ICICI Prudential Life Insurance Company Limited (ICICI Prudential Life) has long been at the forefront of customer-focused innovation. The Company has consistently offered cost-effective, market-leading savings and protection products to meet the diverse life-stage needs of its customers. The Company’s approach of providing the right product, to the right customer, at the right price, through the right channel has enabled ICICI Prudential Life Insurance to be a trusted life insurance partner for its customers.

The Commitment to Customer-Centricity Forges Loyalty and Market Leadership

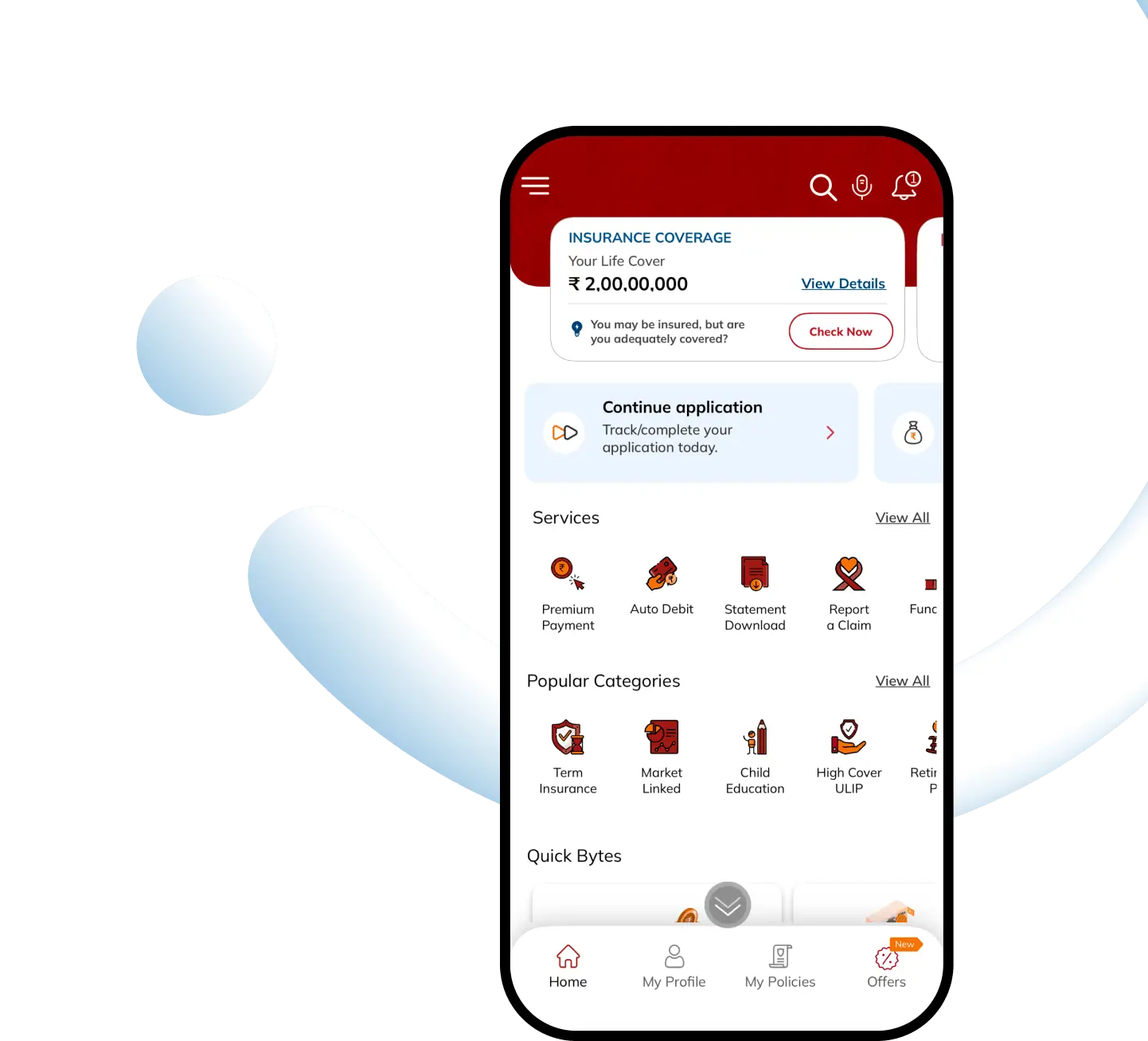

ICICI Prudential Life’s commitment to customer-centricity and innovation has empowered the company to drive meaningful progress in the Indian Life Insurance Industry. The company has been leveraging its Mobile App, designed as a one-stop shop for its customers in buying and managing policies with ease. The App boasts several innovations to empower customers, such as access to more than 60 policy-related services, products tailored to their life goals, and apt product recommendations for ease of interaction and business.

The app has an intuitive dashboard that displays policy information, quick actions for performing frequent requests, and easy access to products & services, along with value-added features such as a user-friendly calculator, helping customers plan better for their life goals, such as children’s education, home purchase, and retirement planning. Another value addition is ICICI Pru Life – Fit Life, encouraging customers to adopt healthier lifestyles by setting and tracking health goals like walking a certain number of steps daily.

To deepen the relationship with customers, ICICI Prudential Life has been engaging with its customers on the app to provide relevant information across the policy term. In this process, customers are reminded via notifications to renew their policies on time to ensure uninterrupted risk coverage. The renewal payment experience on the app also offers flexibility of choosing a preferred mode of payment from multiple payment options, UPI, debit card, net banking, wallet, scan & pay, and NFC (near-field communication).

The policyholders are also being served through self-help options available on the app. The ‘How to’ videos hosted on the app further guide the customers in completing their interaction with the Company. Today, every 2nd interaction that customers of ICICI Prudential Life have with the brand is happening through the mobile app. The app is amongst the best in the Indian private insurance industry with a customer rating of 4.7 on both the Play Store & App Store (as of April 30, 2025), which resonates the customer satisfaction with the Company’s app. ICICI Prudential Life has the highest Net Promoter Score (NPS) in the industry, an achievement repeated over consecutive years — a clear testimony of the company’s leadership in customer engagement practices.

Maximising CleverTap’s Capabilities to Deliver Customer-Centric Engagement

Extending the strong customer focus of the brand, the ICICI Prudential Life team envisioned an engagement strategy to deepen customer relationships by delivering highly personalised experiences. They believe true connection depends on delivering personalised experiences that resonate with each customer. And personalised experiences are delivered based on an understanding of customers’ unique needs and preferences throughout their journey from initial exploration to long-term loyalty.

The company leverages CleverTap’s sophisticated all-in-one engagement platform to leverage customer insights and tailor experiences accordingly. By analysing customer data, including demographics, purchase history, and in-app behaviour, the ICICI Prudential Life team developed highly targeted segments. This granular level of understanding enabled them to:

- Offer relevant product recommendations: Customers receive personalised product suggestions aligning with their interests and needs.

- Provide timely reminders: Customers are gently encouraged to complete important actions, such as renewing policies, finalising purchases, or life-existence verification, ensuring a seamless and uninterrupted experience.

- Capitalise on key moments: Memorable customer interactions are created through exclusive offers on special occasions and festivals to keep customers engaged.

- Continuous optimisation: The team leverages A/B testing and Split testing to experiment, optimise content and timing for each customer segment to identify the most impactful & rewarding approach

Strong Results Achieved on Volume & Quality of Engagement

In FY2025, the key driver for enhancing customer engagement has been segment-based app push notifications, delivering a 133% increase in impressions and a 90% uplift in customer clicks. Furthermore, adding more channels for engagement and personalization – such as in-app messaging, app inbox, email, and native display banners – contributed 20% to the total customer clicks, which grew significantly by 121%. Recent data suggests that these engagement initiatives have helped the brand trend toward positive outcomes for new business, with an incremental growth of 38% in Q4-FY2025 compared to Q3-FY2025.

ICICI Prudential Life Insurance has consistently been at the forefront of customer experience, innovation, and technology adoption. We are crafting a personalised, end-to-end digital experience that enhances the user’s experience without overwhelming them. Thanks to the power of MarTech tools like CleverTap that leverages the data and adds value in every customer interaction.’’