Globally, 1.3 billion people are underserved by banks and traditional financial institutions, according to a report by the World Bank Group.* But in Indonesia, a full two-thirds of people are unbanked.*

This is a concern across the archipelago, because when greater numbers of people are able to participate in a country’s financial system, this reduces economic inequality and inclusion promotes socio-economic growth. This is where non-banking financial institutions like Home Credit fill in the gaps.

Founded in 1997, Home Credit is an international consumer finance provider with a presence in nine countries across Europe and Asia. The company’s mission is to serve financially underserved segments to drive credit penetration and increase financial inclusivity.

In Indonesia, since 2013 Home Credit has served around 5 million customers (as of June 2021). Home Credit provides financing for consumers who want to purchase products like household appliances, electronic equipment, mobile phones, furniture, and so on. Apart from this, they also have other financial products such as working capital financing, Home Credit Card, and Home Credit Pay (a co-branding electronic money cooperating with a licensed Payment System Services Provider).

To understand how they make life easier for their users, we spoke to Adi Asriadi, Senior Digital Marketing Manager, and his teammates Lanjar Sidik Permadi and Pratama Agus Nugroho. His team manages all the digital marketing and growth campaigns across websites and mobile.

The digital marketing team at Home Credit Indonesia were finding it difficult to send large amounts of push notifications due to backend and data warehouse issues. As this could potentially affect engagement metrics, they set out to find a marketing automation platform that could help them address this challenge.

While evaluating various marketing automation platforms, they saw the added benefits of having an integrated solution that could provide both behavioral analytics and cross-channel messaging. “With such a platform, we could see what the user does from the point they install or register or sign the contract. We also can find ways to engage with users who drop off or are on the verge of dropping off,” says Asriadi.

It was important for the team to connect with users wherever they were in the customer life cycle. To do this they needed omni channel campaigns that included: push notifications to bring users back to the app, in-app notifications to enhance user experience, and highly targeted remarketing ads to drive conversions.

After evaluating the various customer engagement solutions available in the market, Asriadi found a perfect match in CleverTap. “We chose CleverTap as it combined real-time user analytics and customer engagement under a single platform, helping us understand the user journey end-to-end. Additionally, it helps us connect with the right user with the right product-offering at the right time,” says Asriadi.

The digital marketing team uses messaging channels like push notifications and in-app notifications to drive product awareness among newly onboarded users.

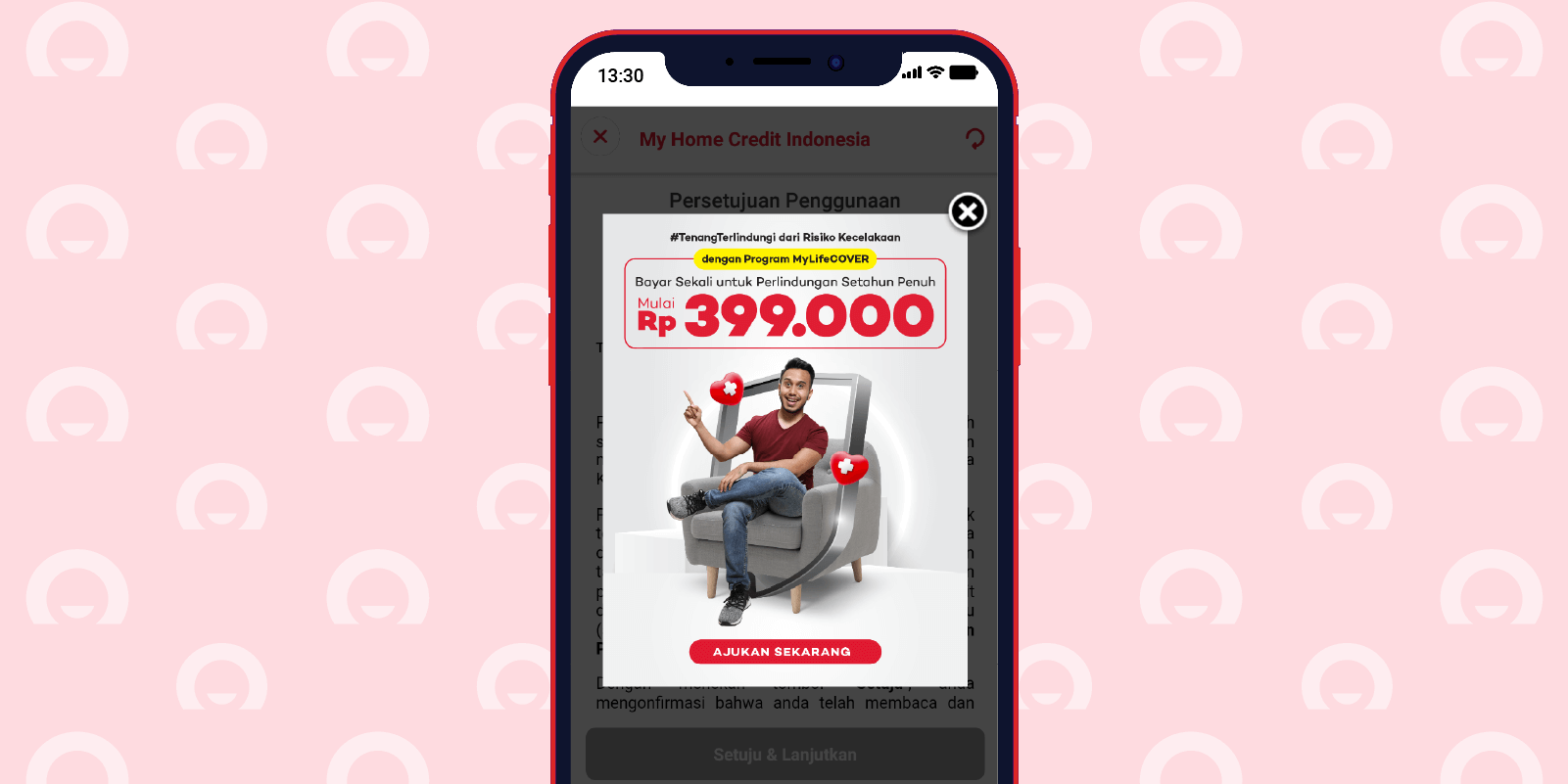

In-app campaign used by Home Credit Indonesia

In-app campaign used by Home Credit Indonesia“By connecting our data warehouse to the CleverTap API, we build custom segments based on the user’s eligibility for various products like electronic financing and working capital financing,” explains Permadi. When these users meet the eligibility criteria, targeted push notifications and in-app messages promoting their product portfolio are released to the users.

“We test our value propositions using A/B testing, and we distribute it to two sets of our user base, both 25% each. The variant which wins the test is sent to the remaining 50% of the user base,” details Nugroho about their A/B testing strategy. This helps them get the best version of their core message to their user base.

This approach lets the team make decisions based on actual data rather than mere hunches or gut instincts. It also maximizes their campaign conversion rates, boosting engagement over time.

Chinese OEM dominates the Asian market. But these devices have a low deliverability rate for push notifications. CleverTap’s Xiaomi and Huawei Push help them reach more users on Chinese OEM devices.

In addition, many users opt-out of push notifications. Using enhanced push delivery, Home Credit Indonesia easily counters this challenge by enhancing the delivery of push notifications to devices that missed receiving them.

CleverTap’s pre-built dashboards help them gain a 360-degree view of user behavior and answer some vital questions: How many users have engaged in a particular day? How many users have made purchases in the app over the past week? How many users have uninstalled the app in a month?

“We check events and funnels on a daily, weekly, and monthly basis. This is important for us to understand how users move from app launch to homepage and then to our offer page and so on,” mentions Asriadi.

Trends give them the capability to understand how users use the app and decipher app traffic patterns. “Additionally, if there are any issues with our mobile app, we can check it using trends in real-time,” he adds.

Using CleverTap’s real-time analytics, omnichannel campaigns, and Enhanced Push Delivery, Home Credit Indonesia, have achieved average CTRs that are 3.5x higher than the industry average of 1.72%. Similarly, the average CTRs for their in-app notifications are 12% higher than the industry average of 11.1%.

The digital marketing team is eager to experiment and grow with CleverTap. They are looking forward to using CleverTap’s geofencing, RFM, and push templates. We are excited to be a part of their digital marketing efforts and help them in their mission of driving credit penetration and financial inclusivity.