CleverTap offers a robust set of tools purpose-built to help insurance providers create seamless, intelligent, and personalized web experiences.

- Visual Editor for Real-Time Web Customization

CleverTap’s Web Visual Editor allows marketers to edit, test, and personalize website content without writing a single line of code. Whether it’s updating homepage banners or customizing other webpage elements, changes can be deployed instantly to align with user segments.

- Dynamic Personalization for Precise Targeting

With CleverTap’s Product Experiences, marketers can continuously experiment and optimize their web and app functionalities, including user interface elements and workflows, without the need to rely on engineering teams. Furthermore, they can deliver personalized experiences for specific audiences with a no-code approach.

- Omnichannel Web Engagement for Maximum Impact

CleverTap offers a wide range of web messaging channels, including push notifications, pop-ups, exit-intent, web inbox, and native display, among others, that help marketers improve engagement and the chances of website conversions. Together with dynamic web messaging capabilities, marketers can effectively engage with customers at the right moment, triggered by real-time behavior.

- AI-Powered Scribe for Intelligent Messaging

Scribe uses generative AI to craft emotionally intelligent, persuasive messages based on user context. For example, it can help craft the perfect nudge to re-engage a user who abandoned a claim process or suggest a coverage upgrade during renewal.

- IntelliNODE for Next-Best-Action Personalization

IntelliNODE leverages predictive analytics to recommend the most relevant next action for each user. Whether it’s nudging for an upsell, reminding about KYC, or surfacing FAQs, every interaction is personalized and data-backed.

Conclusion

As insurance customers continue to rely on web platforms for key interactions, delivering optimized and personalized web experiences becomes essential for driving engagement, trust, and growth. Insurers that succeed will be those that understand the nuances of digital behavior, harness customer data intelligently, and adopt a digital-first approach to orchestrate cohesive, personalized journeys at scale.

With CleverTap’s suite of capabilities, from visual editing and dynamic messaging to AI-powered personalization, insurance providers can transform static websites into responsive, intelligent engagement engines that convert interest into action and relationships into loyalty.

Explore how CleverTap can help you deliver experiences that build trust, retention, and long-term value.

Shivkumar M

Head Product Launches, Adoption, & Evangelism.Expert in cross channel marketing strategies & platforms.

Free Customer Engagement Guides

Join our newsletter for actionable tips and proven strategies to grow your business and engage your customers.