Across the world, our lives have been irrevocably affected by the COVID-19 pandemic. From mask wearing in public spaces and entire companies working from home, to virtual family gatherings and conducting many other aspects of our lives online, a lot has changed this past year.

For migrant workers, the uncertainties of the job market due to the pandemic have made it difficult for them to support their families back home—and the cost of wiring money just adds to their everyday challenges. Reliable, fast, and low-cost international money transfers are key to keeping cross-border payments flowing freely in these difficult times. CleverTap’s customer Paysend makes international payments hassle-free.

The Paysend Story

Paysend is an online money transfer platform that lets users send money abroad to cards, bank accounts, and digital wallets. Launched in London in 2017, the service revolutionized how money is transferred around the world by being the first to introduce global card-to-card transfers. Currently, they actively operate in over 90 countries, serving more than 3.5 million customers worldwide. The delivery options depend on the receiving country- in some countries cash pick-up is available.

Recently they’ve launched two new products in the UK- cards, and multi-currency accounts. These features will be rolled out in Europe soon.

Challenges

-

Track Campaign Effectiveness

Track Campaign Effectiveness -

Boost Transactions

Boost Transactions -

Improve Retention Rates

Improve Retention Rates

Tracking Campaign Effectiveness

After creating engagement campaigns via email, SMS, and push notifications, Paysend found it difficult to measure the effectiveness of these campaigns. Unless they had accurate data on performance, they couldn’t make any meaningful efforts to optimize and maximize campaign effectiveness. They realized that being able to track campaign results would also support a stronger customer-brand relationship.

Boost the Number of Transactions

Paysend wanted to understand how customers were moving through the conversion funnel. They needed to identify where exactly customers were dropping off before completing a transaction. Once they identified the reasons, they needed to create ways to boost registrations, first transactions, and repeat transactions.

Improve Retention Rates

Across the globe, a key challenge faced by mobile apps is low user retention. Considering ever-increasing acquisition costs, it’s important for marketers to proactively work towards boosting retention. The team knew that improving their retention rate and customer lifetime value was critical to their long-term success.

Solution

While the Paysend team was seeking ways to improve tracking campaign performance, an employee recommended CleverTap. As an integrated analytics and engagement platform built to solve retention issues, CleverTap was the perfect solution.

With CleverTap’s complete engagement toolkit, they could optimize their marketing efforts across the entire customer lifecycle. Real-time user analytics enable them to understand user behavior and trigger engagement campaigns based on customer behavior. Additionally, automated and predictive segmentation allows them to identify and target specific user groups with tactics to boost retention and lifetime value.

The main growth goals for the marketing team include increasing:

MAUs who actively transact

Retention rates

Customer Lifetime Value

Transaction volume

Conversions

Segmentation to Target Key User Groups

Using a combination of custom events and user properties, Paysend creates clearly defined segments which allow for highly targeted engagement campaigns. Some of the custom events and user properties include registrations, transactions, transaction volume, and time between transactions.

Further, past behavioral segmentation aids them in creating segments based on actions a user has taken for tracked events. And live segmentation allows engagement to happen in real time.

Split Delivery to Test Message Copy

The marketing team tests versions of their message in different languages to determine which version performs best. The default language option on the app is English.

Now, the team is testing campaigns in other languages to compare the effectiveness against a default language campaign. Using split delivery, they choose what percentage of the target audience receives each variant of the message.

For instance, for users whose interface language is French, they perform a split delivery test where 50% of users receive campaigns in French and the rest receive it in English, and campaign stats measure the effectiveness of each variant.

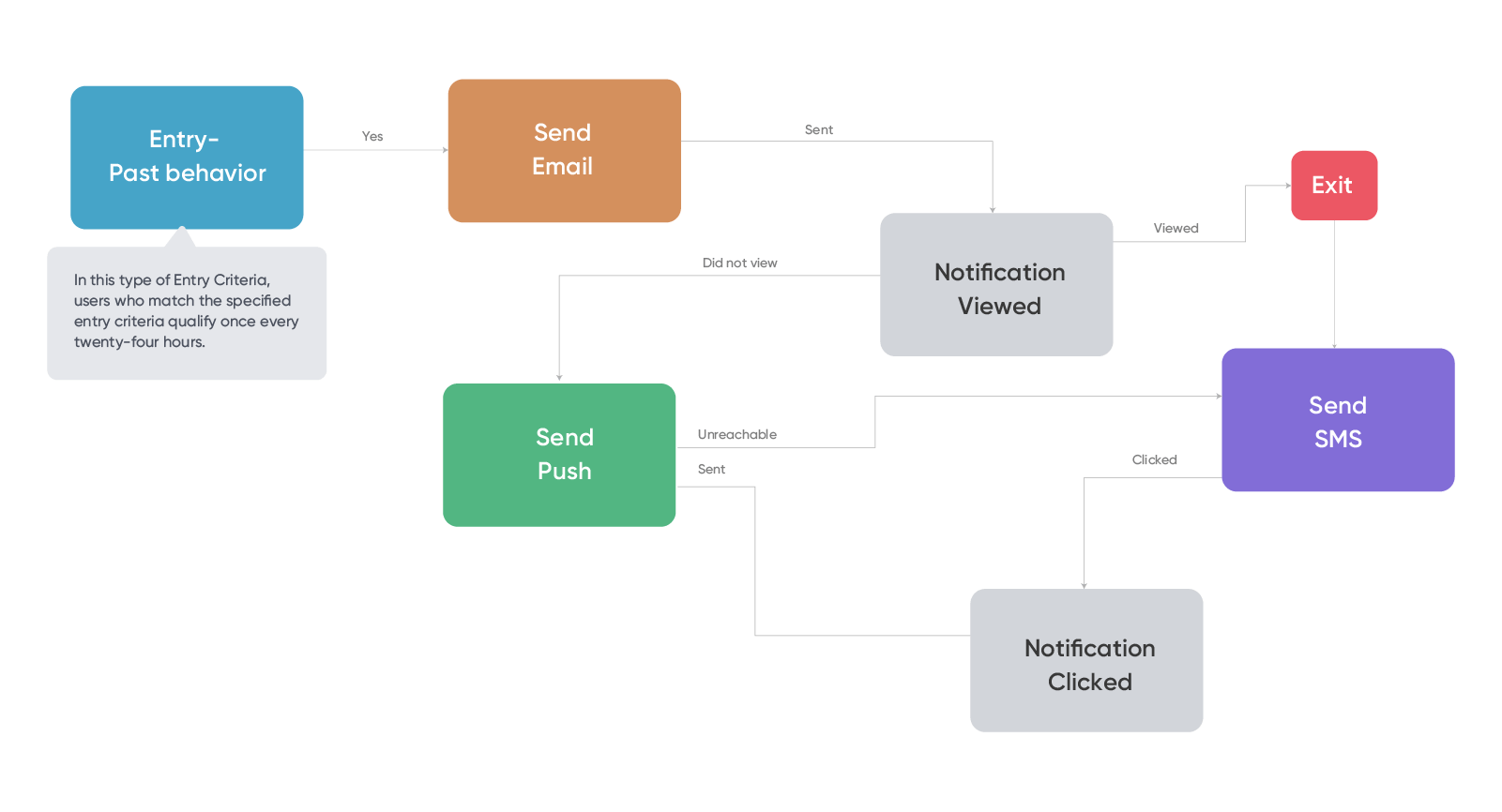

Automated Journeys to Boost Transactions

Using journeys, they create complex sequences of user action-triggered campaigns across messaging channels like email, SMS, and push notifications. These sequences of campaigns are aligned to the company’s growth goals of increasing the count and volume of transactions. Also, some of the journeys intend to revive user segments identified as likely to hibernate or at risk of churning.

A magnified snapshot of one of Paysend’s engagement journeys

Some of Paysend’s most pivotal journeys are to:

Onboard new users who’ve downloaded the app

Convert users who registered 3 days ago and haven’t transacted yet

Users who completed over 5 transactions and have stopped transacting

Create ad-hoc communication for festive seasons

Further, the team views campaign stats in real time to see how users are navigating through these journeys.

Results

CleverTap’s omnichannel campaigns have helped Paysend achieve impressive results. Their average CTR for push notifications is 17%, which is 10x the industry average. The number of users who’ve installed and registered on the app has increased by 22% weekly. Users who’ve repeated transactions have increased by 23% quarter-over-quarter, and the number of users who’ve converted has increased by 5.4% quarter-over-quarter.

What’s next?

The Paysend team is eager to explore and experiment with more of CleverTap’s functionalities to further improve engagement and retention. We are excited to power their growth efforts and help them in enabling money to travel across the globe.

Denis Mikheev

Denis Mikheev  Arkadiy Glazov

Arkadiy Glazov  Svetlana Dvoryashina

Svetlana Dvoryashina