Finance apps are having a moment *– and the impact is profound. App downloads surged, and usage rocketed by as much as 85%* as consumers abandoned in-person banking for apps.* The numbers are staggering, and growth is off the charts.

But turning heightened interest into lasting loyalty isn’t always an easy task. It raises the bar for customer experience, increasing pressure on marketers to understand and respond to consumer requirements in real time.

Leading companies don’t just map an individualized customer journey. They harness data to detect and decrease friction at key stages and drive deep-funnel conversions.

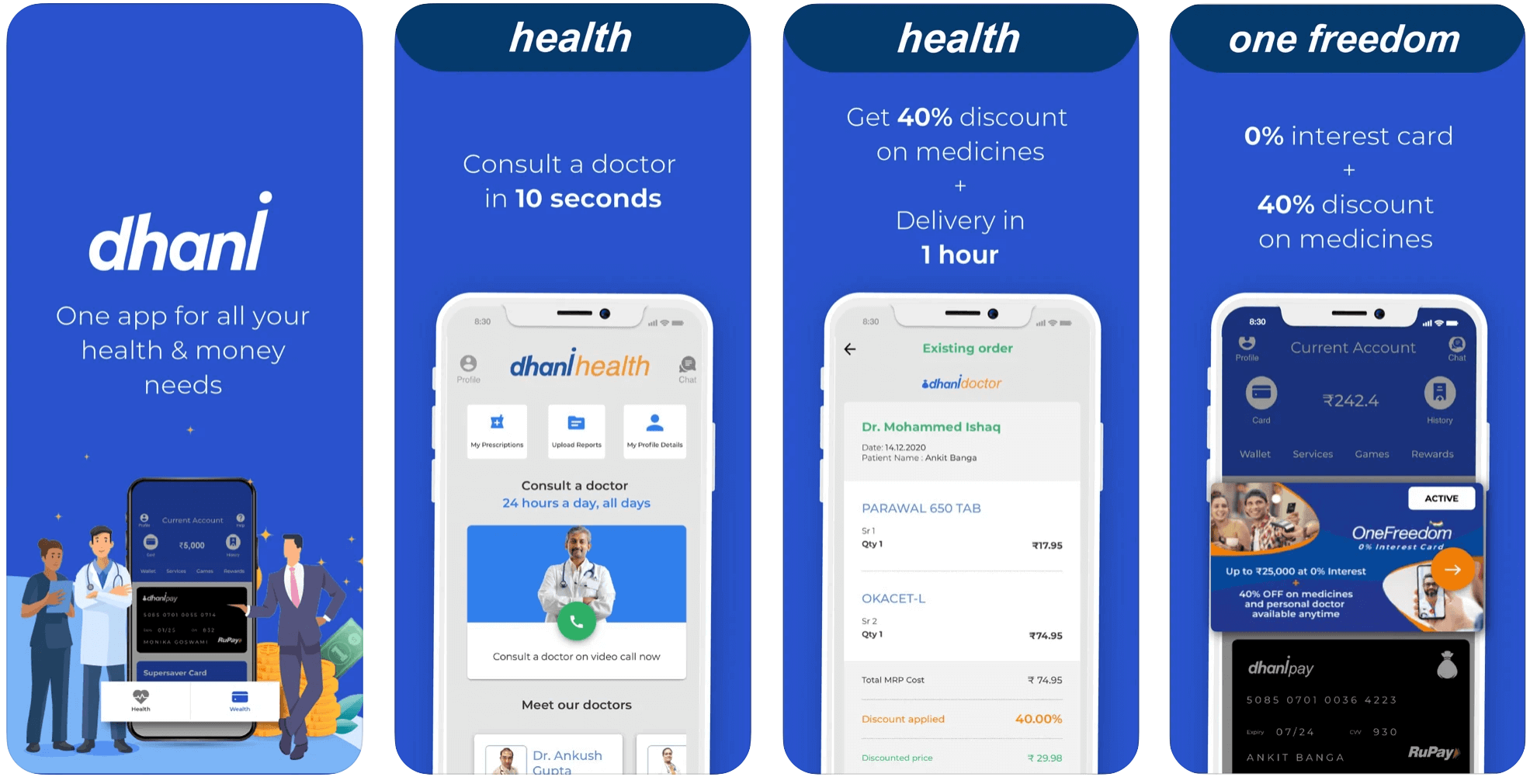

It’s a blueprint that Indiabulls — one of India’s leading home finance companies — is following to help consumers plan their financial wellness and increase the use of the Dhani app. Launched in 2017, it offers consumers personal advice and loans on the fly. The app counted nearly 20 million users as of November 2020. It’s a user base that Indiabulls says is set to grow 10x by 2024 thanks to contextually relevant messaging and a laser focus on customer convenience.

Collecting insights into how users interact with the app and then channeling these into the product have allowed the team to reach two milestones. First, they were able to architect a journey that allowed customers with the necessary documentation to process loans online in less than five minutes. Then, they beat their own benchmark, reducing time to under three minutes.

“Speed is an essential factor in Dhani’s success,” says Ankit Banga, who leads digital marketing at Indiabulls Group companies. “Processing loans in less than three minutes has been one of the critical stories for us. It’s the key DNA for the company and for us as an organization.”

Appearing as a guest on the Reimagine Growth podcast miniseries, Banga shares his company’s journey to understand and unlock data in order to drive innovation where it counts. “There is a lot of data readily available and accessible. The challenge is to make real sense out of the data from a customer experience point-of-view and your product point-of-view,” Banga explains.

Reading Data Signals to Customize Communications

Customized communications start with the customer.

“It’s all about the data. Develop the multiple lenses that allow you to make meaningful interpretations of the data and then apply that to specific customer segments and campaigns,” Banga says.

He provides a quick checklist of the key questions marketers should frame and answer to focus their efforts:

- What is the customer doing on the app?

- How long or how frequent are their sessions?

- What are the app sections and stages where customers spend time to do important actions, such as fill in personal data as part of the registration process?

- How can that process be improved?

- What are their daily actions, and how do they match the everyday use and trends you see across your audience?

Equipped with a more holistic view of customer actions, marketers can double-down on customer communications that are genuinely useful and effective.

“What really works is to time communications to when users do something,” Banga says. Working with CleverTap has allowed Indiabulls to align real-time communications with user context. It’s a winning combination that enables marketers to connect with users in the magic moment when they likely need or appreciate it most.

Banga offers the example of a Dhani user who downloads the app to apply for a loan and with the expectation that the process will be simple, straightforward and, above all, fast. He describes a scenario where a user encounters an issue in the process and would benefit from a tutorial or a recommendation to make the next move. This, he says, is an instance when users don’t just accept relevant messaging — they depend on it.

“The next task is to decide which platforms yield the best result and then use that [insight] to channelize your mix and catch the customer at the right time.” It’s here that working with CleverTap and drawing from data around how customers use the app and respond to messaging has allowed Indiabulls to increase conversions by between 10-12% depending on the campaign.

The ability to provide personalized assistance the instant a user needs it is essential, Banga says. “It’s then that you have the customer at the right point in their journey, and you have their attention. If you wait hours or days, then chances are they will have lost interest or even gone off to another app.”

Following the 4x Formula to Encourage Brand Interaction

In practice, this means “shuffling channels every ten days” to see what works. “You need to continuously experiment with your benefits and with your tone of communications,” he says. More importantly, marketers need to mix channels and messaging to find the level of personalization that truly strikes a chord with users.

It’s not a task that marketers want to leave to chance.

In the case of Indiabulls, Banga says, the process to test the messaging mix – and then match it with how you have bucketed users in the first place – follows a simple and effective principle called the “model of four.” The concept, informed by data from numerous campaigns, dictates that four is the optimal number of times to reach a customer early in the journey.

“Working with CleverTap, we work to reach each customer four times using four different mediums to ensure we have reached them and informed them about the product,” Banga explains. “You always have to be careful when you’re creating an interaction versus an irritation for the customer. You have to create a balance, and we have found four times works for us.”

Mobile Games Help Keep Users Interested And Entertained

Gamification is another tactic that works for Indiabulls. “We introduced games because we realized people had more time to spend in apps, and we adapted our strategy to the needs of the hour,” Banga explains. He estimates that 90% of users play the Spin the Wheel game, a simple game that Indiabulls designed to engage all users with all skill sets.

Encouraged by the game’s runaway success, Indiabulls has created Dhani Cash, a loyalty points scheme that allows users to convert rewards into real cash. Users can then use the money to pay EMIs (equated monthly installments) or purchase healthcare, a new subscription offer that Indiabulls launched to offer immediate and affordable access to medical care and advice.

Plans are also underway to expand the offer to enable subscribers to use the app to order and pay for home delivery of medicines and prescriptions. “We have two offers — finance and healthcare — and we are moving toward becoming more of a Super App,” Banga adds. It’s product and strategy expansion enabled by effective engagement marketing that keeps users primed to purchase and coming back.

The Takeaway

TL;DR Many Fintech apps may aim to be Super Apps, combining commerce, payments, and exceptional customer experience. But only a handful have the capability to make it happen.

Indiabulls and its Dhani app are making strides thanks to an approach that drives personalized communications and decreases friction at every step of the customer journey.

The starting point is segmentation, but it’s not static. Indiabulls is committed to continuous experimentation to find the right balance, encourage user interaction, and avoid irritation.

Experiment with the channel mix as well as messaging content, context, and tone. Trial and error taught Indiabulls that four is the magic number. It uses this to guide communication (messaging customers four times via four channels to engage and educate users as they enter the funnel) and gauge results.

Find the right balance and be prepared to adapt it depending on how users behave in your app and how they respond to messaging. Connect the dots in this data to tailor individualized customer journeys.

Leave room for surprises and perks that can keep users engaged. Indiabulls introduced games as a way to spend time but quickly discovered other benefits. Gamification can be the first step in a more ambitious strategy to incentivize engagement and generate a new revenue stream. In Indiabulls’ case, stickiness allowed the company to push the envelope and introduce a first-of-its-kind subscription healthcare offer.

To learn more about how Indiabulls is reimagining growth, tune into the entire interview.

Listen to “How Indiabulls Captures Massive Audience Attention With A Multi-Medium Approach Messaging” on Spreaker.

See how today’s top brands use CleverTap to drive long-term growth and retention

Subharun Mukherjee

Heads Cross-Functional Marketing.Expert in SaaS Product Marketing, CX & GTM strategies.

Free Customer Engagement Guides

Join our newsletter for actionable tips and proven strategies to grow your business and engage your customers.