It’s no secret that 2020 was a banner year for ecommerce — revenue is up over 30%.* But we wanted to dive deeper to learn more specifics about how ecommerce marketers are responding to their current opportunities and challenges and find out what they’re planning for 2021.

How strong is monetization and revenue growth? How well are ecommerce brands retaining customers throughout the pandemic? Which engagement channels are they using to stay connected with customers, and which metrics are marketing leaders using to measure success?

To find the answers, we went straight to the source and surveyed over 150 mobile and marketing executives to find out how they plan to thrive in 2021 and beyond. We’re sharing their insights and these latest ecommerce benchmarks to help you assess performance and shore up your marketing strategies.

Revenue & Business Growth

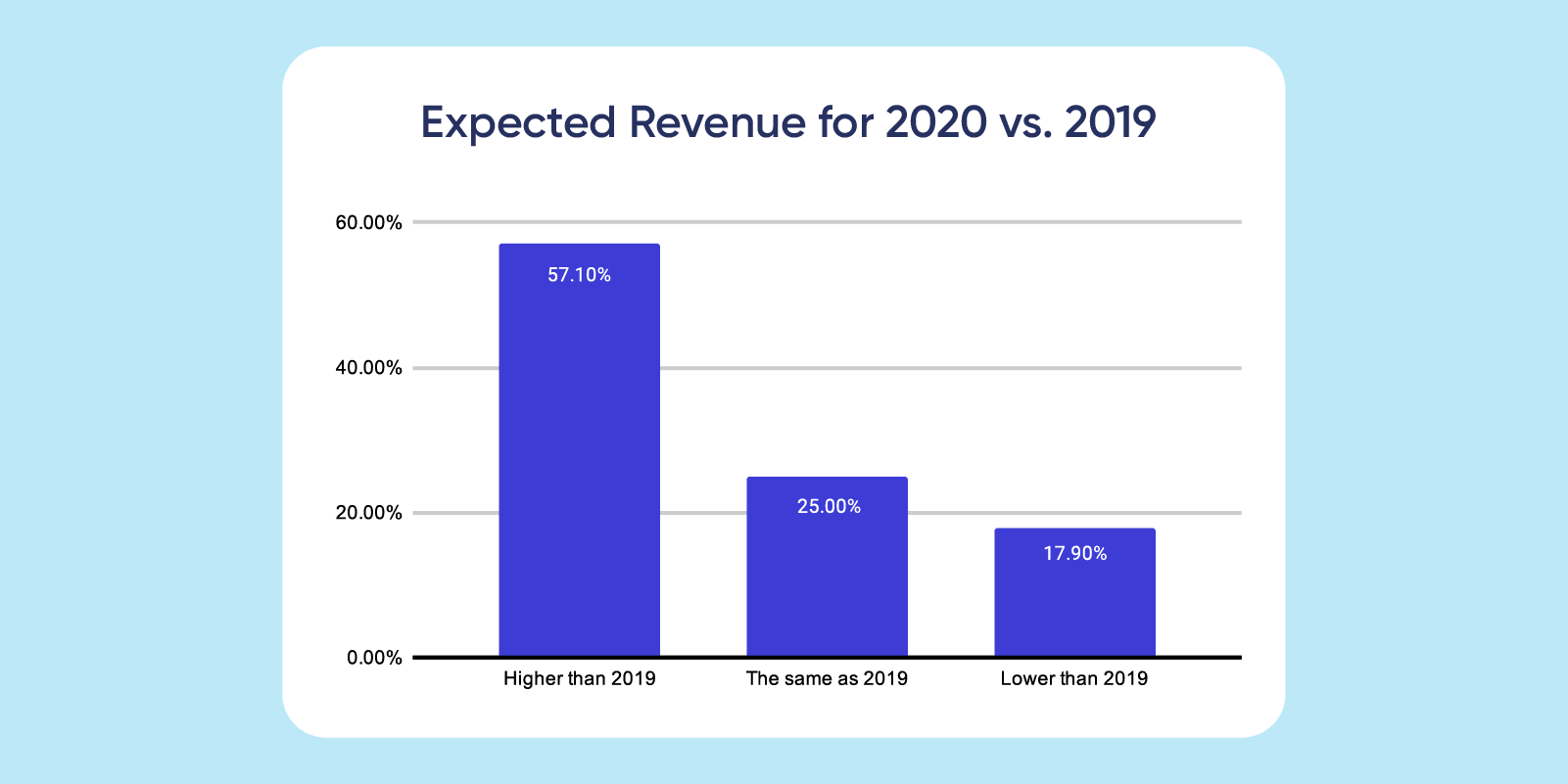

Ecommerce revenue is up 32.4% this year* — a trend that’s reflected in our survey with nearly 60% of ecommerce marketing leaders expecting higher revenue in 2020 compared to 2019.

Naturally, much of this growth is the result of a push in essential categories like groceries and pharmaceuticals, but it’s also been driven by a dramatic lifestyle shift as a result of the pandemic: lockdown resulted in customers spending more in categories like consumer electronics, home furnishings, and gym equipment.

Had the pandemic been short-lived, consumer behavior may have reset to its normal, pre-COVID state. But the duration and frequency of purchasing things like groceries online has likely altered customer habits forever, with a lasting impact on the retail landscape.

The Onboarding Challenge

2020 was the year we all redefined resilience. And while the ecommerce industry may have experienced tremendous growth, marketers know that nothing about it was easy. The challenges have carried over into 2021, and are likely to stick around even after the pandemic subsides.

Which challenges are most pressing for retailers right now?

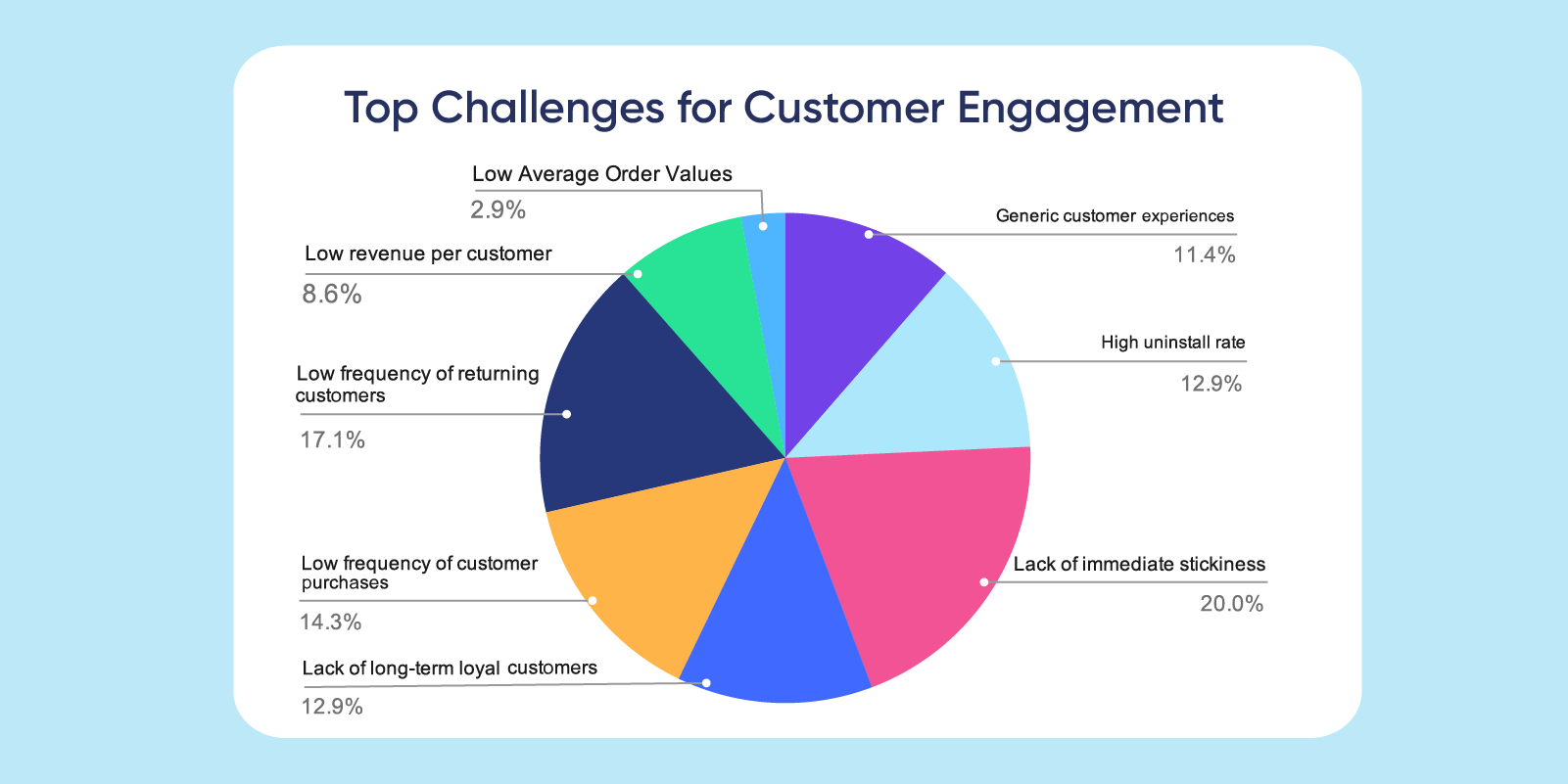

Lack of immediate stickiness is the number one obstacle for ecommerce apps, followed by a low frequency of returning customers.

Ensuring that the first-time user experience exceeds customer expectations and sets up repeat visits (and purchases) is a major hurdle to monetization, especially with mobile expected to account for 54% of all ecommerce sales this year.*

With that kind of revenue at stake, retailers have to deliver a pitch-perfect mobile experience from the very first launch or risk losing potential customers to competitors. And the only way to do that is to get close to your customers. Understanding what motivates each unique customer to engage with and buy from your brand — and delivering the ultra-personalized, value-driven experience they expect from the very first touchpoint — is only possible when you can understand and act on behavioral data.

The Retention Rift

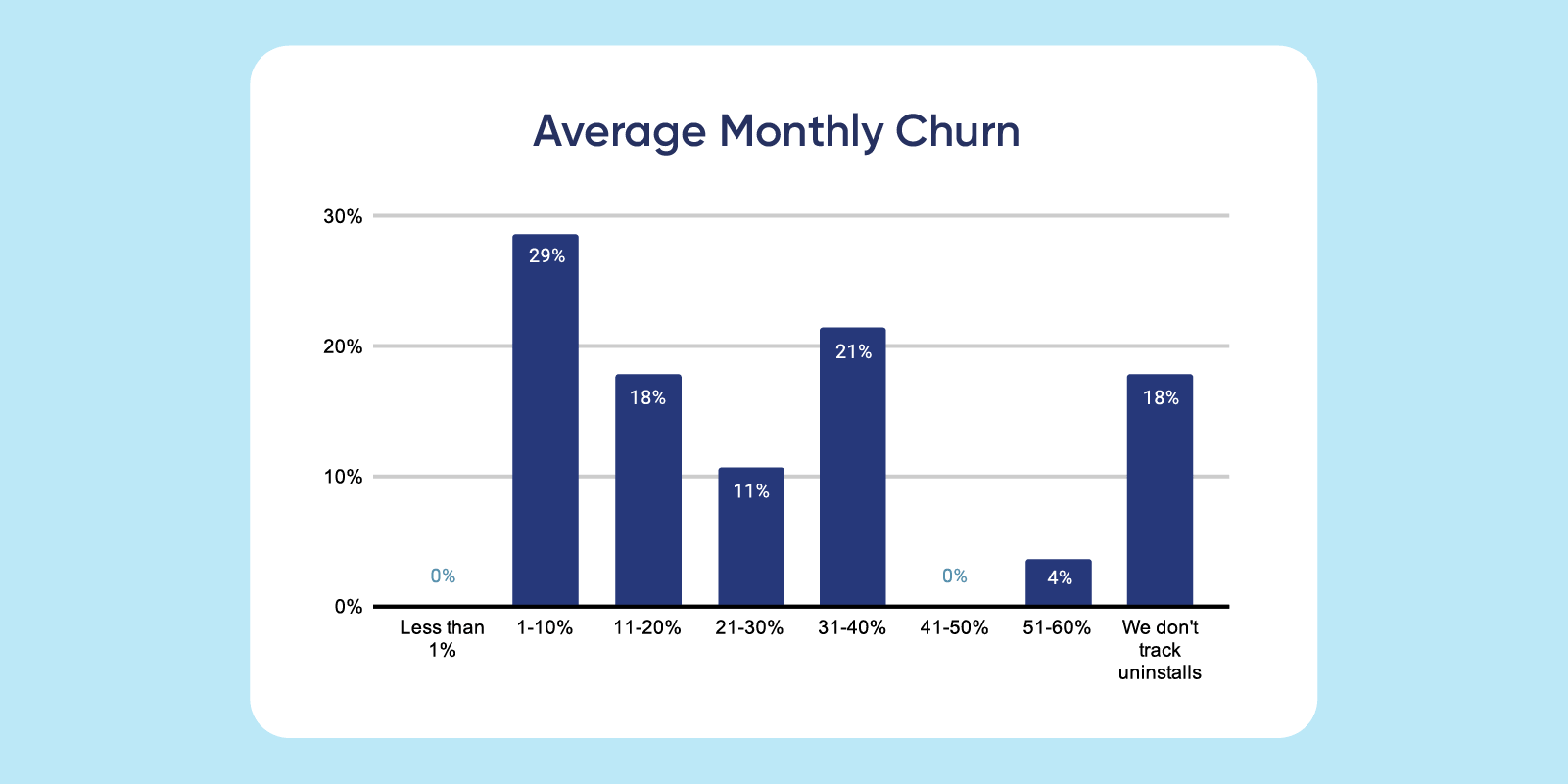

When it comes to customer retention, ecommerce apps appear to be polarized into the brands that “get it” and the brands that don’t. Nearly 30% of respondents say their average monthly churn is just 10% or less, a promising sign for retailers who are looking to drive up customer lifetime value throughout the pandemic and its aftershocks.

On the other end of the spectrum, things aren’t so rosy. A full 25% of ecommerce apps are losing more than 30% of their customers to monthly churn, signaling the continued need to keep retention a top priority. Retailers can’t sit back and expect app users to become repeat customers simply because they’ve been driven online by the pandemic — they must proactively build customer loyalty through smart, value-driven engagement campaigns paired with a superior in-app buying experience.

Surprisingly, over 17% of respondents don’t track monthly churn rates at all, potentially missing out on valuable insights about why customers leave as well as the opportunity to recapture lost revenue through effective winback campaigns.

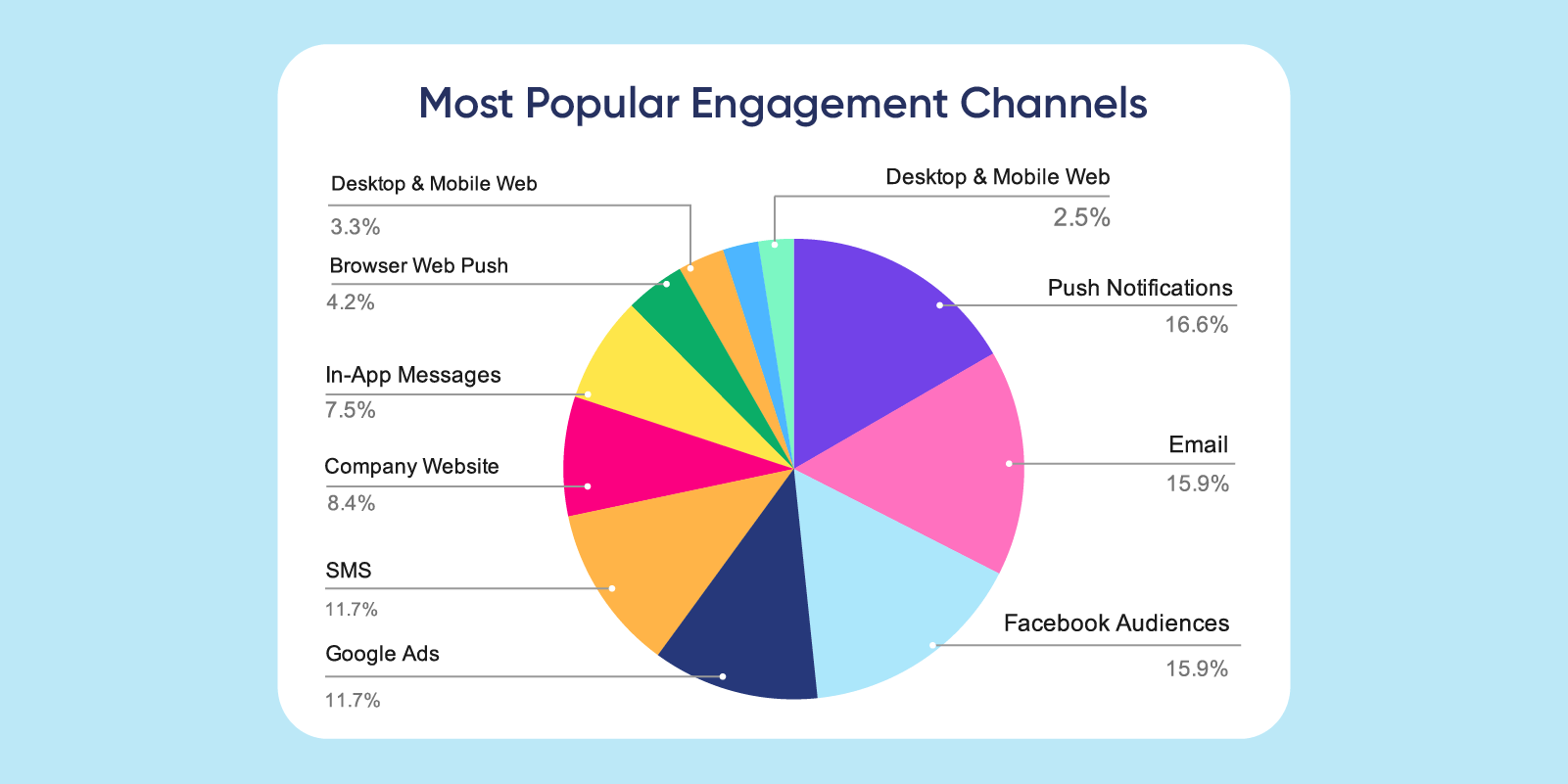

Push, Email, Social: The Trifecta of Customer Engagement

Which channels are retailers using to keep customers engaged? Push notifications, email, and Facebook Audiences are by far the most popular channels, and the majority of marketers we surveyed are sending between 1-5 messages per week on each. These channels are ideal for building brand awareness and pulling users back into your app, a priority for retailers wanting to keep their brands top-of-mind for customers throughout the pandemic.

Less than 10% of respondents are taking advantage of in-app notifications, potentially missing out on a powerful engagement channel for building relationships with active users and loyal customers. In-app messages are ideal for personalized cross-selling campaigns or limited-time discounts that can help prompt more conversions and higher order values.

The Most Important Performance Metrics

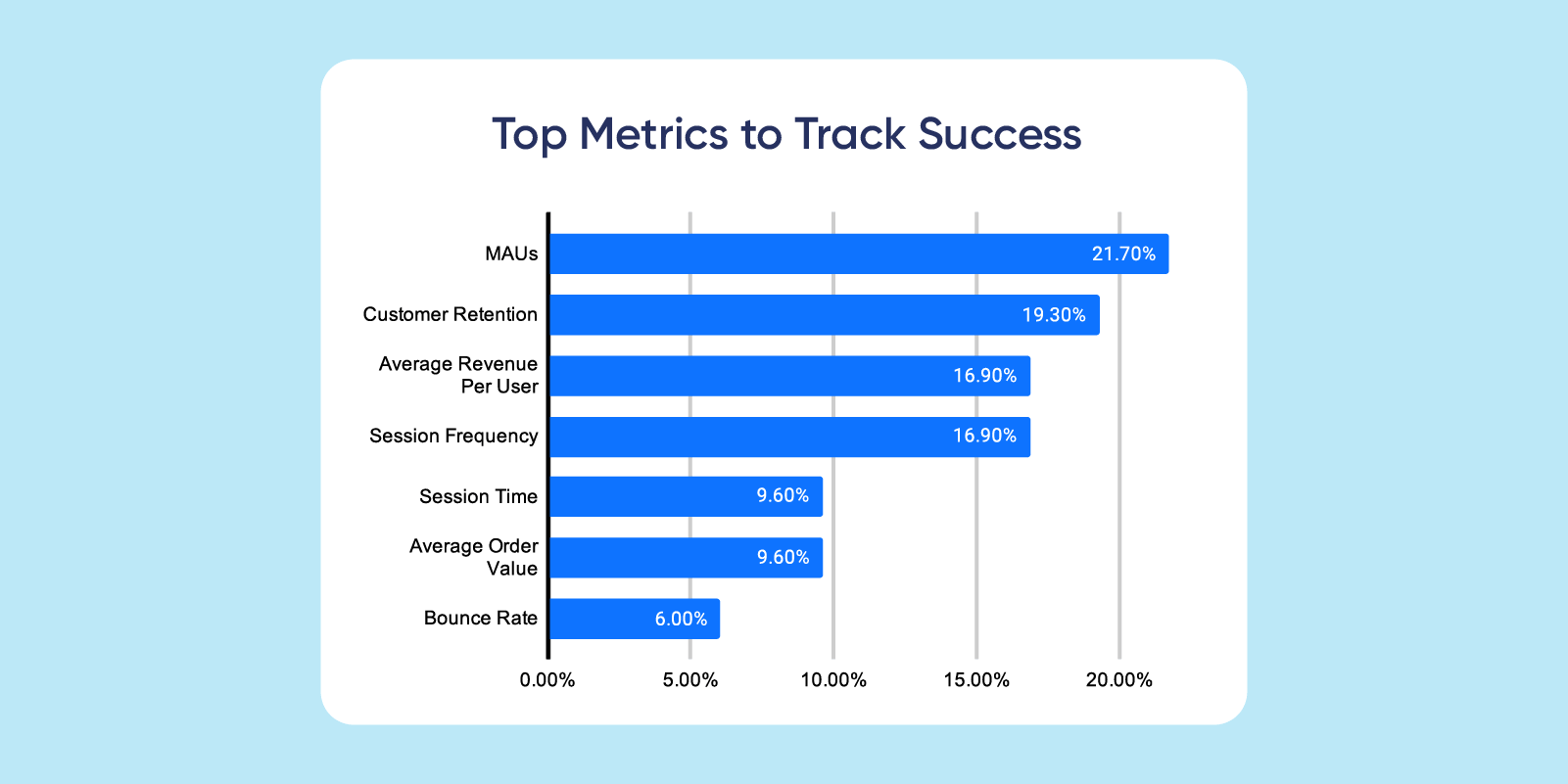

When it comes to measuring performance and growth, the most common metric ecommerce apps are tracking is monthly active users (MAUs). Why? It’s an easy way to gauge the health of your app’s user base and level of customer engagement. If customers are coming back month after month, they must be finding value.

But smart brands understand that MAUs mean nothing without looking deeper at what drives revenue, not just app launches. And that’s retention and Average Revenue Per User (ARPU) — the second and third most popular metrics. Understanding what drives higher Customer Lifetime Value (CLV) is essential to making smart business decisions on everything from customer acquisition campaigns to retention marketing strategies.

Key Takeaways

Since we’re all about making insights actionable, here are the essential takeaways:

- Your first-time user experience is likely the most significant opportunity you have to capture customers. Delivering one that lives up to their expectations will require a deep understanding of what they want and why they downloaded your app — an understanding you can only get through a complete picture of your customer journey.

- In order to combat churn, you have to track uninstalls. This will help you understand what actions (or inactions) lead customers to stop using your app. Then you can fix the friction points in your app, improve the overall customer experience, and improve long-term retention.

- External engagement channels like push, email, and social media are essential for building and maintaining brand awareness. Just don’t neglect in-app messages as a way to engage and reward loyal customers and improve conversions.

- MAUs are a fine way to check your app’s pulse. But it’s not a growth metric. Go deeper to focus on what drives revenue: customer retention and Average Revenue Per User are both critical metrics to track.

For even more insights into revenue and business growth, pressing industry challenges, and how marketers are adapting their strategies, download the full report.

Marketing Survey Research: The Biggest Opportunities for Mobile Brands in 2021

Shivkumar M

Head Product Launches, Adoption, & Evangelism.Expert in cross channel marketing strategies & platforms.

Free Customer Engagement Guides

Join our newsletter for actionable tips and proven strategies to grow your business and engage your customers.