Traditional banking is known for being bureaucratic and inflexible. Over the years, challenger banks have been disrupting the space with customer-first, high-trust new solutions, especially in developing countries, where bank branches are fewer and lines at ATMs are longer.

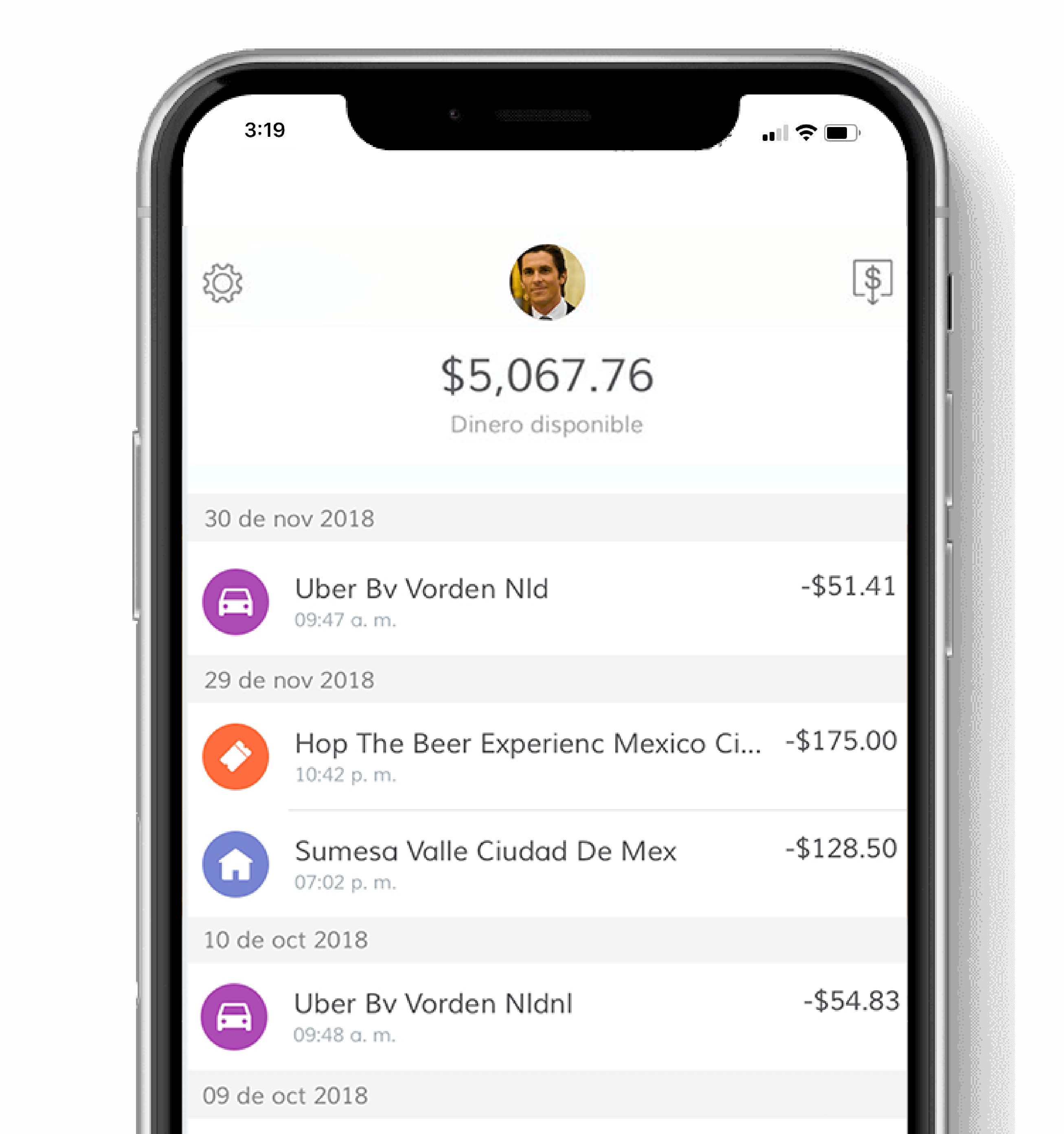

Albo is a leading Mexican challenger bank with over 250,000 active users spread across the country. By offering users an app, bank account, and a debit card, users can open a bank account in less than 5.3 days and access personalized financial tools quickly. Launched in 2016, Albo has raised a total of $26.4 million in Series A funding.

Their team gathers customers from various channels including social media, with the goal to drive product adoption and retention. Their ultimate objective however is to make Albo the only debit card that customers need. But to achieve this, they have to know who their users are and what actions they are taking on the app. Without an analytics and engagement partner, they were operating blindly.

The main KPIs for Albo include: new customers who have made a transaction in the first month, user retention, and product adoption. They searched for a tool that could meet their internal benchmarks and found CleverTap. Now, Albo maintains a metric-driven marketing approach by tracking metrics such as click-through rates, open rates, and conversions.

They created a user journey map for two key journeys: onboarding and retention. The onboarding journey covers all touchpoints from downloading the app to making a first transaction.

The retention journey drives users to adopt key features and become power users. Before deploying their onboarding journey, customers used to take an average of 4 months before their first transaction. Today, it takes them less than a week.

Based on user actions and inactions, Albo can automatically and predictively segment its user base, then create individualized engagement strategies that retain customers.

With Journeys, the team at Albo can take care of onboarding and re-engaging customers while monitoring campaign success and detecting when a campaign becomes ineffective. Different journeys guide users through types of transactions, be it card payments, bill payments, or money transfers.

The team uses push notifications, in-app messages, and emails to communicate with users, and omnichannel messaging forms an important part of their product adoption and retention efforts.

With their current user base being 60% male and 40% female, the team is launching new features and campaigns geared towards increasing female representation on the platform. Furthermore, Albo will focus on lending by making it a core feature for all users.