Your fintech app is up and running, your app store listing optimized, and your marketing automation in place. What’s next?

One of the most important things you can focus on now is onboarding. Why? Because a seamless, thoughtful onboarding experience is the difference between an app that gets deleted after one use and one that becomes part of your user’s financial routine. Onboarding is one of the biggest drop-off points for banks, reducing customer retention and transactions by up to 50%, as per CleverTap’s “Banking on AI” Report.

In this blog, we’ll explore practical onboarding tips that fintech apps can use to earn trust, reduce churn, and spark meaningful engagement—from the very first tap.

Why Should Fintech Apps Care About User Onboarding?

Actually, every app should care about onboarding. But in fintech, the stakes are uniquely high.

You’re asking users to trust you with highly sensitive data and complete processes that involve regulatory friction, like KYC checks, account linking, and ID verification. That means you’re not just introducing a product, you’re managing risk perception and trust from the very first tap.

An effective app onboarding experience lays the foundation for long-term success by increasing Customer Lifetime Value (CLV), maximizing cross-sell and up-sell opportunities from the very beginning. It also improves cost efficiency by minimizing acquisition waste and helps build stronger, long-lasting customer relationships rooted in trust, ease, and personalized engagement.

And here’s the reality check:

- Mobile apps in general see sharp drop-offs, with day 30 retention rates often falling below 10%, depending on the category*.

- More than 70% of users say that trusting a brand is more important now than it was in the past*.

- In markets like China, fintech adoption has reached 90%, setting expectations for intuitive, fast, and secure onboarding*.

Beyond meeting user expectations, fintech apps must also comply with important privacy and financial regulations. This includes data protection laws like GDPR in Europe and CCPA in California, as well as financial regulations like PSD2 and KYC/AML protocols. These rules require apps to collect user consent clearly, verify identities securely, and protect personal data—all without making the experience frustrating or confusing.

At the same time, the fintech industry is facing tighter budgets, which means relying on acquisition alone is no longer enough. Improving app onboarding to retain more users has become one of the most effective and cost-efficient growth strategies available.

The Psychology of Fintech Users During Onboarding

Fintech app users are not just evaluating a new digital product—they’re deciding whether to trust you with their money, their personal data, and in many cases, their financial habits. That decision happens fast, often before a user even completes registration, and it’s influenced by a handful of powerful psychological triggers.

- Risk aversion is the default. In financial contexts, users tend to assume the worst unless reassured otherwise. Any ambiguity—whether in messaging, branding consistency, or security prompts—can lead to hesitation or immediate exit.

- Cognitive load adds up quickly. Users are often required to navigate multiple tasks at once, like reading terms of service, scanning IDs, and understanding product features. Without careful flow design and progressive disclosure, the experience becomes taxing.

- Personalization isn’t just nice, it’s grounding. A tailored onboarding experience that aligns with user intent (e.g., saving vs. investing) reduces friction and builds confidence that the app is right for them.

- Loss aversion can be leveraged constructively. If users believe that dropping off means missing out on tangible value, like faster transfers, fee savings, or investment insights, they’re more likely to complete onboarding.

- Familiarity reduces anxiety. Using design patterns and interactions users already know from other secure apps helps reinforce comfort and confidence.

Designing for the fintech mindset means acknowledging the emotional weight users carry when interacting with financial tools. Your onboarding flow isn’t just guiding a signup—it’s managing perception, de-risking the experience, and establishing your app as a trustworthy partner.

Best Practices for Effective Fintech App Onboarding

The following best practices are core to building a high-converting fintech app onboarding experience. These tips help reduce drop-offs, establish trust, and guide users to activation faster, while aligning with both user psychology and regulatory needs.

1. Show Value Before You Ask for Commitment

Fintech users are inherently more guarded than users in most other app categories. You’re not just asking for an email—you’re asking them to trust your app with their identity, financial data, and potentially their money. That’s a high-stakes decision.

Before prompting them to register, upload documents, or complete KYC, demonstrate the value your app provides. This could include:

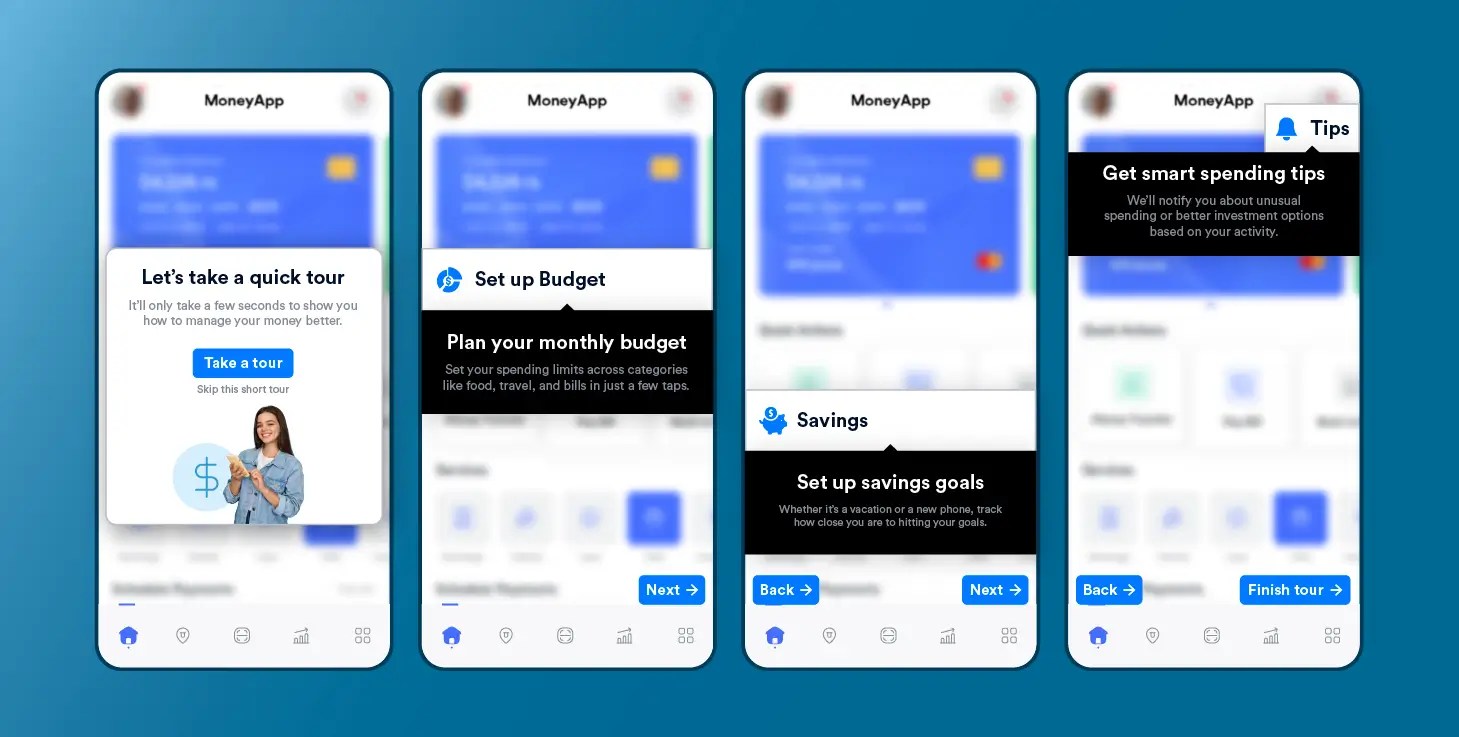

- Interactive product tours

- Sample dashboards showing spending insights or savings goals

- Access to tools like interest calculators or exchange rate lookups

These previews help users understand what they’ll gain from signing up. A “look around mode” or ungated feature access (to a limited extent) builds early confidence and reduces perceived risk.

Apps that showcase value upfront tend to build familiarity faster, which makes conversion feel like a natural next step, not a leap of faith.

2. Establish Trust From the First Tap

Trust is a make-or-break factor for any fintech app. Your onboarding must signal security, credibility, and transparency—immediately. Here’s how:

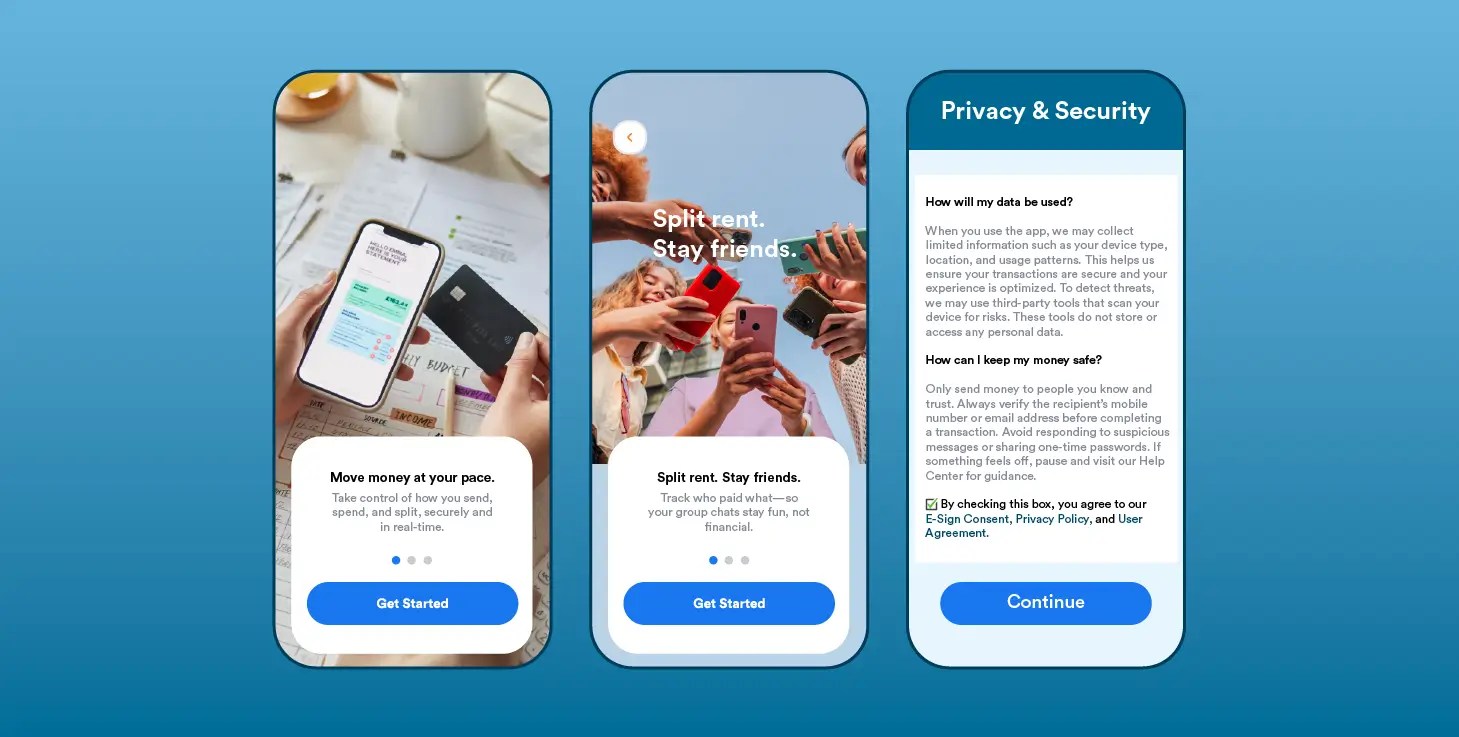

A. Let users explore before registering

Instead of locking everything behind a signup screen, let users interact with the app in a limited way. For example, let them view a sample portfolio, simulate a savings plan, or browse key features. This helps them understand what your app does and why it’s worth their data.

B. Make security visible and active

Fintech users expect bank-grade protection. Reinforce that with tangible cues in your onboarding flow:

- Offer biometric login (e.g., Face ID, fingerprint) during setup

- Introduce 2FA as a proactive protection step, not an afterthought

- Show auto-logout timers or session reminders

- Confirm sensitive activity (e.g., new logins, device changes) with real-time alerts

These actions say: “You’re in control, and your data is safe here.”

C. Explain data requests clearly

Fintech apps need sensitive data to comply with regulations like KYC, AML, and PSD2. But users still deserve clarity.

Rather than showing a blank ID upload screen, add one line of context:

“We verify your ID to comply with financial regulations and keep your account safe.”

Use progressive disclosure—ask only for what’s needed, when it’s needed, and explain why.

D. Use trust-first, emotionally intelligent content like a guide, not a form

Drop the institutional tone. Use microcopy that feels human, empathetic, and confident.

Instead of: “Link external accounts”

Try: “Want a full view of your finances? Securely connect your bank account.”

Instead of: “Upload government ID”

Try: “To get you verified and protect your account, we just need to confirm your identity.”

Language shapes perception, especially when trust is still being built.

3. Simplify and Stabilize Your KYC Process

Fintech forms are often more complex due to the nature of the data being collected (IDs, SSNs, tax IDs, etc.). But that complexity should never be felt by the user.

Best practices include:

- Break long forms into short, guided steps

- Use visual indicators (progress bars, step numbers)

- Validate fields in real-time (e.g., email format, password strength)

- Support diverse inputs (accents in names, international addresses)

- Always preserve user input—never wipe the form after an error

A single broken or confusing form field can kill the entire onboarding experience.

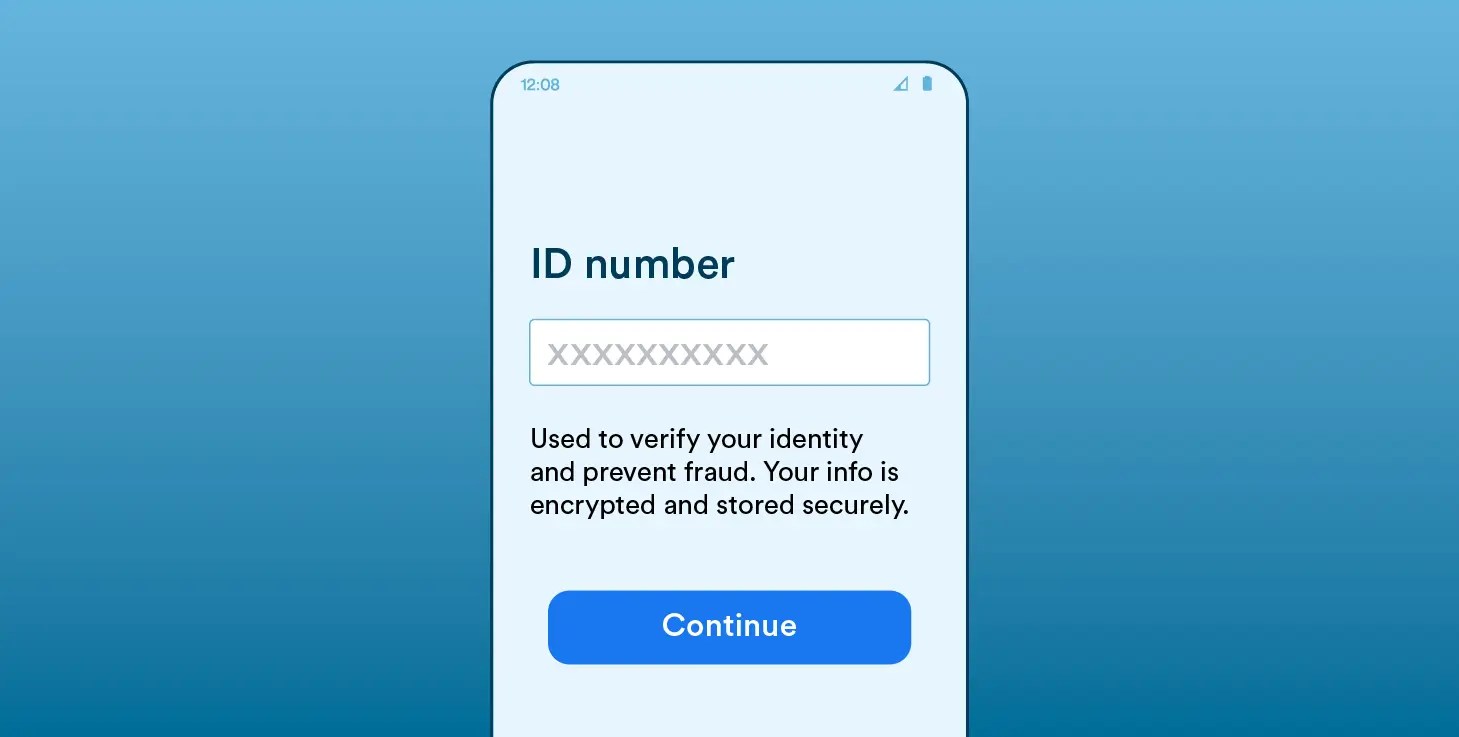

4. Be Transparent With Data Collection

In an industry where users are handing over financial information, clarity isn’t optional—it’s a competitive advantage.

Make it easy for users to understand:

- What data are you collecting (e.g., ID, account access)

- Why do you need it (e.g., regulatory compliance, better recommendations)

- How do you secure it (e.g., encryption, access controls)

Use short, reassuring copy directly alongside fields. Don’t bury critical explanations in your privacy policy.

Instead of: “Required field: ID number”

Say: “Used to verify your identity and prevent fraud. Your info is encrypted and stored securely.”

Transparency builds trust, and trusted users are far more likely to complete onboarding.

5. Build Trust With Security Cues

Even if your backend is airtight, users won’t know unless they can see the signs.

During onboarding, show visible trust-building elements like:

- Lock icons or secure badges near sensitive fields

- Plain-text explanations of your security protocols

- Biometric authentication options

- Indicators that explain fraud protection (e.g., “We monitor transactions 24/7”)

Also, briefly reference compliance with relevant regulations: “We follow GDPR and CCPA guidelines to ensure your data is protected.” The key is to make security feel active, not assumed.

6. Use Behavioral and Progressive Onboarding

Not every user has the same goals—or the same starting point. Some are here to save. Others want to invest. Some are switching banks.

Behavioral onboarding adapts based on how users engage with your app. For example:

- If a user browses investment features, guide them toward setting a goal

- If a user skips account linking, trigger a nudge with benefits later

- If a user completes KYC but hasn’t deposited funds, send a helpful reminder

Progressive onboarding breaks the experience into steps over time—surfacing information only when relevant. It reduces cognitive overload and increases long-term engagement.

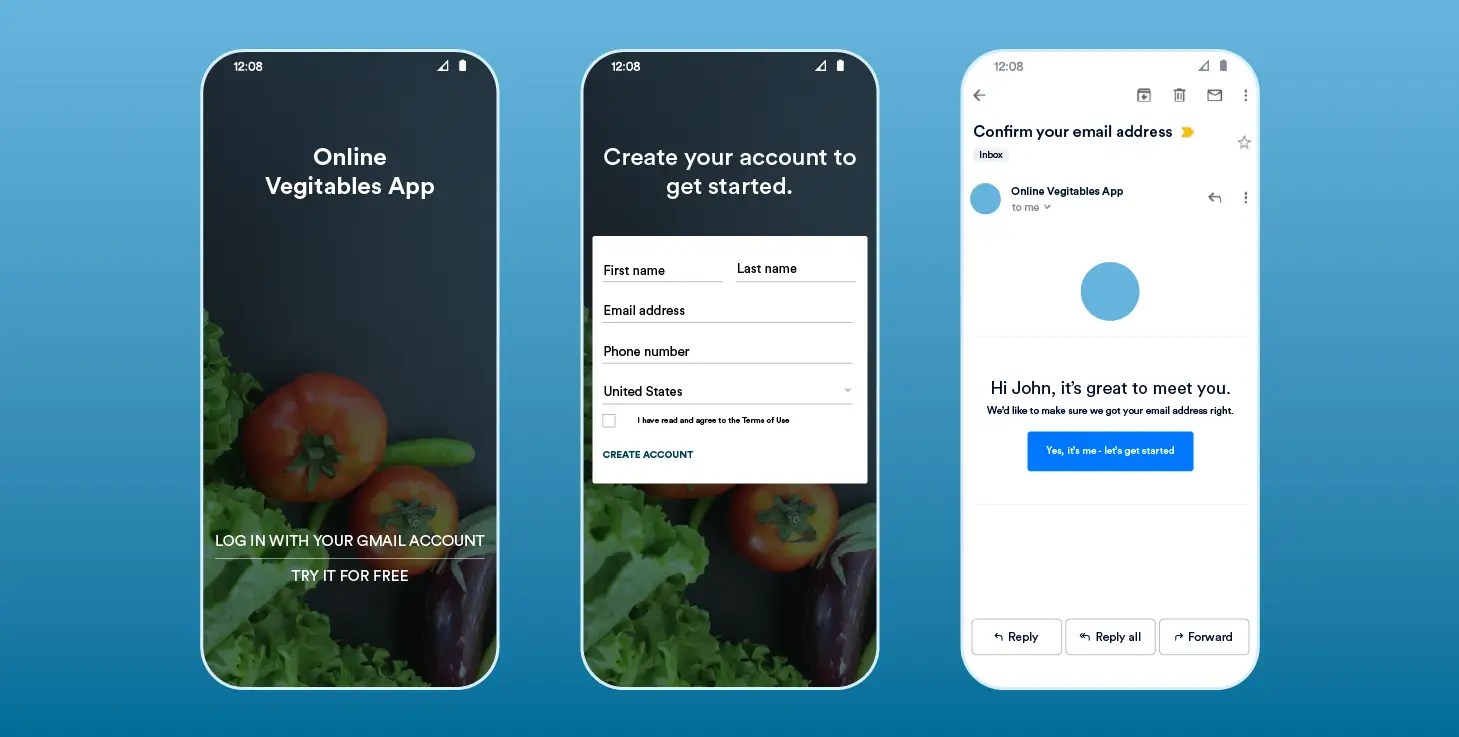

7. Consistent, Cross-Channel Journeys and Nudges with Perfect Timing

Your app onboarding experience doesn’t stop at the app. It continues through email, push notifications, in-app messages, WhatsApp, and even your help center.

To build trust and recognition:

- Use the same tone, terminology, and style across all touchpoints

- Align visuals (colors, icons, buttons) across platforms

- Avoid duplicate content—each channel should feel like a continuation, not a reset

If a user drops off at KYC, your follow-up message should reference that specific moment, not start from scratch. Example: “You’re almost there! Just one quick ID check to activate your account.”

Consistency builds confidence and reduces friction.

8. Inclusive and Accessible Design

Fintech apps must be accessible by design. The more inclusive your onboarding, the broader—and more loyal—your user base becomes.

Follow WCAG 2.1 standards:

- High color contrast and readable font sizes

- Support for screen readers and keyboard navigation

- Large tap targets and adequate spacing

Great onboarding isn’t a one-and-done screen. It’s about delivering a welcome journey, not a checklist. It’s a flow of curated interactions—a personalized welcome, first goal suggestion, in-app tutorials, and usage rewards. This “journey approach” makes users feel guided rather than overwhelmed, and has been shown to reduce drop-off.

Write in plain language. Avoid assumptions about financial literacy or technical skill. Use icons with labels, and keep the copy actionable and supportive. An inclusive app design shows respect to every user.

How CleverTap Helps Fintech Teams Build Better Onboarding

At CleverTap, we work with fintech brands to help them go beyond cookie-cutter onboarding.

Here’s how:

- Journeys: Build multi-step, multi-channel onboarding flows using push, in-app, WhatsApp, or email

- Real-Time Segmentation: Adapt messages based on user behavior—while it’s happening

- Behavioral Triggers: Send nudges when users stall, skip, or struggle

- A/B Testing: See what’s working. Fix what isn’t

- KYC Integrations: Make compliance smoother with built-in tool support

For instance, a leading fintech app used CleverTap to target drop-offs at the KYC stage—and saw a 23% increase in Day 7 retention*.

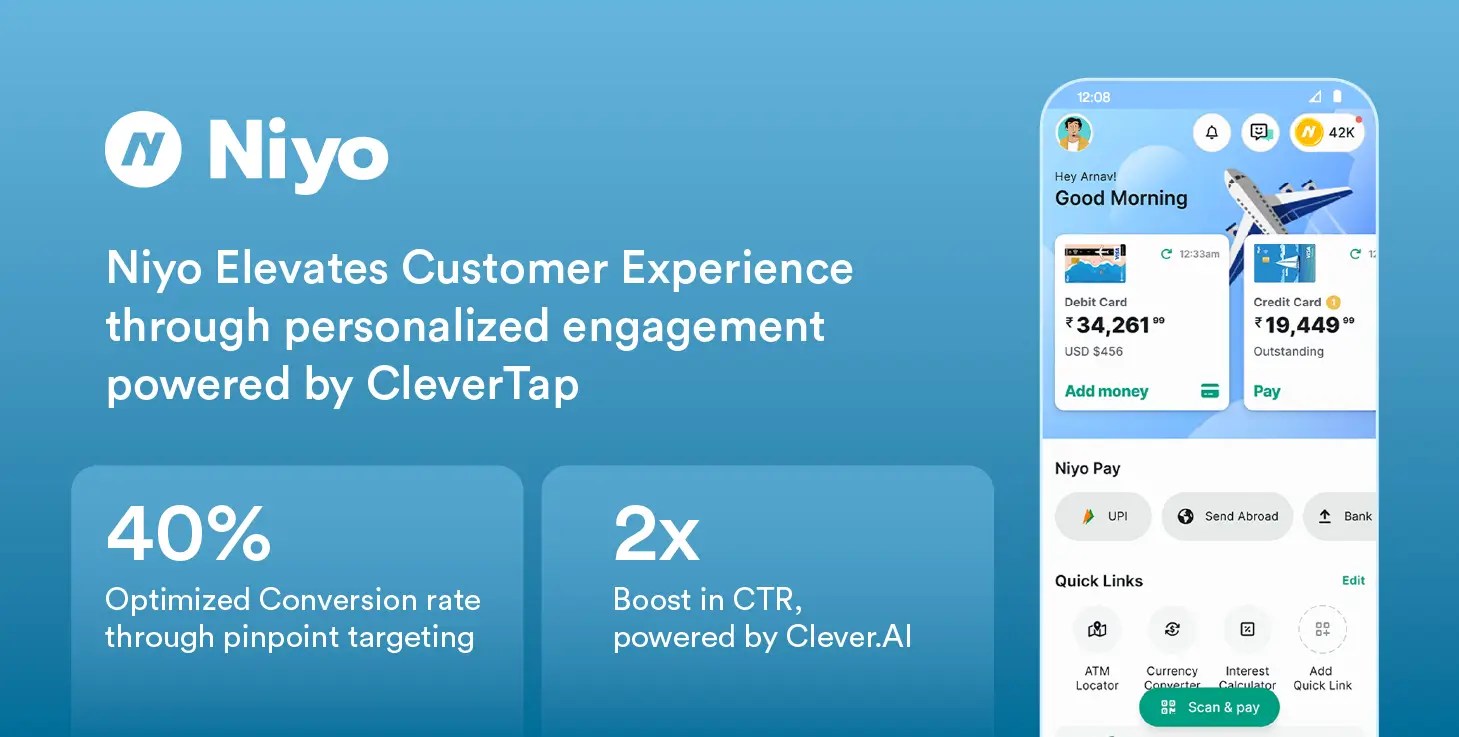

Niyo’s Onboarding Experience with CleverTap

With a mission to deliver seamless banking for India’s mobile-first population, Niyo leveraged CleverTap to transform its user onboarding journey into a personalized, data-driven experience. By harnessing real-time behavioral analytics and event-based segmentation, Niyo was able to identify onboarding drop-offs and craft contextual nudges that guided users toward successful account activations.

The result was a smarter, more responsive onboarding flow that reduced churn and accelerated time-to-value, setting the tone for long-term engagement from the very first interaction. To read the full case study, click here.

If your onboarding is still static, CleverTap helps you make it smart, personal, and measurable.

Final Thoughts

Fintech app onboarding is about more than design. It’s about trust, clarity, and meeting users where they are. It’s not a one-time setup—it’s the start of your relationship with every new customer. And getting it right isn’t just good UX. It’s good business.

CleverTap gives you the tools and insights to build onboarding that adapts, converts, and retains.

Agnishwar Banerjee

Leads content and digital marketing.Expert in SaaS sales, marketing and GTM strategies.

Free Customer Engagement Guides

Join our newsletter for actionable tips and proven strategies to grow your business and engage your customers.