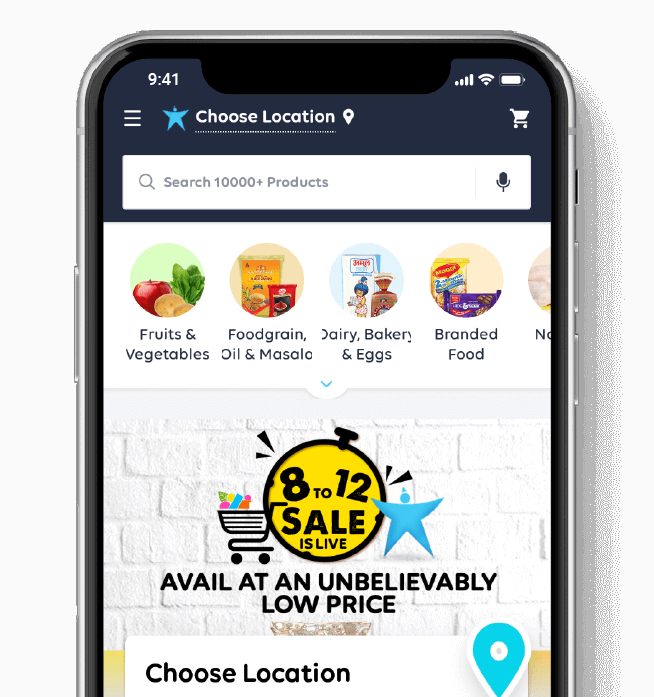

The StarQuik Story

StarQuik is the online grocery shopping venture arm of the TATA group, an Indian conglomerate under the umbrella of Trent Ltd. Launched in late 2017, they offer 10,000+ products in over 10 major categories ranging from fresh fruits and vegetables to home care. Their services are currently available in the cities of Mumbai, Pune, Hyderabad, and Bengaluru.

Challenges

-

Visualizing the end-to-end user journey

Visualizing the end-to-end user journey -

Enhance marketing automation

Enhance marketing automation -

Analytics to aid decision-making

Analytics to aid decision-making

Visualizing the end-to-end user journey

The StarQuik team wanted to visualize the entire user journey, both online and offline in a single platform. An in-depth understanding of user behavior and end-to-end journey would help them build coherent segments and engage those segments by optimizing the user experience. With their previous marketing automation tool, creating user segments was frustrating and time consuming.

Enhance marketing automation

They wanted to extend their reach beyond SMS and push notifications and required an automation tool that would help them create remarketing campaigns for Facebook Audiences and Google Ads.

Analytics to aid decision-making

They needed an advanced analytics tool with preset templates as well as the ability to create custom boards to better understand their user base. They needed answers on how different user groups were behaving over time, and at what times consumers were launching the app. Without an efficient tool, understanding user behavior would require a slew of spreadsheets and complicated formulas.

Solution

A comprehensive understanding of user behavior is a prerequisite to capturing their attention, making better campaign decisions, and creating a seamless buying process. The StarQuik team realized that having a single integrated analytics and engagement platform would enhance their understanding of users, drive data-based decision making, and the campaign orchestration process. Additionally, this helps them in creating a consistent brand experience.

With CleverTap’s complete engagement toolkit, they optimize the customer experience across the entire lifecycle.

Segmentation

In online grocery retail, user behavior differs vastly across geographies, product categories, and monthly spending. StarQuik has identified 12 segments based on user personas. These user personas are further segmented based on their cities and local store location.

These users are further segmented based on recency, frequency, and monetary value (RFM) analysis. RFM automatically creates 10 unique segments based on how recently and frequently a user made a purchase, and how much they’ve spent.

Micro-segments are also created based on product categories. For example, loyal consumers who have made a purchase of INR 500 in the fresh fruits and vegetable category, or loyal potential champions in the edible oil category. Different brands of oils are then promoted to users based on city-wide consumer preferences.

Identifying various user segments has also helped in identifying key user groups and tailoring engagement for them. If a consumer exclusively purchases fresh foods, StarQuik will promote a fresh foods monthly plan.

Bulletins

With Bulletins, StarQuik has greater agility and control over the campaigns they create based on business side occurrences. Purchasing behavior for groceries online differs across the days of the week, where there’s increased user activity on the platform towards the weekends. They identify the business event and create live user segments.

Messaging channels

The team orchestrates campaigns across channels such as SMS, email, and push notifications. With remarketing integration, segments defined on CleverTap are automatically uploaded to Google and Facebook advertising accounts.

The team uses webhooks for their loyalty campaign, which trigger a bonus cashback to the user’s wallet based on certain events recorded by CleverTap. They ran a campaign where they credited a bonus to users based on certain shopping patterns, and built a Journey reminding customers to use their bonus.

Analytics

Tracking events and identifying meaningful trends in user behavior is essential for the StarQuik team. With cohorts, they compare how different user groups behave over time, and with Pivots, they gain clarity around things like when users launch the app or the correlation between sending a notification and uninstalls.

Control Groups

To measure marketing success, the team compares their campaigns with control groups on a campaign and channel level. This helps them answer pressing questions about whether they’re using their channels effectively. Control groups also help them avoid over communicating with users.

Results

By comparing the “add to cart” percentages with their control groups, StarQuik has seen an increase of 5-25%. They’ve also seen a 10-35% uptick in conversions for their abandoned cart Journeys tailored for 3 user segments: those who have never placed an order, those with one order, and those with 2 or more orders.

Additionally, they’ve seen an improvement in their conversions which happen 37.5% faster than the industry average. StarQuik has also been able to reduce its uninstall rate by 39%.

What’s next?

With COVID-19, StarQuik has seen app traffic, conversions, bill values, and shopping frequency jump 3x in their app. In addition, StarQuik is looking to scale its store presence by almost 5x in the next 24 months. With more shoppers opting to purchase groceries online, the future lies in leveraging omnichannel marketing to increase engagement and retain newly acquired customers. Combining physical and digital touchpoints to offer a unified, seamless customer experience across channels will continue to be a top priority for them.