Companies have a simple goal, no matter what size they are: grow the user base and monetize. Modern technology, specifically automation, is used to help them scale every effort — from manufacturing to marketing.

Unfortunately, automation by itself won’t endear you to a customer. You’re going to need something more than shotgun tactics and one-size-fits-all messaging to establish and build a relationship. You’ll need your company to be more relatable — more human. Case in point: how many of you have exited out of a chatbot and decided you needed to speak to a real customer service person?

Humanizing your brand is a worthwhile endeavor, one that improves both the customer experience for your users and the overall brand image.

And it’s particularly critical for Fintech apps to get right as financial services are a basic service, necessary for day-to-day life. No matter who a consumer is, or what generation they may belong to, they need banks, insurance, bill and utility payments, loans, and more.

So what concrete steps should Fintech brands take to connect with users at a more human level?

First, Earn Their Trust

One of the biggest hurdles a Fintech company has to face is one of trust. According to a survey from January 2020, one in five US adults (21%) do not use mobile payment apps. Of those that refuse, 42% say it’s because they don’t trust the security of Fintech apps.*

But there’s an even bigger trust issue over that — with banks and financial institutions themselves. A lot of this distrust comes from the Millennial generation, who saw how the financial crisis of 2008 affected their parents and now have a distaste for traditional institutions.*

This gives Fintech companies a golden opportunity to provide customers with a decidedly better experience. By meeting consumers’ banking needs, Fintech firms have been in a perfect spot to serve audiences untapped by traditional institutions.

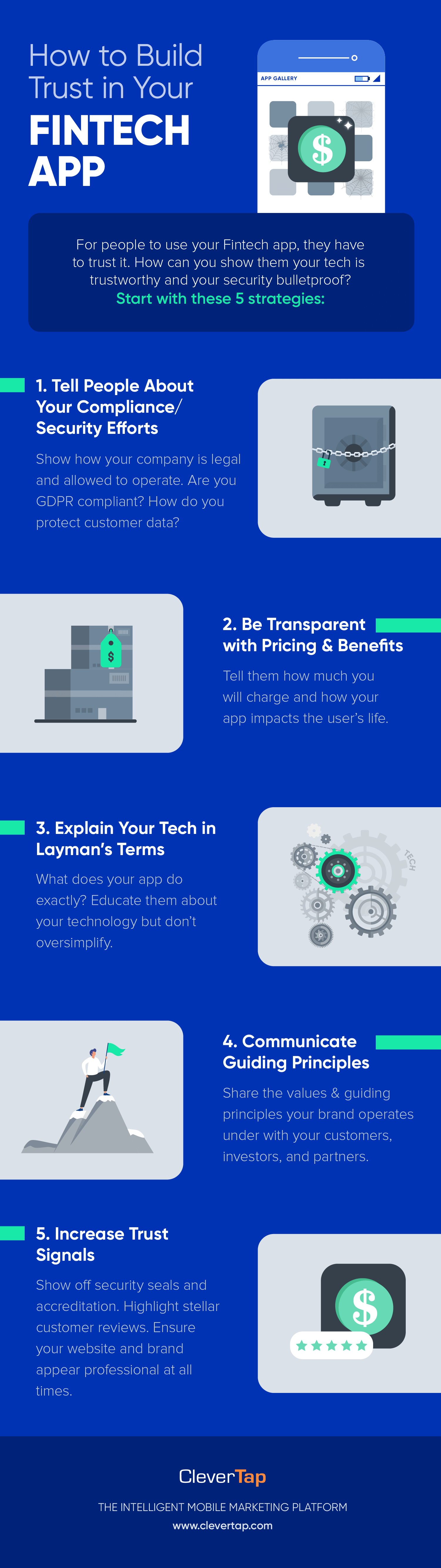

But users must be able to trust their Fintech apps. And to earn that trust, Fintech companies must:

- Prove their technology is reliable and safe: Explain your efforts at compliance and security. Show users that there are protocols in place to safeguard their data and their finances.

- Be transparent with pricing and benefits: Do away with hidden costs and show them the actual total cost of ownership. Also, quantify how the app will benefit users’ lives. Will it save them $200 a year? 2 hours a week?

- Increase the trust signals: This means showing off your third party reviews, security seals, and accreditation on your website and app store pages. Make every effort to prove that your tech can solve problems efficiently, that many people already trust your app and your company.

More tips on trust building below:

Second, Communicate Your Corporate Values

Part and parcel of humanizing your app means pulling back the curtain to show your customers what drives your company. Have a communication plan in place for talking about your internal values with customers, investors, and partners.

These internal values aren’t just a checkbox to cross off, they are part of the larger brand story and should provide your company with a framework to support both your internal decisions and your external communications.

If you’re able to align your internal culture with external demands (i.e. improving the customer experience) then you strengthen your relationship with your customers. And continue to prove your company and your app can be trusted.

But more than that you have to ensure that you have a strong company culture to talk about! Having engaged employees is a critical factor: engaged employees are more likely to improve customer relationships, with a resulting 20% increase in sales.*

Third, Connect Fintech with Emotions

When it comes to money, your customers are humans who experience emotions both positive and negative. They love the convenience of mobile access, same-day deposits, quick transfers or payments. They hate the hassle of having to get through a chatbot, or the lack of clarity when they encounter an error in the app.

But what do most Fintech apps do? Instead of playing to those emotions and underscoring them, many apps choose to disregard them for a more generic, sometimes a very robotic tone.

Write messaging that celebrates with them when money comes in, their loan or credit card application is approved, or they meet one of their savings goals. Find a friendly way to remind them when a payment is due. Craft transparent error messages that explain what the problem is. Give your customer success team members the power to solve simple tickets and delight users in the process.

Using emotional branding to appeal to emotion is a proven tactic in attracting, connecting with, and encouraging your audience to use your app and your services.

Case Study: How Robinhood Demolished User Trust

As this post is being assembled, mainstream news channels are exploding with headlines about GameStop stocks and the market chaos caused by Reddit’s retail traders.*

As of January 28, the Robinhood app took away users’ ability to freely trade stocks including GameStop, Nokia, Blackberry, and AMC due to volatility.* In their blog post, Robinhood refers to their mission to “democratize finance for all” and positions this action as a way to shape customers’ financial futures in the long term. In effect, saying “we want to protect you from the risk of investing in these rapidly changing stocks.”

As expected, the backlash has been brutal. Users are complaining loudly across every social media channel. A class-action suit was filed in New York* and political figures are chiming in to support a potential congressional hearing.*

Many online news outlets have listed the problems with imposing those trade limits.* But if you can set aside the entire financial aspect and focus only on the brand, there’s a fundamental problem: the company says its mission is to give people the chance to make their own investment decisions. But now that customers have decided to trade in these specific stocks, they are being stopped by the company.

If you apply the checklist from above, you get this scorecard:

- Communicate corporate values: Pass, because they state what their mission is

- Connect Fintech app with emotions: Pass, because their messaging talks about the freedom to make decisions

- Build trust with customers: Fail, because now they’re not actually upholding their mission, inspiring feelings of betrayal

- Play the long game of retention: Fail, because now users are uninstalling

Part and parcel of humanizing your app is making it likeable. It looks like they have a mountain of work ahead of them to repair the damage of these past few weeks.

Make the Experience Irresistible

Whether your Fintech app is in banking, cryptocurrency, payments, lending, or insurance, you’ve got to have a likeable brand, and this cannot happen without first giving your company humanized branding and communication.

The point being: you build a brand and communicate it with your customers. You align your work culture to your values, and in so doing, create a strong foundation for the customer experience. And you make this experience so irresistible that customers keep returning.

Read More

- Why Smart User Acquisition Starts with User Retention

- Brand Identity: How to Attract & Retain Mobile Customers Consistently

- What is Emotional Branding and How to Use it Effectively

- Tips for Onboarding Fintech App Users Effectively

Industry Benchmarks for Mobile Payment Apps

Shivkumar M

Head Product Launches, Adoption, & Evangelism.Expert in cross channel marketing strategies & platforms.

Free Customer Engagement Guides

Join our newsletter for actionable tips and proven strategies to grow your business and engage your customers.