When it comes to banking and financial services, Fintech has long been lauded as a disruptor — a technology that comes in and destabilizes the existing infrastructure for better or worse. But what happens when other factors come into play to disrupt the disruptor?

Below, we cover three things that are set to disrupt the Fintech space, particularly in the US. And what it will mean for your Fintech app and brand.

How Fintech Disrupted Financial Services

Back in 2016, with Fintech beginning to change how financial services were being delivered, Deloitte listed 5 key takeaways that financial executives had to consider.* These takeaways outlined how Fintech was going to be affecting incumbent companies. They noted how:

- Better personalization in retail financial services products would break the grip of standardized

products. - New markets would open up, offering opportunities to develop new and more profitable audiences.

- Incumbents would use online social norms and platforms to get more complete control over aspects of the financial supply chain, from decision support to financial intermediation.

- The playing field would level out as large and small firms took advantage of emerging networks and platform-based services to lower cost, improve compliance, and focus on markets where they have true competitive advantage.

- New sources of data would emerge and both AI and analytics would grow more advanced, but that the contribution of real humans would become more important than ever.

For the most part, those factors ended up coming true, leading to a more widespread acceptance of the technology, which the current pandemic has only accelerated on a global scale.

In a recent post, The New Rules of Fintech, Hernando Rubio, the CEO of Fintech startup MOVii, had this to say about the disruption as revolution:

“Banks have been offering services for hundreds of years, but since they have been using old technology and have a very expensive cost structure, their business model is defined based on charging fees. And only 20% of the audience can afford those fees. The other 80% are who the Fintech revolution is for.”

3 Factors That May Disrupt Fintech in the US

But with the current state of events, there are three factors which may yet disrupt the Fintech industry as it now stands.

1. Big Brands Are Competing With Startups

Many Fintech startups found success by acting quickly, innovating on products that their customers needed, and supplying affordable financial services supported by cutting-edge digital tools. Suddenly, small startups could provide unbanked people in developing nations with the ability to pay their bills online, and join a world of contactless transactions and digital payments.

But the incumbent financial institutions haven’t just been taking notes, they’ve been investing in — and buying up — Fintech startups, eventually folding the new technology into their tech stacks and product portfolios.

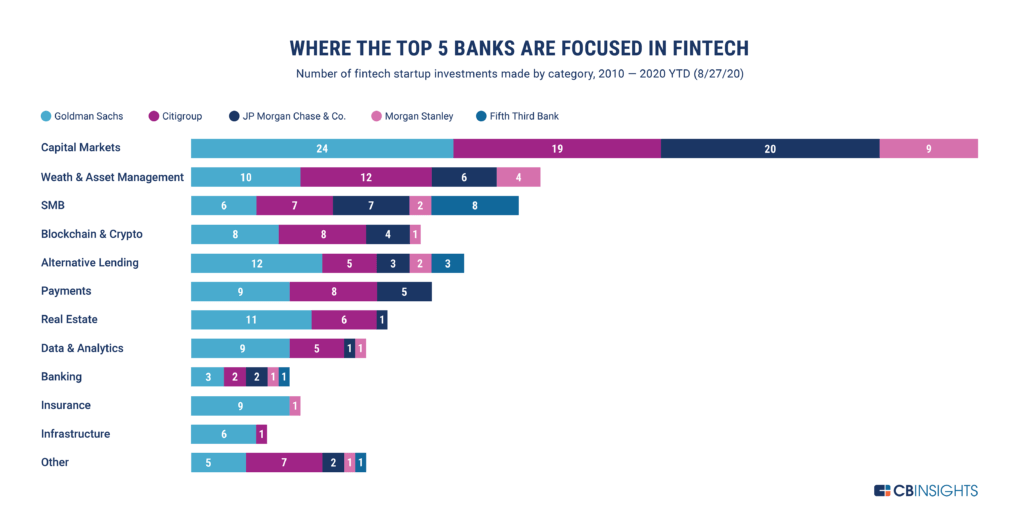

From 2018 to 2020, Goldman Sachs and Citigroup participated in 59 and 38 Fintech deals respectively. In that same time span, JP Morgan invested in 10 companies in capital markets and 5 in SMB solutions. Meanwhile, other US banks like Morgan Stanley, Fifth Third Bank, Bank of America, Capital One, and Wells Fargo backed at least 10 Fintech deals since 2012.*

Number of Fintech startup investments made by category. (Image: CB Insights* )

What might the repercussions be for Fintech apps?

These more traditional incumbent services have the benefit of scale and experience. Their large customer base provides them with much more actionable data and their investments into Fintech give them the tools to achieve the speed of startups. Which means the first mover advantage of Fintech may not be enough to keep startups afloat if and when these incumbents decide to go after the same markets.

2. Blockchain Is the New Gold Rush

Every year we read that blockchain technology is on the verge of becoming as mainstream as, say, Facebook. After all, when grandparents start using a digital tool, that only means it’s reached peak adoption.

And blockchain is getting there, with brands like Microsoft, AT&T, Home Depot, Whole Foods, and most recently, Paypal and Square allowing payment using bitcoin and digital currencies.* Something that would have been unheard of a mere 2 years back, when bitcoin was being hailed as a scam and a bubble that would soon burst.*

These days, more and more big businesses are throwing money behind blockchain, trying to be first movers in a mad rush to launch the killer application for it.

But how does this disrupt the current state of Fintech?

The fact that blockchain is a decentralized tool with no one single repository for user data is a huge factor in giving Financial technology an edge. The decentralization can help mitigate fraud and bolster cybersecurity for Fintech businesses, keeping data from being altered even as it is shared between different financial service providers.

This security allows blockchain to not only support digital payments but also smart contracts, share trading between users, and establish a user’s digital identity.

Sure, it’s still in a growth phase and its full potential has yet to be reached, but like other emerging technologies, blockchain should be monitored and explored as its eventual utility might give your Fintech business the advantage it needs.

3. The Incoming Biden Administration is Supportive

The pandemic accelerated the usage of Fintech services, bringing about a critical mass of people making use of online banking or digital payments — some for the first time. But, like anything that achieves massive popularity, a battleground appears between supporting new innovations and controlling the older infrastructures that it seeks to disrupt.

Thankfully, the outlook looks positive for the coming year.

Just last January 2020, there were already 108 bills in the US Congress that directly impacted Fintech, with 56% percent of them capturing bipartisan support* – a crucial factor for getting anything approved. These bills ran the gamut from supporting more stringent regulation to improving the industry’s supervisory functions to improving the ways that small businesses could raise capital. Furthermore, there were 199 other bills that indirectly impacted Fintech.

And with the Biden administration being supportive of the Fintech industry, it is expected to be a top priority. According to Isaac Boltansky, director of policy research for Compass Point Research and Trading, financial services issues will fall directly behind the pandemic, health care and the environment as top priorities for the new administration.*

In an interview, Boltansky said: “The fact that we’re still talking about sending people checks in 2020 should be deeply frustrating to everyone involved. So I think there will be a willingness, if not an eagerness, to examine the financial architecture. That provides an opportunity for Fintechs.”*

The Bright Future of Fintech

However the future may play out, the fact remains that Fintech apps are integral to the smooth running of a post-COVID world where contactless transactions are a necessity. And these three factors, though they might spell out new problems for the financial technology industry, are still secondary to the primary challenge of every Fintech app: delivering a personalized, delightful experience that makes life easier for every customer.

Read More

- The New Rules for Fintech in 2021

- How Best to Onboard Fintech App Users

- How to Build Trust in Your Fintech App

The Experience Optimization Pocket Guide

Shivkumar M

Head Product Launches, Adoption, & Evangelism.Expert in cross channel marketing strategies & platforms.

Free Customer Engagement Guides

Join our newsletter for actionable tips and proven strategies to grow your business and engage your customers.