AI in banking is now a pivotal force transforming customer engagement. This blog explores how CleverTap’s “Core Four” framework, featured in Banking on AI: A Leader’s Guide to Customer Engagement Excellence, enables retail, neo, and specialized banks to overcome AI adoption challenges and drive personalized customer interactions for sustainable growth.

Artificial Intelligence (AI) is set to transform banking, with projections estimating it could add $1 trillion to the global economy by 2030. As customer expectations shift, banks face growing pressure to integrate AI and meet the demand for seamless, personalized experiences. Nearly 60% of banking customers might switch to competitors if their bank fails to deliver these experiences, highlighting the urgent need for AI-driven engagement strategies. Explore the transformative potential of AI in banking and discover how it can empower banks to create meaningful connections, drive customer loyalty, and ensure long-term growth in an increasingly competitive landscape.

Banking on the Core Four: Enhancing Customer Engagement in the Digital Age

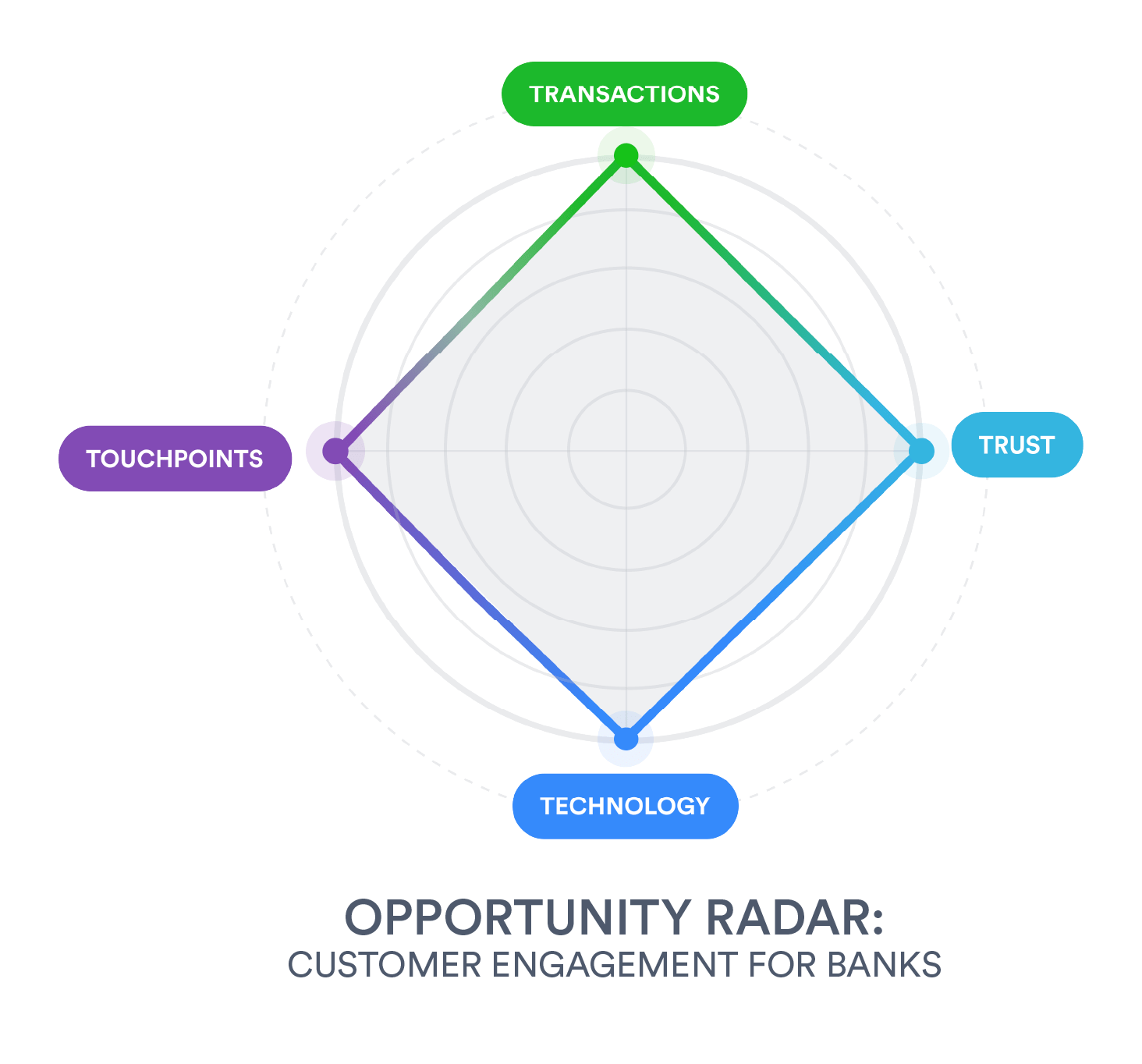

Trust, Technology, Touchpoints, and Transactions from CleverTap’s Core Four customer engagement framework empowers banking professionals across retail, neo, and specialized banks to cultivate stronger relationships and deliver personalized experiences that maximize customer lifetime value.

This framework enables banks to gain a holistic view of customer engagement and seamlessly integrate AI with their MarTech stack to meet evolving customer expectations. The Core Four Framework serves as a foundation for enhancing customer experiences and driving long-term value in the age of AI. Let’s take a deeper look.

Overcoming Banking Sector Challenges: AI as the Key Driver

Banks across sectors, retail, neo, and specialized, encounter distinct pain points tied to their operational models.

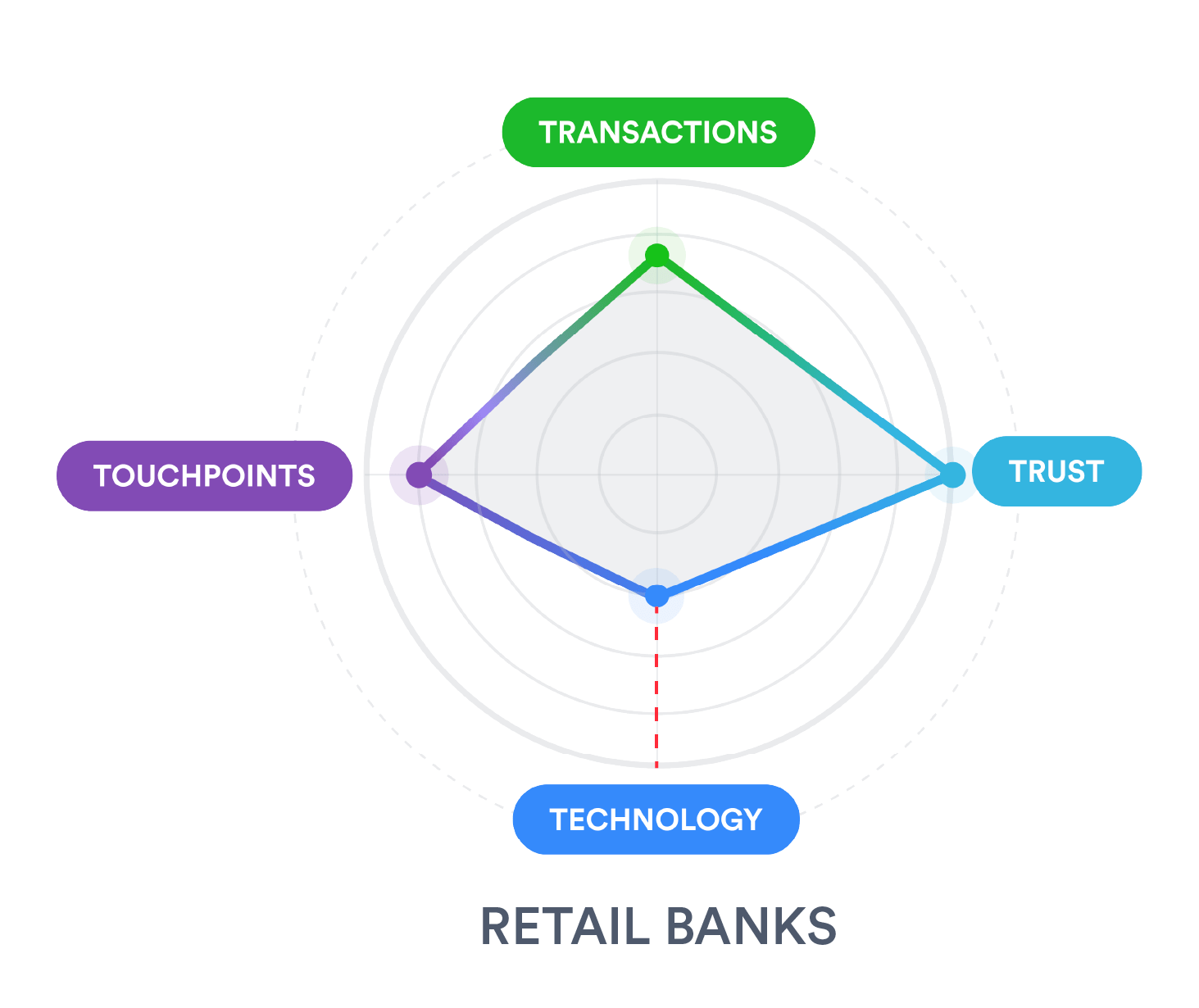

Retail Banks

Retail banks benefit from strong customer trust, backed by a well-established presence and legacy, but often fall behind in technological innovation.

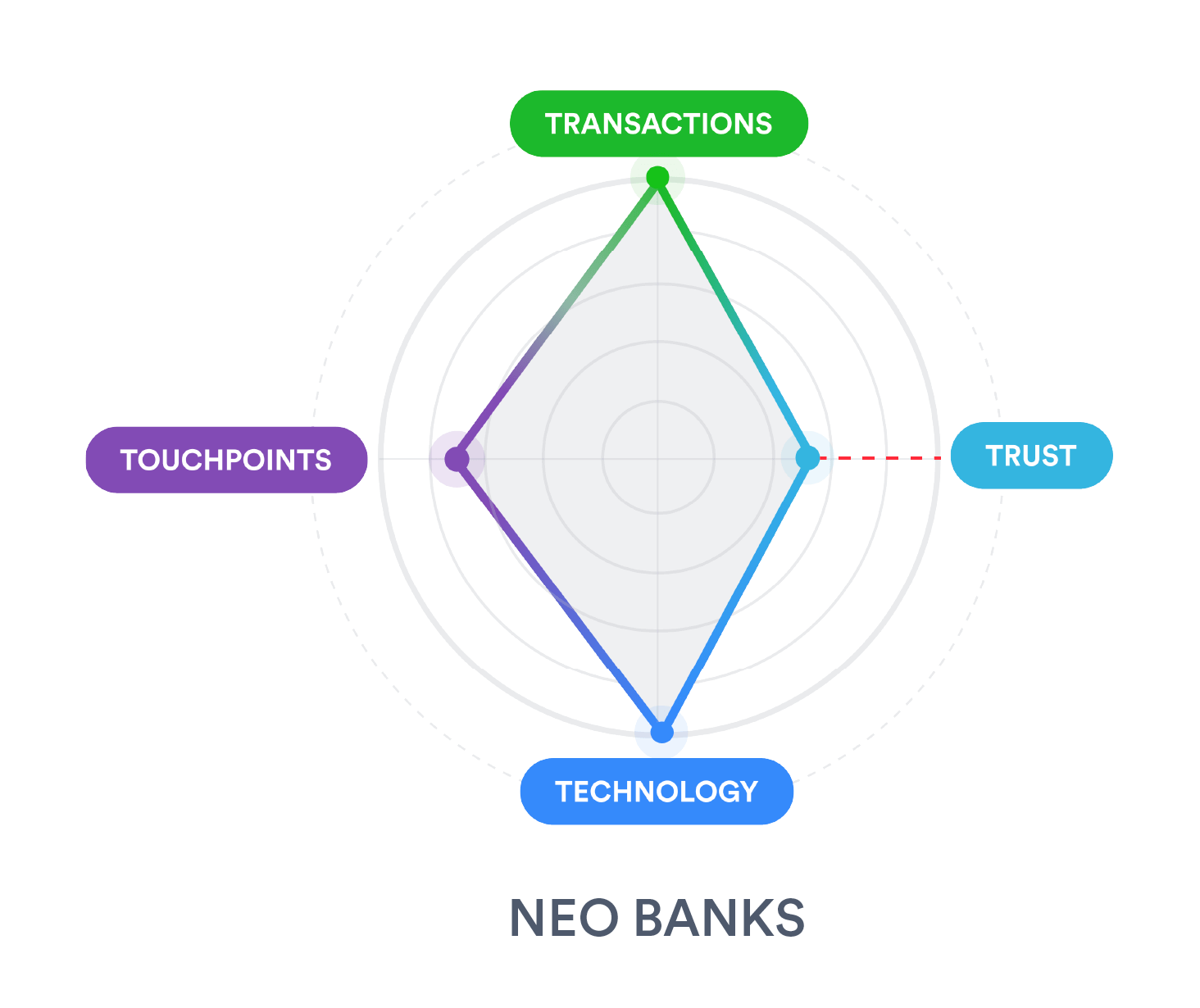

Neobanks

Neo banks excel in high transaction volumes, leveraging digital platforms for ease, but struggle to cultivate the same level of trust as their brick-and-mortar counterparts.

Specialized Banks

Specialized banks foster trust through personalized, community-focused service, yet tend to adopt new technologies at a slower pace.

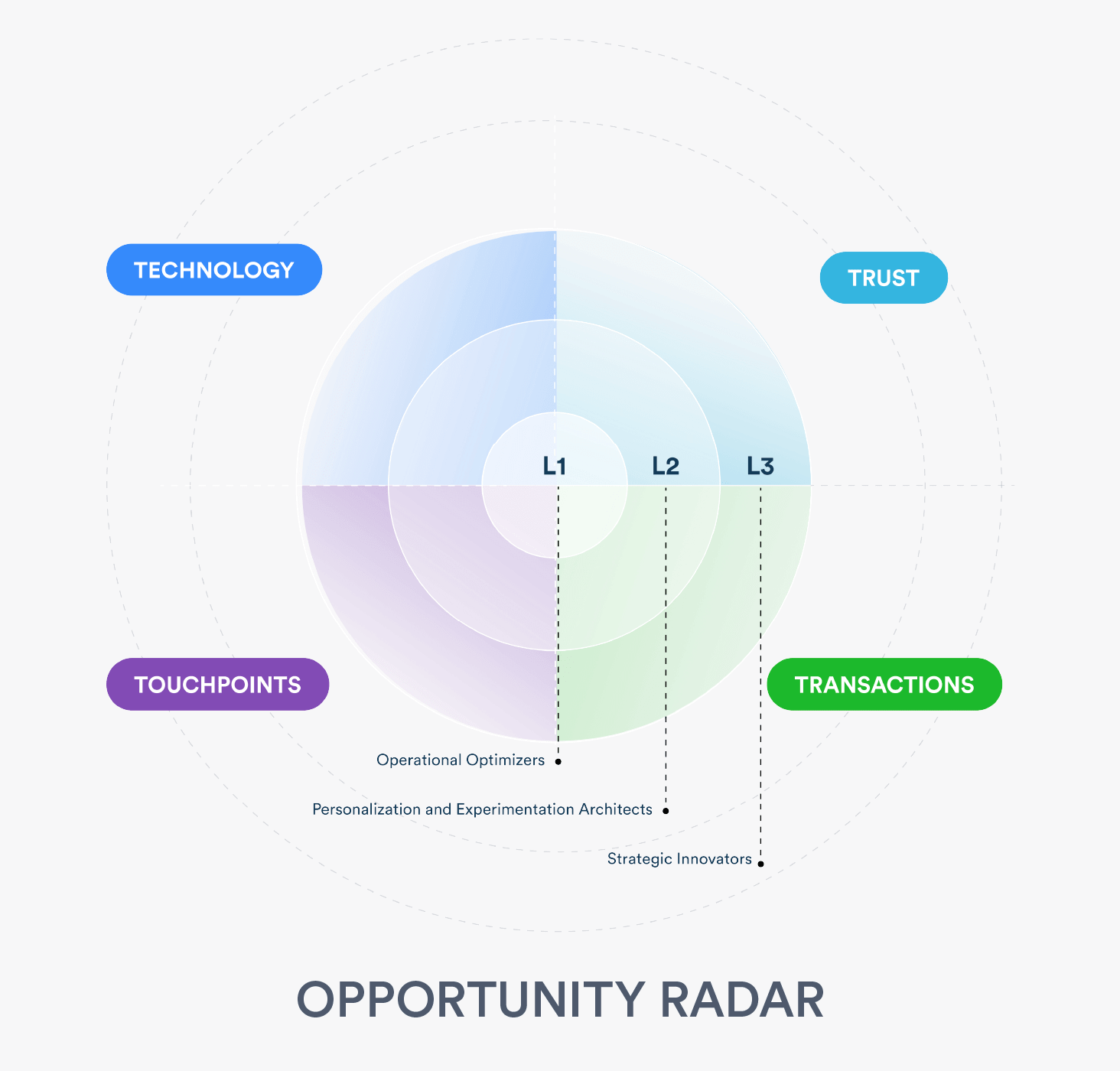

Where Are the AI Opportunities for Banks?

Reference: Gartner Opportunity Radar, Is Your Organization AI Ready?

AI is projected to contribute $1 trillion to banking by 2030, yet many banks remain hesitant to adopt new technologies without proven results. This cautious “wait-and-see” approach can hinder their competitiveness and limit AI’s potential. Banks can unlock AI’s full value by adopting a holistic approach that focuses on the Core Four: Trust, Technology, Touchpoints, and Transactions. According to CleverTap’s Market Research Report, AI can be leveraged across three stages:

- Operational Optimizers – Enhancing efficiency through automation and streamlined workflows.

- Personalization & Experimentation Architects – Using AI for personalized engagement and optimizing conversion rates.

- Strategic Innovators – Applying AI to automate decision-making and provide insights for long-term strategies. By adopting AI across these stages, banks can significantly enhance customer engagement and stay ahead in a rapidly evolving market.

Get a detailed view of the AI Opportunity Radar for banks—download now.

The AI Edge

Driving Efficiency and Scalability

AI solutions in banking have evolved from streamlining tasks like KYC and document verification to enhancing customer experiences with hyper-personalization engines and no-code app optimization for faster testing. With synthetic data, AI now automates complex decisions in risk management and digital experiences, adhering to regulatory standards.

Enhancing Security, Transparency, and Credibility

AI’s journey in banking began with fraud detection and secure authentication, progressing to trust-building through personalized fraud alerts, Gen AI chatbots, and Responsible AI frameworks for ethical transparency. Innovations like real-time compliance management and automated AML compliance help banks optimize oversight and build trust.

Optimizing Customer Interaction

AI adoption started with campaign automation and now includes contact center assistants, virtual financial influencers, and AI-powered wealth management tools. With dynamic segmentation and voice banking, banks automate and personalize customer journeys.

Transforming Core Financial Operations

In core operations, AI streamlines transaction processes, automates loan processing, and manages payment exceptions, reducing time and improving efficiency. Hyper-personalization and AI-driven onboarding journeys further optimize services, guiding customers to tailored solutions.

AI in Banking: AI-Powered Growth for Banks

How can retail, neobanks, and specialized banks harness the power of AI to drive revenue growth, increase customer lifetime value (CLV) while also retaining their most valuable customers by fostering trust, optimizing key touchpoints, and creating seamless, personalized experiences. Let’s take a deeper look.

Customer-Centric Strategies for AI-Driven Retail Banking Success

To thrive in the evolving financial landscape, a shift from a product-first to a customer-first approach, leveraging AI as the core enabler, is essential. Retail banks currently benefit from high trust levels due to their established reputations, physical presence, and diversified touchpoints; however, they often lag in technology adoption and optimizing transactions. Below are strategic recommendations to empower retail banks in technology adoption.

“In banking, large-scale adoption happens when results are evident. A value-centric approach is what we look forward to, which helps us understand how to adopt AI correctly.”

Nikhil Padmanabh, Head – Martech & Digital Analytics, Axis Bank

Eliminating Data Silos for Powering AI

Eliminate data silos by unifying data from sources like CRM and transactions. A unified data strategy is vital for AI adoption and a 360° customer view. This enhances targeted segmentation and enables true one-to-one personalization. Retail banks can use synthetic data to supplement real data and safeguard privacy, further enhancing AI models.

Leveraging AI for Real-Time Customer Segmentation & Hyper-Personalization

Deliver personalized experiences at scale by dynamically segmenting customers based on real-time behaviors. Implement AI-driven customer segmentation that evolves continuously, factoring in goal predictions and life stage changes. Use AI for deep customer profiling and predictive analytics to enhance personalization. Integrate AI-driven personalization into omnichannel marketing strategies for seamless and contextually relevant experiences.

Integrate AI-Powered Recommendation Engines for Enhanced Engagement

Leverage AI models to identify early indicators of changing customer needs. These may include life events or financial stress. Trigger proactive engagement to reduce churn and boost satisfaction. Maximize conversion by reaching out to customers at the right time with the right product offering.

Democratize AI Usage Across Business Teams

Empower teams to iterate quickly on user interfaces and features. This approach helps banks respond to customer feedback and market trends. Implement no-code or low-code AI platforms to reduce dependency on technical resources. This flexibility allows non-technical teams to design and optimize digital experiences, ensuring that customer journeys are continuously enhanced to meet evolving needs.

Building Trust and Efficiency with AI for Neobanks

While neobanks thrive on technological innovation and user experience, they often struggle to match the trust and reliability of retail banks. To tackle these challenges, neobanks can harness AI to elevate customer interactions and boost transparency across all touchpoints. Below are strategic recommendations designed to empower neobanks in this endeavor.

“Neo banks offer all the financial services of a traditional bank with greater innovation, building trust through technology, cybersecurity, and personalization.”

Belén Gavilán, Chief Growth Officer, Tenpo

Elevate Customer Trust with Advanced AI Security

Prioritize transparency to build customer trust. They must openly share how their AI-driven fraud detection systems work. Implementing real-time monitoring to identify suspicious patterns is essential. Additionally, communicating the safeguards in place reassures customers about data security. Integrating user feedback loops will also refine these systems, enhancing both effectiveness and transparency.

Optimizing Customer Journeys Through AI-Driven Experimentation

Optimize customer journeys and automate app/web experiences with AI-first strategy to foster and build trust. AI-powered experimentation customizes experiences based on preferences. Systematic testing, combined with real-time data and feedback, ensures agile adaptation to evolving customer preferences.

Building Customer Trust Through AI-Driven Behavioral Analytics

Neobanks can boost customer trust by using AI-powered behavioral analytics and machine learning to gain deeper insights and identify pain points. AI models analyze real-time customer data, detect patterns, and predict concerns, enabling proactive solutions like personalized alerts. Natural language processing (NLP) helps assess customer feedback and sentiment, allowing banks to refine their offerings based on

satisfaction levels.

Reinforce Trust with Automated Financial Advisory Services

Develop AI-powered robo-advisors that provide customers with personalized investment and savings strategies based on their financial goals and risk tolerance. By offering accessible, data-driven advice, neobanks can empower users to make informed financial decisions, enhancing the overall customer experience and engagement.

Enhancing Experiences with AI for Specialized Banks

While specialized banks excel in building trust through strong connections with regional communities and a focus on personalized services and product offerings, they often face challenges in rapidly adopting new technologies. Specialized banks must strike a balance between their community-oriented approach and the integration of modern technological solutions, ensuring they enhance customer interactions while keeping pace with industry advancements.

Generative AI powering problem resolution with a prompt and real time customer support

Leverage generative AI, which enhances customer support by providing context-aware, emotionally intelligent responses. It reduces wait times with instant, accurate answers while adapting language and tone to resonate with users. Use AI-driven chatbots, which offer real-time support and use feedback loops to refine interactions. They seamlessly escalate complex issues to human agents when necessary, boosting efficiency and enhancing customer loyalty.

Customized Risk Assessment Models

Develop AI-driven risk assessment models tailored to specialized banking sectors, such as agricultural or small business financing. Incorporate alternative data sources and advanced algorithms. This approach will improve the accuracy of credit evaluations. It will also ensure fair access to financial services for underserved customers.

AI-Powered Open Banking Boost for Transactions

Specialized banks should adopt AI-powered open banking strategies to drive growth and address their biggest challenge of audience size and product offerings. Integrating with third-party FinTechs can help overcome these limitations by expanding product suites and extending the customer base. Leveraging AI will optimize data utilization, enabling hyper-personalized experiences that differentiate their services. Implementing predictive models based on customer behavior and utilizing API connections will allow for tailored financial solutions.

Collaborative Innovation Hubs

Create AI-enabled innovation hubs that foster collaboration between specialized banks, fintech partners, and customers. By leveraging collective intelligence and co-creating solutions, these hubs can drive the development of innovative products and services tailored to the unique needs of specialized banking sectors, enhancing market relevance and customer satisfaction.

6 Key AI Outlooks in Customer Engagement for Banking: The Future of Banking (2030)

As the banking sector navigates the complexities of an increasingly digital world, the integration of artificial intelligence (AI) has emerged as a pivotal force reshaping customer engagement. Looking ahead to 2030, banks face the challenge of evolving from traditional practices to innovative, customer-centric models that leverage technology to enhance experiences. CleverTap’s Banking on AI: A Leader’s Guide to Customer Engagement Excellence in Banking, outlines six key outlooks that highlight the transformative potential of AI in banking. Let’s take a peek into these. By embracing these trends, banks can not only improve operational efficiency but also cultivate deeper relationships with customers, ultimately leading to a more robust and resilient financial landscape.

Synthetic Data: The Future of Innovation in Banking

To combat challenges like data silos, banks will focus on innovative solutions such as synthetic data. AI-driven synthetic data generates realistic datasets that ease privacy concerns. This will enable banks to test products and improve customer experiences.

Unlocking Emotional Engagement in Banking

To bridge the emotional gap in customer interactions, banks will focus on creating immersive experiences that resonate deeply with customers. By integrating AI algorithms to analyze behavior in real time, banks can deliver personalized gamification, such as adaptive challenges and dynamic rewards.

Modernizing MarTech, Leveraging AI-Powered Ecosystems and Open Banking

To stay competitive, banks should modernize legacy systems by adopting an ecosystem approach for a MarTech stack that integrates data sources, applications, and services. AI-powered ecosystems connect digital services, providing features like consolidated financial views and embedded lending.

AI-First and Customer-Centric Banking: Charting the Future

To strengthen connections with customers, banks should adopt a customer-first strategy rather than a product-first approach. This shift can lead to higher relational Net Promoter Scores (NPS) and build trust. By utilizing AI for dynamic personalization based on real-time customer behavior, such as spending patterns, banks can proactively engage with tailored offers.

AI Gaining and Building Trust in the Banking Context

To ensure regulatory compliance and cultivate trust with their customers, banks should adopt a responsible AI framework. This framework enhances transparency, accountability, and fairness in AI algorithms. It also addresses increasing concerns about data privacy. By creating a secure environment, banks can reassure customers that their personal information is managed responsibly.

AI Powering Open Banking: Seamless Integration of FinTech Partnerships

To ensure seamless integration of innovative financial solutions, collaboration between traditional banks and fintech firms will become more prevalent. Implementing AI-powered open banking solutions can transform traditional banks into dynamic ecosystems, where customers benefit from a wider range of services, transparency, and real-time value-added insights.

Conclusion

AI in banking has the power to drive a customer-first approach that optimizes every aspect of the customer journey. Retail banks, for example, benefit from high trust levels but often struggle to unify data for advanced personalization. By eliminating data silos and adopting a holistic AI framework like CleverTap’s Core Four, banks can build strong, lasting customer relationships and unlock the full potential of AI.

As the industry moves toward a value-centric model, banks can leverage AI to stay competitive, enhance customer engagement, and solidify trust, paving the way for a future where financial institutions are not only operationally efficient but deeply customer-focused. Explore CleverTap’s AI framework for enhancing customer engagement in banking. Talk to us.

Stop following—start leading with AI in banking. Download Now

Subharun Mukherjee

Heads Cross-Functional Marketing.Expert in SaaS Product Marketing, CX & GTM strategies.

Free Customer Engagement Guides

Join our newsletter for actionable tips and proven strategies to grow your business and engage your customers.