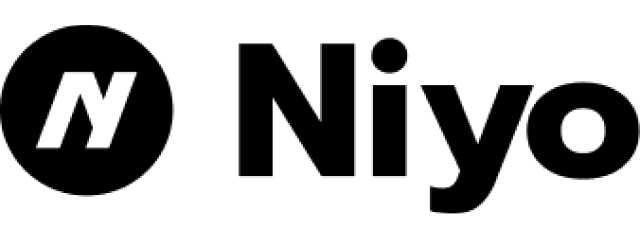

Niyo, a fintech start-up, began operations as a neobank in 2015. Led by an experienced founding team with a keen sense of what the customer wants, the company realized in 2023 that there was some customer dissatisfaction with the requirements of international travel. “The modern Indian customer is used to smooth, unified experiences, but runs into friction at every touchpoint while travelling abroad, from applying for the visa to arranging for foreign exchange,” says Vinay Bagri, CEO and Co-Founder, Niyo.

Niyo decided to address this with the launch of international cards with zero forex markup. This was eagerly received by customers, encouraging the company to continue its foray with value-added services such as flights, visas, travel insurance, forex cash, remittance, and international ATM withdrawals. The team termed this the “The Niyo Way to Travel” and ensured all this & more are accessible via the Niyo App.

Adopting a Feature-Rich Solution for Complex Needs

The travel-related offerings are the latest in a series of targeted innovations by Niyo since its inception – such as a zero-balance card for blue-collar workers, a dual-purpose savings and investment account and a wealth management app. With this key philosophy of customer-centricity, Niyo had looked for a powerful customer engagement solution that would help it create memorable experiences, irrespective of any complexities in the background.

Being a player in the tightly regulated Indian financial services space is an additional challenge. The strict compliance and regulations, which are essential for safeguarding customer funds and data, do add complexity to daily operations. For instance, the customer onboarding process is more rigorous compared to other sectors. This means that, in addition to streamlining the experience to the degree of speed and convenience that customers are accustomed to, it also needs a level of automation and security that guarantees complete adherence to stringent and evolving regulations.

There was one more challenge unique to the sector. Operating in the current ecosystem-led environment requires every financial services player to collaborate with different partners for different activities along the value chain, based on competencies and regulatory permissions. A fintech’s technologies, including the CRM, have to adapt to these evolving partnerships and any consequences they may bring.

After some deliberation, the Niyo team chose CleverTap for the task. “The solution has a track record of providing top-range personalized CX for digital-first businesses in all sectors including financial services,” explains Sushanth Ravikumar, SVP-Marketing. “It also provides advanced automation, and robust security credentials which were critical for us.”

Tailored Onboarding for a Frictionless First Impression

The initial interactions between a company and a customer can be make-or-break. Aware of this, the Niyo team uses CleverTap’s capabilities to modernize onboarding experiences. Consider, for example, when a customer wishes to get a credit or debit card issued by a partner bank on Niyo, it involves multiple steps. In addition to mobile verification, setting the passcode, and choosing a card, the customer has to be guided through the mandatory steps of document verification, VKYC and placing the card order. Once the card is delivered, the card also needs to be activated.

With CleverTap, Niyo has made this experience simpler and more customer-friendly. Automated notifications alert a customer to complete the next step in the onboarding journey within a set period. Document uploads, VKYCs and card activations happen on time and in a compliant manner, so the customer’s journey from a prospect to an active member gaining from the Niyo community is quick and trouble-free.

What’s more, Niyo has separate conversion funnels for each user flow and product offering, and tailors omnichannel journeys and communication within these funnels, to improve the customer experience. Let’s see how this works in the case of onboarding. A mobile-verified customer may not have selected a banking partner within 15 minutes of starting the process. This triggers customized notifications via email and SMS urging them to do so, reminding them how they can benefit from the app, once on board. The Niyo team has found that this finely targeted approach delivers robust results. The team achieved a conversion rate of 40% and a CTR of 2% for SMSes for the mobile-verified funnel, validating its usefulness for customers and the company.

Onboarding is the first and most important interaction we have with our customers. CleverTap understood the challenges we have around the process in our highly regulated sector and helped make it a seamless and compliant experience which sets the stage for positive long-term customer relationships

Niyo uses CleverTap to Preserve Customer Trust during Crises

Deep customer engagement goes beyond delivering personalized interactions for situations that are expected. It is about supporting your customers and safeguarding your reputation during unexpected crises. Niyo leveraged CleverTap to do exactly this when one of its banking partners had to pause a specific type of transaction on their cards due to regulatory requirements.

The team rallied around to minimize the inconvenience to the impacted cardholders. The users rendered dormant and at-risk of churn due to this development were targeted over two phases. Niyo engaged these customers via personalized WhatsApp and email messages highlighting travel and cashback offers, using CleverTap automation – incentivizing them to sign up for cards from other partners and sharing the offer codes promptly once they signed up.

Scribe, an emotionally intelligent content generator, a part of CleverAI suite, was used to create the messaging which ranged from building a sense of anticipation to creating urgency and trust. Compared to a 1.5% CTR for earlier messages, Scribe-powered content delivered a 2X better CTR of 3%.

Out of the dormant users targeted over two calendar months, the campaign successfully re-engaged 12% of the base. CleverTap’s automation has also helped Niyo gain from the continued momentum, as the customers drawn in by the campaign continue to move through the conversion funnels.

We initially adopted CleverTap for its flexibility and automation to streamline daily scenarios. But these strengths proved useful to preserve our reputation and customer base even in tough situations, cementing our belief in the platform

Fine-tuning Customer Engagement in Real-time

Satisfied with Clevertap’s versatility to simplify experiences across its diverse products, Niyo plans to use more of it as it races ahead with travel tech and many more innovations. The tailored journeys within funnels that span a sequence of activities provide pertinent data about drop-off points and user progression time – that can help tangibly improve experiences and the impact of engagement. Omnichannel campaign and journey automation ensure that customer engagement is both tailored and consistent within these funnels.

Niyo is also creating customized dashboards on CleverTap. The teams use this to monitor ongoing KPIs as well as to measure the performance of a new feature launch or marketing activity. With the use of functionality like cohorts and funnels, teams get rich visualizations and insights to quickly spot areas that need improvement, and initiate data-led, customer-focused action.

Customer engagement with our communication and products changes in real-time. CleverTap helps us stay on top of this, so we can remain relevant and competitive in a fluid landscape.