The good news: apps have become the “channel of choice”* for consumers, fueling record adoption of finance and insurance apps. The not-so-good news: consumers’ increasingly high expectations for customized experiences that meet their specific needs.

This is particularly true in the insurance sector. A survey of insurance companies by global consulting firm Accenture reports that more than three-quarters (80%)* of customers are looking for personalized offers, messages, pricing, and recommendations. Unfortunately, Accenture also found that a significant number of companies are falling short of the promise of personalization. Over 20% of insurance customers complained their providers “do not tailor customer experiences at all.”

Striking the Balance Between Automation and Personalization

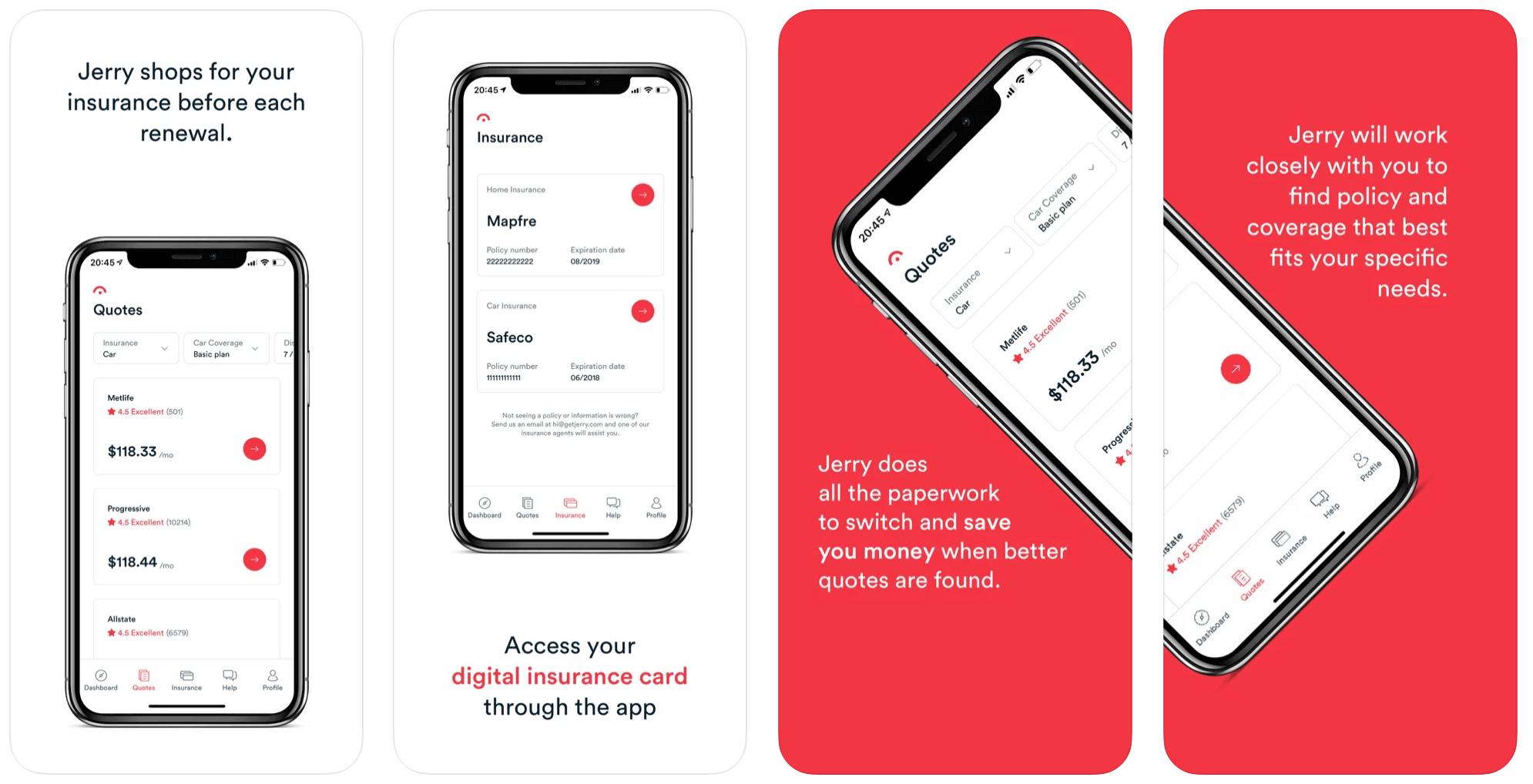

The race is on to satisfy consumer craving for relevant and personalized offers, recommendations, and messaging at every step of the journey. But not all companies will be in catch-up mode this year. Jerry — the first fully automated insurance agent for car and home insurance — is on the fast track to revolutionize the insurance industry and make owning a car as easy as taking a drive.

The fast-growing fintech startup, with offices and employees across three countries, has built an AI-powered personal concierge that makes car ownership a breeze, says John Spottiswood, Jerry COO. In practice, Jerry takes an insurance broker’s role, contacting the customer’s insurance company on their behalf to get current coverage details. Jerry then analyzes the customer’s insurance needs to ensure they have the coverage that’s right for them. In advance of every renewal, Jerry also uses its machine learning capabilities to compare prices from up to 45 insurance companies, presenting customers with the top three options.

Appearing as a guest on the Reimagine Growth webinar series, Spottiswood shared how an avalanche of interest, buoyed by top-notch app store reviews, has elevated the importance of personalization at every step of the customer journey. “Automation and AI are at the root of Jerry’s success,” he says. “But it’s critical to balance efficiency with personalization.”

Jerry’s product lineup, which now includes home and rental insurance, fuels impressive customer acquisition. “But driving lasting loyalty demands deep insights to reach customers on their journeys and the capabilities to make the shopping experience for insurance as simple as the experience of looking for a flight on Expedia.”

Using Customer Insights to Power Continual Conversations

The team is obsessed with keeping its customer base protected and saving users money.

It’s this mindset that has allowed the company to achieve impressive metrics. Jerry has generated over 25 million quotes for customers and delivered AI-powered advice that saves its customers over $5 million every month.

A winning product succeeds in grabbing customer attention and interest. The challenge, Spottiswood says, is keeping the conversation going between app sessions and between renewals. Working with CleverTap allows them to customize and contextualize messaging to drive engagement and bridge the gap between app sessions and interactions.

Personalized messaging that combines high relevancy with a clear and customized value proposition has allowed the company to increase conversion rates by 20%. It’s also resulted in glowing user reviews (hovering between 4.75 and 5) that help it reach new audiences. “When people convert, they get savings, and that positive experience means they are much more likely to put in a positive review,” notes Spottiswood.

More Journeys Drive Better Results

Working with CleverTap to personalize communications is a bonus, Spottiswood says. However, it’s the ability to A/B test messaging quickly and iterate on the fly that clinches the deal. “It’s so valuable for us to be able to see which message is resonating most impactfully with our customers.”

It can be a tall order for a startup team, but not if the tools take the work out of personalizing messaging across multiple journeys.

“We’ve micro-segmented to the point where there are almost 30 separate journeys depending on which sort of a group a customer falls into,” Spottiwood explains. Some customers are returning to check if they can save money, and some are buying insurance for the first time. “Each customer has a different history and a different expectation on the product, and so we need to be able to communicate that in a very individual way based on their situation.”

Encouraged by positive business results, Jerry is ready to reach higher. “So now, we can create a different set of journeys for people who have savings over a certain point, or premiums lower than a certain amount,” Spottiswood explains. “We can pull in the specific information so that the message can say, ‘Hey, this quote from Progressive could save you this amount,’ and so not only is it a personalized journey, but it’s a set of personalized messages on that journey.”

And that, he adds, allows his team to focus on improving the product and driving deeper engagement. There are plans to leverage recommendations, launch a membership product, and expand the portfolio.

The Takeaway

TL;DR Consumers depend on fintech and insurance apps for assistance and advice at every step of the journey, giving marketers an unparalleled opportunity to engage customers who are primed to act.

Drive conversions — and deepen customer loyalty — with notifications and communications that guide consumers. And, if you are a company like Jerry that specializes in price comparisons and saving your customers money, tap personalization to deliver customers good deals and great value.

Just keep in mind: even the ability to automate and deliver the best offer won’t clinch the deal if you aren’t equipped to make data-informed decisions about who, when, and how to target app users. Convincing customers to take the plunge demands messaging that understands their unique needs.

When it comes to customization and segmentation, more is better. Build capabilities to map and personalize multiple customer journeys (Jerry has 30 and counting).

And ensure your app stays at the center of your customers’ experience. You can achieve this by delivering personalized messages and communications that help customers from onboarding to sales and encourage deep engagement and frequent use every step of the way.

To learn more about how Jerry is reimagining growth, tune into the entire interview. And watch for updated profiles of Jerry and other fintech pioneers in our upcoming Fintech Playbook.

Listen to “Personal Insurance Shopper Jerry Shares Essential Rules To Automate Personalized Marketing” on Spreaker.

See how today’s top brands use CleverTap to drive long-term growth and retention

Subharun Mukherjee

Heads Cross-Functional Marketing.Expert in SaaS Product Marketing, CX & GTM strategies.

Free Customer Engagement Guides

Join our newsletter for actionable tips and proven strategies to grow your business and engage your customers.