M-KOPA faced a fundamental challenge in engaging millions of customers across diverse markets. It relied on fragmented tools that couldn’t provide an integrated customer view or enable real-time communication.

Our customers operate across diverse markets, and we needed a platform that could guarantee our communications reach reliably while delivering business impact. CleverTap delivers. Its unified platform lets us run automated, intelligent campaigns that scale effortlessly. The reliability and personalization directly drive customer conversions and retention – the metrics that matter most for our business. The support and partnership from the CleverTap team have been instrumental in achieving our goals.”

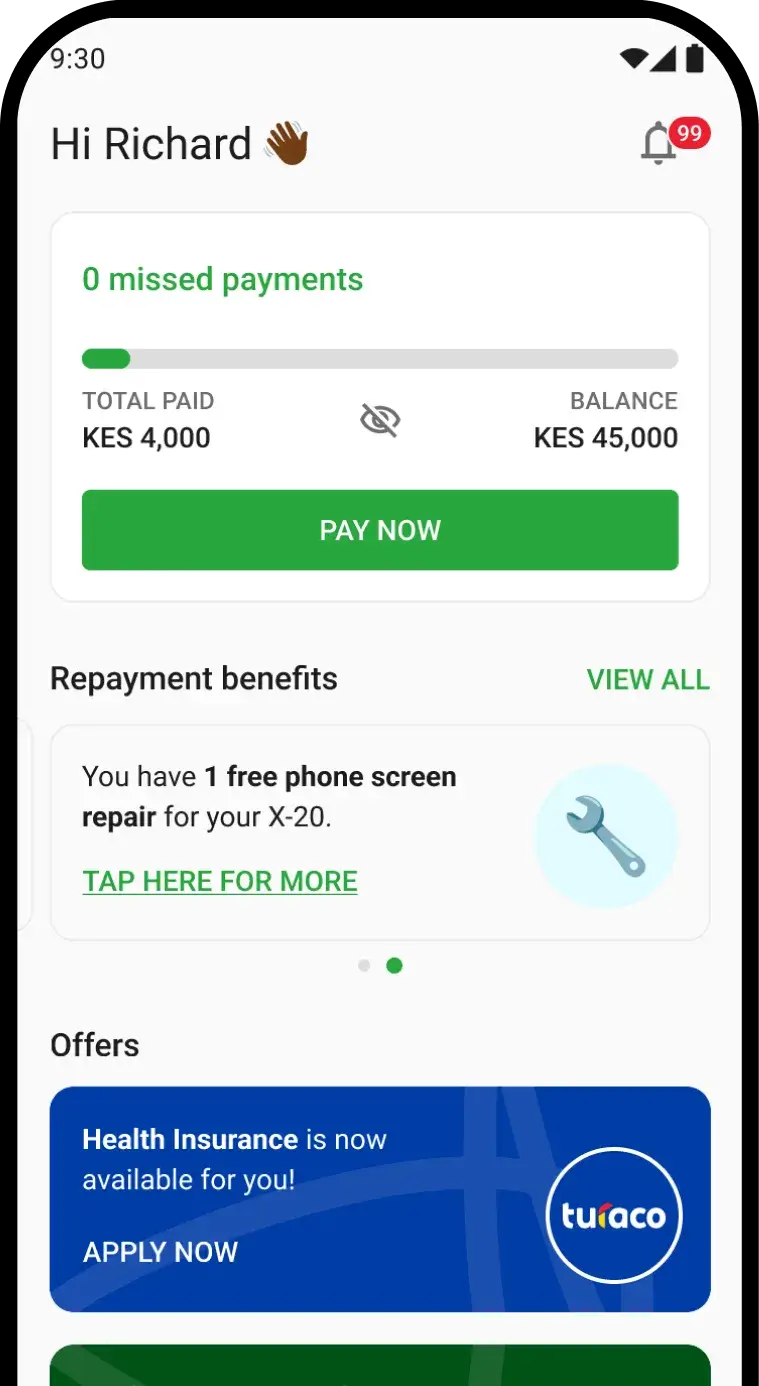

M-KOPA is Africa’s leading fintech platform, democratizing access to affordable financial and digital products for everyday earners. By combining innovative software, hardware and distribution, M-KOPA has deployed $2+ billion in credit, enabling 7+ million customers across 5 African markets to own quality smartphones, e-motorbikes and access life-changing digital services. To sustain this growth, M-KOPA needed a scalable engagement engine that could deliver contextual communication – from onboarding to loan repayment reminders – while optimizing performance across fast-growing markets.

M-KOPA faced a fundamental challenge in engaging millions of customers across diverse markets. It relied on fragmented tools that couldn’t provide an integrated customer view or enable real-time communication.

Segmentation was manual and slow, and there was no system in place for event-based communication and retargeting. M-KOPA sought a powerful platform that unified information and had the capabilities to engage the right customer at the right time.

M-KOPA leverages CleverTap to effortlessly create live user segments based on key criteria. For example, customers ready for cash loan products versus those at risk of churn are now intelligently identified. This precision segmentation ensures every communication lands with relevance, dramatically reducing wasted outreach and boosting campaign efficiency.

M-KOPA orchestrates complex, multi-channel customer journeys end-to-end through CleverTap. Rather than managing campaigns manually across disconnected systems, the team now runs always-on, personalized flows that nurture customers from awareness through conversion. This has reduced manual errors, improved delivery rates by 40%, slashed execution time by 60% and given conversions a fillip.

For greater effectiveness, M-KOPA personalizes the communication around its core offering. Instead of generic offers, customers receive messages like “You qualify for X amount,” powered by real-time event data. This makes the communication highly relevant to the user, helping them relate to the messaging quickly and easily, dramatically improving conversion rates.

By ingesting customer events into CleverTap, M-KOPA delivers timely, personalized messages that drive action. Messages are A/B tested across markets and channels, resulting in up to a 15% boost in CTRs. The team also leverages the advanced RenderMax capability to ensure push notifications cut through device-level restrictions, so customers never miss important, tailored communication.

Having leveraged CleverTap successfully for over two years, M-KOPA plans to expand automation across all product lines and markets. The company is exploring WhatsApp as an additional engagement channel and aims to deepen personalization and use advanced A/B testing to further improve retention and financial inclusion across 5 markets.