The evolution of payments is an interesting one: cash, checks, credit cards, and now digital payments. At one time, each of these was the newest in payment technology. Mobile wallets might be the newest kid on the block, but this payment option has made a significant impression since Google first unveiled Google Wallet in 2011. In fact, the global mobile wallet market size is expected to reach over $3 trillion by 2022.*

When the payment ecosystem opened its doors to mobile wallets in 2011 — nearly a decade before the pandemic — it was viewed with mixed emotions. But like most things, the need and demand for contactless payment technology resulted in expedited adoption and usage.

It’s therefore important that marketers understand the true value of mobile wallets and how they can increase conversion rates and lead to customer retention and loyalty.

Keep reading to learn the benefits of mobile wallet marketing, examples of companies that have successfully used this marketing tactic, and how marketers should take advantage of this channel in 2021 and beyond.

You can also jump to our infographic to find out more on the newest approach to digital payments.

What Is a Mobile Wallet?

A mobile wallet is exactly what it sounds like: a wallet that stores payment information on a mobile device. As mentioned above, Google, along with a number of partners, teamed up in 2011 to launch this ‘new’ mobile payment system. Google Wallet used NFC or near-field communication, which allows devices in close proximity to each other to exchange information wirelessly.

Shortly after this launch, Gartner released a report that predicted global mobile payments would generate $86.1 billion in revenue from 141 million consumers.*

Google Wallet might have kicked things off, but the competition wasn’t far behind. Apple Pay was rolled out in 2014, and in 2018, Google Pay — a combination of Google Wallet and Android Pay — was officially available for Android users. First, let’s explain the difference between a mobile wallet and a mobile payment app like Google Pay.

- Apple/Google Wallet: an app in your phone that replaces a physical wallet

- Apple Pay/Google Pay: A digital “card” that appears in your wallet and allows digital payments to occur

The future potential and value of mobile wallets haven’t gone unnoticed in the U.S. or around the world. By 2027, the global mobile payments market will reach $12.06 trillion* and the number of Americans who will use proximity mobile payments will surpass 100 million in 2021.*

Cashless payments have the edge. They are convenient and innovative, and brands like Google and Apple know that their loyal customers are likely to embrace the technology.

Google Pay vs. Apple Pay vs. Samsung Pay

These three payment platforms have a few differences, other than being designed for their respective mobile devices — including the number of users that they will add between 2020 and 2025. According to an eMarketer report, here are the number of users that all three mobile platforms are expected to accumulate in the next four years.*

| Apple Pay | Google Pay | Samsung Pay | |

| Users (2020 to 2025) | 14.4M | 10.2M | 2M |

While Apple Pay is growing quickly, this growth isn’t being embraced by retailers at the same pace. According to analysis from Incognia*, more than 80% of retailers reviewed in the study supported PayPal as an in-app payment option, but only 20% supported Apple Pay. It appears Apple is sensitive to this and in order to remain valuable to all users, Apple now allows BitPay Prepaid Mastercard holders to use Apple Pay to make in-store, online, and in-app purchases.

Google Pay is also on a recruitment drive for more app users with big plans for an app design in November 2021. In partnership with almost a dozen banks and credit unions, the app will offer Google Plex accounts, a reward system, and other personalized features to appeal to customers.

As Google gears up to introduce a new reward system, Samsung closed down its points incentive program. In January 2021, it was announced that the program would be terminated and Samsung users would only receive rewards for purchases made on Samsung.com, the Galaxy Store, and other Samsung-branded outlets. Only time will tell if the predicted 2 million expected users by 2025 will feel FOMO when it comes to rewards via mobile payment options.

So how can marketers take advantage of these trends to transform customer experiences and increase engagement? That’s where mobile wallet marketing comes in.

What Is Mobile Wallet Marketing?

Mobile wallet marketing refers to the marketing efforts that include tools such as personalized loyalty cards, passes, and tickets to engage customers on mobile. No app is required and customers don’t have to opt-in as a result.

In case you aren’t convinced of the value of mobile wallet marketing, here are three important stats around the future of digital payments:

- Cash is becoming less popular with consumers. Total transactional value for digital payments is expected to yield a CAGR of 12.01% from 2021 to 2025.*

- Mobile wallet usage is on the rise— one-third (32%) of consumers have 3+ mobile wallets downloaded.*

- When shopping online in 2020, nearly half of millennials (46%) in the U.S. used digital or mobile wallets.*

5 Benefits of Mobile Wallet Marketing

It could be said that mobile wallet marketing requires a more modern approach to traditional customer loyalty programs, particularly as smartphone users expect real-time, relevant, and personalized content. If a customer isn’t loyal to your brand, then Customer Lifetime Value will take a hit. It’s essential that marketers understand some of the main benefits of mobile wallet marketing to pave the path to success:

- Loyalty scheme/program enrollment is faster, easier, and streamlined

- Customers can engage with brands and incentives outside of the app

- Location-based offers and content are available anytime

- Offers can be used in multiple ways (in-store, online, and in the app)

- Easy-to-access coupons and offers lead to higher redemption rates

5 Important Elements of Mobile Wallet Marketing

No app needed? Check. No required opt-in? Check.

Mobile wallets sound like a great tactic to reduce uninstalls, improve retention rates, and support the overall user experience. While every mobile wallet experience is unique, there are five important elements to mobile wallet marketing that will help contribute to a successful strategy. Let’s look at them a little closer.

1. Alerts and Notifications

When it comes to mobile wallet marketing, push notifications and alerts reign supreme — particularly when these notifications appear on the lock screen. What’s more, this is a great opportunity to add personalization.

Don’t just send the key information in your notification like Walgreens did below. Show the user that they are valued and add in simple things like their name to up your personalization game.

2. Personalization

In 2018, a report from Vibes* found that nearly 100% of surveyed respondents would save mobile wallet content to their smartphone if it was personalized. Although it’s been a few years since the report was released, the importance of personalization still holds up.

Personalized content can take many forms, from including customer names to creating dynamic content that’s targeted based on user data and behavior. As mentioned above, don’t lose the opportunity to personalize content that appears in mobile wallets.

3. Passes, Coupons, and Loyalty Cards

Although users don’t need an app to access a mobile wallet, brands should definitely sync their apps so that customers can download coupons, passes, and loyalty cards and save them in their mobile wallets. Here are some key benefits for offering passes, coupons, and loyalty cards:

- You can update offers on passes anytime so the content remains fresh

- You can send push notifications to remind users when offers expire

- You can use location data to provide users with relevant coupons

4. Real-time Updates

So much changed from 2019 to 2020, including consumers’ reliance on real-time, digital payments. The pandemic contributed to a sizable spike in transactions — 41% YoY. This equates to 70.3 billion real-time payments that were processed last year.*

This proves that real-time updates in mobile wallets are both needed and wanted by consumers. One example of this is real-time updates on loyalty points. Give your customers something to look forward to as they watch their points add up. Why not share notifications when your customers are close to the next level of points?

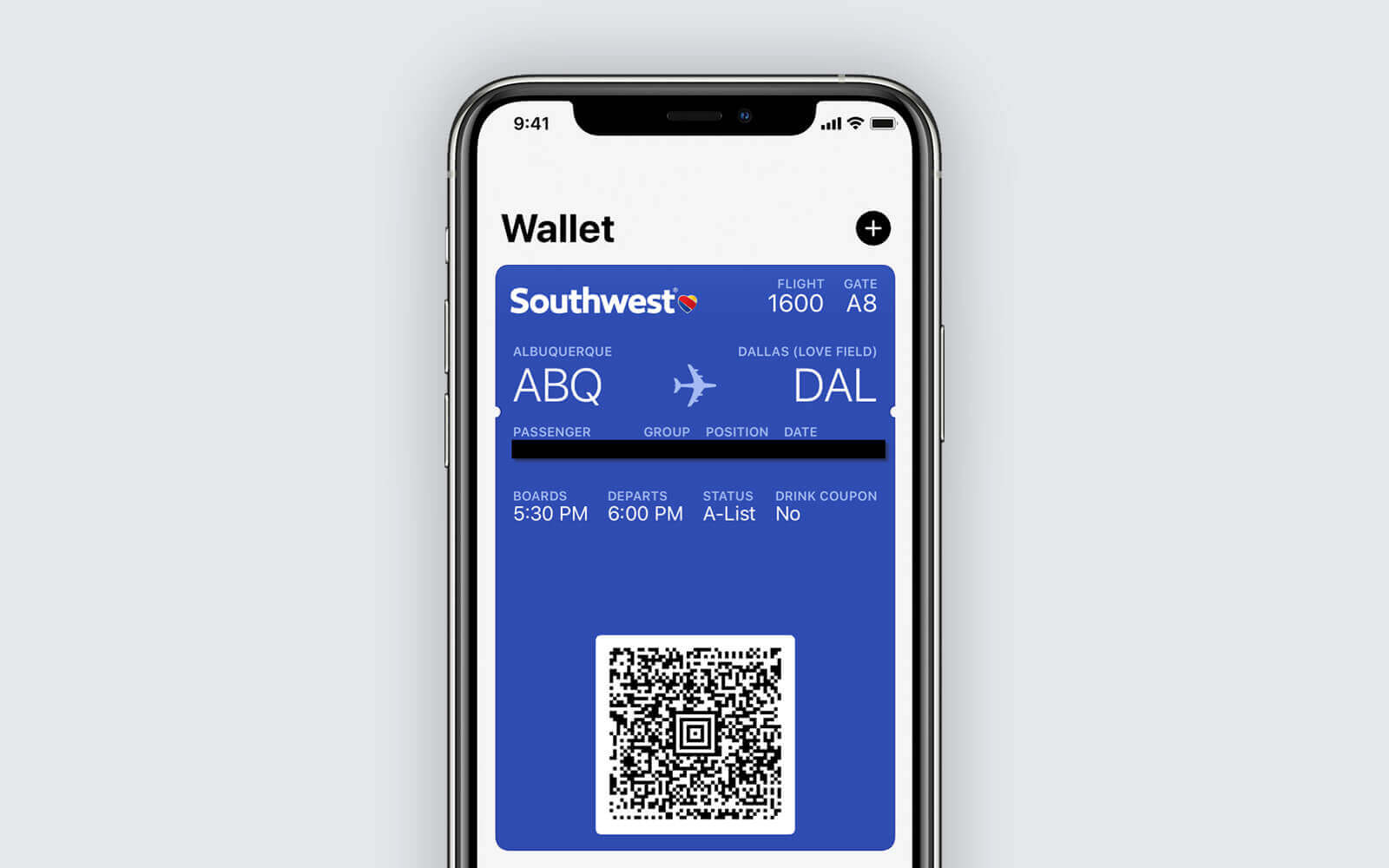

5. Tickets

This is probably the most common and recognized example of mobile wallet marketing. Customers can easily save their boarding pass directly to Google Pay or Apple Wallet. The days of losing your paper boarding pass are probably not officially over, but at least having your ticket on your smartphone is one less thing to worry about.

One thing to note: travel is a real-time experience so ensure that systems are in place to update your customers if there is a flight delay or gate change.

3 Challenges of Mobile Wallet Marketing

Nothing worthwhile comes without challenges and mobile wallet marketing is no exception. The future is bright, but in order for marketers to avoid unnecessary mistakes and manage expectations, we’ve outlined five challenges that brands are likely to face with mobile wallet marketing.

1. Reluctant Retailers

In 2019, JC Penney dropped Apple Pay as a possible payment option. The reason was a combination of a customer complaint on Twitter and failure to meet Visa’s deadline to enable EMV contactless chip functionality. This ultimately powers mobile wallets.

However, for every reluctant retailer, you have an innovative one, like 7-Eleven. The international convenience store chain created its own mobile wallet for customers to take advantage of contactless payments. Customers can add funds and pay for items using the 7-Eleven Wallet.

2. Security and Fraud Concerns

Although nothing is fraud-free, mobile wallets have the benefit of relying on tokenization and biometric authentication. Rather than the 16-digit card number, a token — which is a selection of randomly generated numbers — is received by a retailer at the checkout. The information is shared but without the actual bank details. What’s great is that this number is useless after the transaction.

Biometric authentication adds that extra layer of security and protection for customers and retailers. Facial recognition or a fingerprint can be required to access a mobile wallet, helping prevent any security or fraud concerns for both parties.

3. Lack of Rewards Available

There’s a reason that credit cards that offer cashback and points toward perks like free flights are so popular with customers. While a customer can keep their credit card in the wallet, an actual mobile wallet doesn’t offer rewards separately.

To keep users engaged, marketing activity related to mobile wallets should be supplemented by traditional marketing tactics such as push notifications, personalization, and real-time updates.

Mobile Wallets Help You Connect With Customers

Although cash and credit cards are still more popular than mobile wallets, it’s likely that the latter is not far behind. Connected customers have altered their behaviors to align with an increasingly contactless payment world.

Brands that want to adopt a mobile wallet marketing strategy should pay attention to industry trends while acknowledging that the digital consumer is no longer a one-payment-option creature — and hasn’t been for some time.

Subharun Mukherjee

Heads Cross-Functional Marketing.Expert in SaaS Product Marketing, CX & GTM strategies.

Free Customer Engagement Guides

Join our newsletter for actionable tips and proven strategies to grow your business and engage your customers.